From 1 July 2021, for 2021-22, 2022-23 and later periods, the small business company tax rate is 25%.

Otherwise, the general company income tax rate is 30%.

From 2016-17 to 2019-20 the small business company tax rate was 27.5%, having been progressively lowered from 30% in 2014-15 and earlier years.

Tax rates for small business companies with aggregated turnover below $50 million have been progressively lowered (from the 30% rate as it was in 2014-15 and prior), to reach 25% by the 2021-22 year. See schedule below.

Dividend franking arithmetic? Scroll down for the dividend franking calculators.

Small Business Company Tax Rates By Year

| Tax Year | Aggregated Turnover Threshold | Tax rate |

| 2014-15 and earlier * | n/a | 30% |

| 2015-16 | $2 million | 28.5% |

| 2016-17 | $10 million | 27.5% |

| 2017-18 | $25 million | 27.5% |

| 2018-19 | $50 million | 27.5% |

| 2019-20 | $50 million | 27.5% |

| 2020-21 | $50 million | 26% |

| 2021-22 | $50 million | 25% |

| 2022-23 | $50 million | 25% |

| 2023-24 | $50 million | 25% |

| 2024-25 | $50 million | 25% |

| 2025-26 | $50 million | 25% |

| 2026-27 | $50 million | 25% |

Arising from the 2016-17 budget (see more below), the small business company tax rate was reduced from 30% to 27.5% from 1 July 2016 (for the 2016-17 year) along with an increase in the qualifying turnover ceiling to $10 million.

The qualifying turnover ceiling moved to $25 million from 1 July 2017, and to $50 million from 1 July 2018.

From 1 July 2017 a passive income test was introduced as described below.

Investment companies – subject to 80% passive income test from 2017-18

To be eligible for the tax rate reduction from 30% to 27.5% (later reduced to 26% and 25%), a company must be carrying on business in its own right.

The company tax return form requires confirmation of base rate entity status in order for the lower tax rate to be applied.

Ruling TR 2019/1 provides ATO commentary and clarification of when a company is considered to be “carrying on a business”.

Commencing from 1 July 2017, companies eligible for the lower tax rate must be “Base Rate” companies.

In order to further define the scope of eligibility for reduced tax rates, the Government confirmed that passive investment companies were never intended to be eligible, and passed legislation (see below) which sets out an “80% test” to support this policy intention, with definitions of “Base Rate Entity” and “Base rate entity passive income“.

The Treasury Laws Amendment (Enterprise Tax Plan Base Rate Entities) Bill 2018 (now law) provides a “bright line” test for corporate tax entities to qualify for the lower corporate tax rate.

The carrying on a business test is replaced with a passive income test, under which companies that are generating predominantly passive income (i.e. 80% or more) will not be eligible for the lower corporate tax rate.

What is passive income?

Base rate entity passive income (“passive income”) is defined generally to include dividends, interest, royalties and capital gains.

Non portfolio dividends paid to a holding company (a minimum 10% equity requirement) are not treated as passive income.

Company income derived through a trust or partnership only has passive income to the extent that the income is referable to passive income of the underlying trust or partnership. See more here (with examples) and LCR 2019/5

Amendments to the Bill further clarify that the interest income of various kinds of registered financial services entities is excluded from the passive income definition.

The amendments are to apply from 1 July 2017 for the 2017-18 year onwards. As a practical measure, the ATO had advised that for the 2016-17 year companies will not be selected for audit “based on their determination of whether they were carrying on a business in the 2016-17 income year, unless their decision is plainly unreasonable”.

Law from 1 July 2017

A corporate tax entity will qualify for the lower corporate tax rate for an income year only if:

- no more than 80% of the corporate tax entity’s assessable income for that income year is base rate entity passive income; and

- the aggregated turnover of the corporate tax entity for the income year is less than the aggregated turnover threshold for that income year.

Law Until 30 June 2017

A corporate tax entity will qualify for the lower corporate tax rate for an income year only if:

- the corporate tax entity carries on a business in the income year; and

- the aggregated turnover of the corporate tax entity for the income year is less than the aggregated turnover threshold for that income year.

