‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

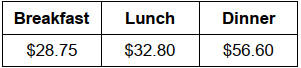

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

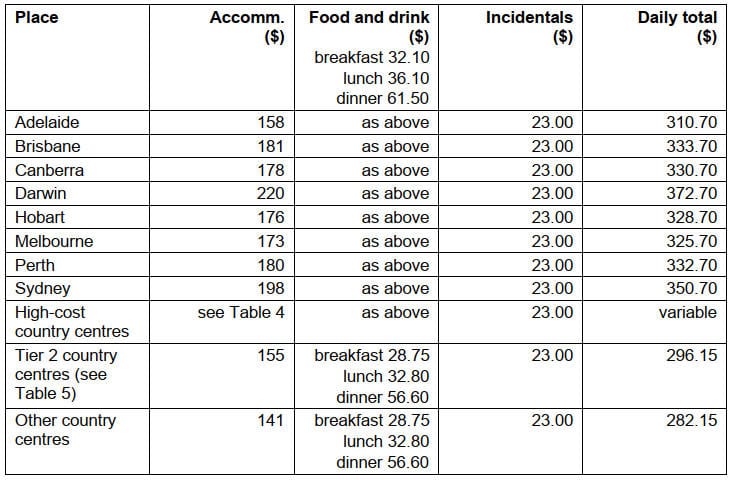

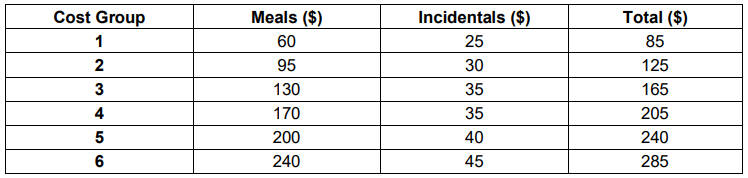

2023-24 Domestic Travel

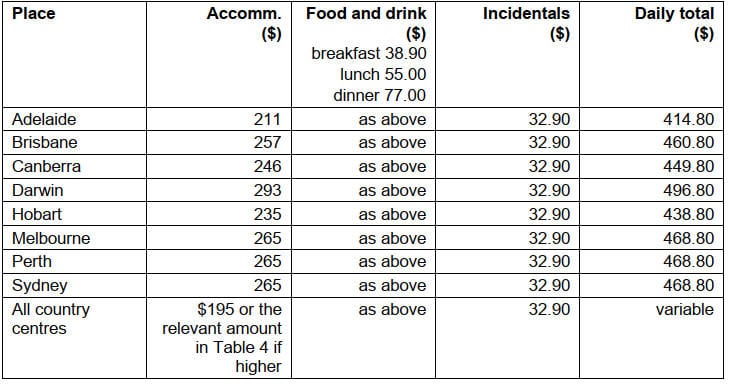

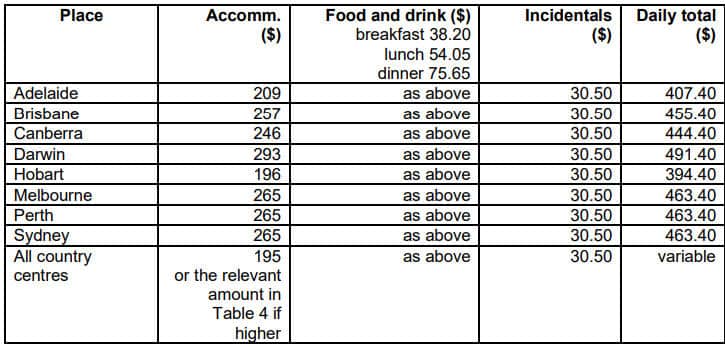

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

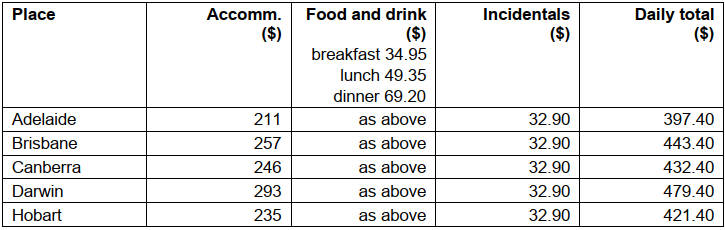

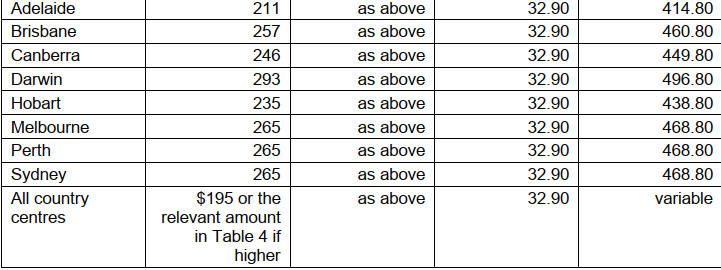

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

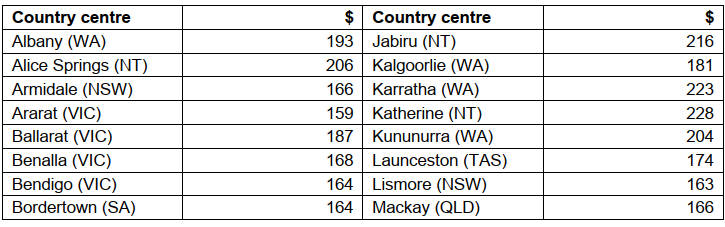

