Income passing through a trust will normally be taxed in the hands of the beneficiary at their individual tax rate.

Income distributed to a resident beneficiary who is under a ‘legal disability’ (see definition below) will in most cases be taxed at their ‘normal’ tax rate by assessment sent to the trustee. The beneficiary receives a credit for tax paid by the trustee.

Trustee Tax Rates for income not distributed is typically taxed at a higher rate (45% + medicare) by an assessment sent to the Trustee.

For this reason, accumulating income in a trust would tend to be avoided if possible (sometimes it can’t – see deceased estates) in all cases where the average tax rate of the beneficiary is lower than the highest marginal tax rate.

Under the current individual tax scales, that average break-even rate would be a relatively high income.

There are also a number of modifications to the ‘normal’ taxing of trust beneficiaries which are designed to prevent exploitation of the rules, often by way of income splitting, or more agressively, by obscuring the ultimate beneficiaries.

Income splitting lowers overall tax because of the progressive nature of the individual tax scales, and the fact that company tax rates are lower than the marginal tax rates of individuals at higher levels of income.

Rules which discourage exploitation include higher tax rates for minors on passive income, penalty tax rates for closely held trusts with undisclosed beneficiaries (briefly discussed below), and a tax on distributions to beneficiaries outside the designated group of a family trust.

A trust is a legal arrangement which is implemented via a trustee. It is treated as an entity for taxation purposes. Trust estates are popular for tax, estate planning and asset protection.

Resident Trust Estate

A trust is tax-resident of Australia if at any time during the income year

- a trustee was resident, or

- the central management and control was in Australia

Trusts are required to calculate their net income as if they are resident.

For tax purposes it matters whether a trust is resident or not because:

- Sec 99 and 99A trustee tax assessments (when no beneficiary is presently entitled) are limited to the Australian-source income of non-resident trusts

- The transferor trust rules apply an accruals basis of taxation on the income of non-resident trusts in low-tax jurisdictions (Div 6AAA)

See also:

- Trustees beware – distributions of capital gains to non-resident beneficiaries held to be taxable in the Greensill decision

- Is my trust a resident trust estate and why does it matter? A case study.

Adult trust beneficiaries – no legal disability (Sec 97)

A beneficiary of a trust who is

- aged 18 at the end of the year of income

- presently entitled to a share of the net income, and

- not under a legal disability

– pays tax on the share of trust income at normal individual rates – resident or non-resident – with part-year tax free threshold apportionment where applicable (sec 97).

Note: Division 6D overrides this to the extent that penalty tax is payable by the Trustee if trust beneficiary reports are not provided on time, or in relation to untaxed ’round robin’ trust income. See further: Trustee beneficiary reporting rules

See also: Taxation Determination TD 2012/22 – A beneficiary’s share of the net income of a trust estate is worked out by reference to the proportion of the income of the trust estate to which the beneficiary is presently entitled

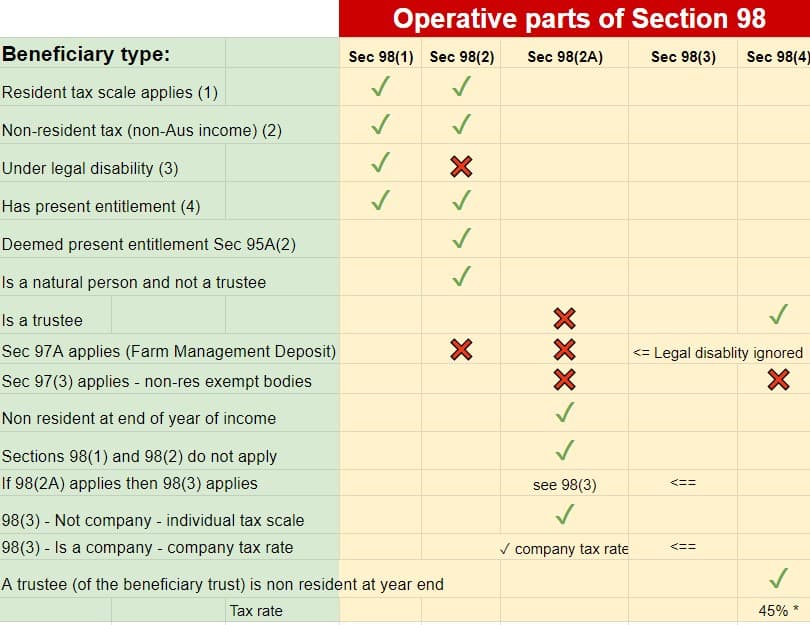

Trustee tax assessments (Sec 98)

