Depreciation of Work Related Motor Vehicles

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.

Depreciation of most cars based on ATO estimates of useful life is 25% per annum on a diminishing value basis (or 12.5% of the vehicle cost for 8 years). Work vehicles e.g. taxis and couriers have higher rates,

Depreciation rates can also be self-assessed.

Temporary asset rules allowing a full expensing of asset cost (subject to car limit) expire on 30 June 2023, and are to be replaced with a less generous allowance limited to smaller businesses, with a deduction limit of $20,000. Details were announced in the 2023 Budget and are further explained here.

[27 January 2022]

Proposed new determinations e-bikes and e-scooters

The Commissioner has proposed adding effective life determinations for assets purchased (or otherwise first used or installed ready to use) from 1 July 2022 for the following:

| Asset | Effective life (years) |

| Electric bicycles (e-bikes) | 5 |

| Electric scooters (e-scooters) | 2 |

The determinations will appear under the heading E in Table B of the Commissioner’s Effective LIfe Schedules

The car limit specifically applies to passenger vehicles which are designed to carry a load less than one tonne and fewer than nine passengers.

The car limits are adjusted each year in value, and are set out below. Motorcycles and other types of vehicle are not subject to the limit. People with a disability are also excluded from the limit.

If not eligible for an instant asset deduction, car depreciation rates and claims for work-related motor vehicles, are quite straightforward once the effective life is known.

As a work-related expense, depreciation is one of the operating expenses claimable as a deduction under the Log Book substantiation method.

Unlike an operating expense such as fuel or maintenance, the claimable capital cost of a car is spread over several years, based on an estimate of its useful life. Depreciation, or the ‘decline in value’, is the calculation of the costs to be allocated to each of the years of the vehicle’s use.

On this page:

- Vehicle Depreciation Rate – Commissioner’s Estimate

- Commercial Vehicles – statutory limits

- Car Depreciation Cost Limit

- Example effective life calculation

- Depreciation calculation methods

- What is a vehicle’s cost?

- A Comparison of Prime Cost and Diminishing Value Depreciation Schedules

- Commissioner of Taxation’s Effective Life Schedules

- Accelerated depreciation – instant asset write-of

Vehicle Depreciation Considerations

Issues to consider when formulating a depreciation claim include:

- cost base – the definition of ‘cost‘ – what’s included, and the valuation

- how to determine the useful life; and if choosing the Tax Office estimate, the applicable base year

- the method of depreciation: diminishing value or prime cost

- the effect (if any) of the luxury car limit

What is a vehicle’s cost?

‘Cost’ generally has its normal meaning, being the amount paid for the vehicle. But if the amount paid wasn’t market value, then a market value may be substituted.

Certain initial expenses are included in the ‘cost’ base for depreciation purposes including stamp duty, delivery charges, and initial repairs or improvements.

Input tax credits to the extent claimable (i.e. GST) are excluded from the cost. If the vehicle is 100% business and the taxpayer is GST registered, one-eleventh of the cost is excluded.

The cost for depreciation purposes of a car includes a radio, air conditioner and other equipment attached to the vehicle. A detachable item such as a radar detector is considered as a separate asset and not part of the vehicle’s cost base. See Taxation Ruling IT 2611.

Vehicle Depreciation Rate – Commissioner’s Estimate

The depreciation rate of a vehicle depends on the length of its useful, or “effective” life. Effective life is estimated based on the type of vehicle and the conditions under which it is used.

Taxpayers can choose to use the Commissioner’s estimate or to self-assess the effective life.

For the following common types of motor vehicle the current Commissioner’s Estimates of Effective Life for vehicles acquired after 10 May 2006* are:

Vehicle designed to carry a load of less than 1 tonne and fewer than 9 passengers

| Effective Life (Years) | Diminishing Value Depreciation Rate* | Prime Cost | |

| Generally | 8 | 25% | 12.5% |

| Hire and Travellers cars | 5 | 40% | 20% |

| Taxis | 4 | 50% | 25% |

* Assets acquired since 10 May 2006 may use a diminishing value rate equivalent to double the prime cost rate.

Car Depreciation Cost Limit

The depreciable cost of motor vehicle is subject to the Luxury Car Limits, which assumes an upper limit on the cost on which depreciation is calculated. If the vehicle costs more than the limit, depreciation is only calculated on the limit.

