Tax laws limit the amount of money you can voluntarily contribute to your super account on a concessional basis.

‘Concessional’ means the contribution is tax deductible.

Concessional Contributions Caps in years 2017-18 to 2024-25

| Year | Age | Cap Amount |

| 2024-25 | All ages | $30,000 |

| 2023-24 | All ages | $27,500 |

| 2022-23 | All ages | $27,500 |

| 2021-22 | All ages | $27,500 |

| 2020-21 | All ages | $25,000 |

| 2019-20 | All ages | $25,000 |

| 2018-19 | All ages | $25,000 |

| 2017-18 | All ages | $25,000 |

Year End Planning For June 2024

As the end of the financial year approaches, a little advance planning can help to maximise benefits and avoid traps.

Here are some key points to bear in mind:

- The maximum amount you can contribute for deduction purposes is not the same for everyone. It can vary based on an individual’s total superannuation balance at the previous 30th June.

- Unused concessional contributions can be carried forward for up to 5 years.

- Contributions generally must be allocated within 28 days following the month in which they are received, for June contributions, which must be allocated by the following 28th July.

- Trustees and members have responsibilities to report, document, and allocate contributions properly to avoid excess contribution determinations.

- There also may be strategies which utilise unused caps or reallocate contributions to help optimize contributions overall.

As always, consider professional advice before taking any actions. For more info check out this article: Maximising Concessional Contributions Before 30 June

See also: SMSF Checklists – ATO

Bring Forward of Unused Concessional Contribution Caps

Concessional contributions are those made ‘before tax’ and are subject to a 15% tax rate in the hands of the receiving super fund.

Unused concessional super contributions (i.e. contributions less than the annual cap set out above) from previous years can be claimed if your total super balance is less than $500,000 at 30 June of the previous year.

The unused cap amounts can be carried forward for a maximum of 5 years, after which they expire.

See article with examples: Tax benefits for unused ‘carry forward’ concessional superannuation contributions – BDO

Subject to conditions, unused annual caps starting from 2018-19 can be carried forward for up to 5 years, after which they expire if not used. For example, 2018–19 caps will be permanently lost if not used by 2023–24.

To use any unused cap in a year, the following conditions must be met:

- total super balance at 30 June of the previous financial year is less than $500,000. The Total Superannuation Balance is the sum of all your super balances in any funds.

- contributions are made in excess of the concessional cap for the year. The 2020-21 annual contribution limit is $25,000. From the 2021-22 year the limit is $27,500.

Exceeding The Caps

Exceeding the contributions caps automatically invokes higher tax or loss of preferred tax status. See the notes under Excess Contributions Tax.

However there is discretionary power available to the Tax Commissioner to relieve penalty treatment in some limited circumstances.

This includes circumstances where a cap has been breached by an event outside an individual’s control, such as the super fund receiving compensation from a financial services provider.

There may also be circumstances surrounding a financial year-end when contributions made are allocated by the Fund’s administration to a tax year which may not have been intended.

To see in detail the bases on which the Commissioner’s discretion is exercised, see Super contribution caps and further in Law Administration Practice Statement PS LA 2008/1 which reviews the Commissioner’s discretion to disregard or allocate to another period superannuation contributions for excess contributions purposes.

Non-concessional contributions and CGT caps 2007-08 to 2024-25

Non-concessional contributions are after-tax contributions and are so are normally tax-free on eventual withdrawal.