Source: Explanatory Memorandum

See also:

- Understanding which corporate tax rate to use – Deloitte

- Law Companion Ruling LCR 2019/5 Base rate entities and passive income – ATO

- Company tax rate changes and ‘bright lines’ – Institute of Chartered Accountants

- What is the Company Tax Rate? And what is the Imputation Rate?– Tax Rambling blog

2015-16 tax rate – small business entities – 28.5%

Announced as part of the Federal Budget 2015 and now law, from 1 July 2015 the tax rate for Small Business companies was reduced to 28.5%.

Before 1 July 2016, Small Businesses Entities were those with aggregated turnover (i.e. grouped with related entities) of less than $2 million.

Company tax cuts from 2016-17

![]() The 2016 Budget contained proposals for reducing company tax rates.

The 2016 Budget contained proposals for reducing company tax rates.

Initial amendments brought to parliament were to have extended rate reductions progressively to all companies. Through negotiation in order to secure passage of the legislation, the government agreed to limit the tax rate reductions to “base rate” companies, progressively extending from small business entities to entities with aggregated turnover of less than $50 million.

The consequence of this limitation was that the corporate tax rate for entities with an aggregated turnover of $50 million or more remained at 30%.

The Treasury Laws Amendment (Enterprise Tax Plan) Bill 2016 was passed by the parliament, and operates from 1 July 2016.

In addition to the modified 2016-17 budget reductions, government policy was to further reduce the corporate tax rate for all companies to reach 25%, initally by 2026-27. However following defeat of the Treasury Laws Amendment (Enterprise Tax Plan No. 2) Bill 2017 in parliament the Bill was abandoned.

The “final” iteration: In October 2018 the Government announced that the then scheduled introduction of the 25% rate would be brought forward to land in the 2021-22 year. This latest tax reduction schedule is now law and reflected in the final column of tax rates shown above.

For details of the amending law see Treasury Laws Amendment (Lower Taxes for Small and Medium Businesses) Bill 2018. See also: New Bill to accelerate tax cuts for small and medium sized businesses

* Historical company tax rates, and for other entity types, can be reviewed here.

What is aggregated turnover?

Aggregated turnover of an entity is a term which is defined to include the annual turnover of an entity for an income year, and to which is added the turnovers of any entity which is “connected” or “affiliated” at any time during the year, for the period they were connected or affiliated.

“Turnover” refers generally to ordinary income.

Definitions:

| Aggregated turnover | Section 328.115 |

| Annual Turnover | Section 328.120 |

| Connected Entity | Section 328.125 |

| Affiliated Entity | Section 328.130 |

See further information:

- Aggregation

- Tax Determination TD 2021/7 – Aggregated turnover for entities with differing year end only includes the annual turnover of connected entities for the period that matches your income year.

- Tax Determination TD 2022/5 – the application of the ‘connected with’ concept to corporate limited partnerships

- Taxation Determination TD 2023/5 – guidance on the discretion in subsection 328-125(6) to determine that an entity does not “control” the test entity.

Section 328-125(6): If the control percentage referred to in subsection (2) or (4) is at least 40%, but less than 50%, the Commissioner may determine that the first entity does not control the other entity if the Commissioner thinks that the other entity is controlled by an entity other than, or by entities that do not include, the first entity or any of its * affiliates.

Similar Business Test

The Treasury Laws Amendment (2017 Enterprise Incentives No. 1) Bill 2017 gives effect to a modification of the same business test, (which qualifies the applied to the deductibility of prior-year company losses), by replacing it with a ‘similar business’ test.

The new rules apply to losses incurred from 1 July 2015.