The depreciation cost limits are indexed once a year based on the year-on-year movement (if any) in the motor vehicle purchase sub-group of the consumer price index based on the sum of the quarters in the year to the preceding March quarter.

For the 2024-25 year the cost limit is $69,674

Index calculation: March 2024 CPI sub-group total of four quarters 445.7 divided by March 2023 total 435.5 = indexation factor of 1.023

For the 2023-24 year the cost limit is $68,108

Index calculation: March 2023 total 435.5 divided by March 2022 total 413.8 = indexation factor of 1.052

For the 2022-23 year the cost limit is $64,741

Index calculation: March 2022 index 413.8 divided by March 2021 index 388.1 = indexation factor of 1.066

For the 2021-22 year the cost limit is $60,733

Indexation calculation: March 2021 index 388.1 divided by March 2020 index 377.9 = indexation factor of 1.027.

For the 2020-21 year the cost limit is $59,136

Indexation calculation: March 2020 index 377.9 divided by March 2019 index 368.1 = indexation factor of 1.027.

For 2019-20 the limit is $57,581

Indexation calculation: March 2019 index 368.1 divided by March 2018 373.0 = indexation factor of 0.987 (zero uplift)

Limits for earlier years:

- for 2018-19 $57,581 (TD 2018/6)

- for 2017-18 $57,581 (TD 2017/18)

- for 2016-17 $57,581 (TD 2016/8)

- for 2015-16 $57,466 (TD 2015/16)

- for 2014-15 $57,466 (TD 2014/17)

- for 2013-14 $57,466 (TD 2013/15)

- for 2011-12 $57,466 (TD2012/16)

- for 2012-13 $57,466 (TD2011/18)

See also Car Depreciation Limits

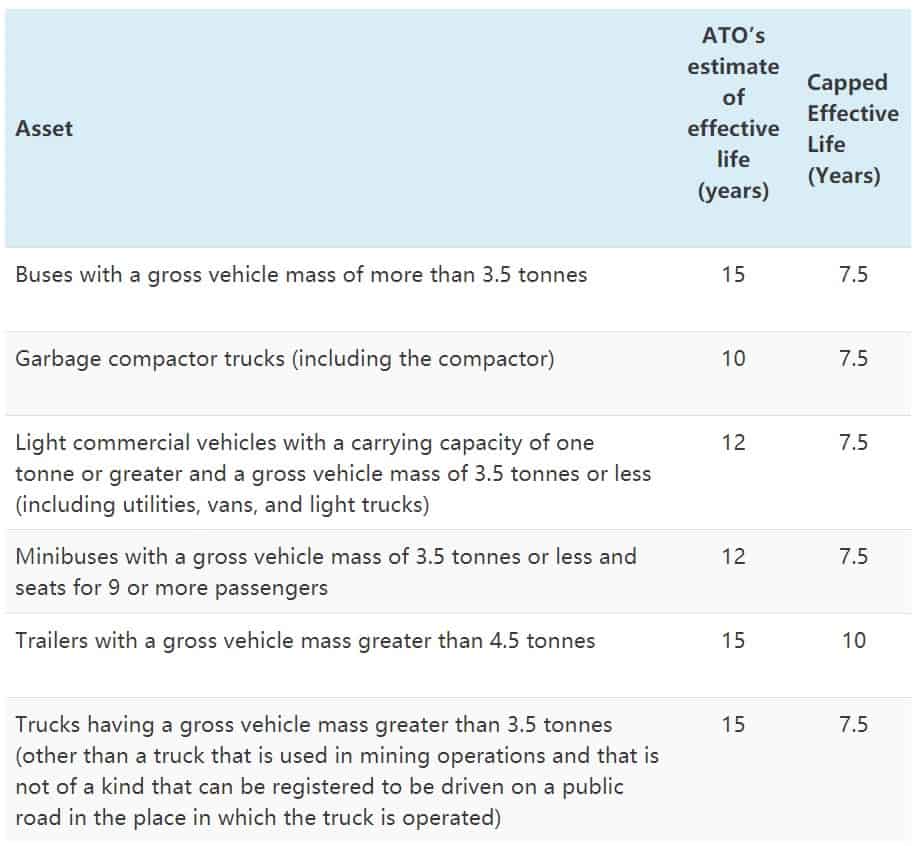

Commercial Vehicles – statutory limits

In general, you can choose either the Commissioner’s estimate of effective life or to self-assess the effective life.

