FBT is a tax on employers, for taxable benefits provided to employees or their associates, by the employer or associates. Typical kinds of benefit are the provision of a car, loans and the payment of expenses. To be taxable, the essential components of a fringe benefit are:

- there is an employment relationship

- a benefit has been provided

- it is not an excluded benefit

Reminder: “emergency assistance” to employees is exempt from FBT. See more here.

On this page and further information links:

- Benchmark Interest Rate

- Board Fringe Benefits

- Cap on Entertainment

- Car Fringe Benefits

- COVID-19 and car fringe benefits

- Car FBT- Statutory Formula Method

- Car FBT – Operating Cost Method

- Car Parking FBT

- Cents Per Km Other Than A Car

- Debt Waiver Fringe Benefits

- Declarations – FBT

- Entertainment Fringe Benefits

- Exemptions and Concessions Checklist

- FBT Exempt vehicles

- Exemption Threshold Record Keeping

- Expense Payment Fringe Benefits

- FBT Checklists

- FBT Concessional Caps

- FBT Declarations – Substantiation

- FBT Instalments

- FBT Rates & Gross-up Rates

- Housing Fringe Benefits

- Income – Reportable Fringe Benefits

- Indexation For Non-Remote Housing

- Living Away From Home FBT

- Loan Fringe Benefits

- Minor Benefits Exemption

- ‘Otherwise Deductible’ Rule

- Property Fringe Benefits

- Public Benevolent Institutions Caps & Rebatable Employers

- Rates of FBT

- Reasonable Food & Drink

- Remote Area FBT Concessions

- Reportable Fringe Benefits

- Return Forms PDF download

- Returns – lodgment

- Salary Sacrifice – Salary Sacrifice Car

- Small Business and Work-Related Expenses

- Taxi Travel amendment

- Vehicles – exempt from FBT

- What does FBT affect?

- New for 2022

- New for 2021

- New for 2020

- New for 2019

- New for 2018

FBT Rates and FBT Gross Up Rates

Fringe Benefits Tax is applied annually on the calculated grossed up net value of benefits provided, at a rate equivalent to the top marginal rate of income tax including medicare levy.

| FBT Year ending | FBT rate | Type 1 Gross-up Rate | Type 2 Gross-up Rate |

| 31 March 2024 | 47% | 2.0802 | 1.8868 |

| 31 March 2023 | 47% | 2.0802 | 1.8868 |

| 31 March 2022 | 47% | 2.0802 | 1.8868 |

| 31 March 2021 | 47% | 2.0802 | 1.8868 |

| 31 March 2020 | 47% | 2.0802 | 1.8868 |

| 31 March 2019 | 47% | 2.0802 | 1.8868 |

| 31 March 2018 | 47% | 2.0802 | 1.8868 |

| 31 March 2017 | 49% | 2.1463 | 1.9608 |

| 31 March 2016 | 49% | 2.1463 | 1.9608 |

| 31 March 2015 | 47% | 2.0802 | 1.8868 |

| 31 March 2014 | 46.5% | 2.0647 | 1.8692 |

For a gross-up rate spreadsheet calculator see here.

The threshold which determines the requirement to pay in advance by four quarterly instalments is $3,000, based on the FBT liability for the previous year.

FBT: What’s new in 2024-25

- Reasonable food and drink – see Commissioner’s determination for 2024-25

- Indexation factors for valuing non-remote housing – 2024-25 updated here

- the FBT benchmark interest rate for 2024-25 is 8.77 % per annum – see FBT benchmark interest rates

- FBT cents per kilometre for vehicle other than a car for 2024-25 – see here

- FBT record-keeping exemption threshold for 2023-24 uplifted to $10,334 – see Exemption Thresholds

- Car parking FBT daily fee threshold – TBA

- The pay in advance quarterly instalments threshold is $3,000, based on the FBT liability for the previous year.

- Treatment of EVs: Home charging costs (4.2 cents per km) – FBT exempt vehicles – see Practical Compliance Guide PCG 2024/2

- From 1 April 2024 employers can choose to rely (partly or wholly) on alternative travel records and records in place of Declarations. Each of the alternative requirements are described in a series of Legislative Instruments with associated Explanatory Memoranda.

FBT: What’s new in 2023-24

- Reasonable food and drink – see Commissioner’s determination for 2023-24

- indexation factors for valuing non-remote housing – 2023-24 updated here

- the FBT benchmark interest rate for 2023-24 is 7.77% per annum – see FBT benchmark interest rates

- FBT cents per kilometre for vehicle other than a car for 2023-24 – see here

- FBT record-keeping exemption threshold for 2023-24 uplifted to $9,786 – see Exemption Thresholds

- Car parking FBT daily fee threshold – $10.40

- The pay in advance quarterly instalments threshold is $3,000, based on the FBT liability for the previous year.