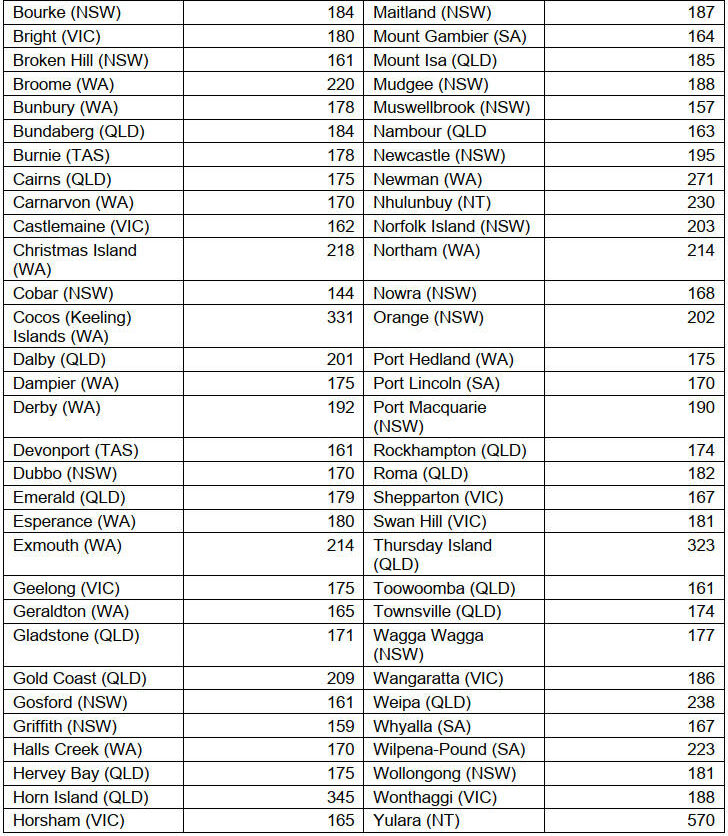

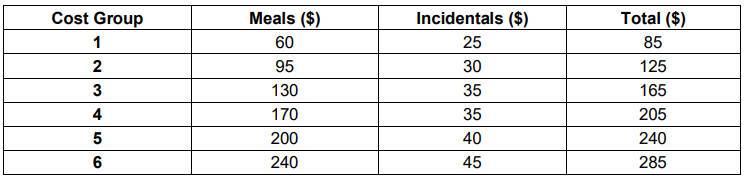

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

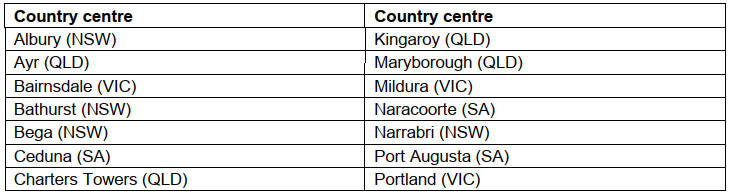

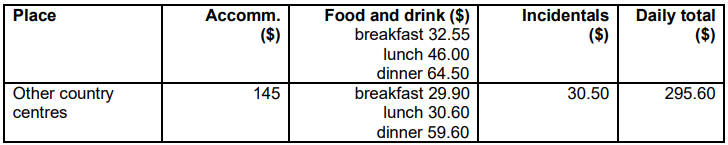

Table 5: Tier 2 country centres

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

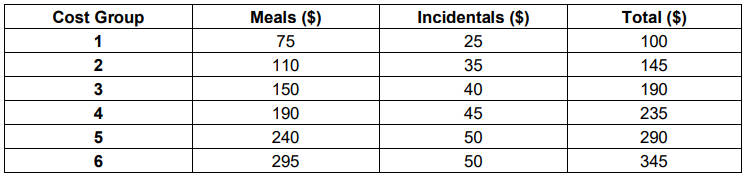

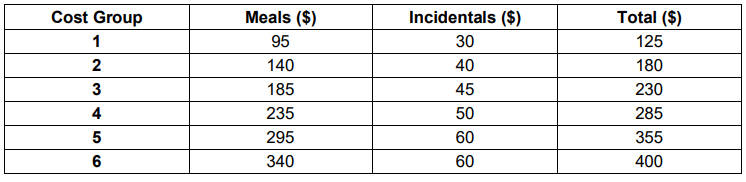

2023-24 Overseas Travel

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

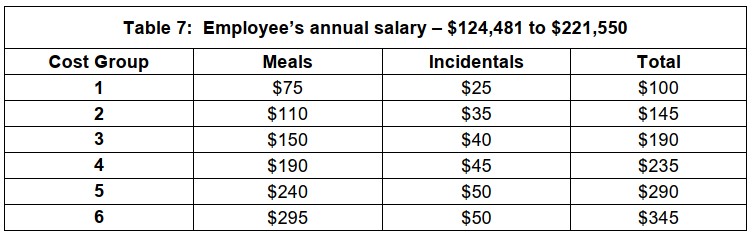

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