| Year | Non-concessional | CGT |

| 2024-25 | $120,000 | $1,780,000 |

| 2023-24 | $110,000 | $1,705,000 |

| 2022-23 | $110,000 | $1,650,000 |

| 2021-22 | $110,000 | $1,615,000 |

| 2020-21 | $100,000* | $1,565,000 |

| 2019-20 | $100,000* | $1,515,000 |

| 2018-19 | $100,000* | $1,480,000 |

| 2017-18 | $100,000* | $1,445,000 |

| 2016-17 | $180,000 | $1,415,000 |

| 2015-16 | $180,000 | $1,395,000 |

| 2014-15 | $180,000 | $1,355,000 |

| 2013-14 | $150,000 | $1,315,000 |

| 2012-13 | $150,000 | $1,255,000 |

| 2011-12 | $150,000 | $1,205,000 |

| 2010-11 | $150,000 | $1,155,000 |

| 2009-10 | $150,000 | $1,100,000 |

| 2008-09 | $150,000 | $1,045,000 |

| 2007-08 | $150,000 | $1,000,000 |

Bring Forward: Non Concessional Caps & Maximum Bring-Forward Periods From 1 July 2024

| Total Super Balance | Non Concessional Cap | Max Bring-Forward |

| Less than $1.66 million | $360,000 | 3 years |

| $1.66 million to less than $1.78 million | $240,000 | 2 years |

| $1.78 million to less than $1.9 million | $120,000 | nil |

| $1.9 million or more | nil | nil |

Bring Forward: Non Concessional Caps & Maximum Bring-Forward Periods From 1 July 2022

| Total Super Balance | Non Concessional Cap | Max Bring-Forward |

| Less than $1.48 million | $330,000 | 3 years |

| $1.48 million to less than $1.59 million | $220,000 | 2 years |

| $1.59 million to less than $1.7 million | $110,000 | nil |

| $1.7 million or more | nil | nil |

Bring Forward: Non Concessional Caps & Maximum Bring-Forward Periods Years 2017-18 to 2020-21

| Total Super Balance | Non Concessional Cap | Max Bring-Forward |

| Less than $1.4 million | $300,000 | 3 years |

| $1.4 million to less than $1.5 million | $200,000 | 2 years |

| $1.5 million to less than $1.6 million | $100,000 | nil |

| $1.6 million or more | nil | nil |

Bring Forward of Unused Non Concessional Contributions Caps

Unused Non Concessional contributions caps for a particular year can be brought forward and used in later years, subject to a number of limits and conditions.

Current rules are those brought into effect from 1 July 2017, which allow for unused caps to carried forward for up to 3 years, depending on pre-existing fund balance.

The bring-forward cap amount is set based on the cap in the first year of the period, which in turn will be based on the Total Super Balance in relation to set limits.

The Total Superannuation Balance is measured at 30 June of the immediately preceding financial year.

Conditions:

Your Total Super Balance (as at 30 June of previous financial year) must be less than the General Transfer Balance Cap by at least the amount of the annual contributions cap

| From .. | Cap | Annual Contributions Cap |

| 1 July 2017 | $1,600,000 | $100,000 |

| 1 July 2021 | $1,700,000 | $110,000 |

| 1 July 2023 | $1,900,000 | $110,000 |

Age: Must be under age 65 at any time in the first (trigger) year. Legislation has increased this age limit to under 67 from 2020-21.

Not already in an active bring forward period: Excluded from the non-concessional cap are contributions sourced in eligible personal injury payments, and contributions from small business disposals which can be dealt with under the lifetime CGT cap amount.

Contributions over the limits result in higher tax rates, acting as a penalty.

Superannuation contribution caps are categorised as concessional, non-concessional and CGT amounts, with some further differentiation based on the age and status of the superannuation fund member.

Concessional contributions are essentially those contributions which are tax deductible, and include both employer and personal contributions.

