The Private Health Insurance tax rebate (PHIR) is based on a percentage of private health insurance premium paid.

The percentage rebate is subject to an income test which restricts availability to those (currently) on single incomes under $144,000 or family incomes under $288,000.

These ceilings were increased from $140,000 and $280,000 respectively from 1 July 2023.

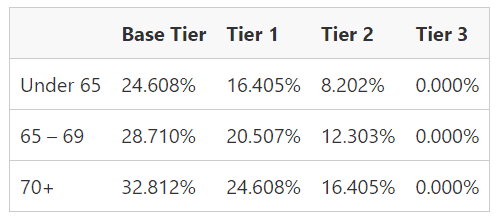

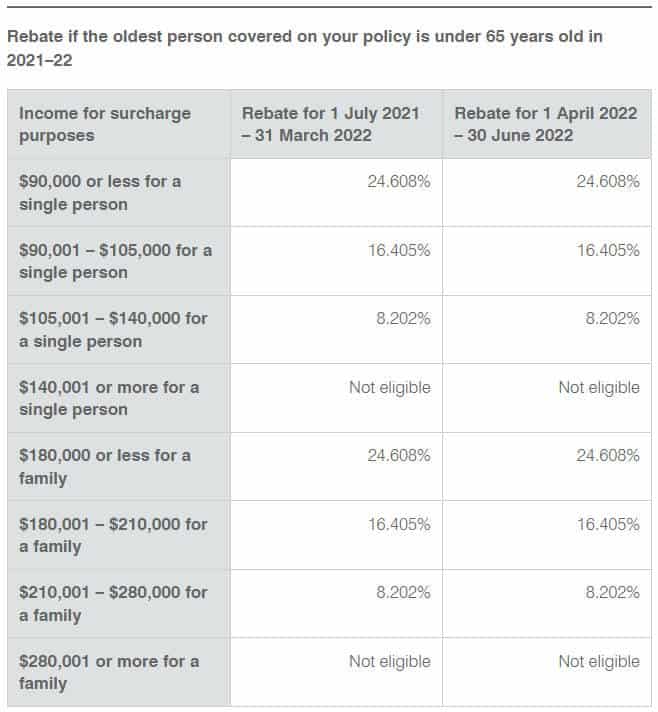

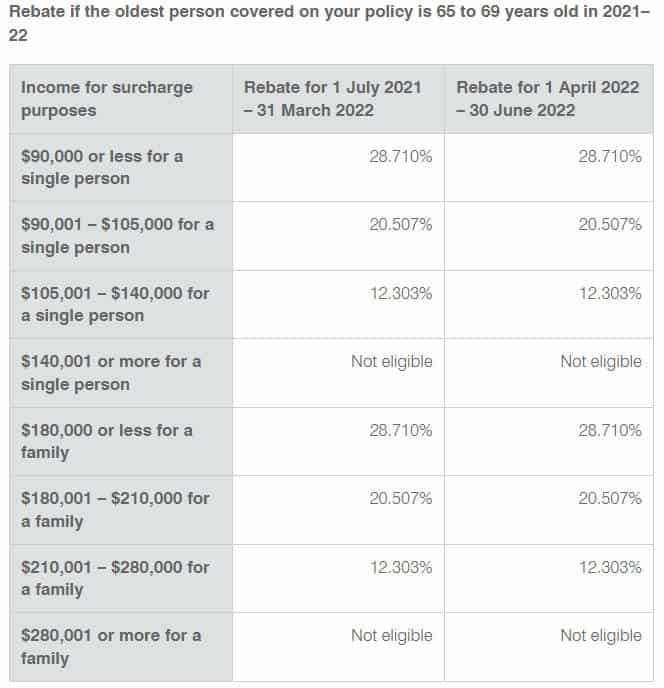

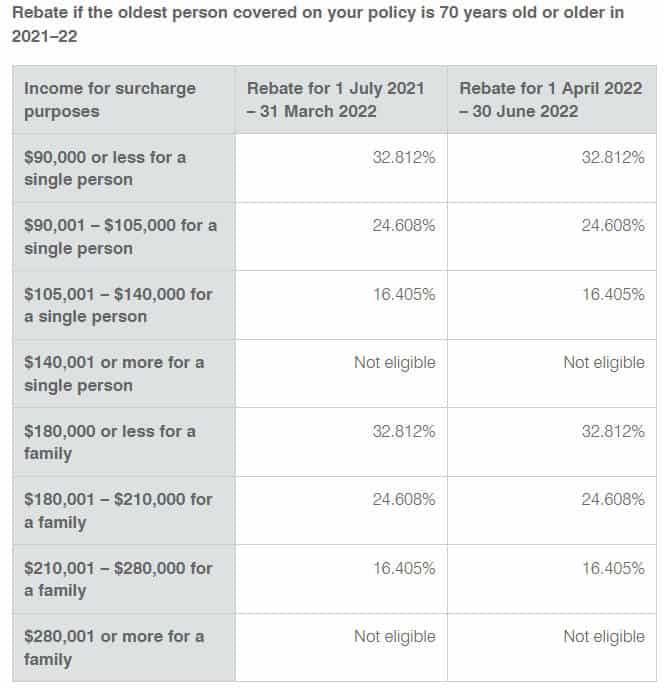

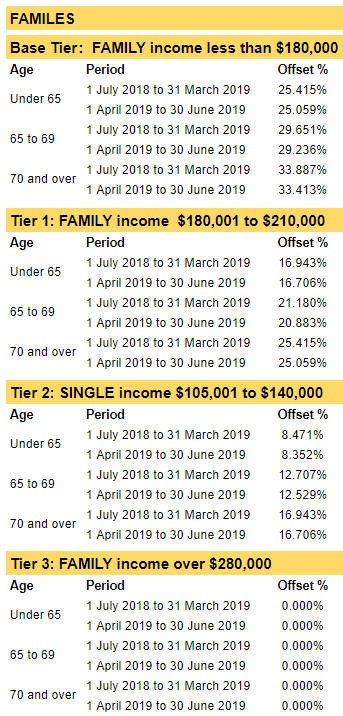

Further adjustments according to age groups, with older groups entitled to higher claims, are set out in the tables below.

How Private Health Insurance Rebate Is Claimed

The rebate can be claimed..

- as an offset (rebate) in your tax return; or

- as a direct payment; or

- as a reduction in the premiums paid to the health insurance provider.

If you have no tax payable and the premium reduction has not been fully claimed, the offsets are available for refund. Part-year claims are paid on a pro-rata basis. Likewise any calculation adjustment resulting from an overclaim, would be required to be paid back to the Tax Office.

Unclaimed rebate entitlements or over-claims are calculated by the Tax Office on tax return lodgment and issued as an adjustment to the tax assessment calculation.

See further: Private health insurance rebate eligibility

From 1 July 2012, the Health Insurance Tax Offset is limited by income, as calculated in the tables below. If income is over the thresholds, the available rebate may be reduced or stopped completely.

PHIR Annual Inflation Adjustments

From 1 April 2014 annual indexation was introduced whereby the rebate percentages are adjusted annually for each year, applying from 1 April to 31 March of the following year.

They were frozen at 2014-15 levels for 6 years in the period from the 2015-16 financial year until 30 June 2021.

The income thresholds are inflation-adjusted each financial year on 1 July.

