Looking For Tax Deductions?

The ATO’s Occupational Tax Deduction Guides can help you decide what tax claims can be made, how they are calculated and what records are required to keep you legal.

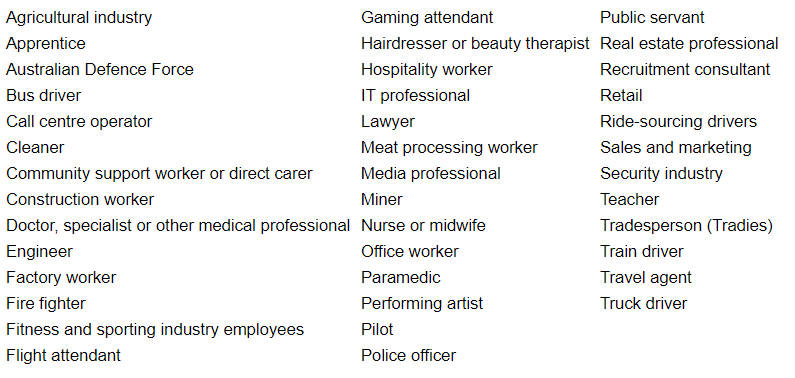

Guides for specific occupations which are in downloadable PDF format have been published by the ATO.

Occupation-specific tax deduction guides (click for info & PDF links)

- See also: Tax Time Tool Kit publications

Home Office Expenses

From 1 July 2022 a new ruling with amended criteria provides a revised fixed rate method with a deduction rate of 67 cents per hour, as an estimate of fair and reasonable additional expenses incurred working from home. See further: Home Office Expenses

Free Smartphone App – Keep a Record of Deductions

The Tax Office has a free mobile app called myDeductions” which is for individuals and sole trader taxpayers and will let you easily record expenses as you go, including car trips and capture images of receipts.

At year’s end the data can be used to pre-fill myTax for your tax return completion or emailed to your tax agent. For instructions and further information: see myDeductions

Business Taxpayers

- Gifts: A gift made by a business taxpayer to a former or current client can be deductible – see TD 2016/14.

- Airport lounge membership: The annual fee incurred on an airport lounge membership for use by an employee can be deductible – see TD 2016/15

Penalty interest as a tax deduction

A Tax Office ruling explains when ‘penalty interest’ is deductible or included in CGT cost base calculations. See Taxation Ruling TR 2019/2

Non-business $300 Immediate Capital Deduction

Assets costing $300 or less that are mainly (i.e. more than 50%) used to earn non-business income can be claimed as a deduction.

If the cost is more than $300, a depreciation claim needs to be worked out.

For more information with links to examples see Immediate deductions non-business taxpayers

Other tax deduction checklists and guides

- Remote workers, miners and tradies (Bantacs)

- Rental Property deductions checklist

- Travelling workers (Bantacs)

- Business tax deductions (ATO)

- Working with children?

- Year end tax planning checklists

- Tax Ruling TR 2020/1 Income tax: employees: deductions for work expenses under section 8-1 of the Income Tax Assessment Act 1997

COVID-19 work-related expenses years 2020, 2021, 2022

The effect of Covid-19 on the types of tax claims that can be made is discussed in the ATO’s article here (pdf).

Key points:

- From 1 July 2022 a new ruling with amended criteria provides a revised fixed rate method with a deduction rate of 67 cents per hour, as an estimate of fair and reasonable additional expenses incurred working from home.

- the temporary short-cut method of calculating home office expenses at 80 cents per hour is available for part of 2019-20, and for the 2020-21 and 2021-22 financial years.

- keep receipts for expenses over $300 which may substantiate a claim in future years (such as for the cost of a desk or computer)

- You may have a claim for PPE (personal protective equipment) if you work in close proximity to customers or clients. Claims might include the cost of gloves, face masks, sanitiser and anti-bacterial spray.

- Industries might include healthcare, cleaning, aviation, hair and beauty, retail and hospitality

- an employee working from home due to COVID-19 and needing to sometimes travel to their regular office cannot claim the cost of that travel (it’s still considered private by the Tax Office).

[See also: Travel between home and work for additional circumstances which may be relevant to a travel claim.]

See also Practical Compliance Guideline PCG 2020/3: Claiming deductions for additional running expenses incurred whilst working from home due to COVID-19

This page was last modified 2023-12-14