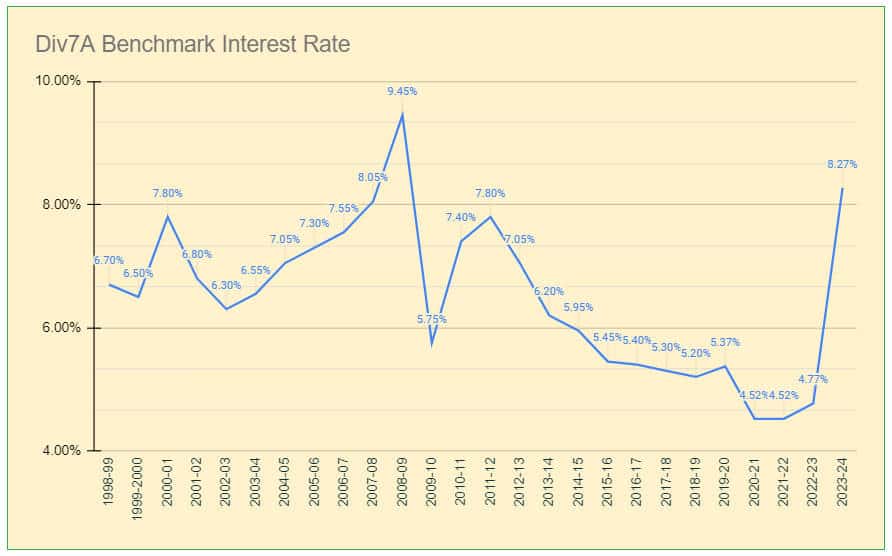

ATO Div 7A Benchmark Interest Rate

The Division 7A benchmark interest rate for an income year is the ‘indicator lending rates – bank variable housing loans interest rate’ last published by the Reserve Bank of Australia before the start of the income year.

Current and Recent Div 7A Rates

For 2023/24 the deemed dividends benchmark interest rate is 8.27%.

Source: Lending rates; Housing loans; Banks; Variable; Standard; Owner-occupier published 7 June 2023.

For 2022/23 the deemed dividends benchmark interest rate is 4.77%.

For 2021/22 the deemed dividends benchmark interest rate is 4.52%.

For 2020/21 the deemed dividends benchmark interest rate is 4.52%.

For 2019/20 the deemed dividends benchmark interest rate is 5.37%.

The Div 7A interest rate is based on RBA’s published Lending rate; Housing loans; Banks; Variable; Standard; Owner-occupier last published before the start of the financial year; most recently at the time of writing that is 7 June 2023.

Division 7A does not apply to loans to associates made under a conforming loan agreement if the rate of interest payable satisfies the benchmark interest rate requirements.

The benchmark interest rate is relevant to private company loans made or deemed to have been made after 3 December 1997 and to trustee loans made after 11 December 2002.

(Note: For benchmark rates applicable to the calculation of loan fringe benefits – see FBT Benchmark Interest Rate)

Extension of Time for 2019-20 and 2020-21 to make minimum yearly repayments (Covid-19 relief)

The ATO has made available extensions of time until 30 June 2021 and 30 June 2022 for Covid-19 affected borrowers to make the 2020 and 2021 minimum yearly repayments respectively under complying Div 7A loan agreements.

The extensions are made available via a ‘streamlined’ application for administrative relief online.

On approval, if the shortfall is made up by the due date, the borrower will not be considered in receipt of an unfranked dividend.

If the extended deadline of 30 June 2021 is not adhered to, either a further (non-streamlined) extension must be obtained, or the 2019-20 tax return amended to include a dividend.

- In advice dated 21 June 2021 the ATO has made available an extension of the 2020-21 repayment period on the basis that the 2020-21 shortfall is made up by 30 June 2022.

- The downloadable application form is no longer available

Proposed Targeted Amendments to Division 7A

Start date: Included in the Budget 2019 announcements the government advised the deferral of the intended start date of these previously announced measures until 1 July 2020. In a further announcement in June 2020 the start date was further revised from 1 July 2020 to income years commencing on or after the date of Royal Assent of the enabling legislation.

At the date of writing, these measures have still not been enacted. ATO commentary is here.

Government consultations have been completed with a view to amending the Division 7A rules with the stated purpose of making them clearer and easier to comply with. It is proposed that Unpaid Present Entitlements be captured within Division 7A.

The proposed measures provide for a change to the reference interest rate rate for complying loans to the Small business Overdraft rate which is generally 2% or more higher than the current benchmark which is based on the variable housing loan lending rate.

See further:

- Div 7A changes for private company loans from 1 July 2020 – consultation process and next steps.

- Division 7A – Changes, changes and more changes proposed to start from 1 July 2019

- What Does The Proposed New Division 7A Mean To Your Existing Loan?

- Targeted amendments to Division 7A

- TD 2022/D1 – Is this the Commissioner’s answer to the lack of targeted amendments to Division 7A?

- Company money: A guide for owners

- Division 7A – benchmark interest rate – ATO

The benchmark interest rate is the Housing loans; Banks; Variable; Standard; Owner-occupier’ interest rate last published by the Reserve Bank of Australia before the start of the financial year.