The general position is that adult beneficiaries under a legal disability are trustee-assessed at normal individual rates.

Section 98 of the tax rules sets out a number of ways a tax assessment can be issued to the trustee instead of the beneficiary.

Tax paid by the trustee is normally available as a credit in the tax assessment of an entitled beneficiary.

* the medicare-exclusive tax rate includes a Temporary Budget Repair Levy of 2% in the 3 years from 1 July 2014 until 30 June 2017. From 1 July 2017 the rate reverts to 45%.

See Sec 98 and also

(1) The general individual resident tax scales are here, however see also – Tax on minors(5)

(2) The general individual non-resident tax scales are here, however see also (1) The general individual resident tax scales are here, however see also – Tax on minors(5)

(3)

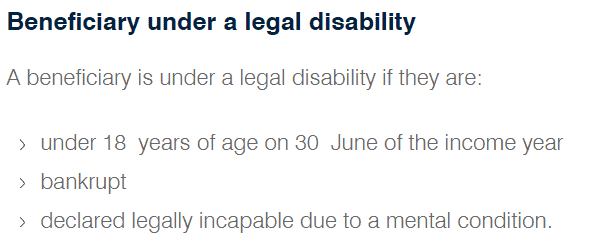

What is a ‘legal disability?’

The meaning of legal disability for tax purposes refers to an individual’s legal capacity to act for themselves. Its meaning is derived from case law and is not expressly defined in the tax rules.

Legal disability is separate from any physical disability, even though someone with a physical disability may in addition have a legal disability.

The most common form of legal disability is that of children (minors) due to their age being under 18 years, but there are a number of other circumstances which can result in a taxpayer beneficiary being under a legal disability.

The Tax Office provides a description for the term ‘legal disability’ in the context of trust beneficiaries as follows:

A beneficiary is under a legal disability if they are:

- under 18 years of age on 30 June of the income year

- bankrupt

- declared legally incapable due to a mental condition.

(4) For notes on the meaning of present entitlement see here.

(5) Children – the tax on minors

The minor beneficiaries’ tax rules are designed to reduce the benefits which might otherwise be available by accessing lower average tax rates from the splitting of unearned income to under-age beneficiaries.

Beneficiaries under 18 receiving unearned income are subjected to a reduced tax threshold, removal of LITO and the application of higher marginal tax rates on that income. There are exceptions in relation to deceased estates, orphans, disabled minors and compensation payments.

A beneficiary is a ‘minor’ if under 18 years old at the end of the year of income. Being under age is a legal disability, and therefore tax is normally assessed to the Trustee. Where the beneficiary lodges a tax return the tax paid by the trustee is applied as a credit.

Income from personal exertion (such as wages) or income earned from the minor’s own savings are excluded from the child income higher tax scale, and taxed at ordinary rates, as is the income from deceased estates, child support (maintenance) trusts and trusts formed from the proceeds of compensation and superannuation.

See further for the tax rates applicable to children’s income:

Trust Tax Return Trust Assessment Codes

The trust tax return assessment calculation codes provide specific information to the Tax Office as to how trust income is to be treated for tax purposes and by implication, to whom assessments (if any) should be served.

The codes are determined by the nature of the trust income and the tax status (both entity type and legal capacity) of each beneficiary, or if no beneficiary, the trustee.

It is important that the correct code be used to avoid incorrect assessments or assessment delays. To accurately determine the correct codes, the legal meaning of terms used must be understood. Professional advice in relation to that is highly recommended.

A list of relevant codes is published as part of the Trust Tax Return instructions updated each year.

