The ATO depreciation rates determine tax deductions which represent the decline in value over time of assets which are associated with your income-earning activities.

Depreciation – Recent Developments

Small Business Energy Incentive

(subject to legislation)

From 1 July 2023 a “bonus tax deduction” will be available of up to $20,000 on maximum expenditure of $100,000 (so 20% of the eligible expenditure) on the cost of electrification and the more efficient use of energy.

The measure will be included in the Federal Budget being released on 9th May, 2023.

Examples reference in the Treasurer’s media release include the electrification of heating and cooling systems, upgrading to more efficient fridges and induction cooktops, and installing batteries and heat pumps.

- the measure will apply to eligible assets or upgrades..

- first used or installed ready for use between 1 July 2023 and 30 June 2024.

- the measure is available to businesses with annual turnover of less than $50 million

Technology & Investment Boost For Small Businesses

Legislation has been assed to provide a technology investment boost in the form of an additional 20% tax deduction on the costs of “digital adoption” by small businesses (aggregated annual turnover of less than $50 million), applying from budget night 29 March 2022.

Eligible costs will include business expenses and depreciating assets that support digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services.

There is an annual cap of $100,000 on each year’s eligible expenditure

Claims arising in 2021-22 will be included in tax returns for 2022-23.

Claims arising in 2022-23 will be claimable within the same year.

Temporary Full Expensing Expires From 1 July 2023

Under a Budget 2023 proposal, with effect from 1 July 2023 the instant asset write-off is being restricted to $20,000 (per asset) for businesses with turnover under $10 million, in the period 1 July 2023 to 30 June 2024.

The temporary full expensing incentives expire on 30 June 2023, which otherwise would have reset the instant asset write-off threshold back to $1,000.

Small businesses with an aggregated annual turnover of less than $10 million will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

Small business pooling rules can be reapplied for assets in excess of $20,000 (i.e. allowing depreciation of 15% first year and 30% thereafter).

See progress of legislation: Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023 and Explanatory Memorandum

Full Expensing Measures Extended to 30 June 2023

Announced as part of Budget 2021 measures, the availability of full expensing is extended by a further year until 30 June 2023. (Budget Paper No. 2 page 29).

See Treasury Laws Amendment (Enhancing Superannuation Outcomes For Australians and Helping Australian Businesses Invest) Bill 2021.

Depreciation – General Rules

When assets decline in value, that represents an economic loss. ATO depreciation is all about recognising that loss as a tax deduction.

Broadly, depreciation is a specific deduction for the cost of assets which provide a benefit to an income-earning entity over more than one financial year.

There are general rules which apply under the uniform capital allowance system, provided by rules set out in the Income Tax Assessment Act 1997.

Most claims for depreciation initially fall under Divisions 40 or 43, with Div 40 mainly covering “plant & equipment” types of items, and Div 43 covering structures including buildings.

Division 40 Depreciation

The Division 40 net is cast widely, covering the majority of assets used to earn income.

A depreciating asset is widely defined to be “an asset that has a limited effective life and can reasonably be expected to decline in value over the time it is used “.

This definition is subject to exceptions such as land, trading stock and a number of others. (Sec 40-30)

The scheme of Division 40 is to allow deductions for the decline in value of income-earning assets over time, based on their effective life.

There are a number of exclusions to Division 40 as well as special allowances that do not explicitly follow the effective life calculation basis.