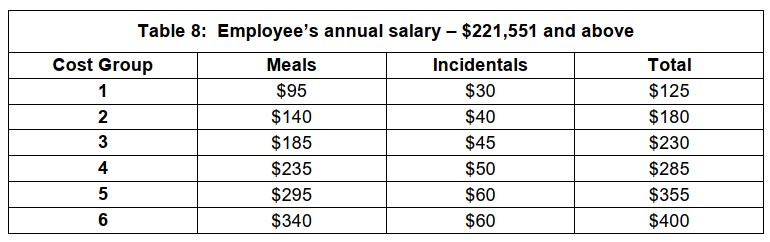

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

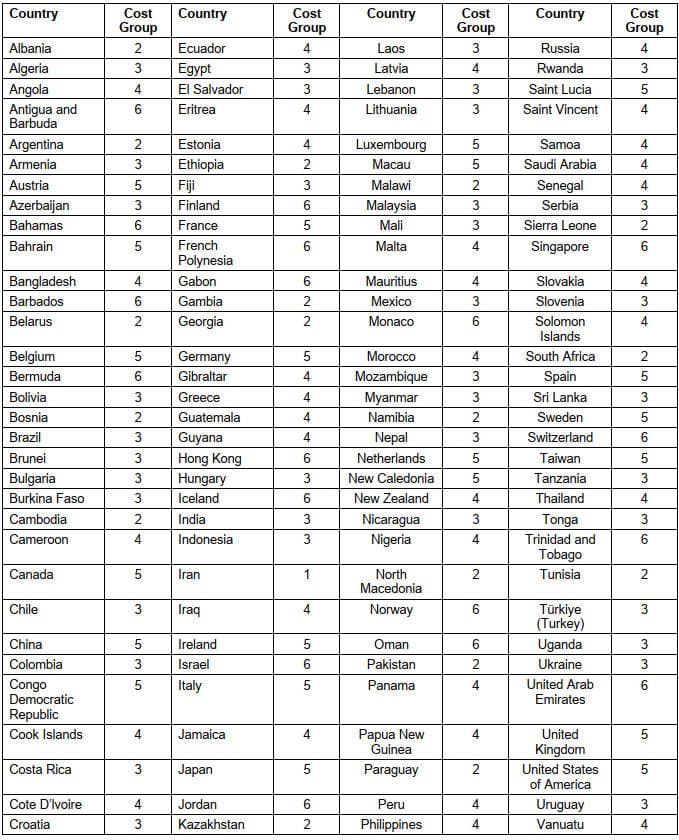

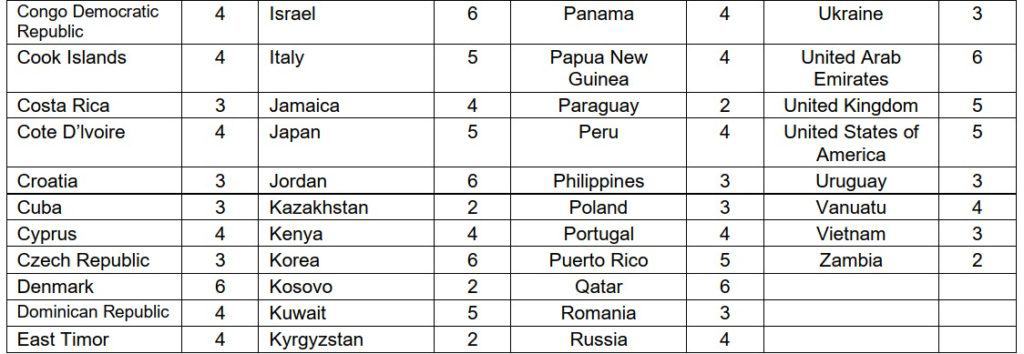

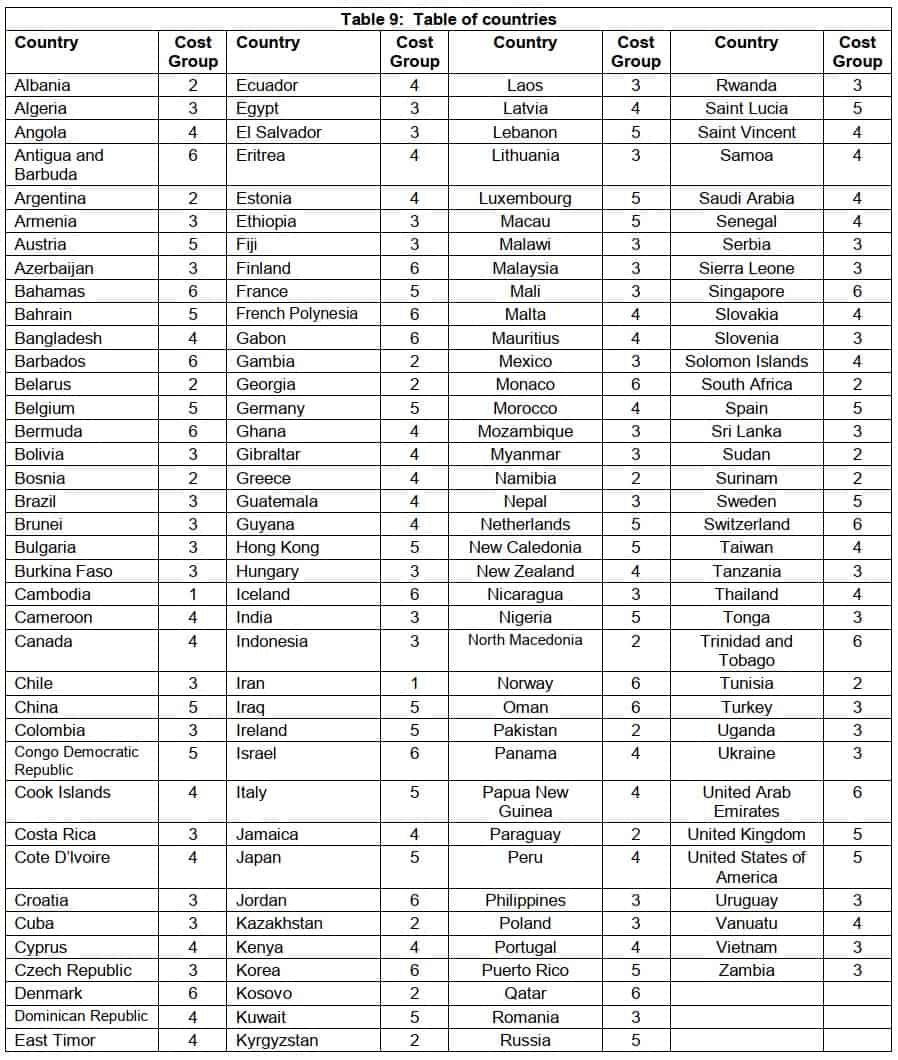

Table 9: Table of countries

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

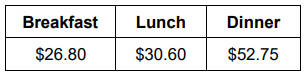

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

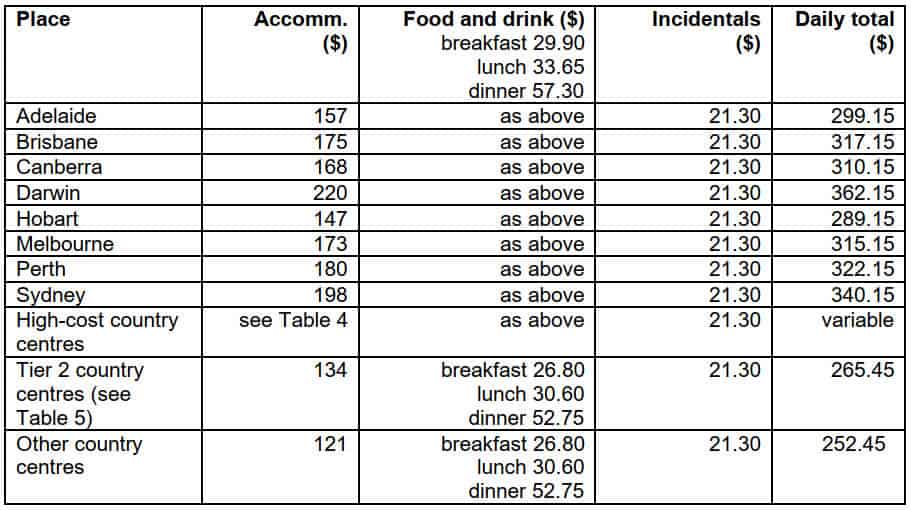

2022-23 Domestic Travel

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

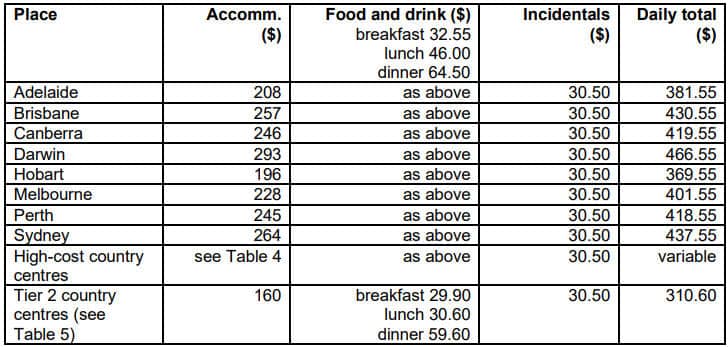