An assessment code is required to be entered into the distribution statement for each beneficiary..

The total distributions must of course reconcile to trust income.

Further information can be found in the Trust Tax Return Instructions:

Closely-held trusts – beneficiary disclosure

Closely-held trusts are required to disclose their beneficiaries annually, failing which a penalty rate of tax applies at a rate matching the top marginal rate inclusive of medicare levy (see notes below).

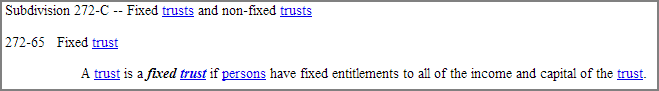

Definition: Unless it is an excluded trust, a trust is a ‘closely held trust’ if:

- up to 20 individuals have between them, directly or indirectly, and for their own benefit, fixed entitlements to a 75% or more share of the income or a 75% or more share of the capital of the trust (‘the 20/75 test’), or

- it is a discretionary trust.

See a summary checklist of exclusions here.

Definition: A discretionary trust means a trust that is not a fixed trust within the meaning of section 272-65 in Schedule 2F.

See: Practical Compliance Guidelines PCG 2016/16 Fixed entitlements and fixed trusts

Definition: An ‘excluded’ trust is defined in Sec 102UC(4) – summarised here – includes ‘family trusts’ (i.e. with a family trust election in force). – See family trust and interposed entity elections.

Tax rates

Trustee beneficiary non-disclosure tax matches the top marginal tax rate inclusive of medicare levy applied to the untaxed net income which is reasonably attributable, or for which a Trustee Beneficiary Statement has not been lodged by the due date.

The rate applied in the period from 1 July 2014 until 30 June 2017 is the top marginal rate of 45% plus medicare 2% plus the Temporary Budget Repair Levy of 2% = 49%.

On cessation of the Temporary Budget Repair Levy (i.e. from 1 July 2017) the medicare-inclusive rate reverts to 47%.

Trustee beneficiary statements are generally due by the due date for the trust’s tax return for the income year, and are included as an appendix to the annual trust tax return instructions.

- Appendix 11: Closely held trust reporting 2022-23

- Appendix 11: Closely held trust reporting 2021-22

- Appendix 11: Closely held trust reporting 2020-21

- Appendix 11: Closely held trust reporting 2019-20

- Appendix 11: Closely held trust reporting 2018-19

See further:

TFN reports and withholding requirements for closely held trusts

Trustees receiving a Tax File Number quoted by a beneficiary under these rules is required to lodge a TFN report within 1 month of the end of the quarter.

This requirement applies to closely held trusts – excluding non-resident trusts, and excluding beneficiaries under a legal disability (minors for example), exempt beneficiaries and super fund beneficiaries – see more here.

If a TFN is not provided by a beneficiary prior to a payment, the Trustee is required to

- withhold tax from any payment to the beneficiary (at the current top marginal rate – see preceding paragraph)

- register with the ATO for PAYG and remit the tax withholdings

- (as under normal PAYG requirements) provide an annual payment summary to the beneficiary

An annual summary of the payments information also forms part of the the trust’s tax return requirements.

Tax deducted by the trustee is available as a credit/refund in the beneficiary’s annual tax return.

Reporting and withholding compliance by closely held trusts is the subject of ATO review activity.

Deceased estates (Trustee tax assessments under Sec 99)

Deceased estates are a ‘special case’ – concessionally taxed for the first 3 tax returns. Tax is paid on income to which no beneficiary is presently entitled at individual rates with the benefit of the full tax-free threshold, and without medicare levy. (See resident rates)

In the 4th and subsequent tax years a progressive tax scale applies as below: (Sec 99)

Minors – income distributions to minors from deceased estates are treated as “excepted income” and taxed at ordinary rates – see Excepted Income.

