As a general principle, a direct journey between home and place of work (and the direct return trip) is considered not to be in the course of doing work, and is therefore not tax deductible.

However there are a number of specific circumstances which cause a journey between home and work to be treated as a work-related cost. This summary is not advice – talk to your accountant before taking action.

Travelling expenses for employees

TR 2021/1: Income tax: when are deductions allowed for employees’ transport expenses?

This ruling sets out when an employee can deduct the cost of travel by airline, train, taxi, car, bus, boat, or other vehicle.

The ruling explains that ordinary travel between home and a regular place of work is not deductible. Expenses of an employee in travelling between work locations usually are deductible. There are, however exceptions.

This Ruling also applies for FBT purposes and the ‘otherwise deductible’ rule.

See also:

Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location – ATO compliance approach

Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

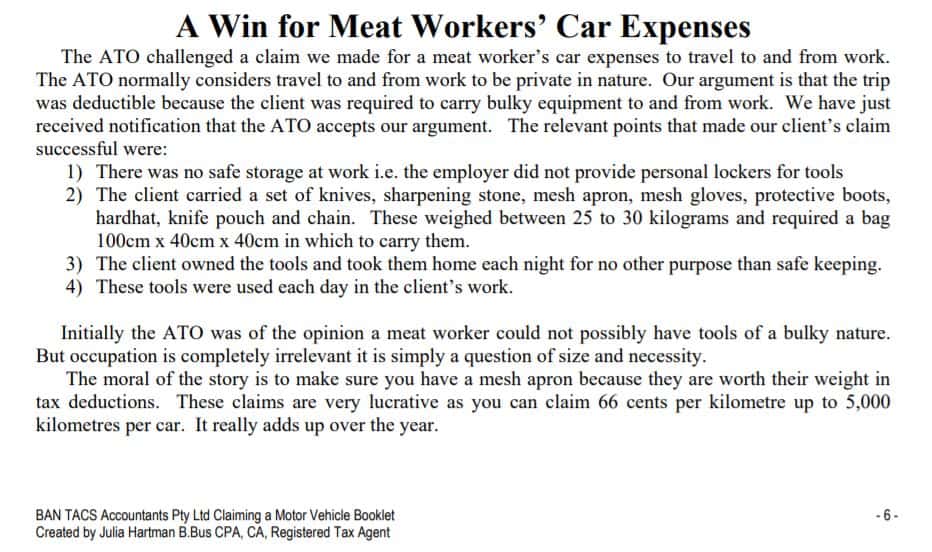

Transport of bulky equipment

Home to work travel is claimable if there is no safe storage at work and therefore of necessity (not just convenience) you transport heavy or bulky equipment (such as a ladder or musical instruments), between home and work.

How heavy does it need to be? In excess of 20kgs is an indication; But review decisions have looked at additional factors such as the type of equipment and its bulk, and whether the equipment itself realistically requires its own transport (with the taxpayer simply hitching a ride), in order to decide whether the trip between home and work takes on a predominantly tax-deductible purpose.

An example of the Tax Office interpreting and enforcing these rules in the case of Curtis Island Bechtel employees can be reviewed here. The correct treatment of meals allowances and claims for internet and telephone expenses are also discussed there.

Examples of bulky equipment used by an inter-city long haulage truck driver are here. They include such items as a portable fridge and sleeping gear, for which (crucially) there is no storage capacity at the employer’s depot.

And here’s another example – see “A Win for Meat Workers’ Car Expenses” (page 6)

Abnormal workplace

Broadly, an abnormal or alternative workplace is not where you usually work or are based.

- the trip between your normal and any alternative workplace while still on duty (e.g. client’s premises, another branch or office) is deductible, as is the return trip to either the normal workplace or directly home.

- from your home to an alternative workplace for work purposes and then back to your normal workplace or directly home is all treated as work-related travel

- trips directly between different jobs (i.e. you are off-duty during the trip in between) are claimable, but not the first or last leg to or from home unless some other factors (e.g. “on the way” below) are involved.

Home as the base

- if home is your base of work or employment, work-related travel starts from home

- workers whose work is “itinerant” – meaning “shifting places of work” – can claim the cost of travel between their home and places of work and back. See tax ruling TR 95/34

‘On the way’

Work related tasks on the way to or from work will only be the basis of a claim for the whole trip if the task was significant – involving for example, a break in the journey. Minor or incidental tasks (like dropping off the mail) are not enough, although any “extra” distance travelled to do so may be claimable. See MT 2027 Fringe benefits tax: private use of cars : home to work travel

For more information generally and examples see ATO: Trips you can and can’t claim

Employees’ accommodation and food and drink expenses travel allowances, and living-away-from-home allowances

Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

See also

This page was last modified 2023-06-27