However for commercial vehicle depreciation claims since 1 January 2005 using the Commissioner’s determination, the rate adopted must be based on the shorter of the capped effective life and the Commissioner’s effective life.

Depreciation calculation methods

The deduction for depreciation requires an estimate of how many years the vehicle will last. You can self-assess the useful life based on the specific circumstances of your business and the vehicle concerned, or rely on the Taxation Department estimates as contained in the Commissioner’s Effective Life Tables.

There are basically two choices of calculation method of depreciation of a motor vehicle for tax purposes: Diminishing Value and Prime Cost.

Both calculation methods contain the following elements:

- cost or base value

- number of days held

- effective life, or remaining effective life

Diminishing Value Depreciation Method

The diminishing value method tends to magnify the depreciation amount in the earlier years. The formula:

– assets from before 10 May 2006:

Base Value x (Days held ÷ 365) x (150% ÷ Effective life in years)

– assets from on or after 10 May 2006:

Base Value x (Days held ÷ 365) x (200% ÷ Effective life in years)

Prime Cost Depreciation Method

The Prime Cost method allocates the costs evenly over the years of ownership. The formula:

Cost x (Days held ÷ 365) x (100% ÷ Effective life in years)

Note also that where motor vehicles are concerned, luxury cars have an upper depreciation limit.

If you need a hand with these formulae to convert Effective Life in years to a depreciation percentage, or would like to compare methods, we’ve built a simple spreadsheet calculator which does the job. You can get it here.

Commissioner of Taxation’s Effective Life Schedules

If choosing to use the Commissioner’s estimate of useful life (rather than self-assess) you will need to ensure that the schedule chosen is applicable to the year the vehicle was acquired.

Links to the current and past year Commissioners Effective Life Tables are here.

The Commissioner’s tables are updated annually. If your asset was acquired in an earlier (or later) period, the Ruling applying for that specific year should be consulted.

How To Use The Effective Life Tables

The Effective Life tables are divided into Table A and Table B.

Under the Tax Office guidelines, use of the Commissioner’s estimate of Effective Life requires that you first try to identify your specific industry under Table A, and then the particular asset.

If your industry category or asset is not listed under Table A, then proceed to Table B, which is a general list of assets. If the asset type is not listed, then you can’t use the Commissioner’s estimate – you must self-assess the effective life.

The Effective Life tables are released in searchable PDF format – which means that despite being quite a long document of some 200 pages, they are searchable for specific text. For example, if you search for the term “Motor vehicles” in the Effective Life tables, the search results will bring you to the listings in Table B as shown in the image:

![Motor-vehicles-TableB-Effective-Life[1]](https://atotaxrates.info/wp-content/uploads/2012/09/Motor-vehicles-TableB-Effective-Life1.png)

When choosing to use the Commissioner’s estimates, these Table B effective life estimates are used when the Table A industry listings don’t provide coverage.

For your motor vehicle depreciation calculation, the effective life in years number will need to be converted to a percentage rate, according to which depreciation method (Diminishing Value or Prime Cost) is preferred.

Example Calculation – Converting Effective Life To A Depreciation Percentage Rate

The current Commissioner’s Estimate of Effective Life (shown in the image above) for an ordinary passenger car (not being a hire car or taxi) purchased since 10 May 2006 is 8 years.

If a vehicle’s life is 8 years, then on a “straight line” basis the depreciation each year will be ⅛, which is equivalent to 12.5%. This is called the Prime Cost method of depreciation , where the allocation is equally spread over the years of ownership.

An alternative choice (the choice is made in the first tax return year of claim) is called the diminishing value method. “Diminishing” because the depreciation percentage each year is applied to the vehicle cost which is reduced by the accumulated depreciation of the previous periods (if any).