- The paper return lodgement and payment deadline is Tuesday 21 May 2024, agent-lodged returns electronically are due by Tuesday 25 June 2024.

- Treatment of EVs: Home charging costs (4.2 cents per km) – FBT exempt vehicles – Practical Compliance Guide PCG 2024/2 was finalised in Feb 2024 and applies from 1 April 2022 for FBT purposes. See: Electric Vehicle FBT exemption and summaries:

- See also: Fact Sheet: Electric Vehicles and Fringe Benefits Tax

FBT: What’s new in 2022-23

- Reasonable food and drink – see Commissioner’s determination for 2022-23

- indexation factors for valuing non-remote housing – 2022-23 updated here

- the FBT benchmark interest rate for 2022-23 is 4.52% per annum – see FBT benchmark interest rates

- FBT cents per kilometre for vehicle other than a car for 2022-23 – see here

- FBT record-keeping exemption threshold for 2022-23 uplifted to $9,181 – see Exemption Thresholds

- Car parking FBT daily fee threshold – $9.72.

- TR 2021/2 was issued to clarify definitions including ‘commercial parking station’, ‘primary place of employment’ and ínrespect of employment’.

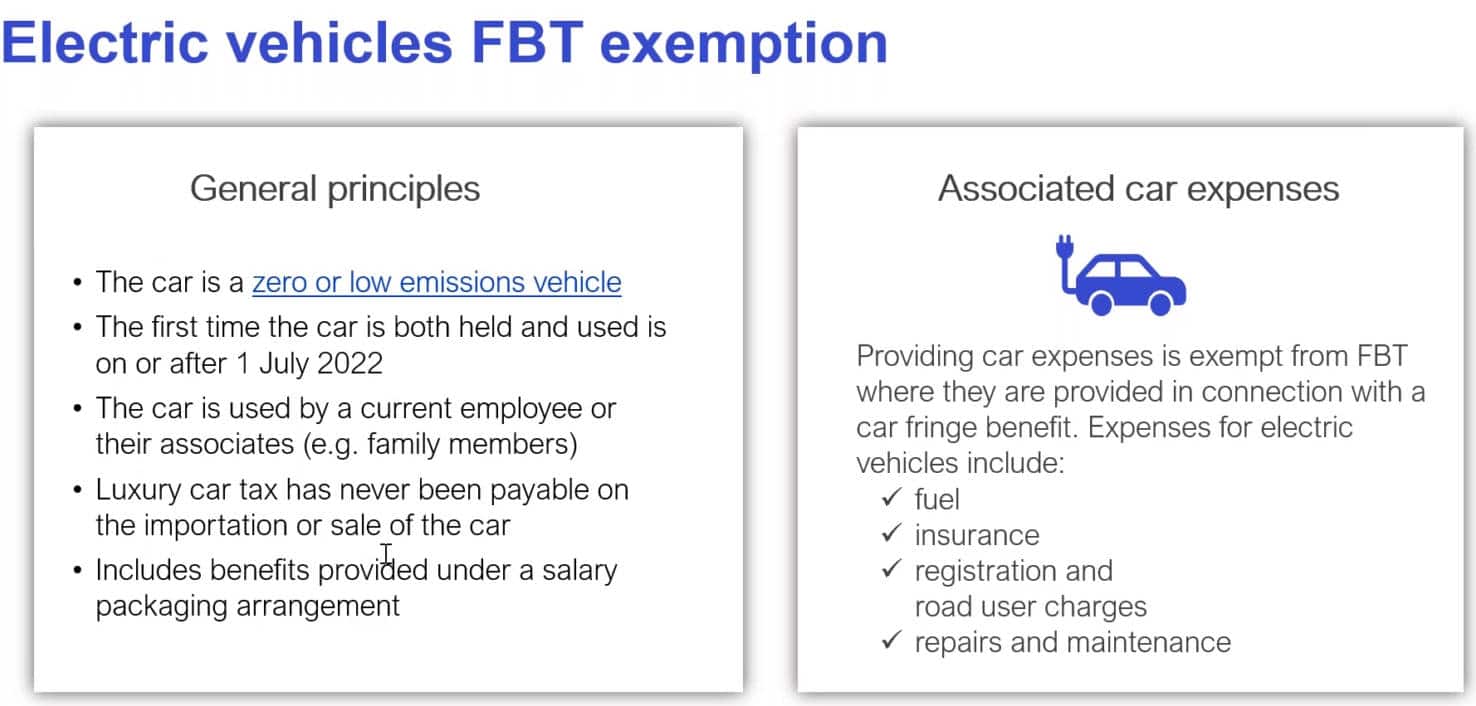

- An FBT exemption applies for eligible zero or low emissions vehicles (for cars at first retail value below the luxury car tax fuel efficient threshold) with effect from 1 July 2022.

- Eligible plug‑in hybrid electric vehicles will also be FBT exempt when provided under arrangements entered into before 1 April 2025.