This generally means the rate for the month of May, published in the month of June. See XLS download from: Indicator Lending Rates – F5.

Div 7A Interest Rates By Year From 1998-99 to Now

| Year | Rate | Reference |

| 2024-25 | tba | RBA reference rate May 2024 |

| 2023-24 | 8.27% | RBA reference rate May 2023 |

| 2022-23 | 4.77% | RBA reference rate May 2022 |

| 2021-22 | 4.52% | RBA reference rate May 2021 |

| 2020-21 | 4.52% | RBA reference rate May 2020 |

| 2019-20 | 5.37% | RBA reference rate May 2019 |

| 2018-19 | 5.20% | TD 2018/14 |

| 2017-18 | 5.30% | TD 2017/17 |

| 2016-17 | 5.40% | TD 2016/11 |

| 2015-16 | 5.45% | TD 2015/15 |

| 2014-15 | 5.95% | TD 2014/20 |

| 2013-14 | 6.20% | TD 2013/17 |

| 2012-13 | 7.05% | TD 2012/15 |

| 2011-12 | 7.80% | TD 2011/20 |

| 2010-11 | 7.40% | TD 2010/18 |

| 2009-10 | 5.75% | TD 2009/16 |

| 2008-09 | 9.45% | TD 2008/19 |

| 2007-08 | 8.05% | TD 2007/23 |

| 2006-07 | 7.55% | TD 2006/45 |

| 2005-06 | 7.30% | TD 2005/31 |

| 2004-05 | 7.05% | TD 2004/28 |

| 2003-04 | 6.55% | TD 2003/19 |

| 2002-03 | 6.30% | TD 2002/15 |

| 2001-02 | 6.80% | TD 2001/20 |

| 2000-01 | 7.80% | TD 2001/1 |

| 1999-2000 | 6.50% | TD 1999/39 |

| 1998-99 | 6.7% | TD 98/21 |

Application of Div 7A

The application of Div 7A treats loans or debts as deemed taxable unfranked dividends. The amount of the deemed dividend is limited to the extent of the company’s distributable surplus.

The following fall within Div 7A:

- Debts forgiven after 3 December 1997 (regardless of when the debt was created)

- Private company loans made or deemed to have been made after 3 December 1997.

- Pre-3 December 1997 loans which have increased in amount or had the term extended

- Division 7A applies to trustee loans made after 11 December 2002.

Interposed payments – reasonable person test

Tax Determination TD 2018/13 sets out the view that section 109T can apply to a payment or loan made by a private company to an interposed entity, even if it is an ordinary commercial transaction.

Section 109T would apply if a reasonable person would conclude that the payment or loan is made solely or mainly as part of an arrangement involving a payment or loan to a shareholder or shareholder’s associate.

Div 7A Corrective Action – Commissioner’s Discretion

A Div 7A deemed dividend outcome can be disregarded at the discretion of the Tax Office, in circumstances considered to have arisen as a result of an “honest mistake or inadvertent omission”.

A Tribunal case which reviewed the Commissioner’s refusal to exercise discretion is discussed here.

In that instance, the Tribunal reduced the penalties for non-compliance from “recklessness” (50%) to “carelessness” (25%), whilst noting that: “Division 7A is complex. Even experienced tax agents struggle with it.”

The Tax Office advise that exercise of the discretion will depend on the extent to which the taxpayer has taken corrective action, or has given undertakings to do so, and the speed with which that occurs.

An example of corrective action is the establishment of a compliant loan agreement and the payment of catch-up payments to create a position at least equivalent to that of having complied from the time of non-compliance.

A Tax Office description of corrective action and example calculations are provided here.

See further:

- PS LA 2011/29 Exercising the discretion under section 109RB of Division 7A

- TR 2010/8 Income tax: application of subsection 109RB(1) of the Income Tax Assessment Act 1936

