A housing fringe benefit is a “housing right” provided to an employee.

A housing right is a lease or licence to use a unit of accommodation which exists when it is the person’s usual place of residence.

A unit of accommodation includes:

(a) a house, flat or home unit;

(aa) accommodation in a house, flat or home unit;

(b) accommodation in a hotel, hostel, motel or guesthouse;

(c) accommodation in a bunkhouse or any living quarters;

(d) accommodation in a ship, vessel or floating structure; and

(e) a caravan or other mobile home.

It is not necessary that the employee have exclusive use of the unit of accommodation.

If the accommodation is not the usual place or residence, then there is no housing benefit but there may be a property fringe benefit.

There are a number of FBT concessions associated with remote areas. A remote area housing benefit is an exempt benefit under s 58ZC.

If the housing is in a non-remote area, the taxable benefit (and valuation methods) depend on the type of housing and where it is.

Accommodation valued by a CPI method uses indexation factors which are updated annually by determination as set out below.

Indexation factors for valuing non-remote housing

2024-25 FBT Year

The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2024.

| New South Wales | 1.073 |

| Victoria | 1.050 |

| Queensland | 1.085 |

| South Australia | 1.063 |

| Western Australia | 1.084 |

| Tasmania | 1.022 |

| Northern Territory | 1.055 |

| Australian Capital Territory | 1.038 |

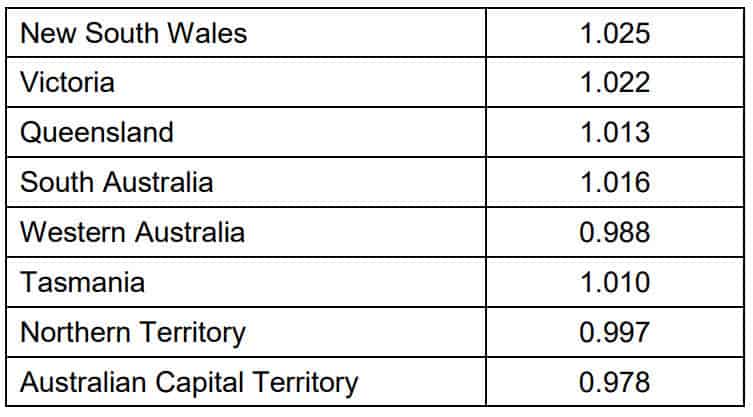

2023-24 FBT Year

The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2023.

| New South Wales | 1.009 |

| Victoria | 1.006 |

| Queensland | 1.046 |

| South Australia | 1.039 |

| Western Australia | 1.087 |

| Tasmania | 1.055 |

| Northern Territory | 1.100 |

| Australian Capital Territory | 1.053 |

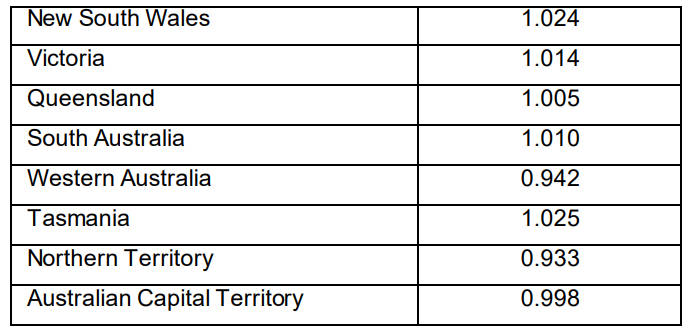

2022-23 FBT Year

The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2022.

