Group Certificates, Payment Summaries, Income Statements

Group certificate requirements for the 2022-23 year will be met by the Single Touch Payroll (“STP”) procedures for most employers which provide a Tax Ready Income Statement.

From 2023 there is a general deadline of 14 July for end-of-year finalisation. The finalisation due date for closely held payees is 30 September each year. See End-of-year finalisation through STP.

A payment summary is still required for any payments not reported through STP.

STP procedures require that employers make a finalisation declaration to the Tax Office on completion of annual payroll processing.

At that point the payroll information becomes ‘tax ready’ and employees’ tax returns are pre-filled with the information. For non closely-held employees, this means that the information should be viewable on myGOV by 31 July.

Single Touch Payroll is compulsory for most employers from 1 July 2019. An annual report to the Tax Office is still required in respect of payments not reported through the Single Touch Payroll system during the financial year.

See ATO requirements for (non-STP) payment summaries

Payment summary lost, missing or incorrect

Steps you can take:

- Contact your employer to get the information

- Check your myTax record to see if the information has been prefilled.

- Re-construct the information from available records e.g. payslips, bank statements etc.

These steps are further explained below.

Terminology:

‘Payment summary‘ refers to the type of annual payroll summary which was issued to each employee before the introduction of Single Touch Payroll processing, or currently, if STP is not being used. Payment Summaries may be issued in paper or electronic (e.g. PDF) format. Some senior citizens still call them ‘group certificates’.

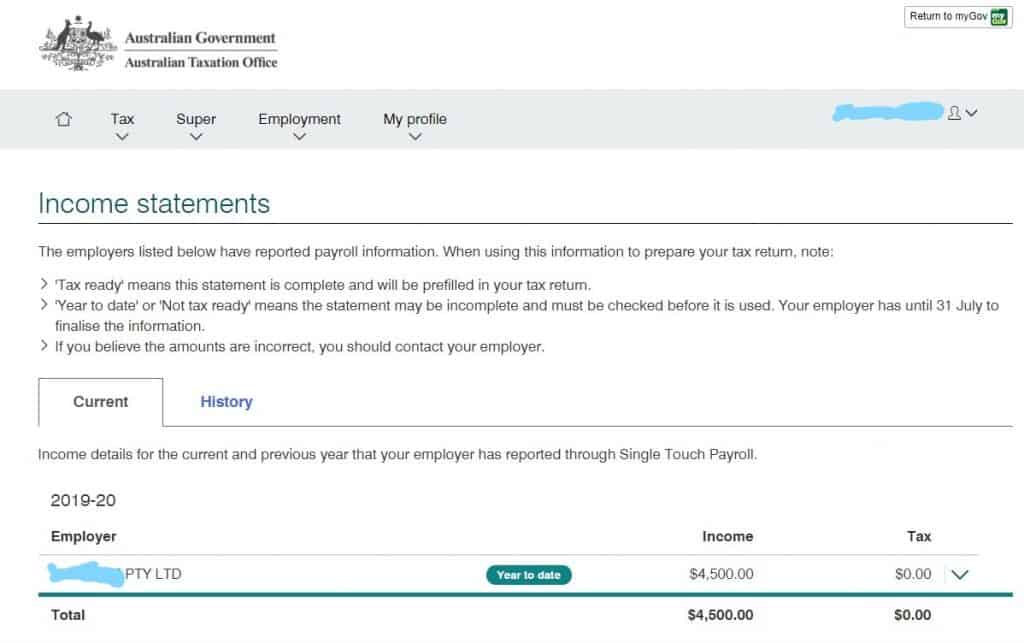

The equivalent electronic document in the Single Touch Payroll system (now used by most employers) is called an ‘income statement‘. The income statement becomes authenticated when it has ‘Tax Ready’ status in the myGov record.

Contact your employer

If a payment summary has been received but subsequently lost, a signed replacement issued by the employer can be requested and used to complete your tax return.

It doesn’t have to be a look-alike replacement. A signed letter or even a photocopy from the employer setting out all the details can be used, as long as it has all the necessary information.

If the payment information you have been provided is inaccurate or (e.g.) has been duplicated, then the best place to start is with your employer in order to carry out necessary corrections.

Check myTax

MyTax users or taxpayers with a tax agent can access pay data from the electronic pre-fill functions on myTax, or via the Tax Agent’s portal, provided the necessary reports have been lodged by the employer.

If the data is available in myTax but not ‘Tax Ready’, you can still proceed to use that information to lodge your tax return, but the Tax Office cautions against the possibility of the numbers changing when finalised. This may require a later amended assessment and other possibly adverse consequences, so is best avoided unless you are certain the numbers are accurate.

Re-construct the information from records

If annual summary payroll details from the employer or online are simply not available, as a last resort you may need to estimate your payroll details from other available records, such as banking records and payslips.

If you use this method, be sure to keep your evidence of the calculation details with your tax records. A statutory declaration is no longer required (as had been a requirement in past years).

