The zone tax offset is a tax rebate for taxpayers in remote areas, or in the case of defence or U.N. personnel, who have had a tour of duty within a designated overseas location.

This tax concession is provided as a reduction of tax which is not refundable if it exceeds total tax payable.

The zone tax offset is calculated as:

- A fixed amount which varies according to geographic location

- A further amount is added to the fixed amount which is a percentage of an amount based on the taxpayer’s dependents (if any).

- only specific dependents are included in the base amount formula, and there are income tests (limits) around both the taxpayer’s and dependents income

The zone rebate or offset falls into two main categories, each with similar requirements and claims structure:

- the zone tax offset which is for residents of specific areas within or near Australia for more than 183 days; and

- the overseas defence forces tax offset which is for ADF or U.N. forces in overseas localities for more than 183 days.

If eligible for both zone and overseas forces offsets, only one can be claimed, but you can claim the one with the higher calculated value.

Zone Locations – Remote Localities- Overseas Forces Localities

- A list of Zone locations is here

- Overseas forces – Specified Localities

FIFO Workers

[Update 1 July 2015]

Announced in the 2015 Budget and now enacted – from 1 July 2015 “fly-in fly-out” and “drive-in drive-out” workers are excluded from claiming the zone rebate where their normal residence is not within the specified tax zone. Until 30 June 2015 it was sufficient for a taxpayer to reside or work in a specified zone for more than 183 days of an income year.

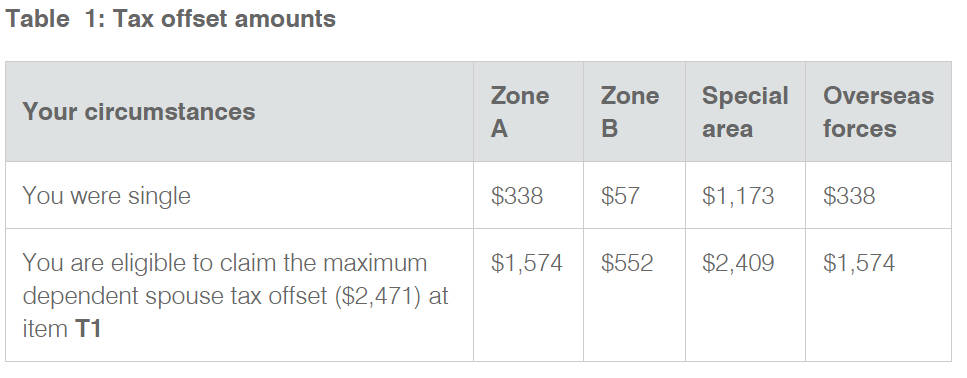

Zone Tax Offset Calculations

Offset claims are made up of a fixed amount, plus a percentage of dependants offset base amount values.

- Zone A offset value is $338 + 50%

- Zone B offset value is $57 + 20%

- Special zone areas offset value is $1,173 + 50%

- Overseas forces offset value is $338 + 50%

Individual dependent offset calculations are (except sole parent) subject to a formula test of income levels with the rebate reduced by the excess of Adjusted Taxable Income over $282 divided by 4; and in general, a part-year apportionment applies when dependency is less than a full year.

DICTO Dependent (Invalid and Carers) rebate and income limits are indexed annually. The DICTO dependents income limits are listed here. DICTO offset eligibility is also subject to adjusted income being below the indexed Family Tax Benefit (Part B) ATI threshold.

Dependent Offset Maximum* Base Amounts

| Offset type | 2022-23 |

| Dependent (Invalid and Carers) (DICTO) | $2,943 |

| Sole parent | $1,607 |

| Each full-time student under 25 | $376 |

| One non-student under age 21 | $376 |

| Each non-student under 21 | $282 |

| Offset type | 2021-22 | 2020-21 | 2019-20 | 2018-19 |

| Dependent (Invalid and Carers) (DICTO) | $2,833 | $2,816 | $2,766 | $2,717 |

| Sole parent | $1,607 | $1,607 | $1,607 | $1,607 |

| Each full-time student under 25 | $376 | $376 | $376 | $376 |

| One non-student under age 21 | $376 | $376 | $376 | $376 |

| Each non-student under 21 | $282 | $282 | $282 | $282 |

| Offset type | 2017-18 | 2016-17 | 2015-16 | 2014-15 |

| Dependent (Invalid and Carers) (DICTO) | $2,666 | $2,627 | $2,588 | $2,535 |

| Sole parent | $1,607 | $1,607 | $1,607 | $1,607 |

| Each full-time student under age 25 | $376 | $376 | $376 | $376 |

| One non-student under age 21 | $376 | $376 | $376 | $376 |

| Each other non-student under age 21 | $282 | $282 | $282 | $282 |

Adjusted Taxable Income Formula

The government adjusted the formula for the inclusion of the value of fringe benefits in Adjusted Taxable Income with effect from 1 July 2017. ‘adjusted fringe benefits total’ is a component of Adjusted Taxable Income。

The meaning of ‘adjusted fringe benefits total’ was modified so that the gross value rather than adjusted net value (previously 51%) of reportable fringe benefits is used, except for PBIs, hospitals and charities.

Adjusted taxable income is the sum of the following:

- taxable income

- reportable fringe benefits amounts (exempt from FBT) multiplied by 0.53

- reportable fringe benefits amounts (not exempt from FBT)

- reportable employer superannuation contributions

- deductible personal superannuation contributions

- certain tax-free government pensions or benefits

- target foreign income (not otherwise included in income)

- net financial investment loss

- net rental property loss

less: - any child support payments provided to another person.