In determining whether a current business is sufficiently similar to a previous business, regard will be had (not exhaustively) to:

- the extent of continued use of the same assets (including goodwill)

- the extent of continuity of activities and operations

- business identity

- the extent of business changes more generally

For a fuller explanation of the effects and application of these measures – see

- Explanatory memorandum

- Increasing access to company losses: similar business test and

- Law Companion Guideline LCR 2019/1 The business continuity test – carrying on a similar business

Guidance – Multinational Anti-Avoidance, Transfer Pricing and Tax Residency

The Tax Office has issued the following guidance:

PCG 2017/2

Simplified transfer pricing record-keeping options

International transfer pricing –concepts and risk assessment – ATO website

PCG 2018/9

Central management and control test of residency: identifying where a company’s central management and control is located.

TR 2018/5 Income tax: central management and control test of residency. The Commissioner’s view on how to apply the central management and control test of company residency following the Bywater Investments cases.

Working out your residency – ATO website. Foreign resident entities are generally taxed in Australia on any income that has an Australian source. Australian resident entities are generally taxed on their worldwide income.

Online services for foreign investors – ATO Online services can be used for foreign investors to manage obligations relating to Australian investments.

TD 2018/12 Income tax: schemes that limit a taxable presence in Australia under section 177DA of the Income Tax Assessment Act 1936 – meaning of ‘directly in connection with’.

PCG 2017/1 ATO compliance approach to transfer pricing issues related to centralised operating models involving procurement, marketing, sales and distribution functions.

PCG 2017/2 Simplified transfer pricing record-keeping options

PCG 2018/D3 Income tax: central management and control test of residency: identifying where a company’s central management and control is located. Assistance for foreign incorporated companies and their advisors to apply the principles set out in TR 2018/5 Income tax: central management and control test of residency.

Taxation Ruling TR 2020/4 Income tax: thin capitalisation – application of the arm’s length debt test contained in the thin capitalisation rules which limit the amount of debt that can be used to finance an entity’s Australian operations.

Practical Compliance Guideline PCG 2020/7 ATO compliance approach to the arm’s length debt test. Guidance guidance for entities in applying the arm’s length debt test, and should be read in conjunction with Taxation Ruling TR 2020/4.

Practical Compliance Guideline PCG 2017/4 The ATO’s compliance approach to the taxation outcomes associated with cross-border related party financing arrangements.

Draft Taxation Determination TD 2019/D9 Exclusion of debts forgiven for reasons of natural love and affection require that the creditor is a natural person

Draft Determination TD 2021/D1 when working out your aggregated turnover, the relevant annual turnovers of entities connected with you, or entities that are affiliates of yours, determined by reference to your income year, even if those entities have a different accounting period to you.

Treatment of franking credits – Imputation

The laws previously provided for the retention of a universal maximum franking rate of 30%.

After the tax rate reduction from 2016-17, the maximum franking rate is tied to the base rate entity rate or 30%.

The franking credit calculators below handle the arithmetic for differing dividend franking scenarios.

Find out what would be the franking credit value for a given dividend amount (at a given tax rate and franking percentage).

Alternatively for a reverse calculation, the second calculator below calculates the dividend value required to absorb a given tax credit (at a given tax rate and franking percentage).

Franking Credit Calculators

SOLVE FOR FRANKING CREDIT AMOUNT

SOLVE FOR DIVIDEND AMOUNT

Enter values to see the result.

See ATO articles Allocating franking credits and Maximum franking credits

Guidance documents – company tax rates issues

Due to the changes surrounding the taxation of companies the Tax Office has released guidance documents.

- LCR 2019/5 Base rate entities and base rate entity passive income. See also this explanatory article.

- PCG 2018/8 Enterprise Tax Plan: small business company tax rate change: compliance and administrative approaches for the 2015-16, 2016-17 and 2017-18 income years

- Taxation Ruling TR 2019/1 Income tax: when does a company carry on a business?