- See more: Electric Vehicle Rebates In Australia and Minister’s media release and Treasury Laws Amendment (Electric Car Discount) Bill 2022 + ATO Fact Sheet: Electric vehicles and fringe benefits tax (Feb 2023)

- Article: How to benefit from the Fringe Benefit Tax Exemption for electric vehicles

- The home electricity cost of recharging batteries of an electric vehicle can be calculated at the rate of 4.2 cents per kilometre with effect from 1 April 2022, under PCG 2023/D1, in order to calculate taxable value of Reportable Fringe Benefits which include employee contributions. More here.

- Law has been amended to allow the Commissioner to make determinations, by legislative instrument, alternative forms of record keeping for FBT purposes. See Treasury Laws Amendment (2022 Measures No 4) Bill 2022. The new guideline take effect from 1 April 2024.

- The paper return lodgment and payment deadline is Monday 22 May 2023, agent-lodged returns electronically are due by Monday 26 June 2023.

See also COVID-19 and fringe benefits tax (ATO)

FBT: What’s new in 2021-22

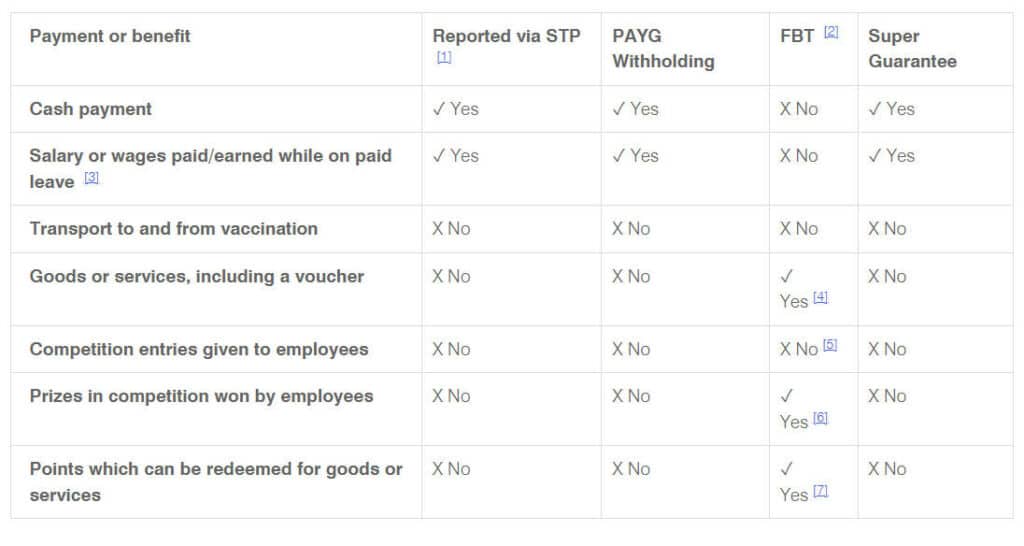

- COVID-19 vaccination incentives and rewards – ATO’s guidance

- Reasonable food and drink – see Commissioner’s determination for 2021-22

- indexation factors for valuing non-remote housing – 2021-22 updated here

- the FBT benchmark interest rate for 2021-22 is 4.52% per annum – see FBT benchmark interest rates

- FBT cents per kilometre for vehicle other than a car, (no change) for 2021-22 – see here

- FBT record-keeping exemption threshold for 2021-22 uplifted to $8,923 – see Exemption Thresholds

- Car parking FBT daily fee threshold – $9.25; and application of finalised ruling to replace the withdrawn TR96/26.

- Exemption on work-related items – see Small Business and Work-Related Expenses

- Small business exemptions extended to employers with aggregated turnover of up to $50 million (car parking and work-related devices)

- FBT Instalment threshold – last year liability of $3,000 or more

Covid-related Benefits Summary

Providing employees with vaccine incentives or pets can lead to FBT obligations: ATO

Car Parking From 1 April 2022

From 1 April 2022 the definition of commercial car parking to include shopping centre car parks and other car parking facilities.

Tax Ruling TR 2021/2 issued 16 June 2021 provides the ATO’s updated position in this regard.

FBT: What’s new in 2020-21

- COVID-19 and working from home benefits – Tax Office Guidance

- Exemption (to apply from 2 October 2020) for training or education provided to a redundant, or soon to be redundant, employee for the purpose of assisting that employee to gain new employment. Exclusions include salary packaging arrangements. See exposure draft here.

