What Is An Employee?

In order to comply with PAYG requirements, businesses need to understand the legal definition of an employee for income tax purposes.

This can be a grey area, and there are several recent tax cases which resulted in the Tax Office re-evaluating its guidance.

If a worker is deemed an employee, even if not designated as such, then the employer has an obligation to deduct tax instalments and remit them to the Tax Office.

The following documents set out ATO’s current position.

Income tax: pay as you go withholding – who is an employee?

Taxation Ruling TR 2023/4

Key factors which indicate an employment relationship include:

- Control: The engaging entity (business/employer) has a right to control how, when and where the worker performs their work.

- Personal service: The worker is required to perform the work personally and cannot delegate, subcontract or assign their work to another.

- Remuneration: The worker is paid by reference to hours worked, activities performed or a commission, rather than for achieving a specified result.

- Presentation: The worker is presented as part of the engaging entity’s business to the public and to the customers. The worker may wear a uniform, display a logo or use a business name that belongs to the business/employer.

- Other indicia of a contractor relationship:

- The worker’s ability to delegate or subcontract the work

- The extent to which tools and equipment are provided, and expenses incurred, by the worker

- Results contracts: whether the substance of the contract is to achieve a specified result, the worker being free to employ third-party labour, plant, and equipment to do so

- The extent to which commercial risks from injury or defects is borne by the worker

- The extent to which the worker independently generates goodwill from the work

In general, many single factors are not considered conclusive, and sham arrangements and mere labels in agreements carry little weight.

On the other hand, a worker not contracting in an individual capacity, but through a partnership, company or trust, suggests that an employment relationship has not been established.

This is a summary. Please refer to the full document for a more complete understanding of the ATO’s position.

Classifying workers as employees or independent contractors – ATO compliance approach.

Practical Compliance Guideline PCG 2023/2

The guidelines apply to the obligations to withhold tax from salary, wages and other remuneration under the taxation Administration Act 1953, and to pay superannuation contributions for ’employees’ categorised as such under the Superannuation Guarantee (Administration) Act 1992.

Whether a person is an employee of an entity is a question of fact to be determined by reference to an objective assessment of the totality of the relationship between the parties.

Indicia pointing to whether a worker is working in the business of the engaging entity include, but are not limited to:

- control

- right to delegate subcontract or assign work

- provision of assets, equipment and tools

- risk

- manner of remuneration

- goodwill

- labels given to parties in the contract and other descriptors of their relationship.

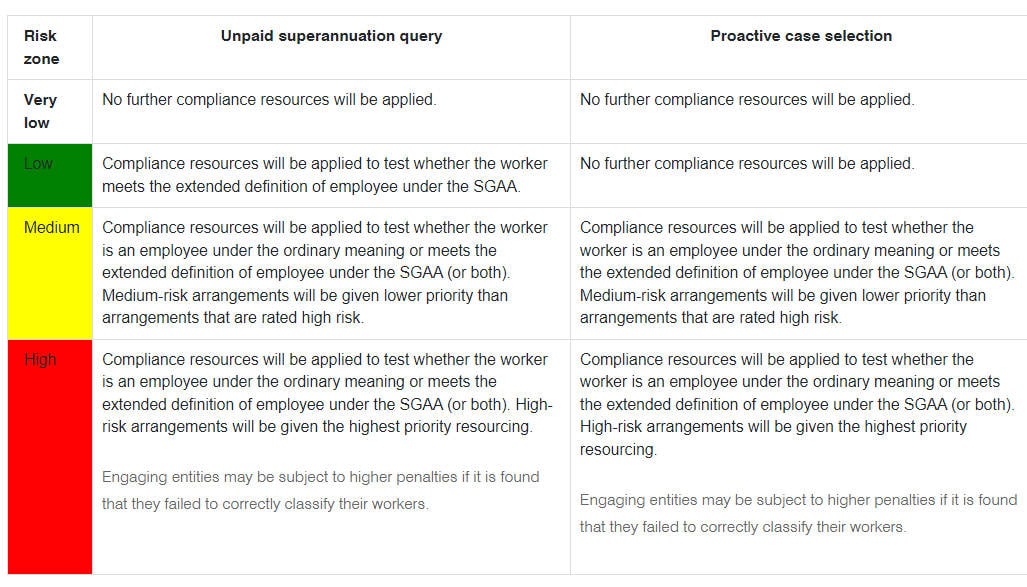

This Guideline sets out a method of risk profiling as the basis for the Tax Office’s enforcement processes.

Businesses may be subject to higher penalties if they incorrectly classify workers.

“High-risk arrangements” as classified according to the Tax Office’s risk categorisation are to be given the highest priority in compliance enforcement activity.

A review by the Tax Office of specific arrangements can be triggered proactively, or as a result of specific information received, such as an employee’s or contractor’s enquiry about unpaid superannuation.

This is a summary. Please refer to the full document for a more complete understanding of the ATO’s position.

Construction, Forestry, Maritime, Mining and Energy Union v Personnel Contracting Pty Ltd

Decision impact statement

The case involved a building worker engaged by a labour hire firm to work on a third party building site.

After decisions by the Federal Court and Full Federal Court that the labourer was not an employee, the High Court concluded that he was.

Reasons for the decision included:

- an emphasis on the terms of the written contract between the parties, the validity of which was not disputed

- the extent of employer control over the work

- various other factors including remuneration mode, work hours, and provision for holidays

- the labourer’s work was integral to the business of the labour hire firm, and he (the labourer) was not operating his own business

The ATO’s response and observations:

- the decision is consistent with the well-established practice of examining the totality of the relationship.

- the most significant clarification arises in primarily examining the terms of the written contract between the parties

- noted that the multifactorial test, considering all aspects of the contractual arrangement over an extended period of time, was rejected, but confirmed that extra-contractual circumstances and conduct may still be considered where:

- there are oral components of the contract; or

- the terms of the written contract have been varied; or

- the terms of the written contract are being challenged as invalid; or

- a party asserts rectification, estoppel or another legal process

- the business integration test along with the examination of control has been elevated as a primary focus of examining contractual terms

This is a summary. Please refer to the full document for a more complete understanding of the matter.

ATO article – Employee or contractor – tax and super obligations compared

A guide to the tax and super obligations of a business when working for them as a contractor compared to an employee.

The following articles discuss recent developments:

Employee or independent contractor?

Practical tips for categorising workers for superannuation purposes

A revised approach for businesses to consider when determining whether workers are employees or independent contractors for superannuation law purposes, based on two recent cases.

What’s Emerging: ATO releases guidance on worker classification

A review of the ATO’s draft guidance refreshing their previous views on worker classification, having regard to developments arising from recent case law.

Employee or Contractor – The Latest Thinking

This article warns that business can face payroll tax, superannuation, and pay-as-you-go withholding tax exposures associated with contractors, and suggests ways to approach mitigating the risks.

Contract remains king and the superannuation guarantee is still unsettled, so check your independent contractor contracts

This article reviews the decision of JMC Pty Ltd v Commissioner of Taxation FCAFC 76 which held that Mr Harrison, a lecturer engaged by JMC on short-term contracts, was not an employee for superannuation guarantee purposes, either under the common law or the extended definition in the SGA Act.

The findings of the appeal decision reinforce the importance of having a comprehensive written contract that reflects the true nature of the relationship between the parties. The page also advises employers and contracting principals to review their superannuation guarantee obligations.

this page was last modified 2023-12-13