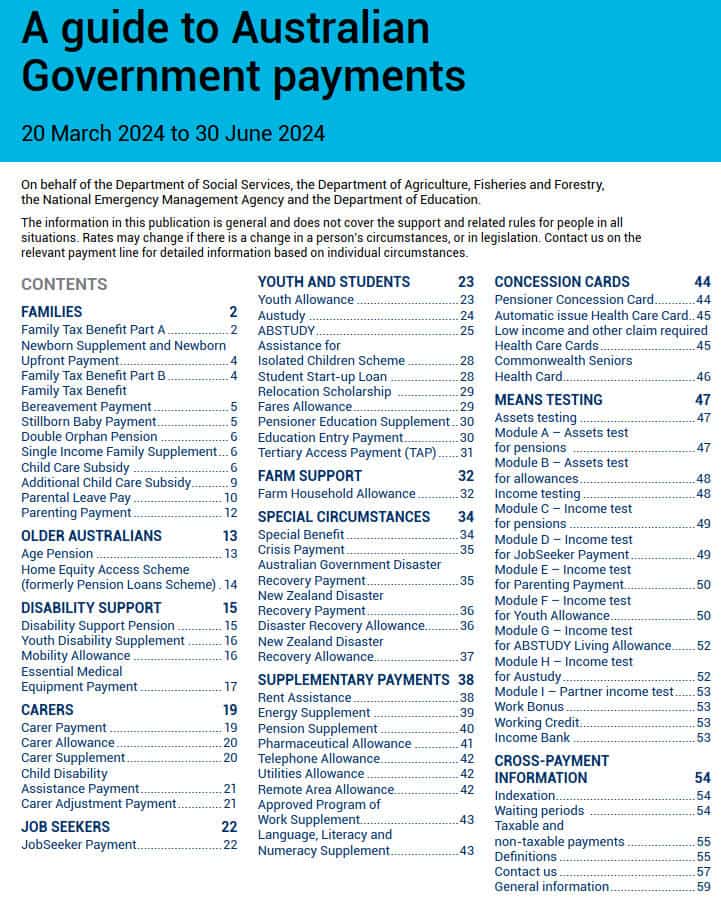

The current Centrelink Payment rates and related qualifying information published by the Department of Human Services. Many benefits are indexed throughout the year. Find out here what you can get.

Current Centrelink Payment Rates

20 March 2024 to 30 June 2024

For the rates booklet Download PDF here

Payments Increases From 20 March 2024

Pensions and Jobseeker allowances are adjusted from 20 March 2024. See full schedule of changes here.

The Basic Rate for Jobseeker went to $762.70 /fn for singles and $816.90 with children.

The full single Age Pension with supplements is $1,116.30 /fn or $841.40 each partnered.

Income and asset eligibility levels have also been inflation adjusted. See the latest guide for full details and qualifying requirements.

Inflation Increases For Payments From 1 January 2024

Certain Youth allowance, student and DSP payment parameters are inflation-adjusted from 1 January 2024. See full schedule of changes here.

January 2024 Enhanced Work Bonus scheme

The Social Security and Other Legislation Amendment (Supporting the Transition to Work) Bill 2023 has been passed which enables eligible social security pensioners over age pension age and certain veterans’ entitlement recipients over qualifying age to earn up to $4,000 before the income test is applied and their payments are affected.

This will occur through a $4,000 increase on commencement (currently nil) and an increase from $7,800 to $11,800 on an ongoing basis.

Recipients who take up full-time work, will also get an extended employment income nil rate period of 24 weeks under the Social Security Act 1991, allowing access supplementary benefits, such as concession cards.

Since 1 December 2022 and until 31 December 2023, a temporary credit of $4,000 has applied to Work Bonus income bank balances. The current changes make this permanent.

The changes take effect from 1 January 2024.