- no change in the FBT and gross-up rates – see table above

- indexation factors for valuing non-remote housing – 2020-21 updated here

- FBT record-keeping exemption threshold for 2020-21 uplifted to $8,853 – see Exemption Thresholds

- FBT cents per kilometre for vehicle other than a car, rates uplifted for 2020-21 – see here

- the FBT benchmark interest rate for 2020-21 is 4.80% per annum – see FBT benchmark interest rates

- Reasonable food and drink – see Commissioner’s determination for 2020-21

- Car parking daily fee threshold for 2021 is $9.15 Adjusted annually – see Car Parking FBT. [expanded definitions of commercial car parking apply from 1 April 2022]

FBT: What’s new in 2019-20

- no change in the FBT and gross-up rates – see table above

- indexation factors for valuing non-remote housing – updated here

- FBT record-keeping exemption threshold for 2021 uplifted to $8,853 – see Exemption Thresholds

- FBT cents per kilometre for vehicle other than a car rates uplifted – see here

- the FBT benchmark interest rate for 2019-20 is 5.37% per annum – see FBT benchmark interest rates

- Reasonable food and drink – see Commissioner’s determination for 2019-20

- Car parking daily fee threshold for 2020 is $8.95- adjusted annually – see Car Parking FBT

- As a COVID-19 response measure the due date for lodgment of 2020 returns has been extended to 25 June 2020

FBT: What’s new in 2018-19

- indexation factors for valuing non-remote housing – updated here

- FBT record-keeping exemption threshold uplifted to $8,552 – see Exemption Thresholds

- FBT cents per kilometre for vehicle other than a car rates uplifted – see here

- the FBT benchmark interest rate for 2018-19 is 5.20% per annum – see FBT benchmark interest rates

- Reasonable food and drink – see Commissioner’s determination for 2018-19

- Car parking daily fee thresholds – adjusted annually – see Car Parking FBT

FBT: What’s new in 2017-18

The following updated rates and thresholds for the 2017-18 FBT year (i.e. from 1 April 2017) have been published:

- FBT rate drops to 47% from 1 April 2017. Gross-up rates are Type 1 – 2.0802 and Type 2 – 1.8868.

- FBT cents per kilometre for vehicle other than a car rates uplifted – see here

- indexation factors for valuing non-remote housing – updated here

- the FBT benchmark interest rate for 2017-18 is 5.25% per annum – see FBT benchmark interest rates

- Living away from home – reasonable food and drink amounts increased – Commissioner’s determinations

- FBT record-keeping exemption threshold uplifted to $8,393 – see Exemption Thresholds

- Car parking daily fee thresholds – adjusted annually – see Car Parking FBT

- Reasonable food and drink – see Commissioner’s determination for 2017-18

- Guidelines – minor use of a provided work vehicle. The Tax Office has released guidance on the private use of ‘eligible’ vehicles by employees. See PCG 2018/3 (previously released as draft PG2017/D14)

FBT: What’s new in 2016-17

The following updated rates and thresholds for the 2016-17 FBT year have been published:

- FBT cents per kilometre for vehicle other than a car rates uplifted – see here

- indexation factors for valuing non-remote housing – updated here

- the FBT benchmark interest rate for 2016-17 is unchanged at 5.65% per annum – see FBT benchmark interest rates

- Living away from home – reasonable food and drink amounts increased – Commissioner’s determinations

- FBT record-keeping exemption threshold uplifted to $8,286 – see Exemption Thresholds

- Car parking daily fee thresholds – adjusted annually – see Car Parking FBT

- Reasonable food and drink – Commissioner’s determination for 2016-17

Other FBT changes for 2016-17

The following changes apply from apply from 1 April 2016

- Liberalisation of the exemption for portable electronic devices

- $5,000 cap on entertainment expenses

- A changed definition for adjusted fringe benefits: The meaning of ‘adjusted fringe benefits total’ is modified so that the gross value rather than adjusted net value of reportable fringe benefits is used, except for PBIs, hospitals and charities. The measures take effect from 1 January 2017 for family assistance payments and for income tax tests from 1 July 2017. See more here: Adjusted Taxable Income

Note also that 31 March 2017 marks the end of the temporary rate increase to 49%. The rate reverts to 47% from 1 April 2017.

FBT: What’s new in 2015-16

A brief summary of updates affecting the 2015-16 FBT year ending on 31 March 2016

- there’s a new FBT rate of 49% and an adjustment of the gross-up rates to 2.1463 (type 1) and 1.9608 (type 2)

- car parking fringe benefits threshold increased to $8.37 – see further car parking fringe benefits

- FBT cents per kilometre for vehicle other than a car – see here

- indexation factors for valuing non-remote housing – updated here

- the FBT benchmark interest rate for 2015-16 is 5.65% per annum – see FBT benchmark interest rates

- Living away from home – reasonable food and drink – Commissioner’s determinations

- FBT record-keeping exemption threshold – increased to $8,164 for 2015-16 – see Exemption Thresholds

PBI and Rebatable Employers Concessions

| Concession type | Years 2018, 2019, 2020, 2021, 2022, 2023, 2024 | 2017 |

| Public benevolent institution (other than public hospitals) and health promotion charities – exemption caps | FBT exemption cap $30,000, Entertainment $5,000 | FBT exemption cap $31,177, Entertainment $5,000 |

| Public hospitals, non-profit hospitals and public ambulance services – exemption caps | FBT exemption cap $17,000, Entertainment $5,000 | FBT exemption cap $17,667, Entertainment $5,000 |

| Rebatable employers – certain non-government and non-profit organisations | FBT rebate 49% capped at $30,000 | FBT rebate 49% capped at $31,177 |

Note for 2016-17: liberalisation of the exemption for portable electronic devices and the $5,000 cap on entertainment expenses measures taking effect for the FBT year commencing 1 April 2016.