| New South Wales | 0.980 |

| Victoria | 0.990 |

| Queensland | 1.019 |

| South Australia | 1.020 |

| Western Australia | 1.044 |

| Tasmania | 1.037 |

| Northern Territory | 1.030 |

| Australian Capital Territory | 1.024 |

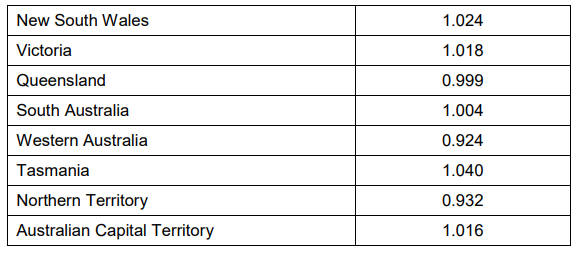

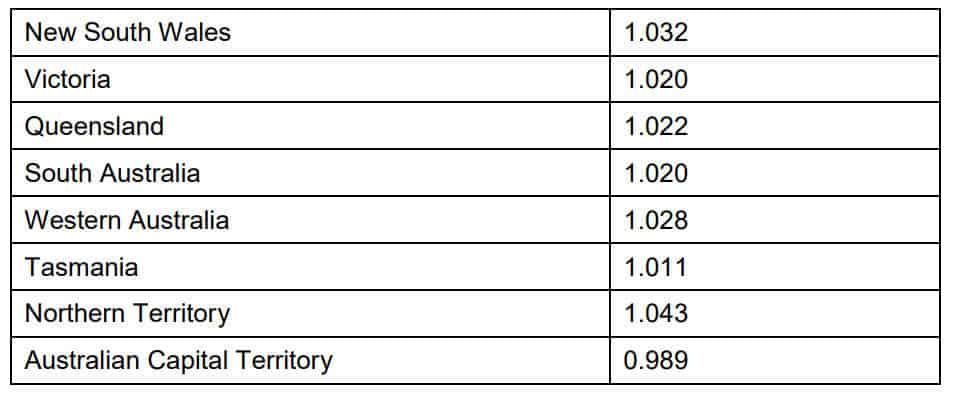

2021-22 FBT Year

The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2021.

| New South Wales | 0.975 |

| Victoria | 1.000 |

| Queensland | 0.998 |

| South Australia | 1.011 |

| Western Australia | 0.991 |

| Tasmania | 1.043 |

| Northern Territory | 0.947 |

| Australian Capital Territory | 1.018 |

Source: ato.gov.au

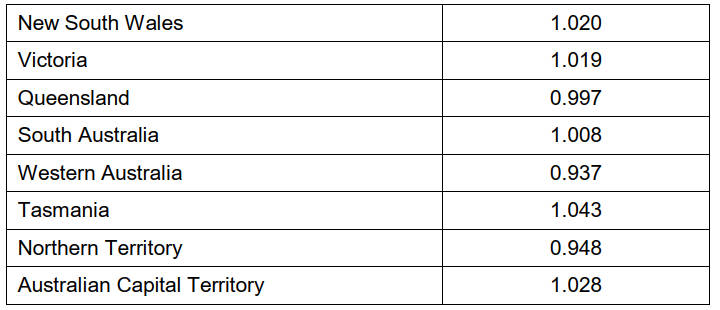

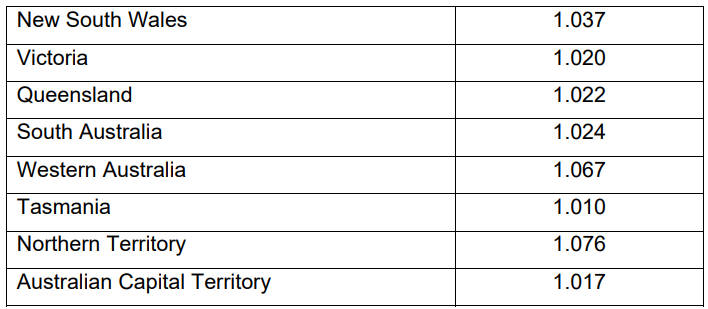

2020-21 FBT Year

The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2020.

| New South Wales | 1.000 |

| Victoria | 1.017 |

| Queensland | 1.002 |

| South Australia | 1.010 |

| Western Australia | 0.969 |

| Tasmania | 1.056 |

| Northern Territory | 0.948 |

| Australian Capital Territory | 1.029 |

2019-20 FBT Year

TD 2019/5 The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2019.

2018-19 FBT Year

TD 2018/1 The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2018.

2017-18 FBT Year

TD 2017/6 The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2017.

2016-17 FBT Year

TD 2016/1 The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2016.

2015-16 FBT Year

TD 2015/4 The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2015.