Additional details:

- Explanatory Memorandum for the Bill

- Working after pension age – DSS

- Work Bonus – DHS

September 2023 pension indexation increase

Fortnightly increases apply from 20 September 2023. They include:

- Jobseeker: $56.10 increase

- Parenting Payment Single $20.30 increase

- JobSeeker and Parenting Payment partnered rates: $54.80 increase

- Age Pension, Disability Support Pension and Carer Payment – singles $32.70 increase; couples combines $49.40

- Single veterans $32.70 increase; TPI payments $53 increase

- Rent assistance – single: $27.60 increase; Family (children) $32.34 increase

- CSHC income limits increase $5,400 (singles) and $8,640 couples combined

- Other supplementary payments including Telephone Allowance and Utilities Allowance are also being indexed

See Minister’s media release. The full list of September 2023 indexation adjustments is here.

Centrelink Budget News: Federal Budget 9 May 2023

Measures include:

- increase the base rate of working age and student payments (jobseeker etc) from 20 Sept 2023

- energy relief payments for eligible Centrelink customers & card holders (no action is required; see note below)

- Single Parents: From 20 September 2023, single parents and carers will be eligible to remain on PPS until their youngest qualifying child turns 14

- Eligible pensioners to get until 31 December 2023 to use their bigger Work Bonus balance.

- Rent Assistance support increase 15% from 20 Sept 2023

For further info see: Services Australia (Centrelink) – Budget measures affecting payments

Energy Relief Payments

The following note was posted on Centrelink’s website on May 9, 2023:

“You don’t need to contact us.

You’ll automatically get the rebate from July if you currently get a state-based electricity relief payment and get one of our eligible payments or concessions.

If you don’t get a state-based electricity relief payment but get one of our eligible payments or concessions we’ll write to you in September 2023.

Read more about the rebate on the energy.gov.au website.”

To find your rebate information based on where you live, visit the Rebates and assistance lookup enquiry form as shown here:

Payments Increases From 20 March 2024

Pensions and Jobseeker allowances are adjusted from 20 March 2024. See full schedule of changes here.

Inflation Increases For Payments From 1 January 2024

Certain Youth allowance, student and DSP payment parameters are inflation-adjusted from 1 January 2024. See full schedule of changes here.

Inflation Increases For Payments From 1 July 2023

Pension and other support income and asset test limits are inflation-adjusted from 1 July 2023, along with a number of other adjustments. See full schedule of changes here.

Inflation Increases For Payments From 20 March 2023

Pensions, Youth Allowance along with income and assets test limits and some other payments are inflation-adjusted from 20 March 2023. The full schedule of indexation adjustments is here.

Inflation Increases For Payments From 1 January 2023

Youth Allowance, Austudy, Abstudy and DSP and some other miscellaneous payments will increase from 1 January 2023. The full schedule of indexation adjustments is here.

Inflation Increases For Payments From 20 September 2022

Social Security payment increases applying from 20 September 2022 are the flow-on effect of the recent (relatively higher) inflation rates.

Perhaps surprisingly, the increases are not historically noteworthy. See article: High inflation = higher social security rate increases – Flagpost blog post 06/09/2022 by Michael Klapdor, Australian Parliamentary Library Services

- March 2024 increases

- January 2024 Indexation

- September 2023 Indexation

- July 2023 Indexation

- earlier periods indexations – see below

- Coronavirus Support info links (on this page below)

- Calculators – Age Pension Eligibility and Rates (on this page below)

Commonwealth Seniors Health Card Income Limits

The government has legislated an increase in the income limits for the Commonwealth Seniors Health Card.

The income limit for couples is $144,000 from 4 November 2022 (instead of indexation). For singles the new income limit is $90,000.

Services Australia has noted it here.

Pensioners’ Asset Test Amendments – Incentivising Downsizing

The government has legislated to

- extend by 12 months (to 2 years) the asset test exemption on sale of home proceeds to give more time to establish a new principal home before affecting pension entitlements; and

- reduce the deeming rate on principal home sale proceeds which are to be used for a new home. The current rate of 2.25% is reduced to 0.25% per annum.