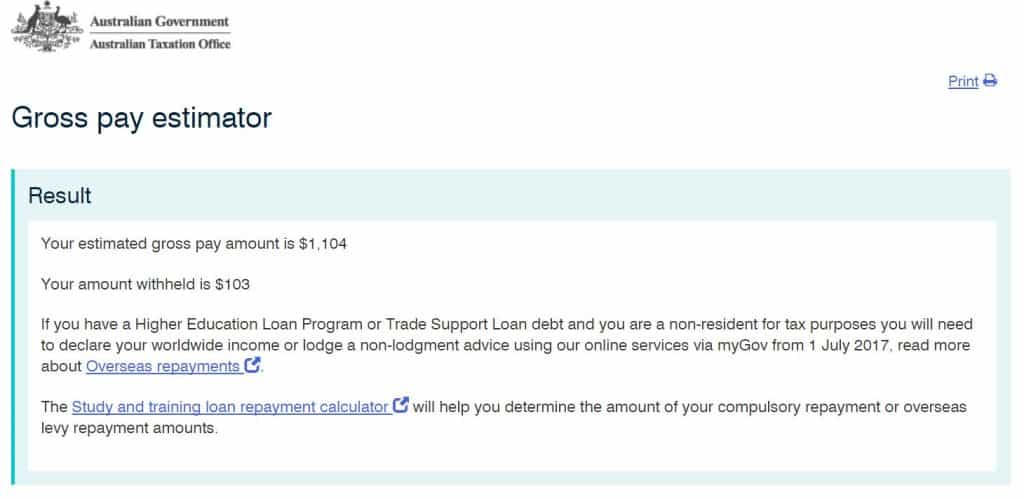

To help estimate the tax withheld, the Tax Office provides a gross pay estimator. The calculator enables you to enter a net pay amount, and returns the gross pay amount. If you have banking records of net pays received, you may be able to accurately estimate the gross pay amounts to put in your tax return.

See further: Income statement not finalised or missing payment summary

Employee working for part of the year – part year payment summaries

Under Single Touch Payroll an employee’s income statement can be ‘finalised” (i.e. an employer makes a finalisation declaration), and a payment summary does not need to be issued. The employee’s tax return pre-fill however does not take place until after the end of the financial year.

Finalisations can also be undone, to allow for example, the re-hire of the employee within the same financial year.

Further information

- Finalising your Single Touch Payroll data (for employers)

- Report Unpaid Super Contributions From An Employer: Start here

- For Employers: Payment summaries and annual reports – due 14 August (if non-STP).

- For information about correcting a tax return which is already lodged – see here.

- To contact the Tax Office directly about any matter start here.

How to check your wage or salary payments on myGOV (my.gov.au)

With Single Touch Payroll being used by most employers, all of your wage or salary payments are being continuously updated on the myGOV platform with every pay run.

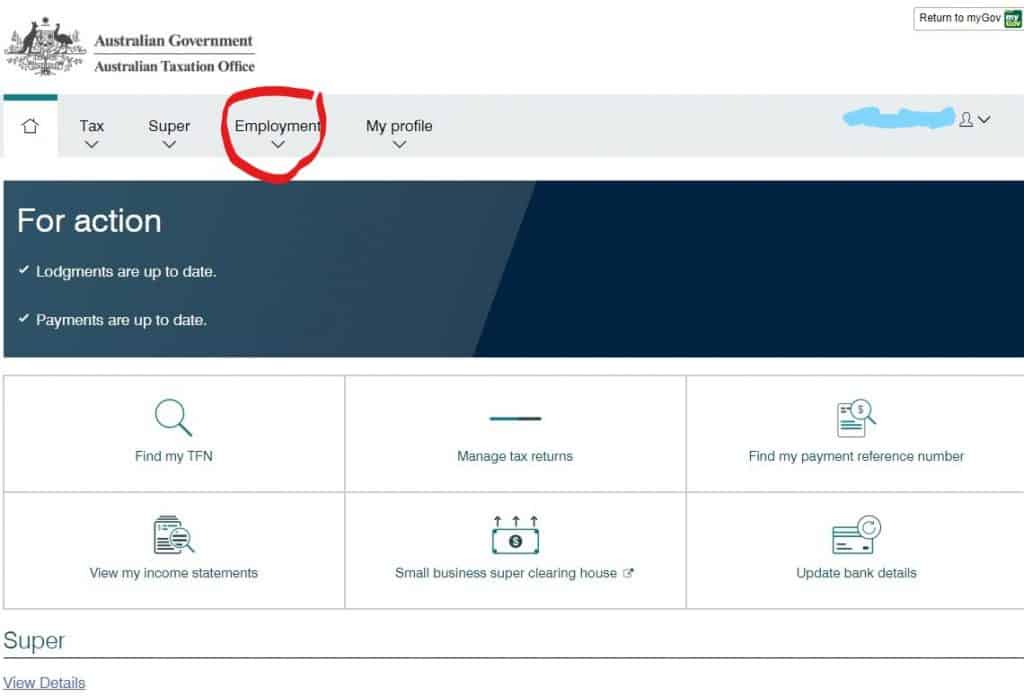

To check your pay year-to-date, login into the myGOV portal and select ATO services.

From the top of the screen (or top left on mobile) select Employment details.

From the Employment details expanded menu select “Income statements”. This will show your employers and employment income year to date.

Single Touch Payroll and payment summaries 2023

STP summaries deadline in 2023 online availability (via mygov portal) is 31 July 2023.

Larger employers (more than 19 employees) were required to adopt the STP online reporting from 1 July 2018. Smaller employers were required to participate from 1 July 2019.

Employers still need to provide a payment summary for any payments not reported through STP.

Employees whose employer has commenced reporting through STP will not receive payment summaries but can access summarised information through myGOV or their tax agent.

Until 2019

Until 2019 (and subsequently for non-STP payrolls), payment summaries were required to be issued to employees by 14 July of each year, covering earnings in the preceding year to 30 June.

Following their issue, the information is sent (or transmitted electronically) by the employer to the Tax Office (14 August), which enables the release of the information to myGov/myTax for taxpayers lodging their own returns online.

See links here for detailed information about payment summary (non-STP) forms and guidelines for employers.

This page was last modified 2023-05-27