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

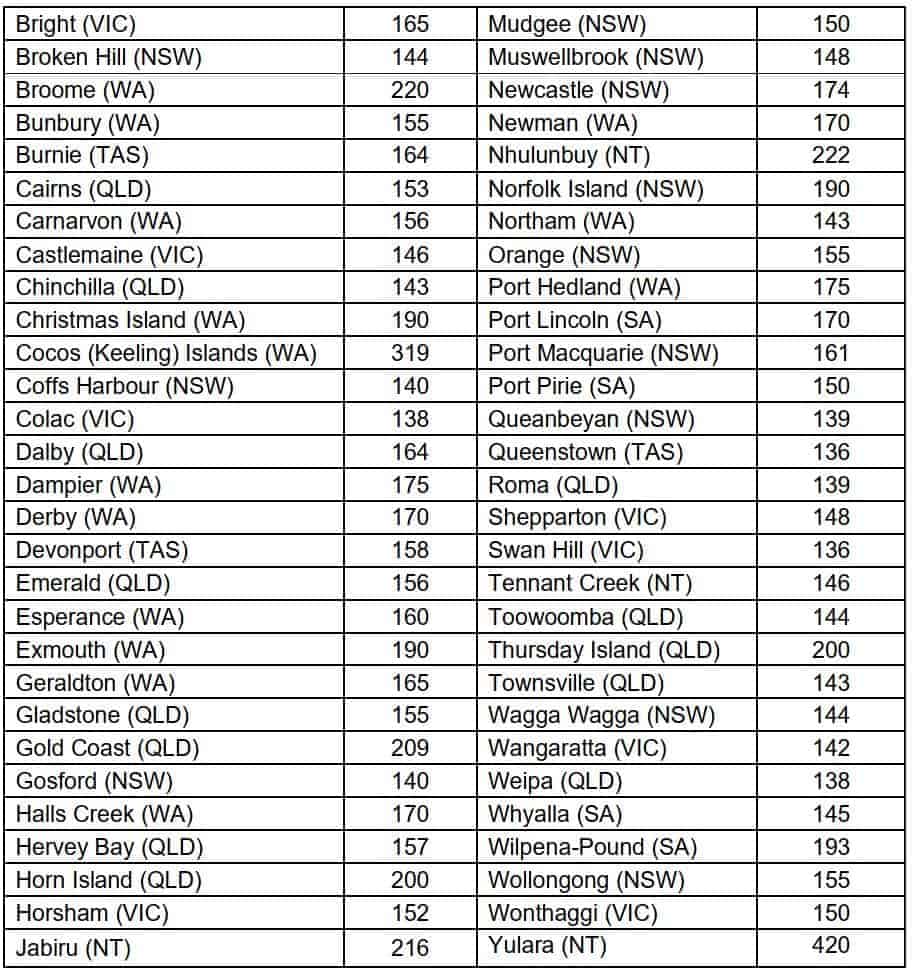

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5: Tier 2 country centres

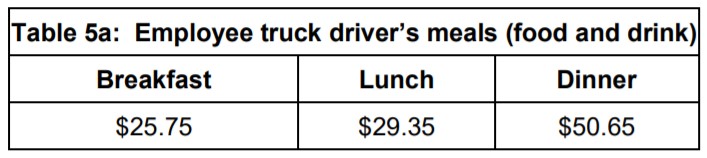

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

2022-23 Overseas Travel

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Table 9: Table of countries

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

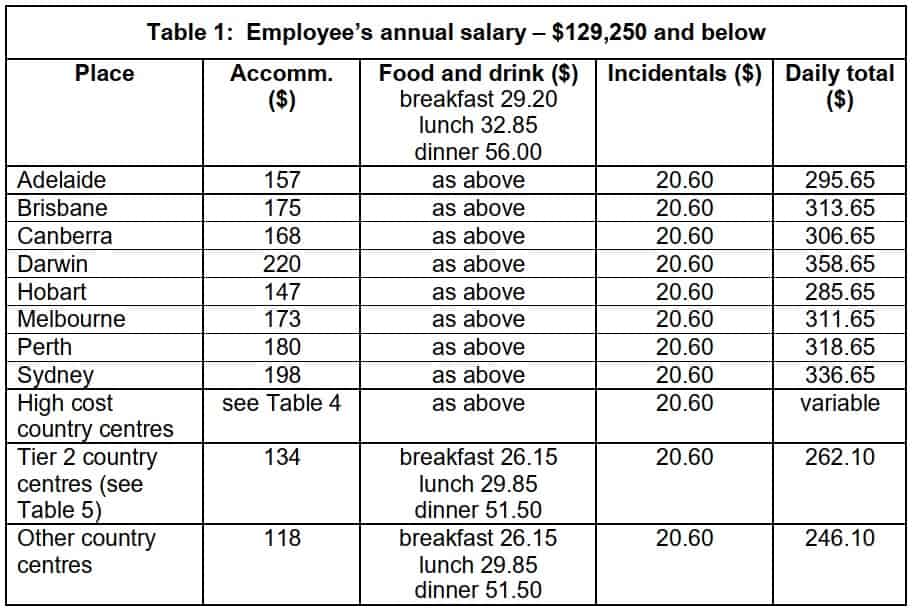

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

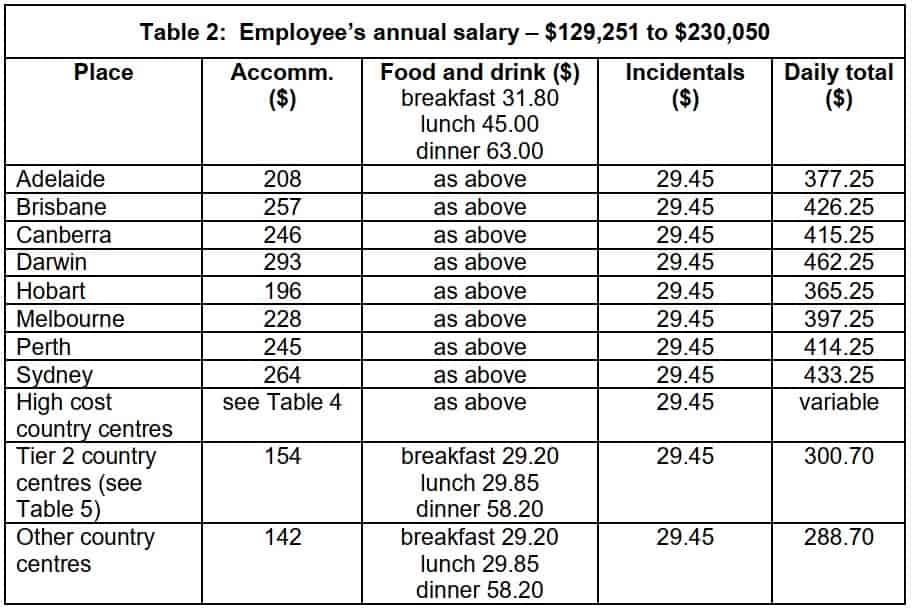