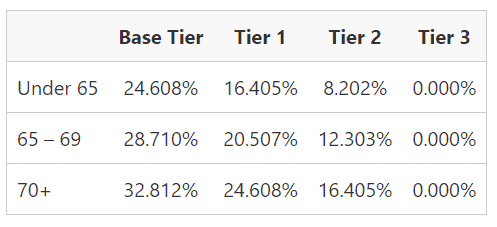

Rebate Percentages 2024-25

from 1 July 2024 to 31 March 2025

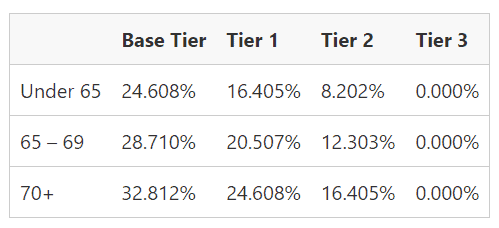

Rebate Percentages 2023-24

from 1 July 2023 to 31 March 2024

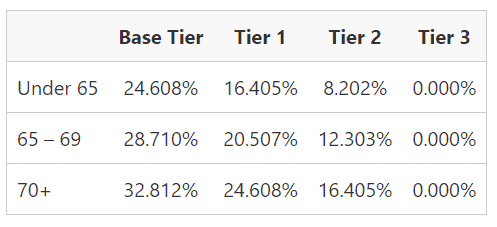

from 1 April 2024 to 30 June 2024

Income thresholds have been uplifted from 1 July 2023.

Income Thresholds Increase in 2023-24

| Income Tier | Single | Families |

| Base Tier | less than $93,000 | less than $186,000 |

| Tier 1 | $93,001 to $108,000 | $186,001 to $216,000 |

| Tier 2 | $108,001 to $144,000 | $216,001 to $288,000 |

| Tier 3 | over $144,000 | over $288,000 |

Income Thresholds 2021-22, 2022-23

Income thresholds:

| Income Tier | Single | Families |

| Base Tier | less than $90,000 | less than $180,000 |

| Tier 1 | $90,001 to $105,000 | $180,001 to $210,000 |

| Tier 2 | $105,001 to $140,000 | $210,001 to $280,000 |

| Tier 3 | over $140,000 | over $280,000 |

The rebate adjustment indexation factor effective 1 April 2023 has been determined as a factor of 1, and therefore there is no change to the rebate percentages for the year to 31 March 2024.

* Family income thresholds are increased by $1,500 for the second and subsequent dependent children.