- Law Companion Ruling LCR 2019/1 The business continuity test – carrying on a similar business

Unincorporated businesses

Also announced in the 2015 budget was a tax discount of 5% up to a maximum of $1,000 applied as a tax offset for individuals with income from an unincorporated Small Business. This has been subsequently revised with more generous offset percentage of 16% applying from 1 July 2016 – see Small Business Tax Offset

See also: Small Business Concessions

Other entities tax rates:

- Life Insurance companies – ordinary: 30%

- Complying superannuation funds: 15%

- Non-profit bodies are exempt from tax on their mutual income. Non-exempt bodies are taxable on their non-mutual net income at the following rates for 2016-17 and 2017-18:

| Non-mutual Income Tax | |

| First $416 of taxable income | Nil |

| $417 to $831 | 55% |

| $832 and above | 27.5% |

- The tax rate for a Public unit trust is also 30%.

- For Fringe Benefits Tax rates – see FBT

Exploration Development Incentive scheme

The Exploration Development Incentive (EDI) enables exploration companies to apply exploration tax losses towards tax credits for shareholders. Australian resident shareholders that are issued with an exploration credit are entitled to a refundable tax offset or additional franking credits. The scheme ended with the 2016-17 year, and was replaced with the Junior Minerals Exploration Incentive.

For further information from the Tax Office, see:

Junior Minerals Exploration Incentive (JMEI) Exploration Incentive Scheme 1 July 2017

On 5 May 2021 the government announced that the scheme would be funded for a further $100 million and extended another 4 years.

Applications open 16 July 2021 and close 15 August 2021 for the 2021-22 income year.

The purpose of the Junior Minerals Exploration Incentive (JMEI) is to provide a tax incentive for investment in small minerals exploration companies undertaking greenfields minerals exploration in Australia.

Australian resident investors of these companies receive a tax incentive where the companies choose to give up a portion of their tax losses relating to their exploration expenditure in an income year.

Key points:

- eligibility for the incentive is limited to investors that purchase newly issued shares

- the incentive is allocated between eligible exploration companies on a first come, first served process

- the total value of the tax incentives available is

- $15 million for 2017-18

- $25 million for 2018-19

- $30 million for 2019-20

- $35 million for 2020-21

- credits available per entity are limited to 5% of the total amount available for each year.

See further: JMEI participation details

The government introduced the exploration tax incentive scheme to apply from 1 July 2017. See legislation details: Treasury Laws Amendment (Junior Minerals Exploration Incentive) Bill 2017

Due to the late passage of the enabling legislation, amendments were included to extend application period for 2017-18 year to 15 May 2018.