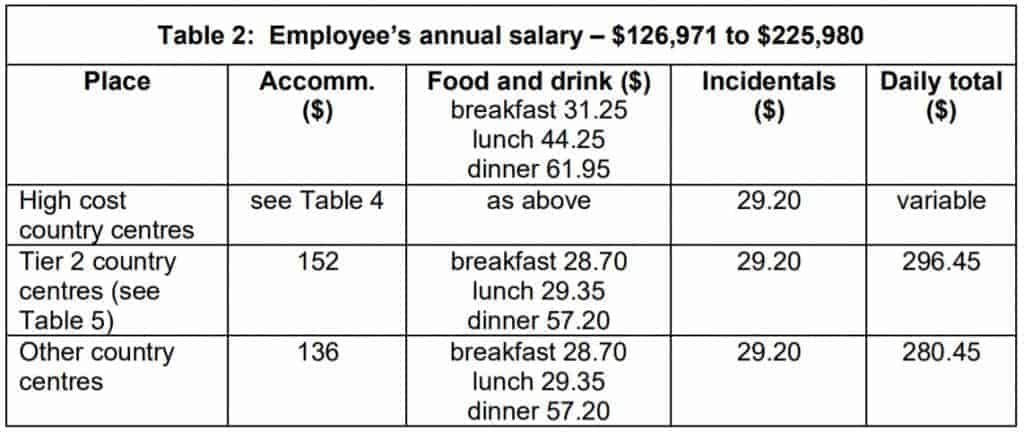

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

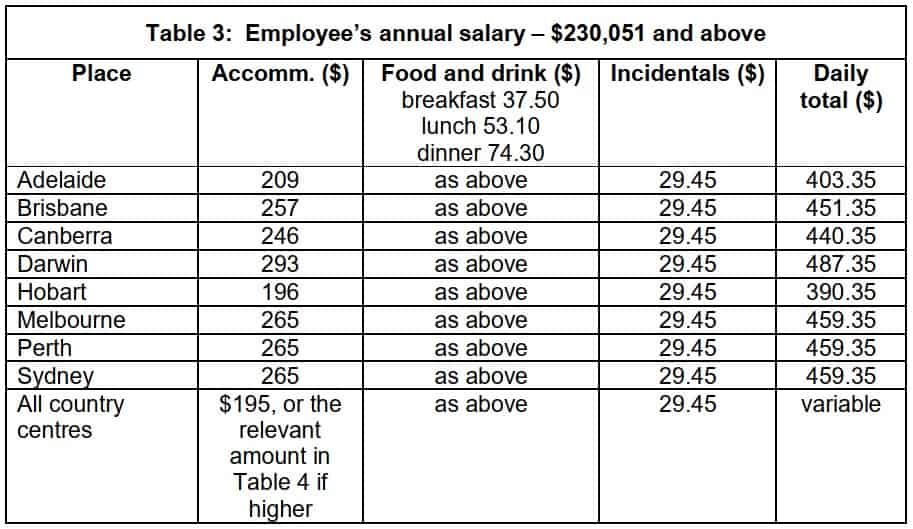

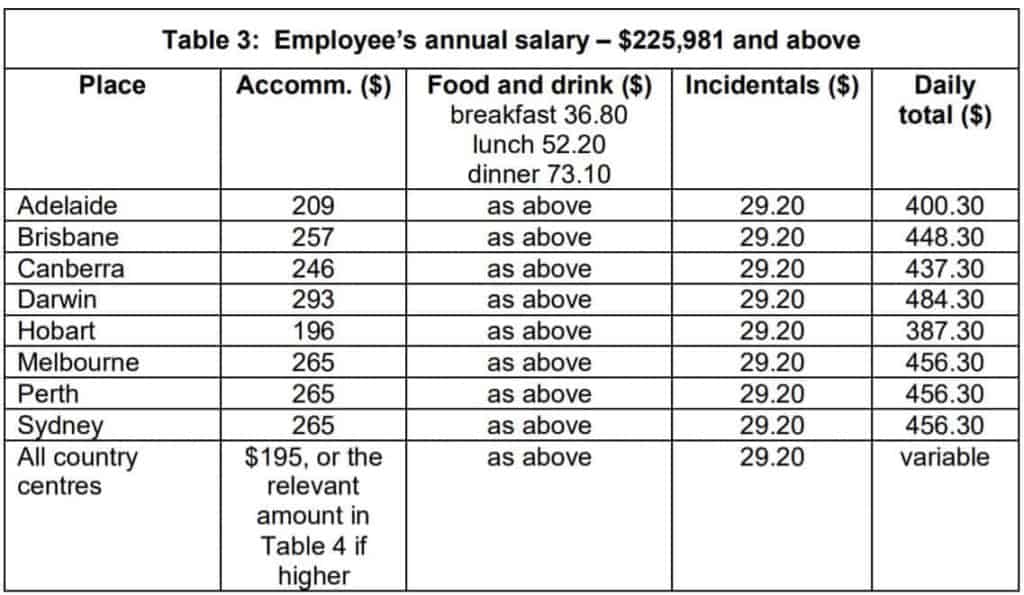

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

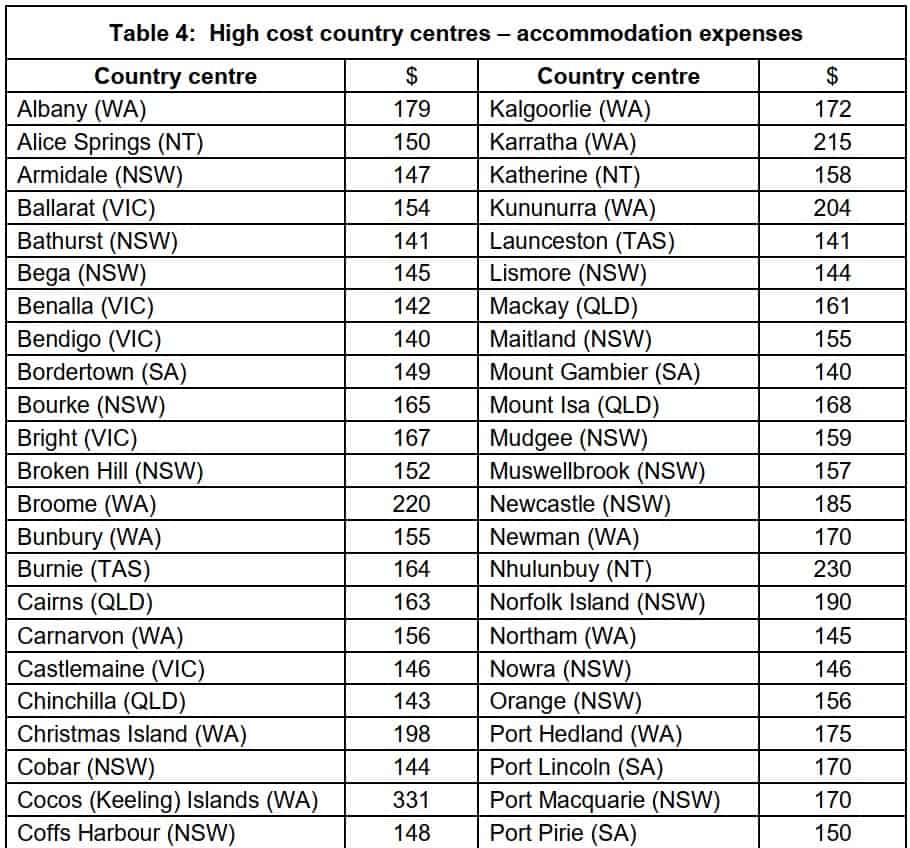

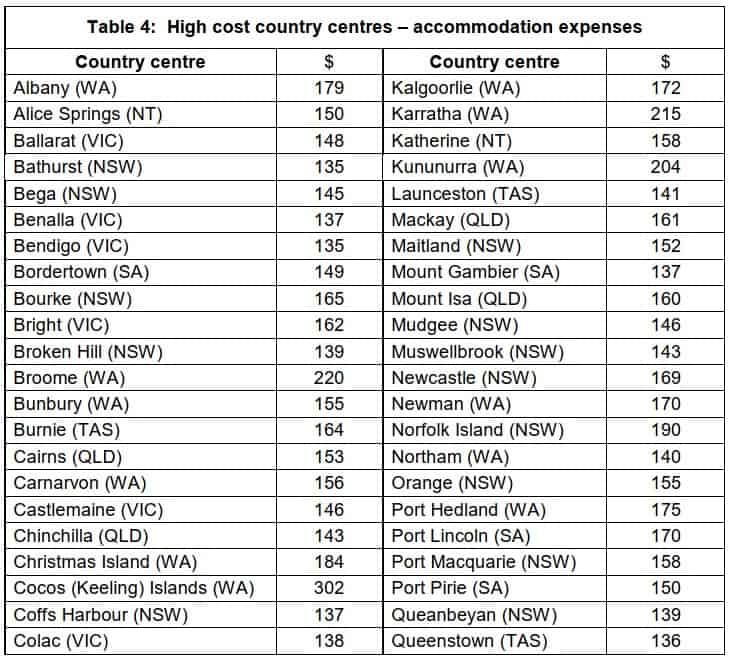

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

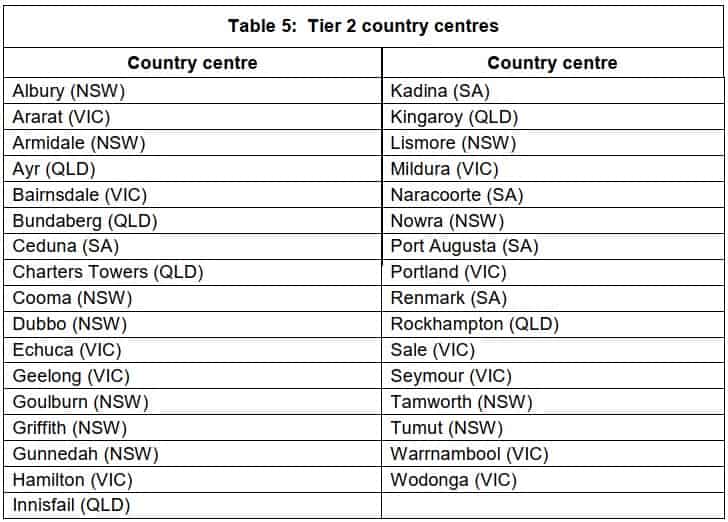

2021-22 Domestic Table 5: Tier 2 country centres

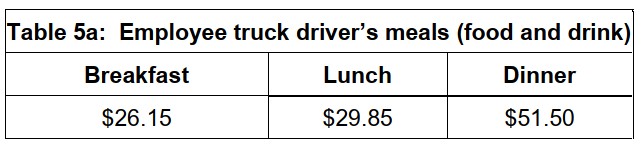

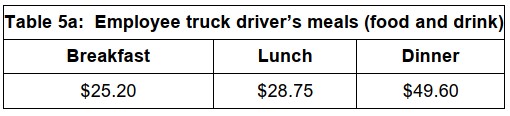

