NON-RESIDENT INDIVIDUAL TAX RATES

- Children tax – nonresident

- CGT and non-residents

- CGT Withholding From Non-resident Property Sales

- Foreign Investment in Australia Policies & FIRB Application Fees

- Working Holiday Makers (Backpackers) Tax Rates

- Non-resident issues link page

- Non Resident For Tax Purposes

- Online services for foreign investors (ATO resources page)

Non Resident Of Australia For Tax Purposes

“Non-resident” for tax purposes essentially means not being “resident”

Being a tax resident of Australia provides access to a lower tax scale and the tax-free threshold, although the medicare levy is added unless there is some basis of exemption (such as for ADF members).

It also means that (in general) your non-Australian income is caught in the Australian tax net.

As a general principle, and subject to exceptions, tax residents are taxed on their world-wide income, non-residents only on their Australian-sourced income.

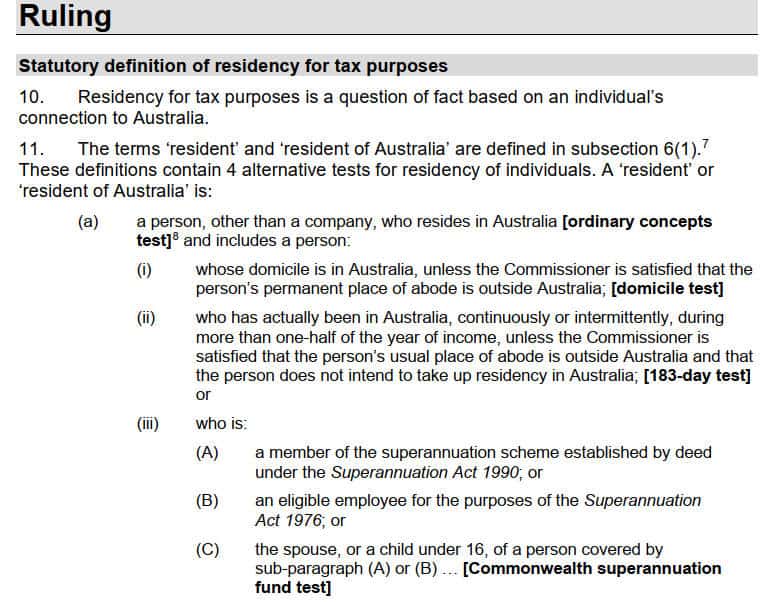

The “resides test” – 183 Days

The ATO has emphasised that the primary determinant of tax residence of Australia is whether or not you live there.

This is referred to as the “resides” test or “ordinary concepts test”, which considers whether you are physically present in Australia, and are resident according to the ordinary meaning.

There are 3 other additional residency tests, which can be applied, one of which is the 183 day test.

The 183 day test indicates residency if you actually been in Australia, continuously or intermittently, during more than one-half of the year of income, unless your usual place of abode is outside Australia, and do not intend to take up residency in Australia.

On this definition, the 183 day test, is not absolute or automatic. The location of a “place of abode” and the taxpayer’s intentions are qualifying exceptions.

The latest ruling on residency provided by the ATO emphasises the significance of circumstances and intentions in the determination of residency, and sets out a number of examples to demonstrate this in action.

Essential reading: Taxation Ruling TR 2023/1 and see also: Residency – the resides test

Non-resident beneficiaries

Draft rulings issued by the tax office conclude that foreign resident beneficiaries are taxable on distributions of gains from Australian non-fixed trusts, which might otherwise have not been taxable if the beneficiary had received the gains directly rather than through the trust.

See Tax Determinations TD 2022/13 (replaced draft TD 2019/D6).

and commentary: Recent determinations by the Australian Tax Office perpetuate international tax trust morass

New Tax Residency Ruling for Individuals 2023

(issued 7 June 2023)

The ATO has finalized its ruling on residency tests for individuals.

Taxation Ruling TR 2023/1 replaces three older rulings, and incorporates case law from the Harding, Pike, and Addy cases.

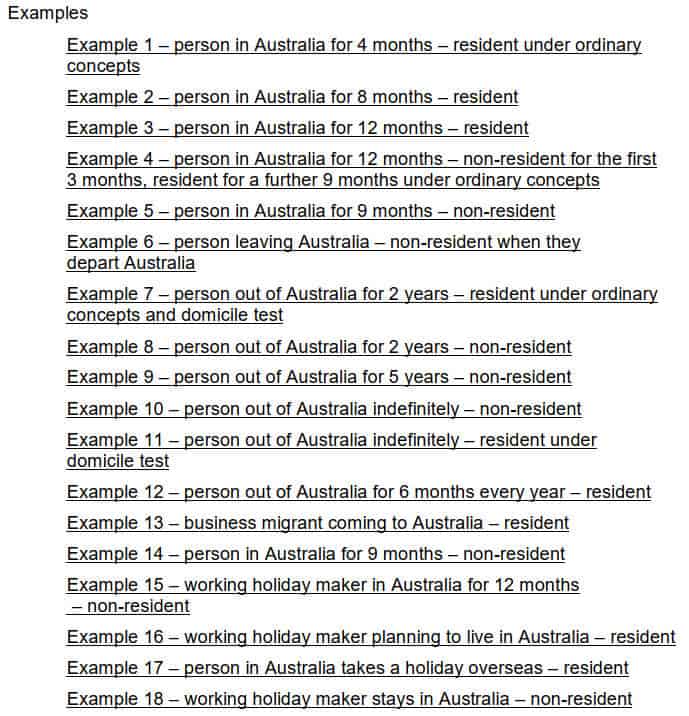

Perhaps the most useful aspect of the ruling is the provision of 18 example scenarios.