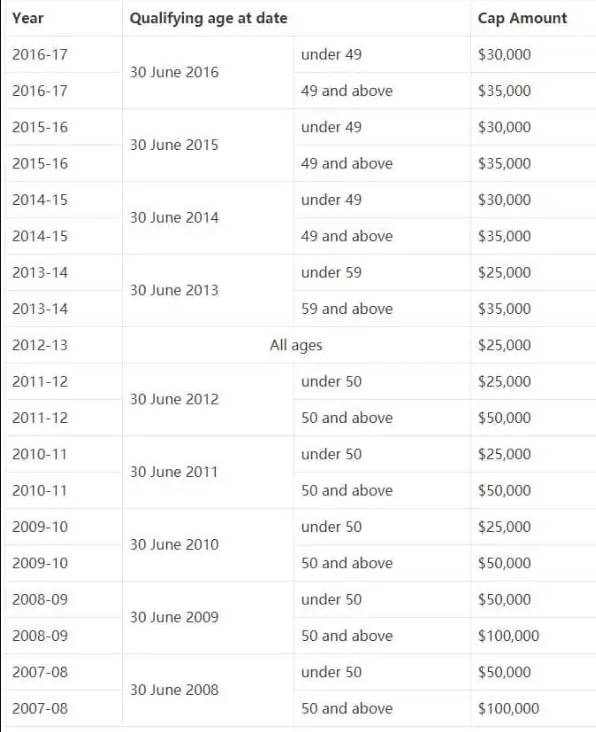

Concessional contribution caps in years 2007-08 to 2016-17

Notes:

- Work Test modification: Budget 2021-22 contained a proposal to remove the Work Test from 1 July 2022 (Budget 2021-22, Budget Paper No. 2 page 19) in respect of non-concessional or salary sacrifice super contributions currently required of older persons (aged 67 to 74). Legislation for the measure takes effect from 1 July 2022. Personal deductible contributions will continue to be subject to the work test.

- From 1 July 2020 the threshold age for application of the work test was lifted from 65 to 67, enabling funds to accept deductible contributions at ages 65 and 66 without needing to meet the work test or exemption requirements.

- Until 30 June 2020: A work test applies between the ages of 65 and 74 – subject to a one-time exemption available from 1 July 2019 where the total super balance is less than $300,000 at the end of the previous financial year.

- At 75 years and over, only mandated super guarantee or award contributions can be made (except for downsizer contributions).

-

Up to 30 June 2013 employee super guarantee entitlement ceased at age 70 years, but from 1 July 2013 those entitlements continue.

For the period 1 July 2011 to 30 June 2013 (only) first time breaches of the concessional cap by $10,000 or less individuals could on application be withdrawn and taxed at their marginal tax rate.

From 1 July 2013 the ATO will issue a determination to enable withdrawal of excess contributions which are then taxed at the taxpayer’s marginal rate, plus an Excess Contributions Charge calculated at the Shortfall Interest Charge rate.

Excess contributions not withdrawn from the super fund are counted as non-concessional contributions.

See more – Excess Contributions Tax.

SMSFs – ‘Contribution Reserving’ Strategy

With limited exceptions, SMSFs are generally required to allocate contributions to a member’s account within 28 days.

This four-week time span sets up a possible circumstance under which a concessional contribution is legally made in year 1, but not counted as part of the member’s balance until financial year 2.

A possible advantage in organising contributions that way would be to maximise super deductions in year 1 without exceeding that year’s contribution cap for the receiving member.

This has come into focus again in the year ending 30 June 2024, because on July 1, 2024 the contributions caps are increasing. However the technique can theoretically be employed to shift deductible contributions from any year to the next.

An additional contribution in year 2023-24 would be unallocated, held in ‘reserve’ until the 2024-25 year when it is then allocated to the member, forming part of the (higher) cap used in that later year.

This can be viewed as an exploit of the difference between a cash accounting of contributions legally made vs the accrual accounting of the super fund.

The Tax Office recognises this as a valid strategy where strict guidelines are followed, including detailed record-keeping.

However the calculations of available cap can be quite complex, after bring-forward balances and the total super balance cap is taken into account.

As such, any member planning to undertake the strategy should be well-advised to enlist the help of a professional advisor. Getting it wrong can subvert the purpose and result in additional tax.

As part of the necessary procedure, the ATO has provided a form to advise them when contribution reserving has taken place.

