The budget for the 2020-21 financial year was published on Tuesday 6 October 2020. Budget papers released here: budget.gov.au or download overview.

Key tax initiatives announced in the budget are listed below.

Measures included in the Treasury Laws Amendment (A Tax Plan for the COVID-19 Economic Recovery) Bill 2020 have been approved by parliament.

Key budget measures include:

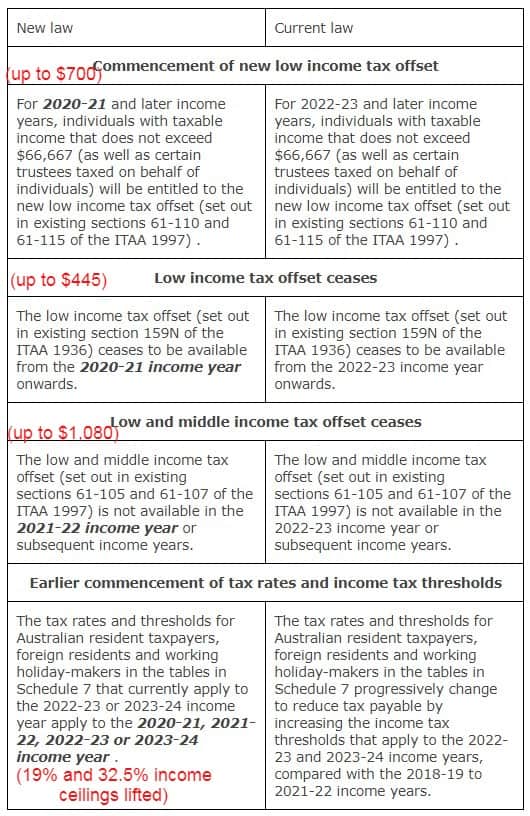

- Planned future personal tax reductions via tax scale adjustments for individuals to be brought forward (by 2 years) to 1 July 2020, with increases in LITO and LMITO. See Tax Fact Sheet and Explanatory Memorandum

- Instant asset write off allowances for businesses enlarged and extended: From 7:30pm (AEDT) on 6 October 2020 until 30 June 2022, businesses with turnover up to $5 billion can deduct 100% of eligible depreciable assets of any value (including improvements to existing assets) in the year of installation. See Explanatory Memorandum.

- These measures are extended to businesses with an aggregated turnover of more than $5 billion due to the income of an overseas parent or associate provided they have invested more than $100 million in tangible depreciating assets in the period 2016‑17 to 2018‑19. (See media release 23 Nov 2020)

- Business losses ‘carry back’ enabled from June 2022 back to offset against profits in or from 2018-19 year, for companies with turnover up to $5 billion. Tax refunds can be claimed with lodgment of 2020‑21 and 2021‑22 tax returns. See Explanatory Memorandum and company tax rates.

- Small business entity turnover threshold for certain concessions lifted from $10 million to $50 million

- State based business support grants given to be tax free (NANE) See Explanatory Memorandum and details here.

- R&D concessions (previously proposed) thresholds and intensity tiers adjusted and deferred until 1 July 2021. See Explanatory Memorandum

- JobMaker Hiring Credit – From 7 October 2020 to 6 October 2021 a government credit of $200 a week for new hires aged 16 to 29 and $100 a week for employees aged 30 to 35. The credits will be paid to employers quarterly in arrears. Eligible employees must have been recipients of JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one of the 3 months prior to hiring. See Fact Sheet and Economic Recovery Package (JobMaker Hiring Credit) Amendment Bill 2020 and Explanatory Memorandum; JobMaker Hiring Credit rules (exposure draft & consultation)

- FBT exemption for employer-provided retraining activities to employees who are redeployed to a different role in the business.

See further:

- Federal Budget 2020-2021 – BDO Australia

- ATO – budget news & legislation timelines

- Budget 2020-21 Super Oracle

- Federal Budget Insights – Johnson Winter & Slattery

[23 July 2020] The Government released an Economic and Fiscal Update which details the impact of the COVID‑19 pandemic and the 2019‑20 bushfires and the associated support and relief measures. The update did not include any new or previously unannounced tax policy measures.

See:

The 2020-21 national budget was handed down on Tuesday 6 October 2020.

See more: Coronavirus pandemic prompts Federal Government to delay budget until October

[20 March 2020] Media Release

This page was last modified 2020-11-09