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Travel

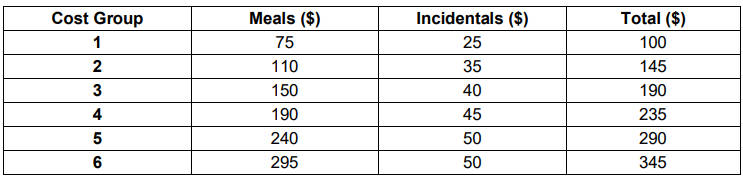

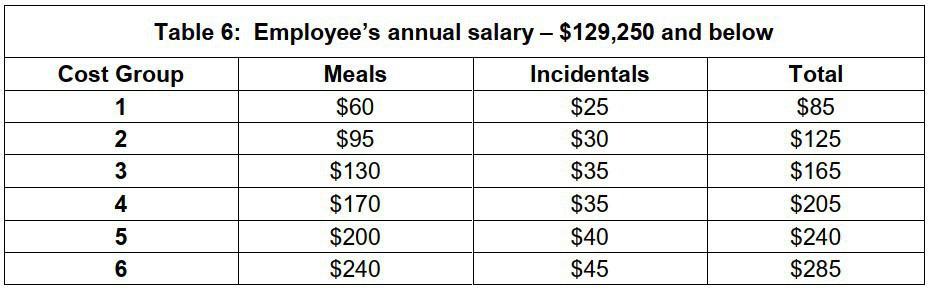

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

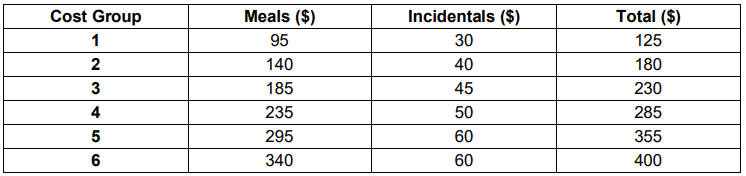

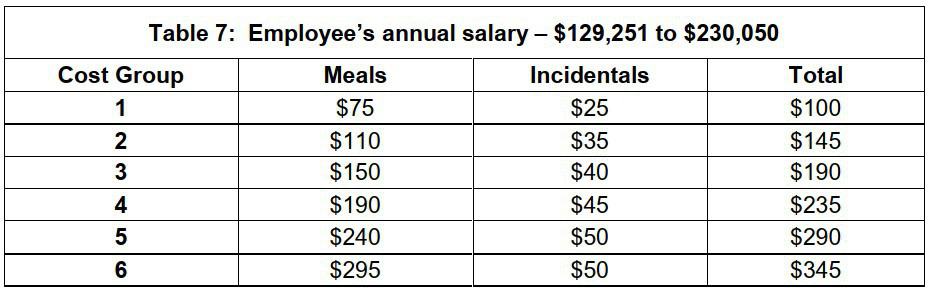

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

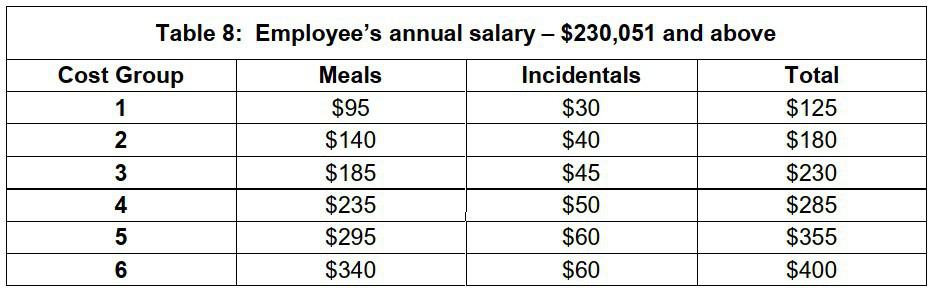

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

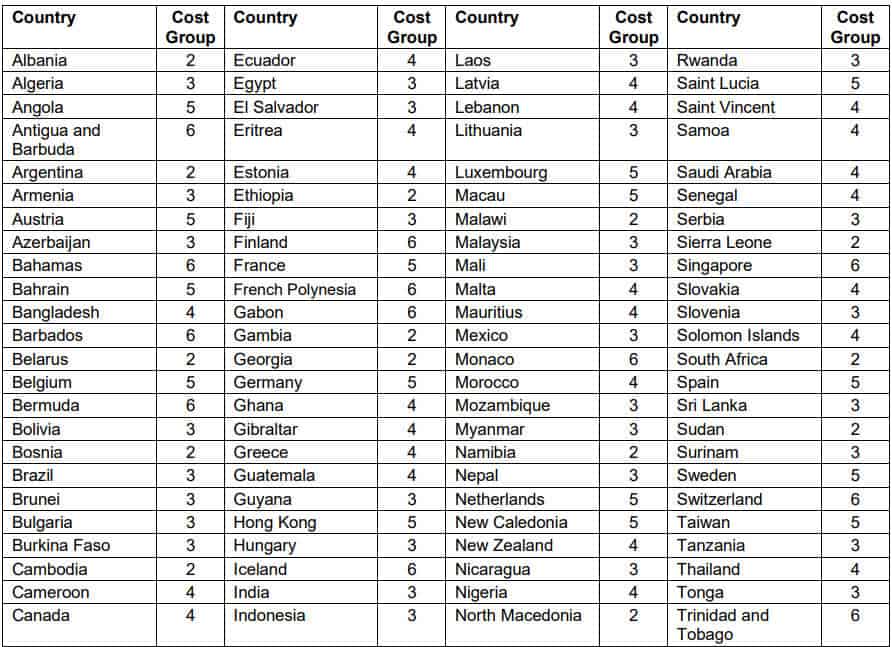

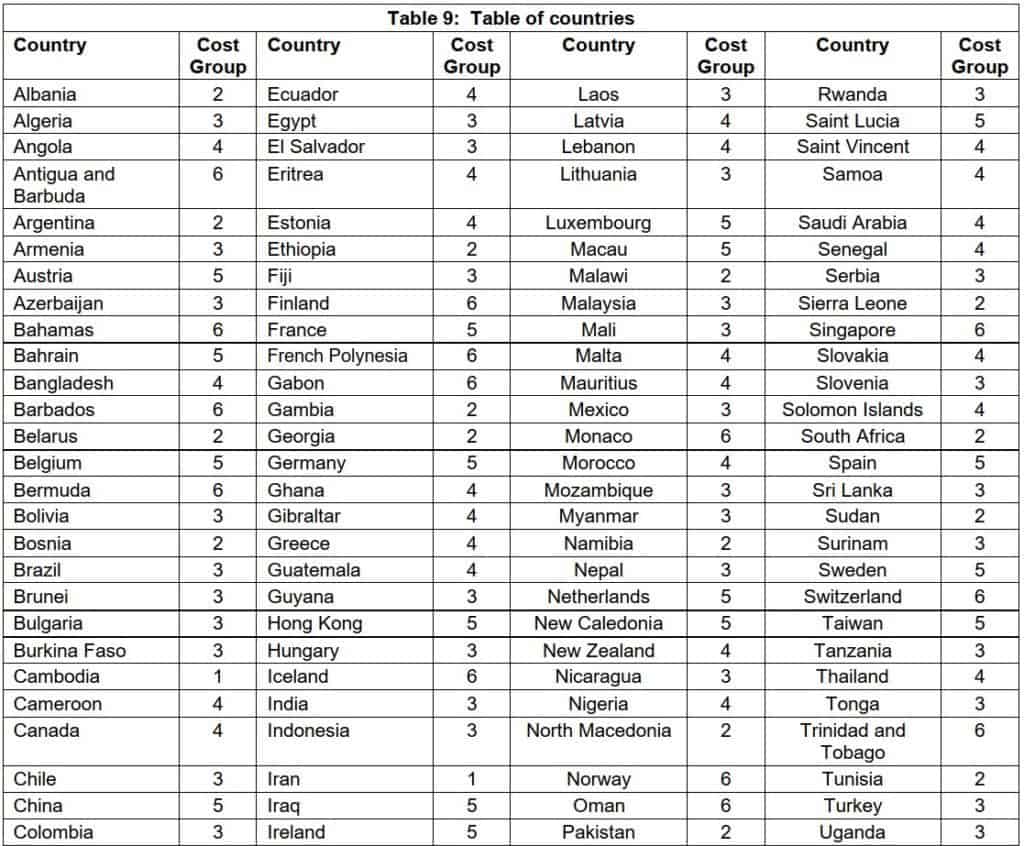

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95.