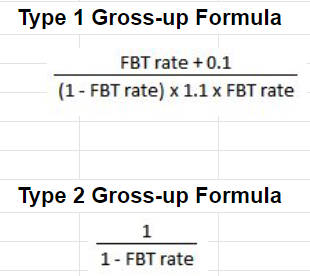

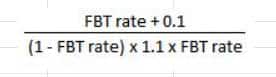

Type 1 and Type 2 FBT Gross Up Rates Formulae

Type 1 gross-up rate is used where there is a GST credit entitlement applicable to the benefit. The formula:

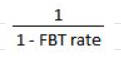

Type 2 gross-up rate is used where there is no GST credit entitlement applicable to the benefit. The formula:

For a formularised spreadsheet view of the gross-up calculations see here.

See also: Taxation Ruling TR 2001/2 Fringe benefits tax: the operation of the new fringe benefits tax gross-up formula to apply from 1 April 2000

FBT rate 2015-16 and 2016-17

The 2014 Budget contained a proposal for a 3-year Temporary Budget Repair Levy to apply from 1 July 2014 until 30 June 2017 at a rate of 2% on personal incomes over $180,000 per annum. The FBT rate was changed to 49% from 1 April 2015 until 31 March 2017.

The expense gross-up rates changed accordingly.

The Fringe Benefits Tax rate increases to 47% from 1 April 2014.

The expense gross-up rates will also change:

- Type 1 (10% gst credit) 2.0802

- Type 2 (no gst claim) 1.8868

Example FBT calculation 2014-15

The basic FBT calculation method grosses up the GST-inclusive benefit, upon which the tax rate of 47% is payable. The benefit and FBT are tax deductible.

Type 1 expenses are those with an Input Tax Credit (“ITC”) available – the gross-up factor is 2.0802

Type 2 expenses are those for which ITC is not available (whether the payment actually includes GST or not) – the gross-up factor is 1.8868.

Example: Taxable value of benefit $5,000

Type 1 benefit (GST creditable) $5,000 x 2.0802 x 47% = FBT of $4,888.47

Type 2 benefit (no GST credit) $5,000 x 1.8868 x 47% = FBT of $4,433.98

FBT rate 2013-14

The Fringe Benefits Tax rate until 31 March 2014 is 46.5%

Gross-up rates:

- Type 1 (10% gst credit) 2.0647

- Type 2 (no gst claim) 1.8692

Earlier years’ FBT rates

| Year ending | FBT rate | Type 1 | Type 2 |

| 31 March 2013 | 46.5% | 2.0647 | 1.8692 |

| 31 March 2012 | 46.5% | 2.0647 | 1.8692 |

| 31 March 2011 | 46.5% | 2.0647 | 1.8692 |

| 31 March 2007 | 46.5% | 2.0647 | 1.8692 |

| 31 March 2001 | 48.5% | 2.1292 | 1.1917 |

The FBT Year of Assessment

The FBT year of assessment and return is from 1 April to 31 March.

Tax Deductible FBT

Fringe Benefits Tax is itself normally tax deductible on an accrued basis, provided there is the necessary connection with the earning of assessable income (thus excluding not-for-profit organisations) (Ruling TR95/24)

Categories of FBT

What’s Caught: Categories of Taxable Fringe Benefit

The Fringe Benefits Assessment Act (FBTAA 1986) separately deals with the following benefits. Each category of benefit has rules which determine the value of the benefit for FBT purposes.

- Division 2–Car fringe benefits

- Division 3–Debt waiver fringe benefits

- Division 4–Loan fringe benefits

- Division 5–Expense payment fringe benefits

- Division 6–Housing fringe benefits

- Division 7–Living-away-from-home allowance fringe benefits

- Division 8–Airline transport fringe benefits

- Division 9–Board fringe benefits

- Division 9A–Meal entertainment (and Entertainment generally)

- Division 10–Tax-exempt body entertainment fringe benefits

- Division 10A–Car parking fringe benefits

- Division 11–Property fringe benefits

- Division 12–Residual fringe benefits

Exemptions

Exemption from FBT can be a consequence of the nature of the benefit, or the characteristics of the employer, or some combination of both.