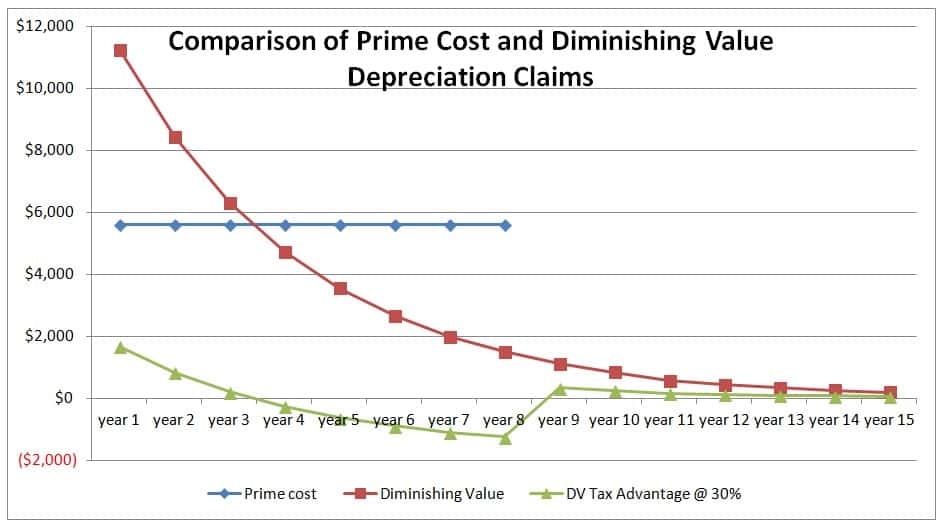

A Comparison of Prime Cost and Diminishing Value Depreciation Schedules

As can be seen from the numbers and chart below, the diminishing value method is often favoured because the percentage rate is higher, giving higher tax deductions in the first few years of ownership. The diminishing value depreciation rate is 2 times the prime cost rate.

A table showing the claims under both methods illustrates this comparison:

Assume: Vehicle cost $45,000 purchased after 10 May 2006, effective life of 8 years. This means the depreciation rates will be 12.5% prime cost or (2 x 12.5% =) 25% diminishing value.

Assume also that the vehicle was acquired at the beginning of the first tax year. If you’re unclear on the arithmetic in converting effective life to a percentage rate, this spreadsheet calculator may help.

| Prime Cost & Diminishing Value Compared | Prime Cost Method (12.5% per year) | Diminishing Value Method (25% per year) |

| Start of year 1 Cost | $45,000 | $45,000 |

| Less: Year 1 depreciation | -$5,625 | -$11,250 |

| Written down cost at end of year 1 | $39,375 | $33,750 |

| Less: Year 2 depreciation | -$5,625 | -$8,438 |

| Written down cost at end of year 2 | $33,750 | $25,312 |

| Less: Year 3 depreciation | -$5,625 | -$6,328 |

| Written down cost at end of year 3 | $28,125 | $18,984 |

| Less: Year 4 depreciation | -$5,625 | -$4,746 |

| Written down cost at end of year 4 | $22,500 | $14,328 |

| Less: Year 5 depreciation | -$5,625 | -$3,559 |

| Written down cost at end of year 5 | $16,875 | $10,679 |

| Less: Year 6 depreciation | -$5,625 | -$2,670 |

| Written down cost at end of year 6 | $11,250 | $8,009 |

| Less: Year 7 depreciation | -$5,625 | -$2,002 |

| Written down cost at end of year 7 | $5625 | $6,007 |

| Less: Year 8 depreciation | -$5,625 | -$1,502 |

| Written down cost at end of year 8 | $0 | $4,505 |

| Total depreciation claims (8 years) | $45,000 | $40,495 |

Diminishing value claims are higher in the earlier years, but take a longer period to amortise the full cost.

After just 8 years, the prime cost method has a $4,500 deduction advantage overall. But when the timing of deductions is considered, a higher deduction rate gives diminishing value a tax advantage in the first 3 years, and again after year 8 at which time the prime cost claims are exhausted.

Small Businesses

Eligible Small Businesses may choose to access Simplified rules which pools assets with an effective life of less than 25 years to be deductible at the rate of 30% per annum on a diminishing value basis (first-year 15%).

Accelerated depreciation – instant asset write-off

For some years since 2013, small businesses have been able to claim depreciation through a Simplified method which allows a faster write-off than would be the case under the general depreciation rules.

Small businesses: see the more generous instant asset deductions currently available under the provisions for accelerated business depreciation claims and ATO Depreciation.

In addition, since 2013 there have been several versions of “instant asset” deductions which enable outright deductions in the year of purchase for assets which cost below a certain amount.

The qualifying conditions and deduction allowances have frequently changed, and are being updated here: Instant Asset Write-off expanded and extended

Further information

- Capital allowances: effective life reviews

- Commercial vehicles – statutory limits on buses, light commercial vehicles etc.

This page was last modified 2022-01-31