2020-21 Domestic Travel

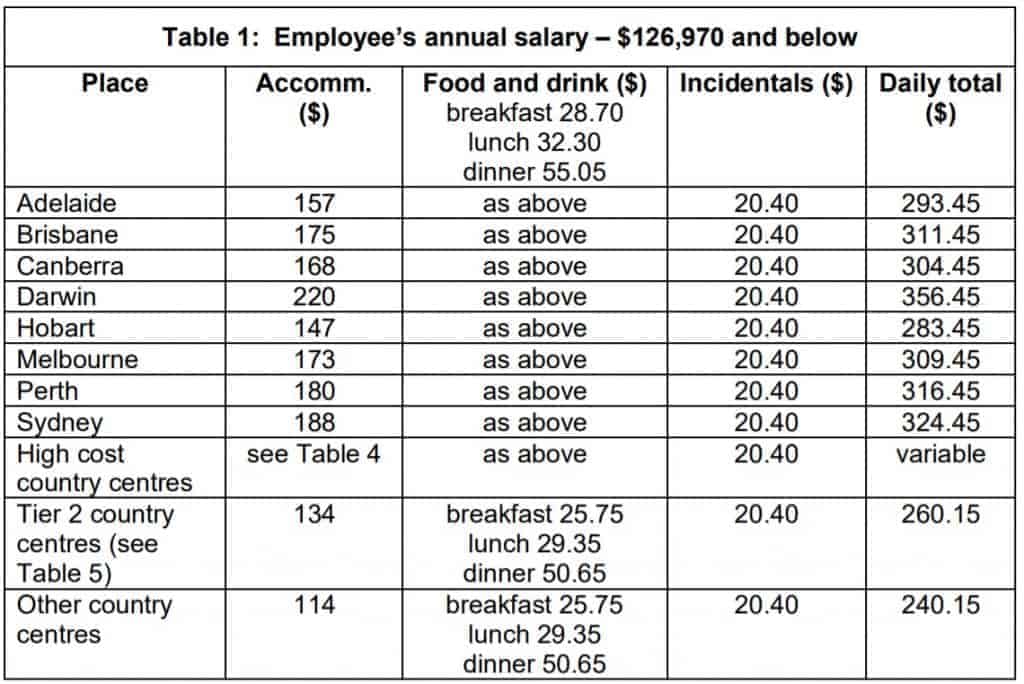

2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

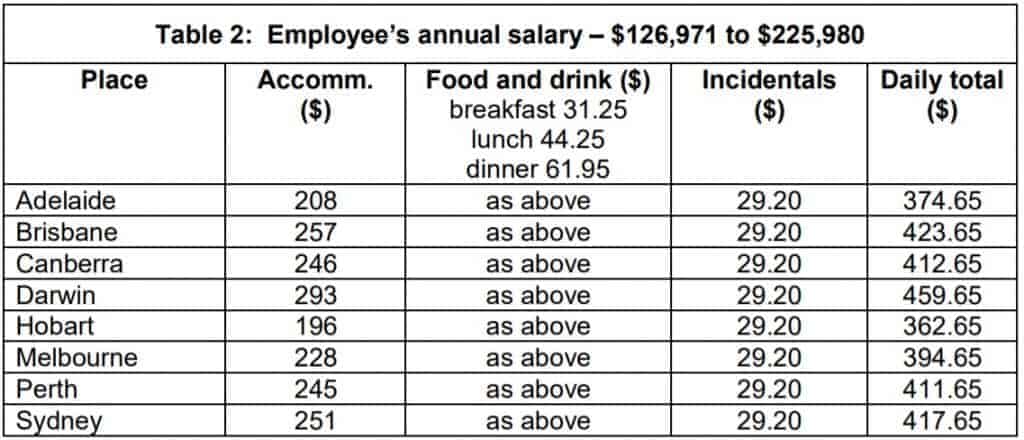

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel

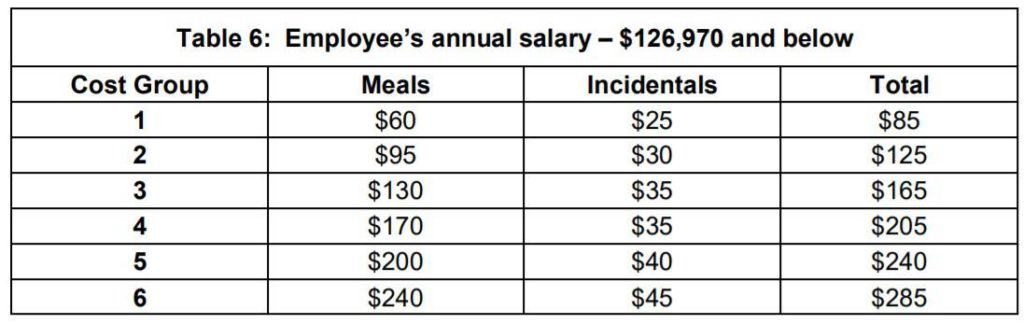

2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

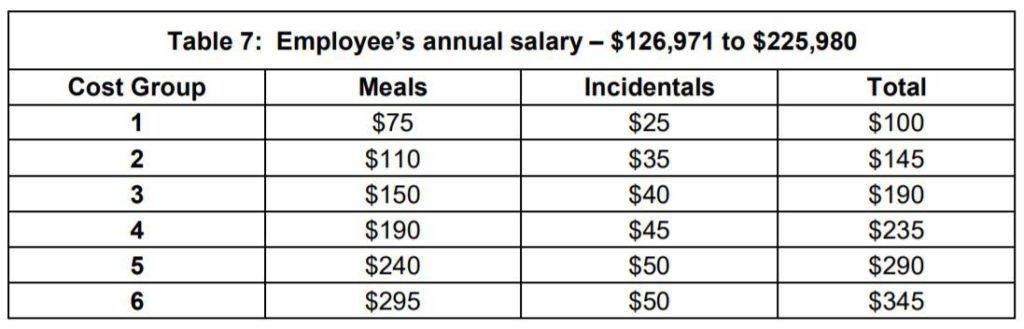

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

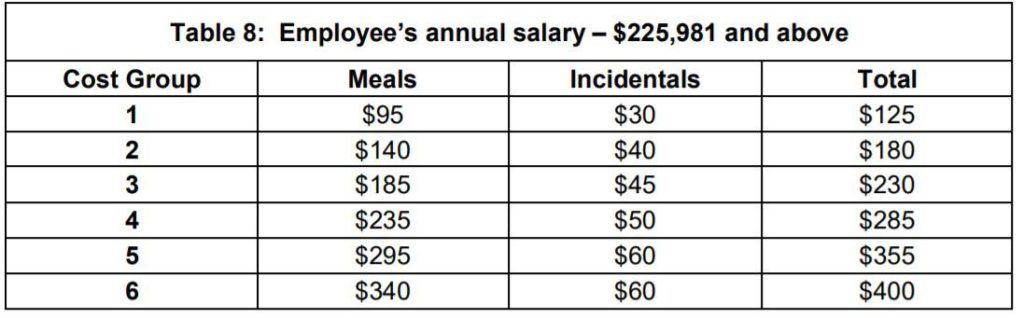

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

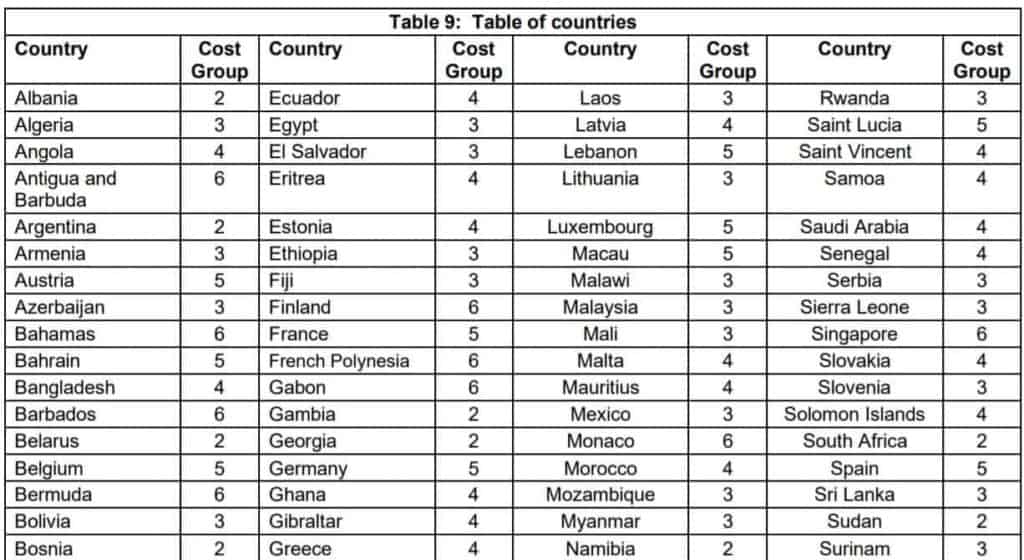

2020-21 Overseas Table 9: Table of countries

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here.