Fringe Benefits Tax – Exemptions and Concessions Checklist

For a comprehensive checklist of items which attract exemption or reduced FBT exposure with links and references – see here: Exemptions and Concessions Searchable Checklist

Taxi travel

The Tax Office position had previously been that the FBT exemption is limited to travel in a vehicle licensed by the relevant State or Territory to operate as a taxi, and thus not extending to ride-sourcing services (e.g. Uber), even though for GST purposes such services are treated as taxi travel.

Legislation was introduced to remove this anomaly, with taxi travel for FBT purposes defined as having the same meaning as for GST. See article: I win my taxi war with the Commissioner and Taxi travel expenses exemption

“In respect of employment..”

For a taxable benefit to arise, the benefit must be provided “in respect of” employment. The Tax Office’s view is that certain benefits provided within a “family setting” – such as that of a birthday gift to a child employed within a family small business – are not caught. An explanation and examples are provided in ruling MT 2016.

The position of shareholder/directors is dealt with in ruling MT 2019. The “in respect of employment” connection is sufficient to exclude volunteers, who are not considered to be employees in this context.

Exempt vehicles

The ATO no longer (since 2017) publishes a list of vehicle types for determining eligibility for exemption, instead using a list of conditions. See further: Exempt vehicles.

Budget 2015: The small business FBT exemption for portable electronic devices for work purposes is expanded to include more than one device performing a similar function from 1 April 2016.

This exemption refers to devices such as laptop computers, tablets and phablets. See Work-related items exempt from FBT

Before the change, there was an exemption limit of one portable electronic device per FBT year performing a similar function.

From 1 April 2021 the small business aggregated turnover limit (the limit for access to this concession) increases from $10 million to $50 million. See further: Small Business concessions

Visa application – non-resident employee

If an employer pays the costs of a visa application for a non-resident employee to remain in Australia, the benefit is not provided in respect of relocation transport and is therefore not an exempt benefit under section 58F of the FBTAA because the employee is already living in Australia. (ATO ID 2013/35).

Fitness class provided by the employer on the employer’s premises

Subsection 47(2) provides an FBT exemption for an employee’s use of a recreational facility which is on the employer’s premises. However, a fitness class conducted in a room within the recreational facilities is not considered to be exempt, because the relevant benefit is the participation in a fitness class, rather than the provision, or use, of a recreational facility. (ATO ID 2015/25)

Minor Benefits – Under $300 (s58P)

Section 58P of the FBTAA provides an FBT exemption for fringe benefits which have a notional taxable value of less than $300. The $300 amount is not a deductible; once the threshold has been exceeded the full amount is subject to FBT. There are exclusions, and qualifying conditions – for more information, see FBT Minor Benefits Exemption.

Reductions of Taxable Value

Reductions: Benefits are Reduced for Tax Purposes

The Fringe Benefits Assessment Act sets out a number of reductions of taxable value in Division 14 and there is more information here: Reductions in fringe benefit taxable value

In-House Property and Residual Benefits – concession withdrawal 22 October 2012 – and salary sacrifice arrangements

In-house fringe benefits are goods or services received by employees which are the same as those provided to customers. In-house goods and services are concessionally valued.

Until 22 October 2012, the concessions provided that

- the taxable value is 75% of the lowest selling price to the public or the cost of the benefit to the employer; and

- The first $1,000 of in-house goods and services provided to employees is exempt from FBT.

Under amendments foreshadowed in the 2012 MYEFO, these concessions were removed, subject to transitional arrangements, which provide that pre-existing salary sacrifice arrangements implemented before 22 October 2012 are excluded from the new rules until 1 April 2014.

See Sec 62 Reduction of aggregate value and Tax free threshold

‘Otherwise Deductible’ Rule

This is the rule under which the FBT tax value of a benefit is reduced by the amount that an employee would have been entitled to claim as an income tax deduction in their personal tax return if the benefit hadn’t been given the employer.

An explanation of the calculation method for an expense payment otherwise deductible amount is here.

Special rules apply to the calculation of otherwise deductible car expenses – discussed here

FBT for PBIs and Not For Profit Organisations

Non-profits

Subject to registration requirements, non-profits may be wholly or partially exempt, rebatable or fully taxable. Partially exempt employers are subject to exemptions caps, with the excess fully taxed.

For more detail of the qualifying pre-conditions for tax exempt status refer to

- Tax Concessions

- Getting endorsement

- Tax ruling 2015/1 – special conditions for exempt entities

Caps are calculated by reference to the grossed-up benefit value, not the value of the benefit.

Cap on entertainment

Budget 2015-16: From 1 April 2016 a separate grossed-up cap of $5,000 applies for salary-sacrificed meal entertainment benefits, with the excess to be counted in calculating the existing FBT exemption or rebate cap.