The form ‘Request to adjust concessional contributions’ (NAT 74851) is lodged with the Tax Office, so that contributions identified in a super fund’s annual return are allocated to the ‘correct’ financial year.

Without this information the Tax Office will be unaware of the timing adjustment, which would then could only be corrected through action (e.g. objection) on incorrect assessments. The Tax Office request that the completed form be lodged before or together with the super fund’s annual return.

Note that this procedure does not apply to non-concessional contributions, nor should the form be used to apply for contributions to be disregarded or reallocated for other reasons.

Guidelines and further information:

- TD 2013/22 Income tax: ‘concessional contributions’ – allocation of a superannuation contribution with effect from a day in the financial year after the financial year in which the contribution was made.

- Contribution reserving – are you aware of all the risks?

- Contributions Reserving

The concessional contributions cap is indexed in line with average weekly ordinary time earnings (AWOTE), in increments of $5,000 (rounded down).

Concessional contributions within the allowable caps are normally taxed at 15%. This is considered a concessional rate, because most taxpayers’ personal marginal tax rates are greater than 15%.

Concessions on higher income earners’ contributions are reduced through the application of an additional (“Division 293”) contributions tax (currently an additional 15%).

Over-the-limit concessional contributions are counted towards the non-concessional cap. To avoid penalty rates of tax, from 1 July 2013 excess concessional contributions can be withdrawn, and taxed at the individual’s marginal rate plus interest. Legislation was passed in March 2015 to treat excess non-concessional contributions on a similar basis (also applying from 1 July 2013).

The potentially higher tax means that in most instances members will want to keep super contributions, and their total funds, within the specified caps.

Budget measures 2017-18

- From 1 July 2017, the Government will improve the integrity of the superannuation system by including the use of limited recourse borrowing arrangements (LRBA) in a member’s total superannuation balance and transfer balance cap.

- Super contributions made from 1 July 2017 may be withdrawn from 1 July 2018 for a first home deposit. Concessional contributions and earnings withdrawn will be taxed at marginal rates less a 30% offset. Up to $15,000 per year can be contributed, $30,000 in total within existing caps. See further: First Home Super Saver Scheme

- From 1 July 2018, the Government will allow a person aged 65 or over to make non-concessional contributions (“downsizer contributions”) of up to $300,000 from the proceeds of one sale of a main residence. See further: Contributions From Home Downsizing

Budget measures 2016-17 summary

From 1 July 2017 a number substantial changes to the superannuation rules relating to contributions caps come into effect:

- the 10% ‘maximum earnings’ condition for personal super contributions deductions is removed

- the concessional superannuation contributions cap is reduced to $25,000, indexed to AWOTE (applicable to all age groups)

- Transfer balance cap – starting at $1.6 million. The transfer balance cap is a limit on how much accumulated super can be transferred into the tax‑free ‘retirement phase’ to receive pension income. The limit will start at $1.6 million, and be indexed to CPI rounded down to the nearest $100,000.

From 1 July 2018 – carry forward of unused concessional contributions

- Unused concessional contributions cap (from the new cap limit of $25,000 per annum) can be carried forward for a maximum of 5 years.

- The carry-forward can only be used if the total superannuation balance is less than $500,000 (as at 30 June of previous financial year)

- The first financial year in which you can access unused concessional contributions is 2019–20

[News: 14 Sept 2016] Treasurer modifies proposed new superannuation cap rules

Upon implementation, the Treasurer has retreated somewhat from earlier proposed changes to the superannuation cap rules, with the following:

- The previously existing annual non-concessional contributions cap of $180,000 per year will be reduced to $100,000

- For under 65 year olds the 3 years’ non-concessional ‘bring forward’ rule remains

- Individuals with a superannuation balance of more than $1.6 million (indexed and tied to the transfer balance cap) will not be able to make non-concessional contributions from 1 July 2017.