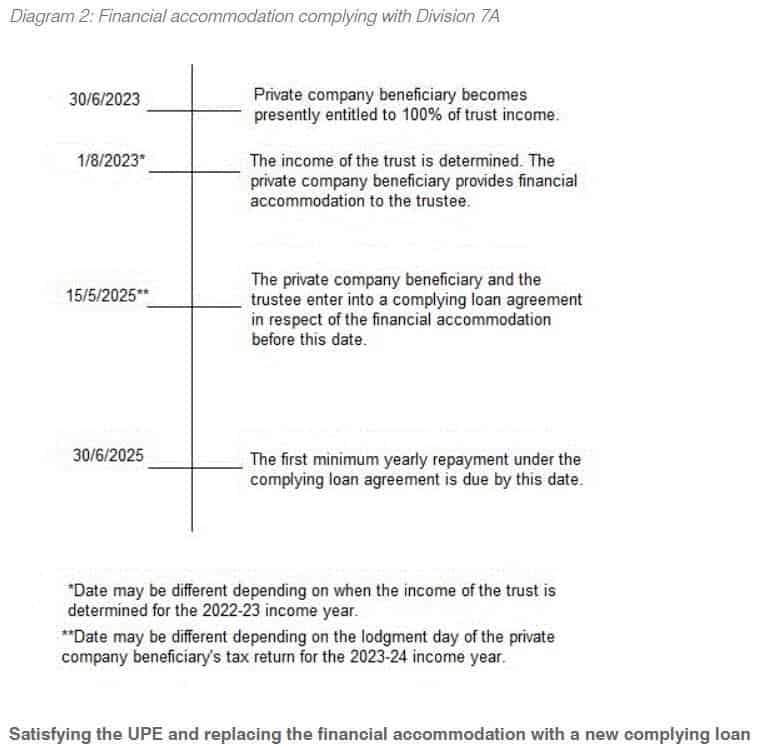

Trusts with unpaid present entitlements owing to private companies

Budget 2018 (8 May 2018): The Government announced its intention to ensure that unpaid present entitlements come within the scope of Division 7A of the Income Tax Assessment Act 1936 from 1 July 2019 (since revised to 1 July 2020).

The purpose of the proposed amendments is to that the unpaid entitlements are either made the subject of a conforming loan and repaid or deemed a dividend.

In 2010 the ATO published a view (TR 2010/3) that unpaid present entitlements owed by a trust to a private company within the same closely held family group were essentially ‘loans’ for the purposes of Division 7A.

This raises the possibility of UPEs being taxed as unfranked dividends.

ATO Div 7 Loan and sub-trusts guidance 2022

For 2021-22 PSLA 2010/4 provided guidance and examples of the application of TR 2010/3, detailing ways (apart from deploying a Division 7A loan agreement) to avoid the ATO applying Division 7A to UPE balances.

Both PSLA 2010/4 and TR 2010/3 were withdrawn with effect from 1 July 2022, and upon the release of draft determination TD 2022/D1 (finalised as Determination TD 2022/11) taking effect from after 30 June 2022.

Earlier years

PSLA 2010/4 and TR 2020/3 can continue to be relied upon for conforming pre-30 June 2022 sub-trust arrangements which were only put in place after 30 June 2022, and the ATO has indicated that compliance resources will not be devoted to such arrangements.

Practical Compliance Guideline PCG 2017/13 sets out sets out the ATO’s compliance approach for unpaid present entitlements under sub-trust arrangements maturing in the 2017, 2018, 2019, 2020 and 2021 income years.

See further:

Trust Reimbursement Agreements And Unpaid Present Entitlements | Draft Guidance Feb 2022

The Tax Office has released a package of draft guidance documents intended to update the administration of issues arising from unpaid trust distribution entitlements.

The guidance bundle includes an approach to Section 100A reimbursement agreements.

Implementation is to expected to commence 1 July 2022.

TD 2022/11 provides the ATO’s considered view on when a private company with unpaid trust entitlements (UPEs) provides a financial accommodation to which Division 7A can apply.

The Commissioner’s view is that even if not converted to an ordinary loan, a UPE can amount to ‘the provision of financial accommodation’ by the private company beneficiary in favour of the trust, and therefore may be considered a loan for Division 7A purposes.

A key amendment to TD 2022/11 in its final form compared to the earlier draft makes it clear that a private company will typically not provide financial accommodation in respect of a UPE until the income year that follows the income year in which the UPE arises.

This will be the case, regardless of how entitlement to income is calculated or expressed. See TD 2022/11 paragraph 12.

See updated ATO commentary (following the release of TD 2022/11) here, and responses to comments received on the draft version here.

Div 7A Loans

The standard escape hatch to the deemed dividend application of Div 7A is provided under Section 109N ITAA1936 for loans meeting the criteria for minimum interest rate and maximum term.

The loan must be:

- in writing, with an agreement in place at least one day before the lodgement day of the income tax return for the year in which the loan is made:

- made at the specified benchmark interest rate

The term of the loan must not exceed

- if secured over property at net market value of at least 110% of the loan value – 25 years

- otherwise, including an unsecured loan, 7 years

The Benchmark Interest rate is determined on an annual basis, so the loan agreement interest rate should be expressed in terms of equivalence to, or exceeding the prevailing benchmark rate.

Section 109E provides a minimum repayment formula, essentially based on the declining loan balance in relation to the remaining term of the loan, and commencing in the year after the loan was made. Interest is provided at each year’s benchmark rate.

Loans complying with Section 109N are also exempt from FBT (since July 2006).

Essential Reference: Tax Determination TD98/22

Until 2018-19 the Division 7A benchmark interest rate was updated annually by the issue of a Tax Determination. Since then rate is “automatically” updated annually by being referenced to the ‘Housing loans; Banks; Variable; Standard; Owner-occupier’ rate last published by the Reserve Bank of Australia before the start of the income year.

Further information and checklists

- Div 7A – Loans By Private Companies – ATO

Free checklists – Division 7A and UPE – CPA Australia

Free checklists – Division 7A and UPE – CPA Australia- Div 7 calculator and decision tool

- Remembering Div 7A loans – Tax Rambling blog

This page was last modified 2023-07-04