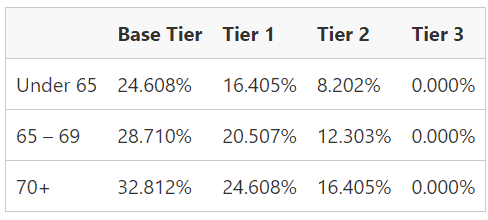

Rebate Percentages 2022-23

from 1 July 2022 to 31 March 2023

from 1 April 2023 to 30 June 2023

Rebate Percentages 2021-22

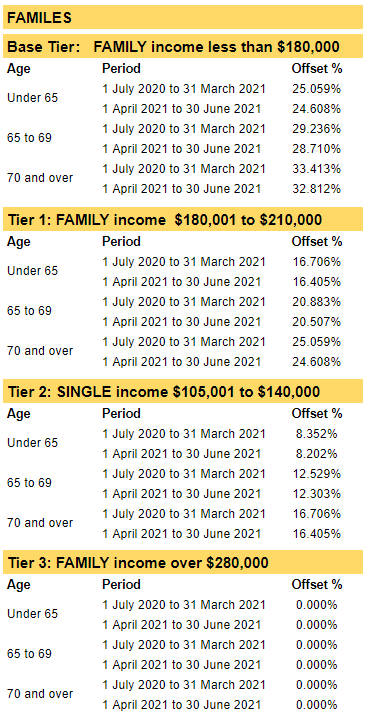

Rebate Percentages 2020-21

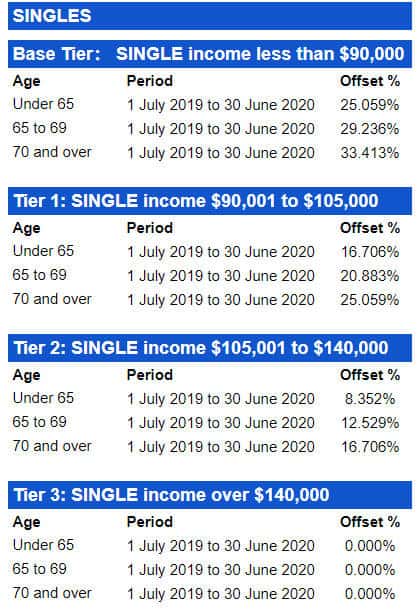

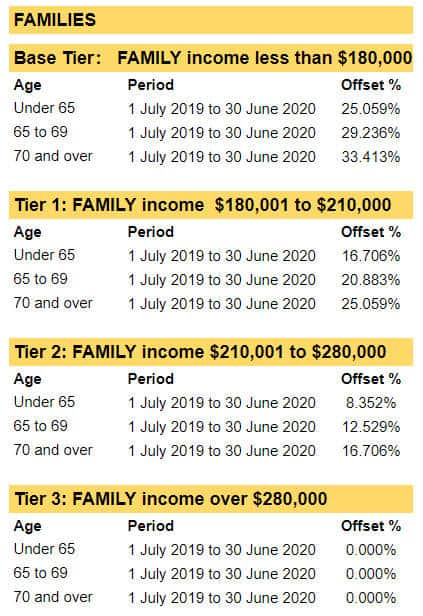

Rebate Percentages 2019-20

Step 1: Select the Singles or Families table.

Step 2: Find your income tier: Base, Tier 1, Tier 2 or Tier 3

Step 3: Select your age (row)

Step 4: The offset claim percentage is in the final column

Age selection is based on the oldest person on the policy.

Family income tier limits are uplifted by $1,500 for each dependant child after the first.

Dependant children’s income is not counted towards family income.

The following examples are based on the tables below:

– Single person with two dependant children, income $181,000, age under 65 has an offset of 25.059% (Base tier limit $181,500)

– Family with 3 dependant children, combined income of $185,000, age under 65, has an offset of 16.706% (Tier 1 limit $183,000)

Special Note for 2019-20: The inflation adjustment calculation for 1 April 2020 produced a Rebate Adjustment Factor of 1, which means that the offset percentages remain constant for the full 2019-20 financial year.

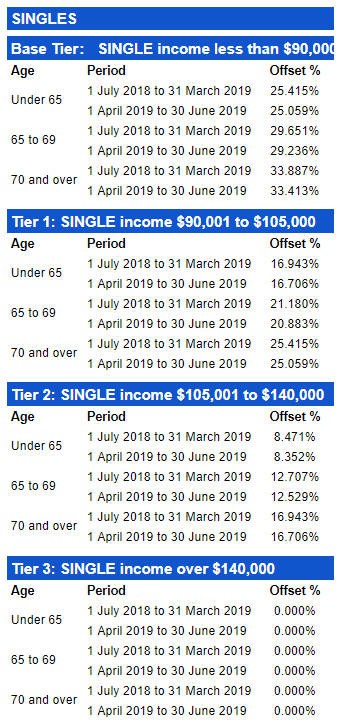

Rebate Percentages 2018-19

Sources:

- Private Health Insurance – Rebate Adjustment Factor Effective 1 April 2019

- Private Health Insurance – Rebate Adjustment Factor Effective 1 April 2018

PHIR Annual Statements

From 1 July 2019 health insurers will not be compelled to issue statements by 15 July as in the past unless requested.

The required information is supplied electronically by insurers to the Tax Office for pre-filling of tax returns.

How to calculate income for PHIR

The allowable percentage rebate claim depends on income level.

‘Income’ for this purpose is a combination of taxable income and other amounts added together.

‘Income’ is the sum of:

- taxable income (excluding First Home Super Saver assessable amounts, and super lump sums taxable component taxed at 0% up to low rate cap amount )

- total reportable fringe benefits – as shown on payment summary (ies)

- net investment losses (financial investments and rental property losses)

- net rental property loss

- reportable employer superannuation contributions (as shown on payment summary(ies)

- deductible personal superannuation contributions

- net amount on which family trust distribution tax has been paid

Single status is determined on the last day of the income year (30 June).

Having a dependent child or children on 30 June means income is assessed against the family income limits (adjusted where applicable for the number of dependent children). Children’s income is not included.

Family income thresholds are applied if you have a spouse on 30 June, and combined income is used for the assessment. This also applies if a spouse dies during the year, even if the surviving spouse is single at year end.

PHIR Income Thresholds and Rebate Percentages 2014-15 to 2020-2021

Under 2014 amendments annual indexation of the income levels for the health insurance rebate and MLS was frozen at 2014-15 levels for 3 years from the 2015-16 financial year until 30 June 2018. A subsequent enactment extended the indexation freeze for a further 3 years from 1 July 2018 to 30 June 2021.

