Low and Middle Income Tax Offset “LMITO” formulae only applies for the years 2019 to 2022.

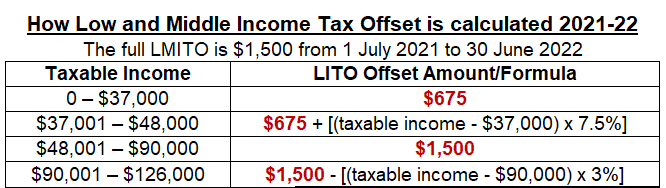

LMITO Formula For 2021-22

The Low and Middle Income Tax Offset is valued at $675 on low incomes up to $37,000. The offset is increased at the rate of 7.5% of income above $37,000 up to $48,000. Incomes above $48,000 to $90,000 have an offset of $1,500 for 2021-22 only.

For incomes above $90,000 the offset is withdrawn at the rate of 3% of income above $90,000. On incomes above $126,000 there is no offset.

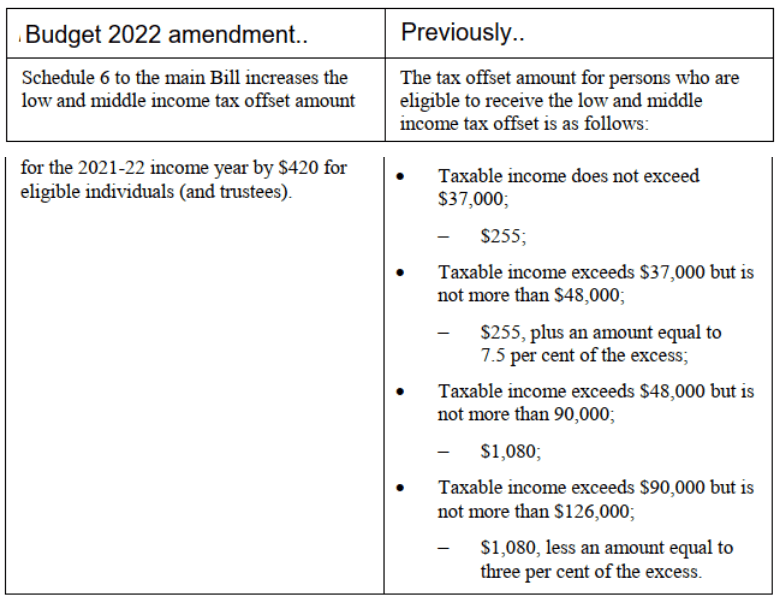

Budget 2022 announcement 29 March 2022:

Low and Middle income earners who were eligible for the LMITO will have that increased by $420 for the 2021-22 financial year (only).

The Low Middle Income Tax Offset becomes payable at the time of tax return assessment, and so the benefit of this increase will flow to taxpayers from July 2022 onwards.

How the formula changed for 2021-22:

LMITO formula from 1 July 2021 to 30 June 2022

| Income | Offset |

| up to $37,000 | $675 |

| $37,001 to $48,000 | $675 plus 7.5 cents for each dollar over $37,000 |

| $48,001 to $90,000 | $1,500 |

| $90,001 to $126,000 | $1,500 less 3 cents for each dollar over $90,000 |

| $126,000+ | Nil |

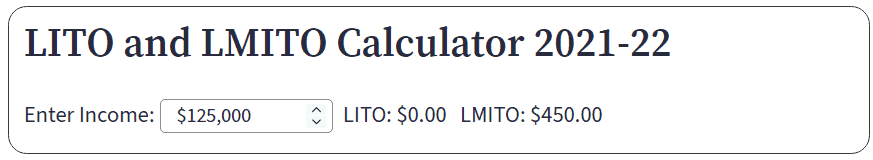

Calculator click/tap to start (opens a new page)

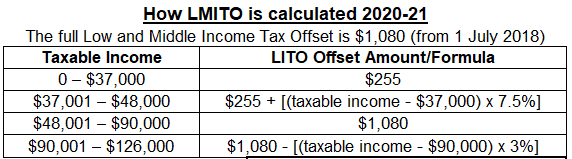

LMITO formula from 1 July 2018 to 30 June 2021

| Income | Offset |

| up to $37,000 | $255 |

| $37,001 to $48,000 | $255 plus 7.5 cents for each dollar over $37,000 |

| $48,001 to $90,000 | $1,080 |

| $90,001 to $126,000 | $1,080 less 3 cents for each dollar over $90,000 |

| $126,000+ | Nil |

The LMITO formula is included in our free excel spreadsheet calculator for the years to 2025. Get it here.

What’s it worth to you? Calculate the low income tax offsets now.

The Low and Middle Income Tax Offset (LMITO) is a tax offset introduced as part of the Budget 2018 measures to revise the personal income tax rates, and subsequently extended to 2021-22.

How To Claim Low And Middle Income Tax Offset

The offset is automatically included in your tax assessment calculation.

As with the Low Income Tax Offset (LITO), the Low and Middle Income Tax Offset is calculated based on taxable income, and does not require the taxpayer’s initiative to claim, other than simply lodging a tax return with correct income details.

The effect of the low income tax offsets is to raise the tax free threshold for most taxpayers.

Legislation for this measure was originally approved by parliament in June 2018, and was increased by the Budget 2019 legislation passed on 4 July 2019.

The years of application were subsequently extended to 2021 and 2022 in the 2020 and 2021 budgets respectively.

The original LMITO base amount was increased from $200 to $255; and the maximum amount increased from $530 to $1080. Revised taxable income tests were also applied.

The LMITO applies in addition to the Low Income Tax Offset (LITO). The offset is paid in arrears, which means it doesn’t turn up until you get your tax assessment after the end of the financial year.

This page was last modified 2022-03-30