- the proposed abolition of the work test for ages 65 to 74 will not proceed (but see later amendments introduced from 1 July 2020 – and Budget 2021).

- proposed catch-up concessional superannuation contributions will be deferred by one year to 1 July 2018.

For further implementation considerations see Law Companion Guidelines provided by the Tax Office:

- LCG 2017/1 – Superannuation reform: defined benefit income streams – pensions or annuities paid from non-commutable, life expectancy or market-linked products

- LCG 2017/3 – Superannuation reform: Transfer Balance Cap – Superannuation death benefits

- LCR 2016/8 – Superannuation reform: transitional CGT relief for complying superannuation funds and pooled superannuation trusts

- LCG 2016/9 – Superannuation reform: transfer balance cap

- LCR 2016/10 – Superannuation reform: capped defined benefit income streams – non commutable, lifetime pensions and lifetime annuities

- LCR 2016/11 – Superannuation reform: concessional contributions – defined benefit interests and constitutionally protected funds

- LCR 2016/12 – Superannuation reform: total superannuation balance

Practical Compliance Guideline PCG 2017/5 – Superannuation reform: commutation requests made before 1 July 2017 to avoid exceeding the $1.6 million transfer balance cap

See also: Pensions from 1 July 2017 — some tips and traps for SMSFs

Legislation details

Progress of the passage of related legislation through parliament can be monitored on the following links:

- Treasury Laws Amendment (Fair and Sustainable Superannuation) Bill 2016 [passed 22 Nov 2016]

- Superannuation (Objective) Bill 2016

- Superannuation (Excess Transfer Balance Tax) Imposition Bill 2016 [passed 22 Nov 2016]

Concessional Contributions Caps For Over 50s Before 1 July 2012

From 1 July 2012 there is a general concessional contributions cap of $25,000. For people aged 50 or more, an increased concessional contributions cap applied until 30 June 2012, non-indexed.

| Year | Cap |

| 2012-13 | $25,000 |

| 2011-12 | $50,000 |

| 2010-11 | $50,000 |

| 2009-10 | $50,000 |

| 2008-09 | $100,000 |

| 2007-08 | $100,000 |

Under previously announced government proposals, the concessional cap was to have been permanently retained at $50,000 for over 50s with total super balances below $500,000. However in 2012 Federal budget announcements, that measure was deferred.

- From 1 July 2013 the cap increases to $35,000 unindexed if aged 59 or more on 30 June 2013 and

- From 1 July 2014 the cap increases to $35,000 for individuals aged 49 or more on 30 June 2014.

Here’s a summary of the main super changes from 2017 ( 2 mins 22 secs), courtesy of RSM in Australia:

..and here’s a brief run-down of the $1.6 million (indexed) pension transfer cap:

Non-Concessional and CGT Caps

Non-concessional contributions are those made from after-tax income (i.e. no tax deduction claimed) and no contributions tax is applied to the super fund contribution.

They include personal contributions for which a tax deduction is not claimed, and spouse contributions. Once in the fund, normal fund tax rates apply to earnings. Non-concessional contributions within limits are not further taxed on withdrawal.

Non-concessional (after-tax) contributions cap rules from 1 July 2017

- annual non-concessional contribution cap reduced to $100,000 per year (being 4 times the new annual concessional contributions cap)

- Individuals aged between 65 and 74 years old will (still) need to meet the work test (but see later plans to relax these rules for low-balance recent retirees).

- The non-concessional contributions cap to be indexed in line with the concessional contributions cap (i.e. AWOTE)

- Transfer balance cap: Non-concessional cap will be zero unless the individual’s total superannuation balance is less than $1.6 million as 30 June of the previous financial year

- For under 65s, new bring-forward rules apply, and there are transitional rules for those who have already triggered the rules in 2015–16 or 2016–17 and have unused balances

Work Test

The Work Test limitation on super contributions by or for older Australians has been relaxed in recent years. The measures include:

As announced in Budget 2021, the Work Test is removed for individuals aged 67 to 74 years in respect of non-concessional contributions.