Income thresholds for the years 2014-15 to 2020-2021

Singles

| Tier | Income |

| No Tier | $0 to $90,000 |

| Tier 1 | $90,001 to $105,000 |

| Tier 2 | $105,001 to $140,000 |

| Tier 3 | over $140,000 |

Families

Family income tiers are double the single amounts. Having a dependent child (at year end), income is assessed by the family income thresholds. Having more than one dependent child increases the amount of the thresholds by $1,500 for each child after the first.

| Tier | Income |

| No Tier | $0 to $180,000 |

| Tier 1 | $180,001 to $210,000 |

| Tier 2 | $210,001 to $280,000 |

| Tier 3 | over $280,000 |

Rebate (tax offset) % from 1 July 2016 to 31 March 2017

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 26.791% | 17.861% | 8.930% | 0% |

| 65 to 69 | 31.256% | 22.326% | 13.395% | 0% |

| 70 & over | 35.722% | 26.791% | 17.861% | 0% |

Rebate (tax offset) % from 1 April 2017 to 31 March 2018

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 25.934% | 17.289% | 8.644% | 0% |

| 65 to 69 | 30.256% | 21.612% | 12.966% | 0% |

| 70 & over | 34.579% | 25.934% | 17.289% | 0% |

2015-16

Rebate (tax offset) % from 1 July 2015 to 31 March 2016

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 27.820% | 18.547% | 9.273% | 0% |

| 65 to 69 | 32.457% | 23.184% | 13.910% | 0% |

| 70 & over | 37.094% | 27.820% | 18.547% | 0% |

Rebate (tax offset) % from 1 April 2016 to 30 June 2016

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 26.791% | 17.861% | 8.930% | 0% |

| 65 to 69 | 31.256% | 22.326% | 13.395% | 0% |

| 70 & over | 35.722% | 26.791% | 17.861% | 0% |

2014-15

Rebate (tax offset) % from 1 April 2015 to 30 June 2015

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 27.820% | 18.547% | 9.273% | 0% |

| 65 to 69 | 32.457% | 23.184% | 13.910% | 0% |

| 70 & over | 37.094% | 27.820% | 18.547% | 0% |

Rebate (tax offset) % from 1 July 2014 to 31 March 2015

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 29.04% | 19.36% | 9.68% | 0% |

| 65 to 69 | 33.88% | 24.20% | 14.52% | 0% |

| 70 & over | 38.72% | 29.04% | 19.36% | 0% |

2013-14 Income Thresholds & Rebates %

Adjusted rebate calculation formula

Commencing 1 April 2014 the private health insurance rebate is calculated by using the commercial premiums (excluding LHC loadings) as at 1 April 2013 and indexed annually by the lesser of CPI or the actual premium increase. This will only apply to premiums paid from 1 April 2014.

On that basis, the adjusted rebate percentages from 1 April 2014 are 96.8% of the specified 2013-14 percentages, reflected in the table below.

Income Tiers:

Singles

| Tier | Income |

| No Tier | $0 to $88,000 |

| Tier 1 | $88,001 to $102,000 |

| Tier 2 | $102,001 to $136,000 |

| Tier 3 | over $136,000 |

Families

Family income tiers are double the single amounts. Having a dependent child (at year end), income is assessed by the family income thresholds. Having more than one dependent child increases the amount of the thresholds by $1,500 for each child after the first.

| Tier | Income |

| No Tier | $0 to $176,000 |

| Tier 1 | $176,001 to $204,000 |

| Tier 2 | $204,001 to $272,000 |

| Tier 3 | over $272,000 |

Rebate (tax offset) % from 1 April 2014 to 30 June 2014

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 29.04% | 19.36% | 9.68% | 0% |

| 65 to 69 | 33.88% | 24.20% | 14.52% | 0% |

| 70 & over | 38.72% | 29.04% | 19.36% | 0% |

Rebate (tax offset) % from 1 July 2013 to 31 March 2014

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 30% | 20% | 10% | 0% |

| 65 to 69 | 35% | 25% | 15% | 0% |

| 70 & over | 40% | 30% | 20% | 0% |

For families with children, the thresholds are increased by $1,500 for each child after the first. So for example if you have two dependant children the family income threshold increases by $1,500, for 3 children by $3,000.