The Ruling explains that residency is determined based on the facts of an individual’s connection to Australia and that intention, motivation, and life circumstances play a role in residency determination.

Differing intentions, motivations and life circumstances can produce differing residency determinations, despite varying periods of absence or presence in Australia.

The ruling replaces Draft Taxation Ruling TR 2022/D2 which was released on 6 October 2022 following a Board of Taxation Review.

Rulings IT 2650, IT 2681 and TR 98/17 are withdrawn.

The draft ruling applies periods both before and after the date of release.

The Ruling applies to arrangements both before and after its date of issue (with the usual exception for dispute settlements already agreed).

See further:

- Taxation Ruling TR 2023/1 Income tax: residency tests for individuals

- ATO finalises TR 2023/1 on residency for individuals – MinterEllison

- Draft Taxation Ruling TR 2022/D2 – PWC

- Australia – Draft Tax Residency Ruling – KPMG

- Review of the Income Tax Residency Rules for Individuals – Board of Taxation

- Treasury Consultation – Modernising individual tax residency

See also Guidance references for multinational business entities

WHM Working Holiday Makers (Backpacker) Tax – final rate amendments apply from 1 January 2017

[update 2 December 2016 – the final position]

From 2017 the marginal 32.5% tax rate on working holiday maker visa holders (the backpacker tax) was reduced to 15% for incomes up to $37,000 from 1 January 2017 under a package of measures passed by parliament.

Over $37,000 the normal non-resident tax rates (starting at 32.5%) apply in the 2017 year, and as adjusted by rate changes in subsequent years.

Current and Past Backpacker Tax Rates can be reviewed here.

Temporary Residence

Being a temporary resident means that:

- your foreign income is not taxed in Australia except employment income earned overseas for short periods while a temporary resident (for which you may be able to claim a foreign income tax offset)

- a temporary resident is not liable to capital gains tax on non-Australian property. (Note: more recently the government has moved to introduce measures to deny foreign and temporary tax residents access to the CGT main residence exemption from 7:30PM (AEST) on 9 May 2017, although existing properties held prior to this date are grandfathered until 30 June 2020.

- special rules apply to capital gains on shares and rights acquired under employee share schemes

- interest paid to foreign lenders is not subject to withholding tax

Additional temporary resident qualifications:

- you are not a temporary tax resident if you or your spouse are resident according to the Social Security Act 1991

- The Social Security Act 1991 defines an ‘Australian resident’ as a person who resides in Australia as

- an Australian citizen

- the holder of a permanent visa or

- the holder of a protected special category visa (which has limited application to New Zealanders who were in Australia on 26 February 2001.)

- from after 6 April 2006, once you have been an Australian resident for tax purposes but not as a temporary resident, you cannot later become a temporary tax resident.

Cessation of temporary tax residence

Ceasing to be a temporary tax resident while continuing as a resident of Australia has the general capital gains tax consequence of bringing taxable property into the CGT net at market value. See CGT and non-residents

More recently the government has moved to introduce measures to deny foreign and temporary tax residents access to the CGT main residence exemption from 7:30PM (AEST) on 9 May 2017.

Properties held prior to this date are grandfathered until 30 June 2020.

See details: Non-residents and the main residence exemption

Note also that there are limited exemptions for income earned by Australian tax residents overseas. See Exempt foreign employment income

Temporary residents and the Medicare Levy

For temporary residents who are not entitled to Medicare support, an exemption certificate is available to avoid the medicare levy being paid on a tax assessment.

Temporary residents who were residents of a Reciprocal Health Care Agreement country are entitled to Medicare and therefore not entitled to an exemption. For further information see Dept Human Services Medicare Entitlement

ATO Residency Resources

The Tax Office provides the following information resources to assist the determination of tax residency:

- Taxation Ruling TR 2023/1 Income tax: residency tests for individuals

- Online residency decision tool. Note the broad disclaimer – the ATO will not be bound by the answer provided by the tool.

- Article: Your tax residency

- Article: Working Holiday Makers

- Article: Taxation of Australian resident WHMs (Working Holiday visa holders) from NDA (non-discrimination article) countries

Australian Super Funds Abroad – a Minefield

The Australian super fund structure is somewhat unique, which can lead to uncertainties and tax risks abroad.

This cautionary tale raises far more questions than it answers, but is nevertheless a great read. See: “Dixon: A Cautionary Case of U.S.-Australian Tax Issues“

Expats in China

See also:

- Challenges of doing business in Australia

- Fact Sheet: Early return from foreign service due to COVID 19 – foreign employment income

- Resident V Non-Resident Tax Status – Why Should I Care? – Coleman Greig Lawyers

- Recent developments in the tax residence of individuals, companies and trusts (Pointon Partners – April 2019)

- Foreign Investment in Australia Policies

- Australian Visa Status

- Capital Gains Tax – CGT and non-residents

- Tax Residence of Individuals & Companies (pointonpartners.com.au)

- Individual Tax Rates – Residents

Residency for tax purposes depends on an interpretation of factual circumstances and intentions. Please seek professional advice before taking action.

This page was last modified 2023-06-07