Zone Tax Offset 2013-14

Dependent Offsets – For Zone Allowance Purposes 2013-14

| Offset type | Offset Value | Adjusted Taxable Income Upper Limit * |

| Dependant (Invalid and Carers) | $2,471 | $10,166 |

| Spouse with no dependent child | $2,471 | $10,166 |

| Spouse with dependent child | $2,871 | $11,766 |

| Sole parent | $1,607 | n/a |

| Each full-time student under age 25 | $376 | $1,785 |

| One non-student under age 21 | $376 | $1,785 |

| Each other non-student under age 21 | $282 | $1,409 |

* Dependent offsets are reduced by the the excess of Adjusted Taxable Income over $282 divided by 4.

Australia – Zone Tax Offset 2012-13

Source: ato.gov.au

Offset Amounts

Offset claims are made up of a fixed amount, plus a percentage of dependants offset values.

- Zone A offset value is $338 + 50%

- Zone B offset value is $57 + 20%

- Special zone areas offset value is $1,173 + 50%

The added percentages are based on calculated actual and notional offset components for dependents as set out in the table below.

Dependent Offsets – For Zone Allowance Purposes 2012-13

| Offset type | Max. Offset Value | Adjusted Taxable Income Upper Limit * |

| Dependant (Invalid and Carers) | $2,423 | $9,973 |

| Spouse with no dependent child | $2,423 | $9,973 |

| Spouse with dependent child | $2,815 | $10,548 |

| Sole parent | $1,607 | n/a |

| Each full-time student under age 25 | $376 | $1,785 |

| One non-student under age 21 | $376 | $1,785 |

| Each other non-student under age 21 | $282 | $1,409 |

* Dependent offsets are reduced by the the excess of Adjusted Taxable Income over $282 divided by 4.

Zone Areas

In Australia zones are categorised as:

- Zone A;

- Zone B; or

- the special remote areas – places more than 250 kms from the centre of an urban area with a population of more than 2499 according to the 1981 census.

The eligible zones do not include offshore oil or gas rigs.

A summary listing of Zone Areas is here.

A longer list of Zone locations is here.

Meeting the 183 days requirement

Eligibility for the zone tax rebate is essentially based on living in one or more of specified locations for more than half a year (183 days).

From 1 July 2015, to be eligible for the zone tax offset your normal residence must be in a zone. Periods of residence can be added together, and need not be continuous.

Whether you reside in a zoned area includes the normal meaning of “reside”, however days of mere physical presence within the zone can also be counted, along with days of absence in some instances.

There is some discretion available to the Commissioner of Taxation to determine what is “reasonable” in the circumstances, on matters of eligibility. Tax Ruling 94/27 has quite a bit of detail on this, and some examples.

The 183 days within a zone requirement doesn’t have to be all within the same financial year. The 183 days rule is flexed or extended in a number of ways:

- the accumulated number of days can include fractions of a day

- it is not necessary that earned income be connected with the zone in question

- as noted above, the eligible days includes the time of physical presence within the area

- a person who was in a zone at the time of death is treated as being fully eligible for that year

- if less than 183 days is accumulated in a year, the days can be counted as part of the total for eligibility in the following year

- from after 1 July 1999, in a continuous period of less than 5 years, a first year total of days which is less than 183 days can be counted with the last year period to achieve a total of more than 183 days

More than one zone

The three zones within Australia have differing offset values, so it is important to know how the rules apply when more than one zone is applicable.

- if more than 183 days is spent in total within zones each less than 183 days, then the eligible days are simply apportioned across each zone category

- if more than 183 days are achieved under any of the rules in more than one zone, you are entitled to claim the highest value zone offset

Zone Tax Offset Calculator

To check the numbers, use the ATO’s Zone or overseas forces tax offsets calculator for specified years.

The calculator manages both zone and overseas forces claim options.

Overseas Defence Forces Tax Offset

The ADF/UN overseas forces offset is for specified overseas locations.

The full value of the offset is $338 + 50% of calculated dependents offset amounts, worked out in the same way as above.

A full claim is available with at least 183 days within the specified locality. A partial claim for a lesser number days is based on the number of eligible days as a ratio of 183.

Any days for which a tax exemption is available are not counted. A death during the year gives rise to a full value claim for that financial year, regardless of the actual number of eligible days accumulated.

Note that in general, where overseas service salary and allowances are made tax exempt, the zone tax offset is not available.

See further:

- Tax Ruling TR 97/2 has detailed information.

- 2022-23 claim information

- 2021-22 claim information

- 2020-21 claim information

- 2019-20 claim information

- 2018-19 claim information

- 2017-18 claim information

- 2016-17 claim information

- 2015-16 claim information

- 2014-15 claim information

- Information for Australian defence forces deployed overseas

Entering Zone Offset claim in the myTax app

Once you are logged in to MyTax app, from the 3rd screen, “Personalise Return” – scroll down to Offsets and tick the box for “Zone or overseas forces”.

When you click Next, a data entry option for the zone offset will show up under the Offsets category. A link is provided there to the Zone Offset calculator in order to calculate the amount to claim.

See also ATO tax return instructions online:

| 2022-23 | 2021-22 | 2020-21 | 2019-20 | 2018-19 | 2017-18 | 2016-17 | 2015-16 | 2014-15 | 2013-14 | 2012-13 |

This page was last modified 2023-06-14