2012-13 Income Thresholds & Rebates

Income Tiers

Singles

| Tier | Income |

| Base | $0 to $84,000 |

| Tier 1 | $84,001 to $97,000 |

| Tier 2 | $97,001 to $130,000 |

| Tier 3 | over $130,000 |

Families

Family income tiers are double the single amounts. Having a dependent child (at year end), income is assessed by the family income thresholds. Having more than one dependent child increases the amount of the thresholds by $1,500 for each child after the first.

| Tier | Income |

| Base | $0 to $168,000 |

| Tier 1 | $168,001 to $194,000 |

| Tier 2 | $194,001 to $260,000 |

| Tier 3 | over $260,000 |

| Age | Base | Tier 1 | Tier 2 | Tier 3 |

| Under 65 | 30% | 20% | 10% | 0% |

| 65 to 69 | 35% | 25% | 15% | 0% |

| 70 & over | 40% | 30% | 20% | 0% |

Further rebate restrictions – from 2013

The premium base

The private health insurance rebate will be calculated using commercial premiums as at 1 April 2013 and then indexed annually by the lesser of CPI or the actual increase in commercial premiums.

This means your rebate (offset) may be calculated on an amount which is less than the actual health insurance premium that you paid

Exclusion of LHC premium loading

With effect from 1 July 2013, the Lifetime Health Cover loading will not be included when the private health insurance rebate is determined. This will effectively increase the premiums payable by those people required to pay the loading.

Insurance Premium Loadings – Lifetime Health Cover

The health insurance rebate is the “carrot”, a government subsidy of health insurance premiums designed to encourage us to take out a minimum level of private hospital insurance cover.

Lifetime Health Cover is the “stick” – a scheme introduced by the Federal Government in 2000 as financial punishment for non-members of private health insurance fund, for everyone over the age of 31 years. In general, if you do not have adequate hospital cover after you turn 31 (determined at the following 1 July) and subsequently take out hospital cover, you will pay a 2% premium surcharge to the health insurer for every year you are aged over 30. The maximum loading is 70%.

The premium loading is removed after 10 continuous years of cover.

There are some concessions and exemptions to the premium surcharge, summarised as follows:

- if your birthday is before 1 July 1934, you are exempt from The Lifetime Health Cover premium loading

- possession of a current Department of Veterans’ Affairs Gold Card is treated as full hospital cover (previous periods holding the card since 1 July 1999 also count).

- gaps in cover of up to 1,094 days in total over your lifetime will not trigger the 2% loading. Over 1094 days will incur a 2% loading on resumption of insurance, and 2% for each uninsured year after that.

- cancelled insurance days spent overseas are excluded from the 1,094 days lifetime limit

- new migrants have a grace period of 12 months from Medicare registration

- short-term suspensions agreed to by the insurer are treated as maintaining cover

- ADF members are considered to have full hospital health cover. Discharge after 1 July after turning 31 years enables a 1,094 day grace period; discharge before, attracts the normal rules.

- citizen or Australian PR overseas on 1 July after turning 31 enables a 12 month grace period on return. While overseas, return visits of up to 90 days are still counted as time spent overseas.

- citizen or Australian PR over 31 and overseas on 1 July enables a lifetime 1,094 day grace period on return. While overseas, return visits of up to 90 days are still counted as time spent overseas

- residents of Norfolk Island are generally treated as ‘overseas’

- The ‘age’ criterion is taken as the age of the oldest person on the policy.

- The tax offset is calculated as the specified percentage of the eligible health insurance premium.

Offsets up to 30 June 2012

Private Health Insurance Offset (not income tested)

| Age | Tax Offset |

| Under 65 years | 30% |

| 65 to 70 years | 35% |

| 70 years and above | 40% |

See also

- Additional medicare levy for higher-income taxpayers without sufficient private hospital insurance coverage – Medicare levy surcharge (MLS)

This page was last modified 2024-03-07