Reportable Fringe Benefits for 2022, 2023 and 2024

Reportable fringe benefits amounts form part of the expanded income tests used in determining eligibility for a number of taxation concessions and benefits of individual taxpayers.

The grossed-up reporting threshold value for 2022, 2023 and 2024 and other years since 2018 is $3,773.

Reporting Fringe Benefits -Threshold

Employers are required to itemise the grossed-up value of all reportable benefits over the threshold in each employee’s annual payment summary. The reportable threshold is determined before grossing-up, it is the grossed-up value that is reported. The threshold is not apportioned for a part year.

Reported payment summary amounts are required to be included in your Individual income tax return at Item IT1.

Benefits which are exempt from FBT are in general not reportable. However benefits which are exempt only because the employer is exempt, such as a Public Benevolent Institution, are required to be calculated and reported as the employee’s notional fringe benefits.

The reporting threshold before gross-up has been the same ($2,000) since 1 April 2007.

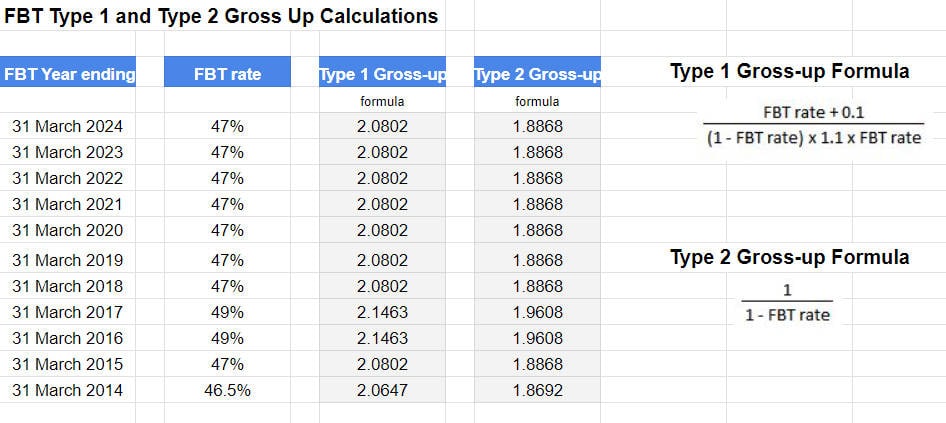

The gross-up rates changed in the FBT years 2015-2017 due to the addition of the temporary deficit reduction levy which applied in those years.

The grossed-up value of the threshold for the FBT year ending 31 March 2017 was ($2,000 ÷ (1 – 0.49)) = $3,921 (based on the then FBT rate of 49%)

The grossed-up value of the threshold for the FBT years ending 31 March 2018, 2019, 2020, 2021, 2022, 2023 and 2024 is: $2,000 ÷ (1 – 0.47) = $3,773 based on the FBT rate of 47%.

Grossing Up Calculation

The grossing-up of reportable fringe benefits is calculated at the Type 2 gross-up percentage.

The gross-up percentage (Type 2) is calculated:

Fringe Benefits Amounts

1 – FBT rate

See assistance for detailed calculation requirements here: Fringe benefits tax – a guide for employers Chapter 5 – Reportable fringe benefits

For a simple gross-up rate spreadsheet calculator see here.

FBT Gross-up Rates

Reporting Period

Reportable benefits are required to be calculated for the Fringe Benefits Tax year which runs from 1 April to 31 March. The reported amounts will be included in payment summaries issued for the overlapping tax year – i.e. from 1 July to 30 June.

Reportable fringe benefits are not taxable income, but they affect the calculations for various entitlements, levies and offsets which take adjusted income into account.

Non-reportable fringe benefits (“Excluded Fringe Benefits”)

Fringe benefits which do not have to be reported are referred to as excluded fringe benefits, and include the following:

- entertainment you receive in the form of food and drink, including associated benefits such as travel and accommodation

- car parking fringe benefits, apart from eligible car parking expense payments

- hired or leased entertainment facilities, such as corporate boxes

- remote area housing assistance, home ownership schemes, and repurchase schemes where the value of the benefit is reduced under FBT law

- costs of occasional travel to a major Australian population centre by you and your family if you live in a remote area

- freight costs for your food if you live in a remote area

- fringe benefits you receive to ensure your security and personal safety because of your job

- emergency or other essential health care you receive as an Australian citizen or permanent resident while you are working outside Australia and you cannot claim a Medicare benefit

- certain Australian Government overseas living allowance payments

- certain benefits provided to you if you are a defence force member

- certain benefits provided to you if you are a police officer

- car benefits coming from your private use of pooled or shared cars.

Regulation amendment 11 April 2013: to exclude living-away-from-home (LAFH) allowances and benefits, including certain expense payment benefits and residual benefits, from being reportable fringe benefits for Commonwealth employees where those employees are required to live away from their normal residence in order to undertake their official duties of employment. The amendments apply in relation to benefits provided on or after 1 October 2012, to align with the MYEFO 2012-13 amendments to LAFH allowances and benefits.

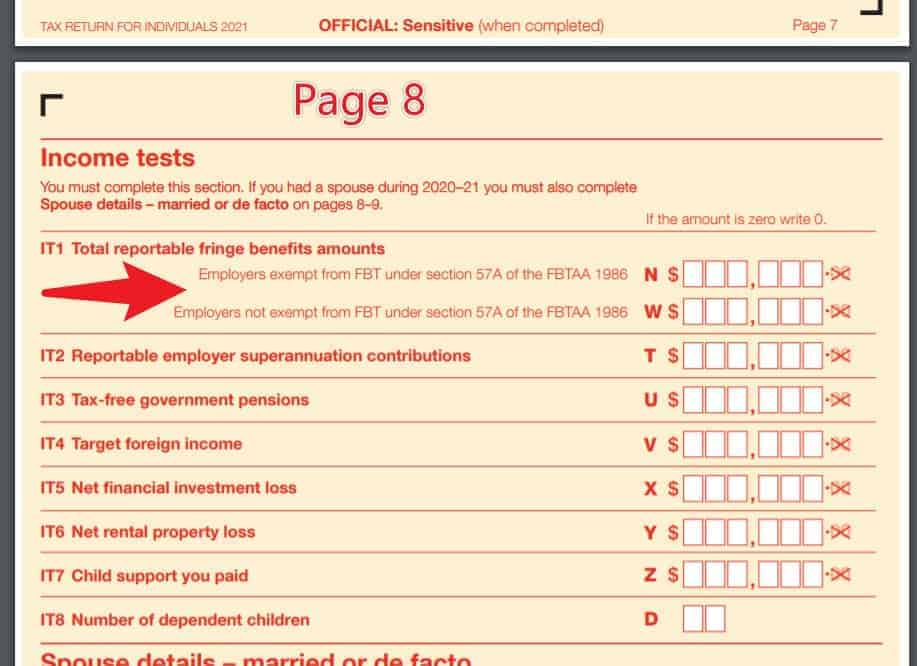

Individual tax return reporting of benefits

Reportable benefits shown on payment summaries are required to be declared in an individual’s tax return.

The quantum of benefits reported will correspond to totals for the immediately preceding year ending 31 March, being the FBT year.

Information is entered into the “Income tests” information area of the tax form which requires itemisation of fringe benefits amounts, reportable superannuation and other matters.

Instructions for the completion of this information for 2022 year here.

Further information:

- Fringe Benefits Tax Assessment Act 1986 – Sect 5E – What is an excluded fringe benefit?

- Income Tests Which Include Reportable Fringe Benefits

This page was last modified on 2022-05-30