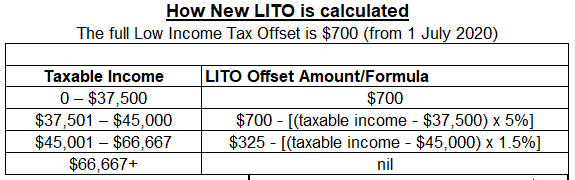

For 2023 full the Low Income Tax Offset is valued at $700 on low incomes up to $37,500.

The offset is withdrawn at the rate of 5% of income above $37,500 up to $45,000, where it is reduced to $325 and then withdrawn at the rate of 1.5% of income above $45,000.

For incomes above $66,666 there is no LITO offset available.

LITO Formula

“LITO” calculation formulae for the tax years 2021, 2022 and 2023 and following.

| Income | Offset |

| 0 to $37,500 | $700 |

| $37,501 to $45,000 | $700 less 5% of [Income minus $37,500] |

| $45,001 to $66,666 | $325 less 1.5% of [Income minus $45,000] |

| $66,667+ | nil |

The Low Income Tax “Offset” is an amount subtracted from tax payable. If the calculated LITO offset is greater than your tax payable, the excess is not refundable, and it also can’t be used to offset Medicare Levy.

LITO and LMITO

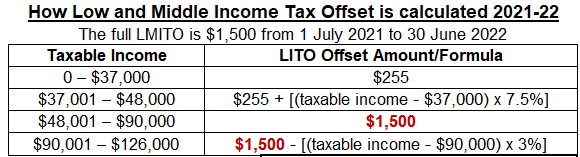

The new LITO of $700 replaced the $445 offset from 1 July 2020, and applies together with the LMITO of up to $1,080 which ended 30 June 2022. (The LMITO was retained for 2020-21, and was later extended to include the 2021-22 year. Budget 2022 increased the maximum LMITO by $420 from $1,080 to $1,500.)

From 2022-23 onward, only the LITO (maximum $700) is applicable. The calculations for both offsets (LITO and LMITO) have been included in the calculators below.

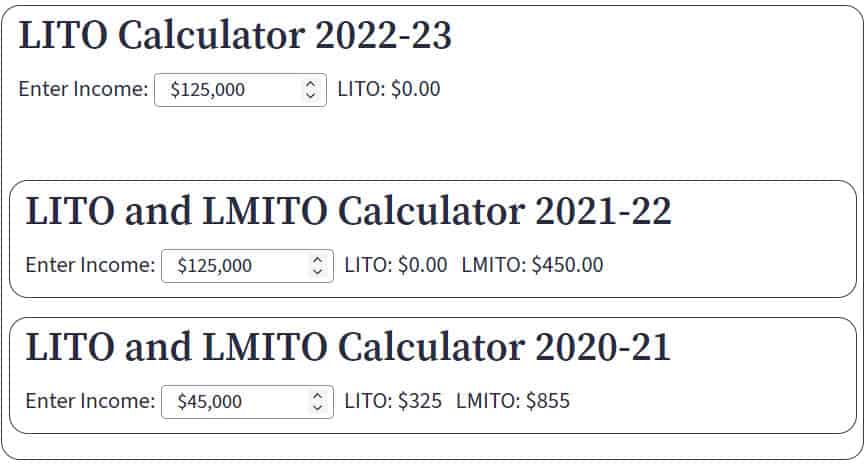

LITO Calculator

How Low Income Tax Offsets are Calculated

How To Claim Low Income Tax Offset

The offsets are automatically included in your tax assessment calculation so a claim does not need to be made within the tax return.

Both the Low Income Tax Offset (LITO) and the Low and Middle Income Tax Offset (LMITO) are calculated based on taxable income, and do not require the taxpayer’s initiative to claim (other than lodging a tax return with correct income details of course).

The effect of the low income tax offsets is raise the tax free threshold for lower income taxpayers, and to reduce tax for those in the middle income ranges.

The History of Recent LITO Adjustments:

Under Budget 2018 proposals

- from 1 July 2018 to 30 June 2022 the new LMITO applied in addition to LITO

- From 1 July 2022 both LITO and LMITO to be replaced by a single LITO

Under Budget 2019 proposals:

- the maximum value of LMITO originally set at $530 was increased to a maximum $1080,

- the new LITO from 1 July 2022 maximum value increased from $645 to $700.

Under Budget 2020 proposals: the proposed “new” LITO of $700 applying from 1 July 2022 was brought forward to apply from 1 July 2020.

The new LITO of $700 replaced the $445 offset, with the LMITO of up to $1,080 being retained for 2020-21.

Budget 2021: The LMITO retained for a further year to 30 June 2022.

Budget 2022: LMITO maximum value increased to $1,500.

Eligibility for low income tax offset

A taxpayer must be an Australian resident individual to be eligible for the low income tax offset.

Trustees assessable under Section 98 may also be eligible for the rebate if the beneficiary is an Australian resident individual. Section 98 deals with beneficiaries who are presently entitled to income but under some kind of legal disability.