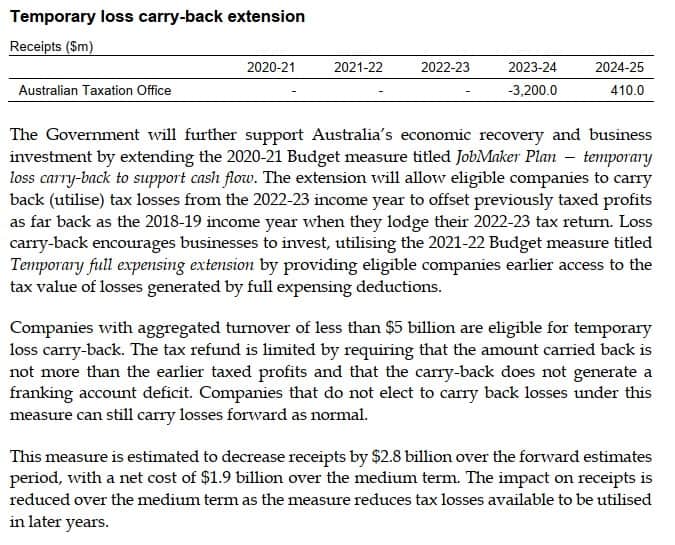

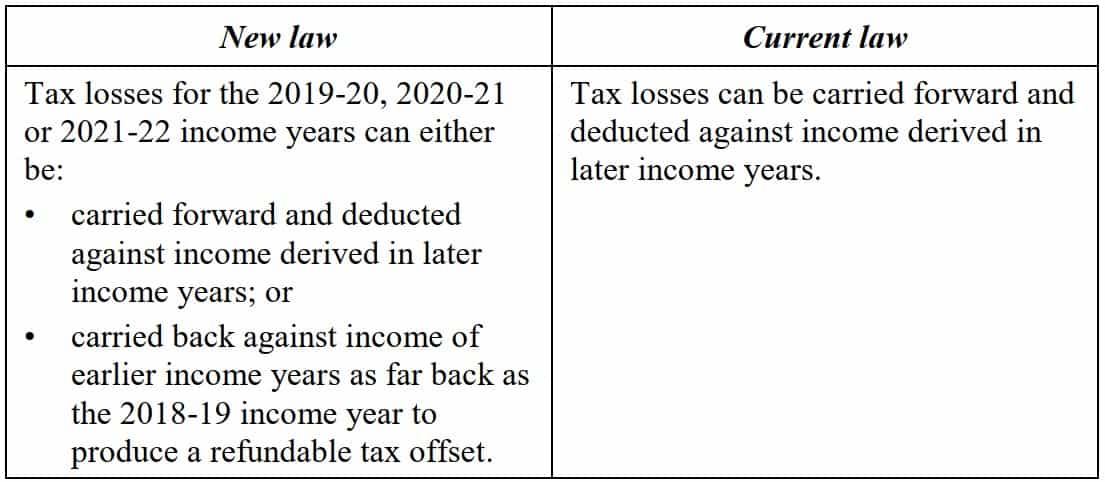

Company Tax Loss Carry-Back temporary Refundable Tax Offset

[Update 11 May 2021] The Government has announced as part of the Budget 2021 measures that the availability of loss carry backs will be extended for a further year to include the 2022-23 financial year. (Budget Paper No. 2 page 30)

Budget 2020 put loss carry backs back on the agenda.

Companies with less than $5 billion turnover are to be able to carry back losses made in the 2019–20, 2020–21 and 2021–22 financial years to an earlier financial year’s tax liability in the 2018–19, 2019–20 and 2020–21 financial years.

The carry back benefit is obtainable by way of a tax refund which is therefore limited by the amount of tax liabilities in the gain years and its franking account balance as at the end of the claiming year.

See

- Loss Carry Back Offset Calculator and Tax Return Tool – ATO

- How To Claim The Refundable Loss Carry Back Tax Offset – ATO

- How To Change Loss Carry Back Choice – ATO

- Avoid common errors when claiming the loss carry back – ATO

- Temporary loss carry-back rules – What you need to know – PWC

- Treasury Laws Amendment (A Tax Plan for the COVID-19 Economic Recovery) Act 2020 (now law)

An Earlier Loss carry back scheme

Legislative amendments to remove the carry-back availability from 2013-14 were included with the Mining Tax repeal measures and took effect from 30 September 2014. See MRRT Repeal Measures Bill.

The ATO provided for a “no-penalty” administrative treatment for companies which may have already claimed for 2013-14 in accordance with the then-existing law. Tax assessments were to have been automatically adjusted by the Tax Office to reflect the repeal.

Large Companies tax instalments

From 1 January 2014 corporate tax entities are required to make PAYG income tax instalments monthly rather than quarterly if they are over the specified turnover thresholds. These changes were foreshadowed in the Treasurer’s 2012 MYEFO.

- Companies with turnover of $1 billion or more

will remit their PAYG company tax instalments monthly from 1 January 2014. - Companies with turnover of $100 million

will commence monthly payments on 1 January 2015. - Companies with turnover of $20 million or more

will commence monthly payments on 1 January 2016.

These proposals will also impact all other entities including super funds, trusts and individuals:

- Entities with turnover of $1 billion or more

will commence monthly payments on 1 January 2016. - Entities with turnover of $20 million or more

will commence monthly payments on 1 January 2017.

For further information: See Monthly PAYG instalments

————————————————————————

See also

- Benchmark Interest Rates for Div 7A loans.

- Proposed changes to Div 7A rules

- BAS Statements info

- R&D Tax Concessions

This page was last modified 2021-11-26

Enter values to see the result.