2014-15 FBT Year

TD 2014/3 The indexation factors for valuing non-remote housing for the purposes of section 28 of the Fringe Benefits Tax Assessment Act 1986 for the fringe benefits tax year commencing on 1 April 2014.

Calculating the value of a housing benefit

The value of a housing benefit is based around market value, i.e. an arms length rental value, disregarding any special factors solely applicable to the arrangements between the employer and employee. This can usually be ascertained by comparing similar properties in the locality. The rental value is reduced by any rent paid by the employee. Within the market value principle there are some variations based on circumstances:

- the accommodation is identical or similar to that provided by a provider in the business of providing caravan, mobile home, hotel, motel, hostel or guesthouse accommodation to the public – the taxable value is 75% of the market rental value, less the amount of any rental payments.

- the market rental value is determined by reference to a long term occupancy rate, which can be estimated as 15% of the prevailing daily rate.

- if the accommodation is not similar (e.g. a house) – the taxable value is market rental value, less the amount of any rental payments.

- other accommodation – the taxable value is the market rental value reduced by any rental payments made by the employee.

- for subsequent years the rental value may be calculated using the first (base) year together with an indexation factor.

- This method may be used for up to 9 years.

- The indexation factor is calculated and published annually – as above.

- Calculations are annualised and then apportioned to period of occupancy.

- for subsequent years the rental value may be calculated using the first (base) year together with an indexation factor.

Temporary Accommodation Concessions

There is a reduction in taxable value available in situations where the employee is provided with temporary accommodation for reasons connected with the relocation of their employment. They include:

- Temporary accommodation of up to 21 days (ending on the day the employee starts work at the new location) at the former location due to the former home being unavailable or unsuitable for occupancy because of the relocation (for example, furniture removal)

- Temporary accommodation at new location from 7 days before starting work at the new location until when the employee could reasonably be expected to occupy the home after it has been purchased or leased

Subject to the employee making a reasonable and sustained effort to buy or lease suitable long-term accommodation and the provision of a declaration, the concession is essentially extendible to 12 months.

Exempt Housing Benefits

– For a housing fringe benefit provided in Australia

Remote area housing in Australia is exempt from FBT if (all conditions):

- for the whole of the tenancy period

- the accommodation is occupied by a current employee, and

- the usual place of employment of the employee is in the remote area

- the nature of business requires employees to move residence locations frequently

- there is insufficient suitable residential accommodation otherwise available at or near the place(s) of employment

A “remote area” is an area

- more than 40 kilometres from an eligible urban area with a census population of 14,000 to less than 130,000, or

- more than 100 kilometres from an eligible urban area with a census population of 130,000 or more.

Tax Zone A or Zone B If the accommodation is in zone A or B (for income tax purposes), to be treated as remote it must be located:

- at least 40 kilometres from an eligible urban area with a census population of 28,000 to less than 130,000, and

- at least 100 kilometres from an eligible urban area with a census population of 130,000 or more.

The population figures are based on the 1981 Census.

Extension of the remote area housing exemption for some regional employers An extended exemption applies to housing benefits for employees of:

- a public hospital

- a government body where the duties of the employee are exclusively performed in, or in connection with, a public hospital or a non-profit hospital

- a hospital carried on by a non-profit society or a non-profit association

- a charitable institution

- a public ambulance service

- a police service.

For these employers, whether or not they are located in zone A or B, the 40 km rule doesn’t apply, and an employee’s housing will be considered as remote if located more than 100 kms from an eligible urban areas of 130,000 or more.

The information on this page is a summary of certain aspects, and should not be relied upon as the basis of a decision. Please seek advice before taking any action.

Further Information and Links

- What is a remote area?

- Fringe Benefits Assessment Act 1986 – ” Housing Right”

- Fringe Benefits Tax Assessment Act 1986 – Sect 61C Reduction of taxable value–temporary accommodation relating to relocation

- Fringe Benefits Tax Assessment Act 1986 – Sect 140 – Eligible Urban Areas

- Miscellaneous Taxation Ruling MT 2025 – Guidelines for valuation of housing fringe benefits.

This page was last modified 2024-03-29