Bankrupts and insane persons are examples of beneficiaries under a legal disability.

Minors (under age 18 at the end of the income year) are also under a legal disability, but under special rules are denied the low income tax offset on unearned income. These rules were introduced to reduce the incentive for income-splitting, typically via a family trust. However, excepted income, such as income from wages earned is eligible for the rebate.

Taxpayers with insufficient income, although they may be eligible, will not receive the full benefit of the low income rebate because it is not refundable. It only operates to the extent of tax which is payable, and then only on incomes below the cut-off points. Any “unused” offset from a year of income cannot be carried forward for a later year claim.

The offset also does not apply against any medicare levy.

The introduction of the middle income tax offset in the years 2019 to 2022 introduced additional thresholds, which complicates the arithmetic somewhat because both rebates apply together in those years. (The calculators above include both offsets together).

Low income tax offsets and the tax free threshold

For most resident adult taxpayers, there is no tax payable on income below the tax free threshold.

The current tax free threshold is set at $18,200, however the effect of the low income tax offsets is to increase the threshold minimum taxable income.

In the years 2018-19 to 2022-23 the low income tax offsets have been adjusted several times.

This has been the effect on the tax free threshold:

| 2017-18 | 2018-19 to 2021-22 | 2022-23 | |

| Nominal threshold | $18,200 | $18,200 | $18,200 |

| Max. Low income tax offset | $445 | $445 | $700 |

| Low & Middle income tax offset | – | $255 or $1,080* | – |

| Effective tax free threshold | $20,542 | $20,542 | $21,885 |

For a longer discussion of the tax free threshold, head over to tax free threshold.

* Middle income tax offsets of $255 and $1,080 apply in the income ranges of $37,000 to $48,000 and $90,000 to $126,000 respectively, so there is no impact on the lower income tax free threshold position.

Low Income Tax Offset Formulae Earlier Years

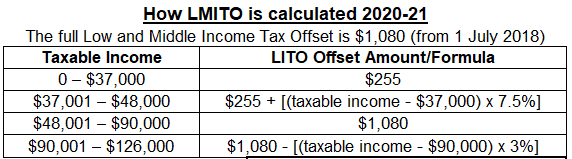

From 2018 the two Low Income Offsets apply together:

1. Low Income Tax Offset (LITO) calculation table from 1 July 2012 to 30 June 2020

| Taxable Income | Offset |

| $0 – $37,000 | $445 |

| $37,001 – $66,667 | $445 – [(taxable income – $37,000) x 1.5%] |

| $66,667 + | Nil |

2. Low and Middle Income Tax Offset (LMITO) calculation table from 1 July 2018 to 30 June 2021 (further extended to 30 June 2022).

| Income | Offset |

| up to $37,000 | $255 |

| $37,001 to $48,000 | $255 plus 7.5 cents for each dollar over $37,000 |

| $48,001 to $90,000 | $1,080 |

| $90,001 to $126,000 | $1,080 less 3 cents for each dollar over $90,000 |

From 1 July 2020 the new Low Income Offset applies:

LITO calculation from 1 July 2020 and later years

| Taxable Income | LITO Formula from 1 July 2020 |

| $0 to $37,500 | $700 |

| $37,501 to $45,000 | $700 – [(taxable income – $37,500) x 5%] |

| $45,001 to $66,667 | $325 – [(taxable income -$45,000 x 1.5%] |

| over $66,667 | nil |

Earlier years

2011-2012 Low Income Tax Offset

For 2011-12 the full offset is $1,500, with a withdrawal rate of 4 cents per dollar of income over $30,000, such that it cuts out at $67,500.

LITO calculation table 1 July 2011 to 30 June 2012

| Taxable Income | LITO Offset 2011-12 |

| 0 – $30,000 | $1,500 |

| $30,001 – $67,500 | $1,500 – [(taxable income – $30,000) x 4%] |

| $67,500 + | Nil |

2010-2011 Low Income Tax Offset

From 1 July 2010 the full offset is $1,500, with a withdrawal rate of 4 cents per dollar of income over $30,000, such that it cuts out at $67,500.

LITO calculation table 1 July 2010 to 30 June 2011

| Taxable Income | LITO Offset 2010-11 |

| 0 – $30,000 | $1,500 |

| $30,001 – $67,500 | $1,500 – [(taxable income – $30,000) x 4%] |

| $67,500 + | Nil |

2009-2010 Low Income Tax Offset

For 2009-10 the full offset is $1,350 with a withdrawal rate of 4 cents per dollar of income over $30,000, such that it cuts out at $63,750.

LITO calculation table 1 July 2009 to 30 June 2010

| Taxable Income | LITO Offset 2009-10 |

| 0 – $30,000 | $1,350 |

| $30,001 – $63,750 | $1,350 – [(taxable income – $30,000) x 4%] |

| $63,750 + | Nil |

See also

This page was last modified 2023-06-03