The measures operate from 1 January 2023.

See: Social Services and Other Legislation Amendment (Incentivising Pensioners to Downsize) Bill 2022 and media release.

Coronavirus Support Info

and see also

- Centrelink rate estimator

- Centrelink payment finder

- Payment Rates Guides – historical versions

- Business payments and services – for businesses, employers and organisations

Rates indexation updates (DSS)

- indexed rates – Jul 2023

- indexed rates – Mar 2023

- indexed rates – Jan 2023

- indexed rates – Sept 2022

- indexed rates – Jul 2022

- indexed rates – Mar 2022

- indexed rates – Jan 2022

- indexed rates – Sept 2021

- indexed rates – July 2021

- indexed rates – Mar 2021

- indexed rates – Jan 2021

- indexed rates – July 2020

- indexed rates – Jan 2020

- indexed rates – Sept 2019

- indexed rates – July 2019

- earlier periods at Trove Web Archives

Age Pension Eligibility and Rates

Qualifying for the Age Pension payable by the government is based on attaining the minimum age, together with income, assets and residence requirements.

Age Pension Qualifying Age

When you become eligible depends on your date of birth. The qualifying age is being increased over time to reach 67 years by 1 July 2023.

| When were you born? | Your qualifying pension age is.. | Date of change |

| From 1 July 1952 to 31 December 1953 | 65 years and 6 months | 1 July 2017 |

| From 1 January 1954 to 30 June 1955 | 66 years | 1 July 2019 |

| From 1 July 1955 to 31 December 1956 | 66 years and 6 months | 1 July 2021 |

| From 1 January 1957 onwards | 67 years | 1 July 2023 |

Age Pension Residence Requirement

The residence qualification requires you to have been an Australian resident for at least 10 years, including at least 5 years without a break in residence.

There are exceptions to the 10 years requirement for refugees and for those transferring from Partner and Widow allowances, having reached the Age Pension age.

A woman who has been an Australian resident for 2 years and whose Australian resident partner has died will also avoid the 10 years requirement.

Being an “Australian resident” for these purposes has a specific meaning. The rules require that you live in Australia as a citizen, PR visa holder, or a Special Category visa holder (New Zealander) who did not arrive after 26 February 2001.

It also a requirement that you be living in Australia at the time of application.

If only one partner of a couple has reached pension age, and the other tests are satisfied, the pension is paid at half the couples rate.

Age Pension Means Tests (Income and Assets)

Eligibility to receive the Age pension is subject to means tests which are applied at the time of application, and ongoing. Worldwide assets and income are counted.

The value limits and pension rates are indexed twice a year, on 20 March and 20 September. We have included the latest schedule of indexed values in the list above.

The value limits vary according your family situation (couple or single) and whether you own a home or not. Values in excess of the current limit reduce the pension available in a sliding scale.

The income test allows a minimum threshold amount, over which the pension payable reduces by a percentage of the excess. The thresholds vary according whether you are single or a couple.

To calculate your pension entitlements, you will need to check the following references, or for a quick estimate use the calculators below:

- Age entitlement

- Income tests

- How does the Work Bonus affect pension rates? (worked example)

- Asset tests calculation guide

- Residence requirements

- Current rates of payment

Age Pension payment calculators

The following calculators are regularly kept up to date, and can be used to estimate your Age Pension entitlement.

Note: These calculators provide estimated calculations, based on specific assumptions. Only Services Australia (the Government agency) can provide an official assessment of your entitlements.

Centrelink Payment Calculators

Services Australia has online tools which can be used to estimate your entitlement to Centrelink payments and to calculate likely payments based on the input of your circumstances.

To calculate entitlements and estimate payments, start here: Online estimators

This page was last modified 2024-01-01