The work test will still apply to individuals aged between 67 to 75 years who claim a deduction for personal superannuation contributions.

This takes effect from 1 July 2022.

Press release here.

Read a detailed summary of the changes here.

Work test historical position

[1 July 2020] Regulations were released to allow people aged 65 and 66 to make voluntary contributions without meeting the work test, with effect from 1 July 2020.

Until 30 June 2020 the work test required that from the age of 65 the work test must be satisfied to enable a super fund to accept a tax deductible superannuation contribution.

What is the work test?

The work test is a limitation on voluntary super contributions by older Australians unless they are “working”.

The work test requires gainful employment for at least 40 hours during a consecutive 30-day period each financial year in which the contributions are made. Unpaid work does not qualify.

Work Test Low Balance Exemption

From 1 July 2019, Australians aged 65 to 74 with a total superannuation balance below $300,000 can make voluntary contributions for 12 months from the end of the financial year in which they last met the work test. See: amending regulation

From 1 July 2013 contributors aged 70 or more are entitled to super guarantee payments from their employer.

Non-Concessional Contributions Caps to 2016-17

Each tax year, the non-concessional cap is a multiple of the indexed concessional cap.

‘Bring Forward Rule’

Under 65 year olds have a ‘bring forward’ non-concessional cap allowance limit of 3 times their cap over a 3-year period. On that basis, the total 3-year non-concessional caps up to 30 June 2017 were:

- for 2016-17 $540,000

- for 2015-16 $540,000

- for 2014-15 $540,000

- for 2013-14 $450,000*

Note: The bring forward rule quantum triggered in 2013-14 remains at $450,000 despite the higher cap values which might otherwise have applied if triggered in a later year.

CGT Cap Amount

The CGT Cap allows the exclusion of eligible CGT amounts (up to a cap) from the non-concessional cap. The CGT cap amount is a lifetime allowance and is indexed each year in line with AWOTE, in increments of $5,000 (rounded down).

Eligible CGT disposal amounts include:

- up to $500,000 of capital gains that have been disregarded under the small business retirement exemption

- the capital proceeds from the disposal of assets that qualify for the small business 15-year exemption

- the capital proceeds from the disposal of assets that would qualify for the small business 15-year exemption, but do not because the asset was a pre-CGT asset there was no capital gain, or the 15-year holding period was not met because of the permanent incapacity of the person (or a controlling individual of a company or trust).

Contribution Timing

Because the caps on super contributions are calculated on a year-by-year basis, it is important to pay attention to the timing of contributions, especially in June towards the end of the financial year.

Contributions credited in the ‘wrong’ year can significantly alter cap calculations and have unintended consequences when seeking to maximise the allowable super concessions. A deduction may be foregone, or a cap allowance unused or exceeded.

Exactly when a contribution is made is influenced by the manner of payment. Payments by cheque, cash, electronic transfer or in-specie asset transfer close to year-end can each produce different outcomes.

Alternative methods of payment have been discussed in an article by Cooper Grace and Ward Lawyers. The table below is a partial summary of examples (abbreviated; see the full article for details).

To read the full article, see: It Depends – When is a contribution made to an SMSF?

| Manner of payment | When received |

| EFT | Funds show up in the (Fund’s) receiving bank account |

| Cheque | When the cheque is received (if banked and cleared promptly) |

| Asset transfer | When transfer is registered, or able to be registered |

| Cash | When the cash is received |

The moral of story is when making contributions which are close to cap or time limits, it is best practice to allow as much time as reasonably possible to avoid any doubt as to when a contribution is being made. Also check with your Super Fund to see if they have implemented an arbitrary time limit in order avoid issues arising.

For further information:

- How Super Works (PDF First State Super)

- Excess Contributions

s291-20 ITAA 1997

Amend Schedule 1

This page was last modified 2024-04-09