The Division 7A calculator and decision tool published by the Tax Office has been updated to the 2022-23 year.

The tool will help determine:

- whether a loan from a private company to a shareholder or shareholder’s associate will be deemed a dividend; or

- whether a payment from a private company to a shareholder or shareholder’s associate will be deemed a dividend; or

- whether a debt owed by a shareholder or shareholder’s associate to a private company has been forgiven and will be deemed a dividend

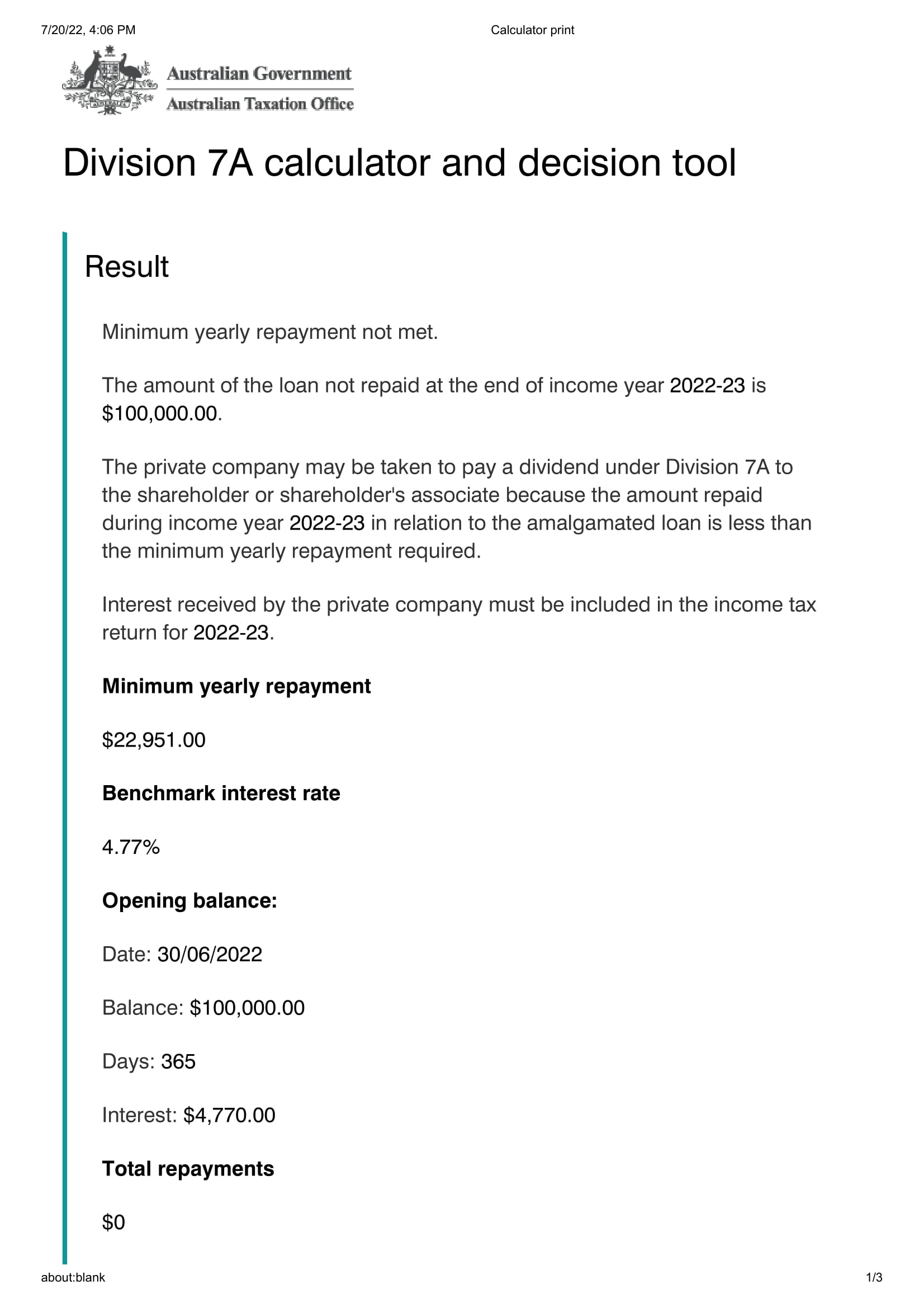

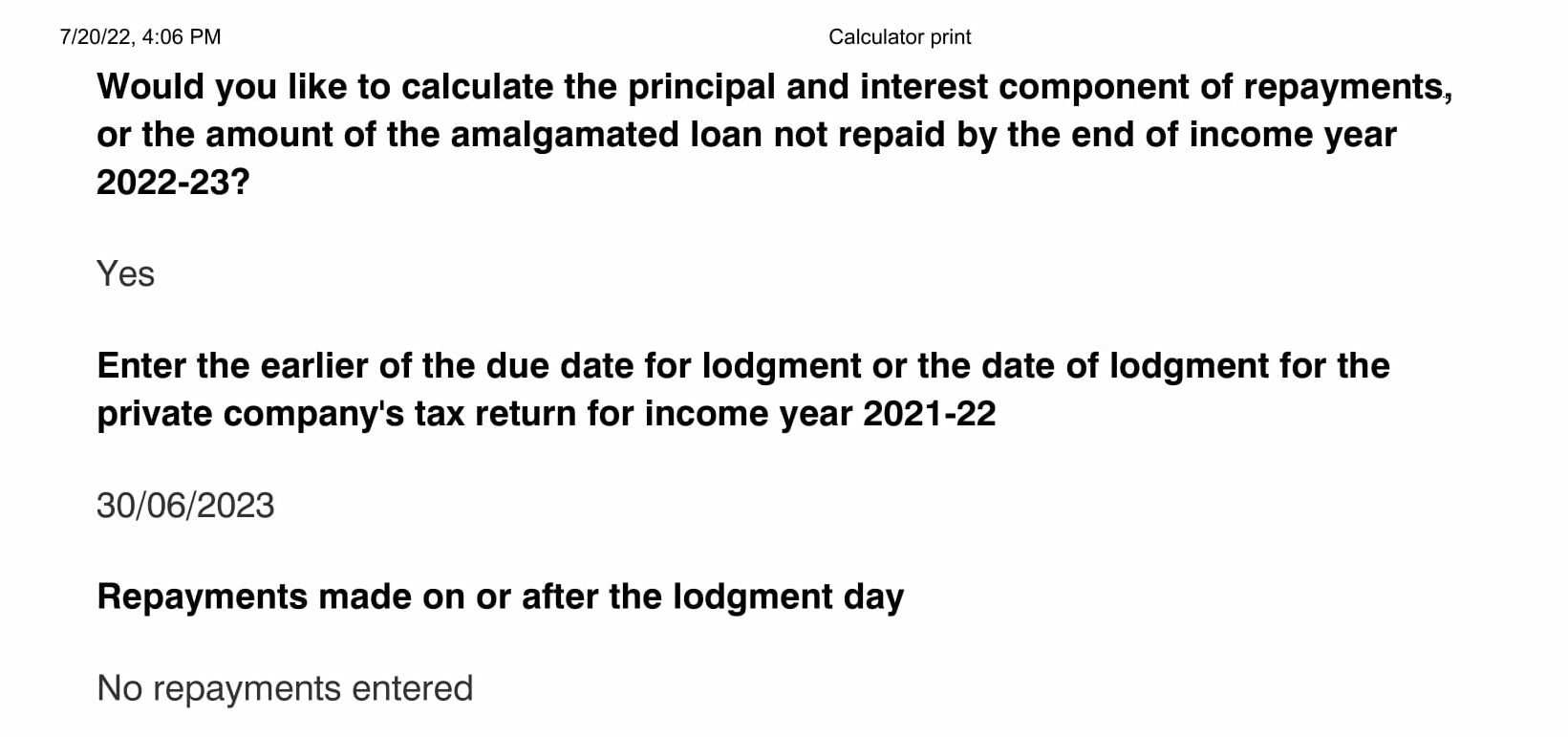

Based on your input, the calculator will then provide calculations for a minimum yearly repayment and the amount of the loan not repaid by the end of an income year

For existing and arising loans in 2021-22 captured by complying loan agreement the calculator tool applies the interest rate for 2022-23 which is 4.77%.

From 1 July 2023, the benchmark interest rate is 8.27%,

The benchmark interest rate for Div 7A complying loans has been relatively stable for the past three years.

The benchmark interest rate in each of the 2020-21 and 2021-22 was 4.52%.

For full details of historical benchmark interest rates and related information see ATO Div 7A Benchmark Interest Rate.

The ATO’s updated Div 7A calculator and decision tool is here.

The tool comprises two components:

- questionnaire-based decision tool to determine whether a private company payment, loan or debt foregiveness should be treated as a deemed unfranked dividend

- complying loan agreement calculator which determines

- the minimum yearly loan repayment

- interest payable for the income year

- closing loan balance

Example Output: Div 7A calculator and decision tool

Div 7A References

- The ATO’s Div 7A calculator and decision tool is here.

- The ATO’s Div 7A information page is here

- Information about the Benchmark interest rate is here

This page was last modified 2023-07-04