The following reasonable travel allowance tables are contained in determination TD 2019/11:

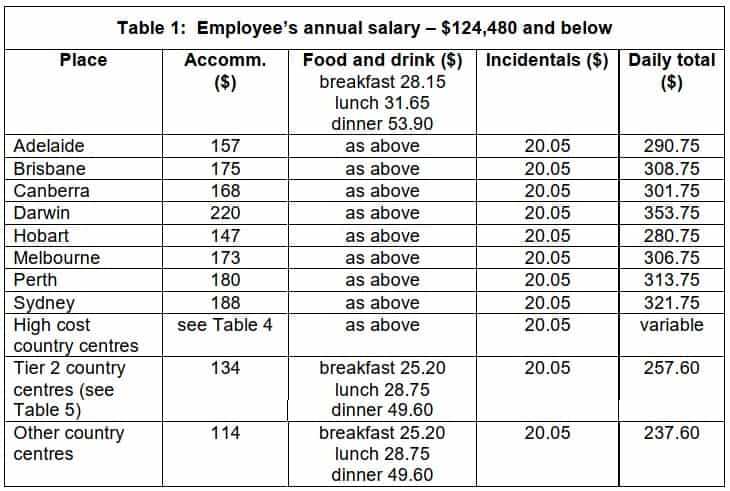

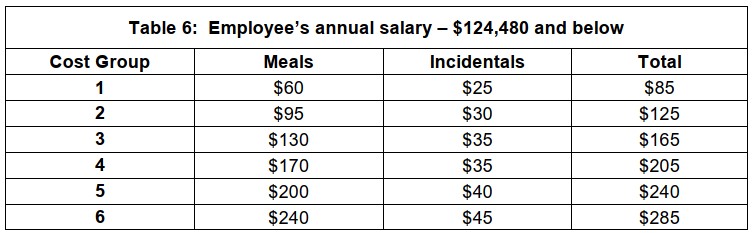

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

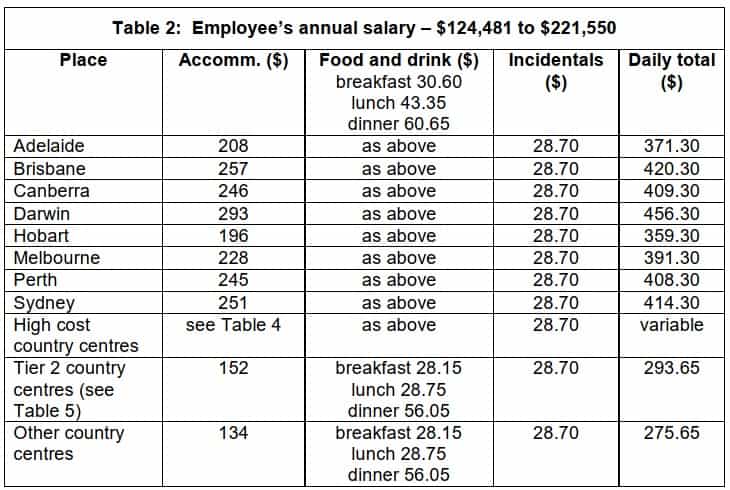

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

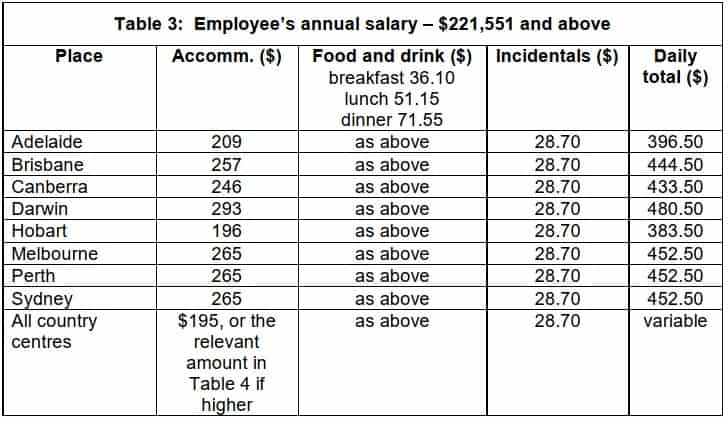

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’, i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points:

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

and:

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

Substantiation in practice

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO.

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip: The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares

Accommodation

Meals

Car hire

Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

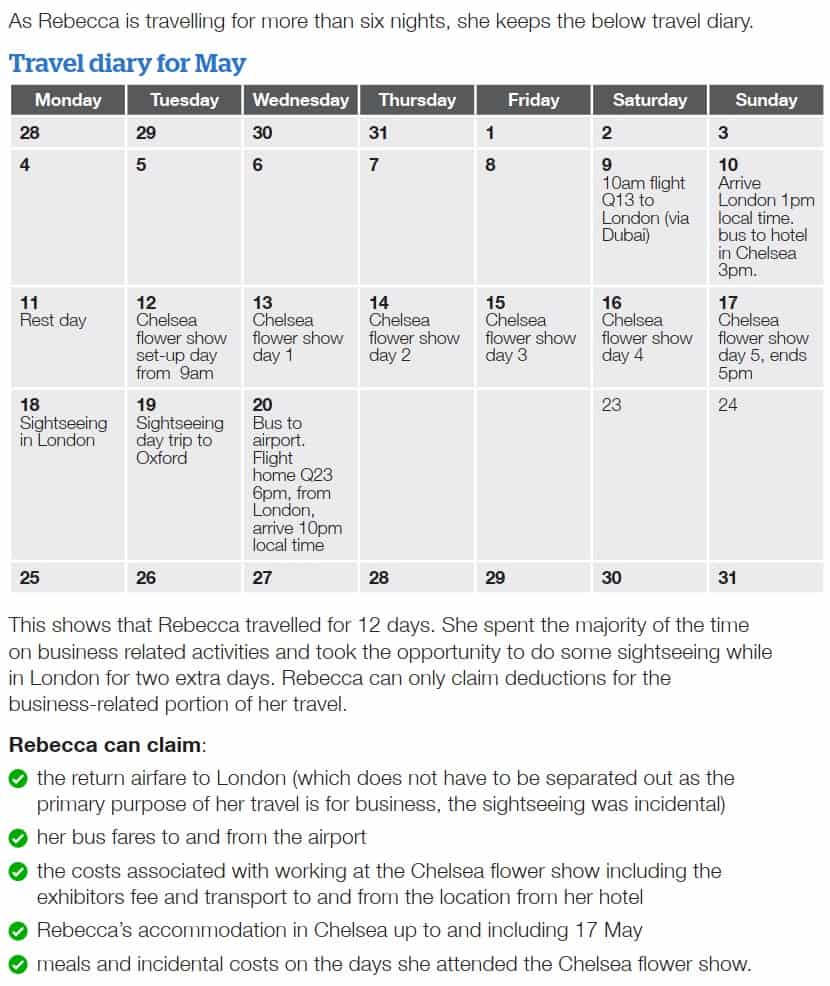

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet)

Allowances for 2018-19

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2018 for the 2018-19 income year are contained in Tax Determination TD 2018/11 (issued 29 June 2018).

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2018 for the 2018-19 income year are contained in Tax Determination TD 2018/11 (issued 29 June 2018).

Download the PDF or view online here.

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60.

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime

(b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament)

(c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2017 for the 2017-18 income year are contained in Tax Determination TD 2017/19.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2017 for the 2017-18 income year are contained in Tax Determination TD 2017/19.

Download the PDF or view online here.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2015 for the 2015-16 income year are contained in Tax Determination TD 2015/14.

An addendum was issued modifying paragraphs 23 to 30 of determination TD 2017/19 setting out the new reasonable amounts, and consolidated into TD 2017/19 as linked above. For reference purposes, the first-released version of TD 2017/19 issued 3 July 2017 is linked here.

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05.

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2016 for the 2016-17 income year are contained in Tax Determination TD 2016/13.

Download the PDF or view online here.

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40.

Allowances for 2015-16

Download the PDF or view online here. For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $28.80.

Allowances for 2014-15

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2014 for the 2014-15 income year are contained in Tax Determination TD 2014/19. For the 2014-15 income year the reasonable amount for overtime meal allowance expenses is $28.20.

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16. For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $27.70.

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17. For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017. For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2023-06-28