Meal entertainment benefits are reportable. See Entertainment FBT, Tax-exempt Body Entertainment Fringe Benefits

See also: TD 2015/12 Fringe benefits tax: When are the duties of the employment of an employee of an employer who is a government body exclusively performed in, or in connection with, a public hospital or a hospital carried on by a society or association that is a rebatable employer?

FBT Concessional Caps

Eligible ATO-endorsed employers are entitled to a tax rebate (tax reduction) of the FBT up to the grossed-up benefit cap amount. Endorsed organisations are referred to as “rebatable employers”. See FBT rebate and Endorsement to access charity tax concessions.

| FBT Tax Year ending | 31 March 2018, 2019, 2020, 2021, 2022, 2023, 2024 |

| Public benevolent institution (other than public hospitals) and health promotion charities | $30,000 |

| Public hospitals, non-profit hospitals and public ambulance services | $17,000 |

| Rebatable employers – certain non-government and non-profit organisations | rebate 47% capped at $30,000 |

| FBT Tax Year ending | 31 March 2016 31 March 2017 * |

| Public benevolent institution (other than public hospitals) and health promotion charities | $31,177 |

| Public hospitals, non-profit hospitals and public ambulance services | $17,667 |

| Rebatable employers – certain non-government and non-profit organisations | rebate 49% capped at $31,177 |

Legislation enacted from the Federal Budget 2014-15 provides for the FBT rate to move to 49% for two years from 1 April 2015. For non-profits, this means the exemption and rebate caps are adjusted accordingly.

| FBT Tax Year ending | 31 March 2015 |

| Public benevolent institution (other than public hospitals) and health promotion charities | $30,000 |

| Public hospitals, non-profit hospitals and public ambulance services | $17,000 |

| Rebatable employers – certain non-government and non-profit organisations | rebate 48% capped at $30,000 |

FBT Year to 31 March 2015

With the change in the FBT rate to 47% for the FBT year ending on 31 March 2015, the tax gross-up rates and underlying maximum expense values also change.

| Cap | Type 1 Gross-Up 2.0802 | Type 2 Gross-up 1.8868 |

| $30,000 | $14,422 | $15,900 |

| $17,000 | $8,172 | $9,010 |

FBT Year to 31 March 2014

| Cap | Type 1 Before Gross-Up 2.0647 | Type 2 Before Gross-up 1.8692 |

| $30,000 | $14,530 | $16,049 |

| $17,000 | $8,234 | $9,095 |

Record Keeping Exemption

The general record-keeping requirements for FBT are fairly detailed and specific, and potentially onerous. See also Section 135C of FBTAA.

Subject to conditions, an employer may elect not to keep full FBT records.

The overall idea is that

- you keep full records for the first year (called ‘the base year’) but may elect not to in subsequent years provided the total benefits don’t increase by more than 20% or $100.

- the base year total benefits must be within the exemption limit which is set for that year (see table below).

Other points to keep in mind which may potentially limit the use of the exemption include:

- you still need to record the value of fringe benefits on employees’ payment summaries to satisfy the Reportable Fringe Benefits requirements.

- The Tax Office can at any time request you to start keeping full records

- your FBT return for the base year must have been lodged on time

- notwithstanding the exemption, sufficient records must be available to show that the 20% limit has not been exceeded, and as supporting evidence for the income tax position

- where car benefits are involved, each exemption year must show that business kilometres or business use percentage (as applicable to the FBT calculation method being used) are within 80% of the base year levels

- the qualifying conditions must be met for all years between the base year and the current year.

Recordkeeping Exemption Thresholds

| FBT Year Ending | Exemption Threshold |

| 31 March 2024 | tba |

| 31 March 2023 | $9,181 |

| 31 March 2022 | $8,923 |

| 31 March 2021 | $8,853 |

| 31 March 2020 | $8,714 |

| 31 March 2019 | $8,552 |

| 31 March 2018 | $8,393 |

| 31 March 2017 | $8,286 |

| 31 March 2016 | $8,164 |

| 31 March 2015 | $7,965 |

| 31 March 2014 | $7,779 |

| 31 March 2013 | $7,642 |

| 31 March 2012 | $7,391 |

Threshold values for earlier years are here.

FBT Returns – lodgment – 2023

The FBT year runs from 1 April to 31 March, with paper returns generally required to be lodged with payment by Monday 22 May 2023.

Agent-lodged FBT Return Due Dates 2023

The extended due date for Tax Agents lodging client returns electronically is Monday, 26 June 2023.

2023 Forms: Downloadable 2023 return form and instructions

2022 FBT Returns

Paper FBT returns were required to be lodged by 23 May 2022 or Agent-lodged returns electronically by Monday, 27 June 2022.

2021 FBT Return

- 2020-21 returns are required to be lodged by 21 May 2021, unless tax agent or other arrangements are in place

2020 FBT return

- 2019-20 returns are required to be lodged by 21 May 2020, unless tax agent or other arrangements are in place. A Bushfires deferral is in already in place, and the Tax Office has an emergency support hotline for COVID-19 and other disaster impacts. See Requirements to lodge and Dealing with disasters.