| Trust income | 2020-21, 2021-22, 2022-23 Trustee tax payable (resident) |

| Up to $416 | Nil |

| From $417 to $670 | 50% of the excess over $416 |

| From $671 to $45,000 | $127.30 plus 19% of the excess over $670 |

| From $45,001 to $120,000 | $8,550 plus 32.5% of the excess over $45,000 |

| From $120,001 to $180,000 | $32,925 plus 37% of the excess over $120,000 |

| Over $180,000 | $55,125 plus 45% of the excess over $180,000 |

| Trust income | 2018-19, 2019–20 Trustee tax payable (resident) |

| Up to $416 | Nil |

| From $417 to $670 | 50% of the excess over $416 |

| From $671 to $37,000 | $127.30 plus 19% of the excess over $670 |

| From $37,001 to $90,000 | $7,030 plus 32.5% of the excess over $37,000 |

| From $90,001 to $180,000 | $24,255 plus 37% of the excess over $87,000 |

| Over $180,000 | $57,555 plus 45% of the excess over $180,000 |

| Trust income | 2017-18 Trustee tax payable (resident) |

| Up to $416 | Nil |

| From $417 to $670 | 50% of the excess over $416 |

| From $671 to $37,000 | $127.30 plus 19% of the excess over $670 |

| From $37,001 to $87,000 | $7,030 plus 32.5% of the excess over $37,000 |

| From $87,001 to $180,000 | $23,280 plus 37% of the excess over $87,000 |

| Over $180,000 | $57,690 plus 45% of the excess over $180,000 |

| Trust income | 2016-17 Trustee tax payable (resident) |

| Up to $416 | Nil |

| From $417 to $670 | 50% of the excess over $416 |

| From $671 to $37,000 | $127.30 plus 19% of the excess over $670 |

| From $37,001 to $87,000 | $7,030 plus 32.5% of the excess over $37,000 |

| From $87,001 to $180,000 | $23,280 plus 37% of the excess over $87,000 |

| Over $180,000 | $57,690 plus 47%* of the excess over $180,000 |

* includes Temporary Budget Repair Levy of 2% applicable for 3 years from 1 July 2014 until 30 June 2017

| Trust income | 2014-15 and 2015-16 Trustee tax payable (resident) |

| Up to $416 | Nil |

| From $417 to $670 | 50% of the excess over $416 |

| From $671 to $37,000 | $127.30 plus 19% of the excess over $670 |

| From $37,001 to $80,000 | $7,030 plus 32.5% of the excess over $37,000 |

| From $80,001 to $180,000 | $21,005 plus 37% of the excess over $80,000 |

| Over $180,000 | $58,005 plus 47%* of the excess over $180,000 |

* includes Temporary Budget Repair Levy of 2% applicable for 3 years from 1 July 2014 until 30 June 2017

Income to which no beneficiary is presently entitled (trustee tax assessment under Sec 99A)

By default the trustee is assessable for tax on trust income for which there is no beneficiary presently entitled, at the top marginal tax rate which is currently 45% (47% in the years 1 July 2014 to 30 June 2017) unless the Commissioner exercises discretion to apply a concessional tax scale (set out below) in relation to property of:

- deceased estates

- bankrupt estates

- certain compensation claims and death benefits

- or as a result of a family breakdown.

An example of the exercise of the Commissioner’s discretion in relation to a deceased estate is set out here.

The concessional tax scale applied on the exercise of discretion under Sec 99A is as above.

Tax rates (surcharge) in the years 1 July 2014 and 1 July 2017

Federal Budget 2014-15 measures increased the top marginal tax rate (before Medicare) by 2% to 47% for a period of 3 years commencing 1 July 2014. The rate incorporating a Medicare factor (i.e. previously already 47%) moves to 49%.

The Medicare levy is not included if the trust is assessed under Section 99A as a deceased estate. From 1 July 2017 the 2% surcharge ceases, with the medicare-inclusive top marginal rate reverting to 47%.