- Returns lodged via the practitioner lodgement service are due by 25 June 2019, with any associated payment due by 28 May 2019.

2019 FBT return

- 2019 returns are required to be lodged by 21 May 2019, unless tax agent or other arrangements are in place.

- Returns lodged via the practitioner lodgement service are due by 25 June 2019, with any associated payment due by 28 May 2019.

2018 FBT return

- 2018 returns are required to be lodged by 21 May 2018 (unless tax agent or other arrangements are in place).

2017 FBT return

- 2017 returns are required to be lodged by 21 May 2017 (unless tax agent or other arrangements are in place

- The tax agent electronic lodgment due date is 25 June 2017, with payments due by 28 May 2017.

2016 FBT return

- 2016 FBT returns are required to be lodged by Monday, 23 May 2016.

2015 FBT return

- 2015 FBT returns lodged electronically by tax agents the latest due date is 25 June 2015

- 2015 FBT paper returns are required to be lodged by 21 May 2015.

- The due date for payment in respect of all returns is 28 May 2015

FBT Return Forms

The Fringe Benefits Tax return forms can be downloaded (PDF format):

- 2024 return form and instructions

- 2023 return form and instructions

- 2022 return form and instructions

- 2021 return form and instructions

- 2020 return (pdf)

- 2020 return instructions (link)

- 2019 return

- 2018 return

- 2017 return

- 2016 return

- 2015 return

- 2014 return

If a return is not required a particular year, to head off unnecessary ATO correspondence lodge a Fringe benefits tax – notice of non-lodgment.

Declarations – Substantiation

There are a number of declarations which are a necessary component of the substantiation of various FBT categories, reductions and exemptions.

Whilst declarations are generally not required to be submitted to the Tax Office, unless specifically requested, the Tax Office can make a request to see a declaration in the course of reviewing, assessing or validating an FBT claim.

When required, declarations must be obtained no later than the due date for return lodgment, or if no return is required, by 21st May following FBT year end.

The ATO’s list of declaration templates is here.

Alternative substantiation records

The Tax Office has released guidelines for records which will meet requirements to calculate FBT with reference to a reduction in taxable value for certain travel expenses and in replacement of various expense Declarations.

The guidelines are applicable from 1 April 2024.

FBT resources and checklists

2024-25

- List of alternative Travel Diary and other records requirements (takes effect 1 April 2024)

2023-24

- Fringe Benefits Tax – Year Ended 31 March 2024 – Andersen Australia

- Searchable checklist of exemptions and concessions

- Checklist of ATO’s FBT Guidance Changes 2024

- FBT season 2024: ATO compliance update – Wolters Kluwer

- FBT checklist 2024

- Navigating Fringe Benefits Tax compliance: Are you ready for FBT season? – BDO

2022-23

- FBT checklist 2023

- Employment Taxes Update (see from page 4 of March 2023 Monthly Tax Update) – PWC

- Article: Key compliance considerations for completing your 2023 Fringe Benefits Tax return – BDO

2021-22

- FBT season 2022: annual compliance update – Wolters Kluwer

- FBT 2022 Hot Topics Checklist – Lowe Lippmann

- Searchable checklist of exemptions and concessions

- Fringe Benefits Tax Return Checklist FBT Year To 31 March 2022

- FBT Checklist 2022 – BDO

2020-21

- FBT-checklist-2021 (pdf)

- 2021 FBT return: What you need to know – series on Youtube (PWC)

- FBT season 2021 ATO compliance update – Wolters Kluwer Australia

2019-20

- FBT time again: ATO update 2020 – Wolters Kluwer

- Important year-end updates for Fringe Benefits Tax – PWC

- FBT 2020 “hot spots”

2018-19

- Important year-end updates for Fringe Benefits Tax – PWC

- FBT Basics 2019 – NTAA

- 2019 return form and instructions

- FBT return checklist March 2019

2017-18

2016-17

- Top 5 things you need to know about 2017 FBT returns – thomsonreuters.com.au

- FBT return checklist March 2017

- FBT exemptions and benefits checklist

- FBT Calculator – Non-Profits – ATO

- FBT in detail – Tax Office guide

- If an FBT return is not required – see Notice of non-lodgment

earlier/other

- 2016 FBT Update and Year End Reminders – Wolters Kluver

- FBT return checklist March 2016

- 2015 Fringe Benefits Tax Update and Year-End Reminders – Lexology/PWC

- FBT return checklist March 2015

Further information

- Tax Office Employer’s Guide – FBT Chapter Listing

- Reductions in fringe benefit taxable value – Australian Taxation Office

- Reportable Fringe Benefits

- Non-profit organisations and FBT

This page was last modified 2024-03-29