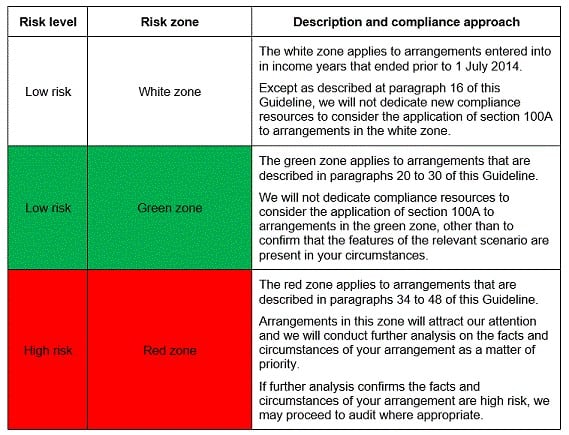

Section 100A Trust Tax Reimbursement Agreements

Section 100A is an anti-avoidance provision which applies tax at the highest marginal rate (currently 47% including medicare).

The penalty tax is applied to the trustee on distributions which are considered by the Commissioner to be part of a ‘reimbursement’ agreement’.

Broadly these are agreements under which a beneficiary is distributed taxable income the benefit of which is enjoyed by someone else, and tax is saved.

A typical circumstance arises where trust distributions are made to children or even a spouse, where there the beneficiaries don’t get the benefit, or where payment was made but was reimbursed in some way so that the net position of the trust is unchanged to that extent.

The Tax Office has shown an interest in enforcing 100A in recent years.

Arrangements of concern are those which are not considered to be ‘an ordinary family or commercial dealing’.

Tax Office guidance has been issued in relation to such arrangements:

- Managing section 100A for the 2021–22 income year

- Taxpayer Alert TA 2022/1

- Taxation Ruling TR 2022/4 – Income tax: section 100A reimbursement agreements – provides the Commissioner’s view about these arrangements and the four basic requirements for section 100A to apply

- Practical Compliance Guideline PCG 2022/2 – contains examples of arrangements and a color-coded classification system for determining their compliance actions:

See also: Trust distributions the Commissioner does not like – 100A – taxrambling.com

Parents benefitting from the trust entitlements of their children over 18 years of age

The Tax Office has issued an alert in 2022 in respect of arrangements under which trust distributions are made to adult beneficiaries for the purpose of saving tax on income which in reality is for the benefit of the parents.

The Tax Office considers that such an arrangement may have a number of possible consequences, including:

- the arrangement is considered a sham

- the arrangement may constitute a reimbursement agreement under section 100A (see above)

- the Parents may be treated as presently entitled

- Part IVA anti-avoidance provisions could apply.

Promotor penalties and Tax Agent compliance action may also be invoked against advisors and others assisting such actions.

See: Taxpayer Alert TA 2022/1 – Parents benefitting from the trust entitlements of their children over 18 years of age

- Trust taxation – reimbursement agreements

- Division 7A and s100A additional guidance for Tax Time 2022

- Closely held trusts and circular distributions

- 6 Ways To Tax A Trust

- The CGT consequences of vesting a trust

- High Court clarifies question on trust streaming of franking credits

- Trust splitting and CGT

- Trusts and franking credit integrity rules

- For Trust Tax Return forms links go to our Forms page

Further information and checklists

- The universal obligation of a trustee: a trustee checklist from Owies v JJE Nominees Pty Ltd

- 2023 trust distributions – critical year-end considerations for trustees

- Year End Trust Distributions: Six Important Steps Trustees Should Be Taking Now

- Tips on Making Effective Trust Distribution Resolutions

- Family trust distribution discussions before year end

- Year end trust resolutions checklist – ATO

- Trust Tax Return Appendix 10 (2022-23) – Rates of tax payable by trustees on behalf of beneficiaries under 18 years old

- Trust losses, Family Trusts and Family Trust Elections

- Rates of tax – beneficiaries under 18

- Trusts – In General

- Taxation Determination TD 2012/11 – a trust beneficiary can get a capital gain from a trust estate in an income year even if the amount of the gain is not established until after the end of the income year.

- Taxation Determinations TD 2022/12 and TD 2022/13: a non-resident beneficiary is assessable on trust capital gains regardless of source. See: Beware the foreign asset in an Australian discretionary trust

- Taxation of trust net income – non-resident beneficiaries

- Greensill Federal Court decision – non-resident beneficiaries

This page was last modified 2024-05-22