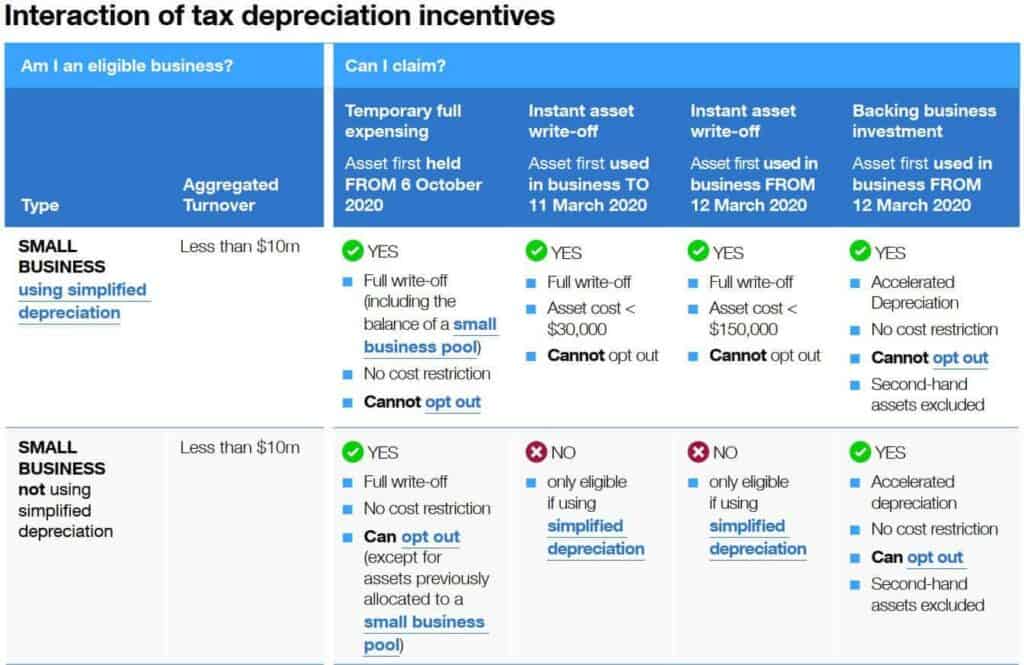

Small Businesses: Subdivision 328-D is carved out of Division 40. This subdivision provides a simplified basis of depreciation claims and asset accounting via a pooling method, and is available to small business entities.

Division 43 Depreciation (Capital Works Deductions)

Division 43 of the Income Tax Assessment Act 1997 enables tax deductions for capital expenses on income-producing buildings, such as extensions, alterations, improvements, and structural improvements.

The provisions of Div 43 allow taxpayers to deduct a portion of the construction costs over the asset’s effective life.

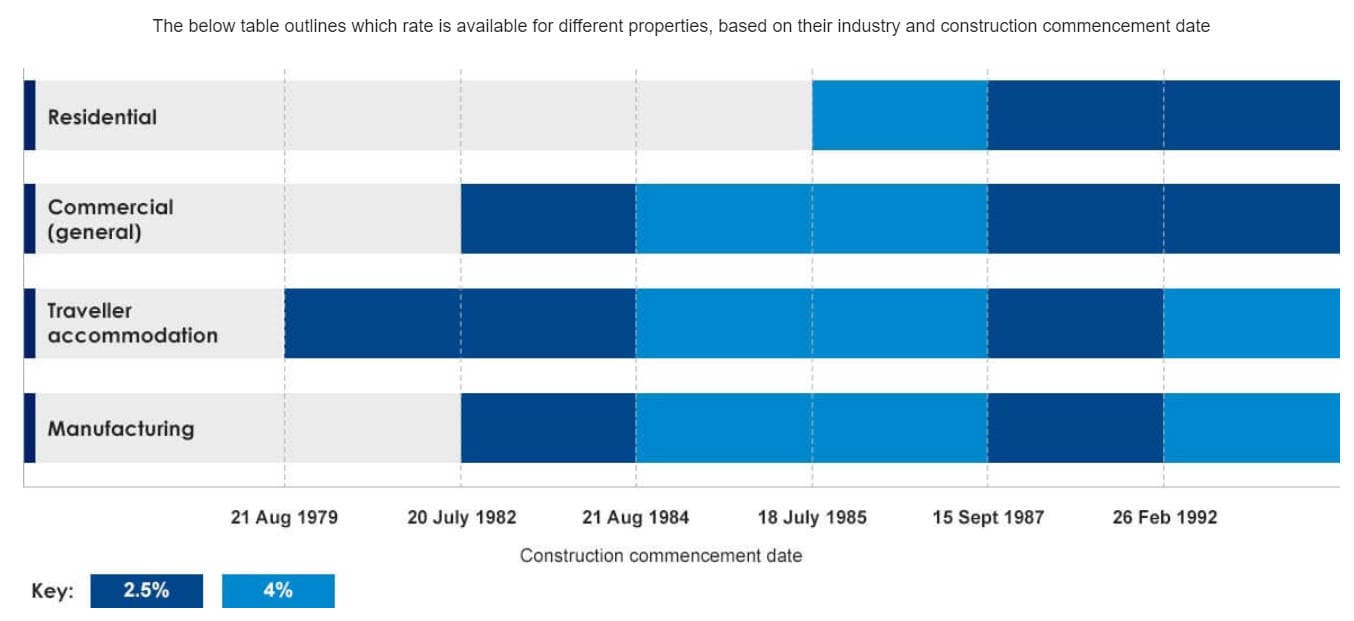

Div 43 Deductions: Rental & Other Income Producing Properties

A property used to generate taxable income can qualify for Division 43 capital works deductions.

Deduction rates vary according to the date of construction and the type of property:

- 2.5% over 40 years; or

- 4% over 25 years for hotels, motels etc.

If construction costs are not known, a Quantity Surveyor can provide an estimate which is accepted by the Tax Office as sufficient evidence of cost.

A number of Quantity Surveyors specialise in this work for property owners and can help to optimise both Div 40 and Div 43 tax claims. For example, see Washington Brown and BMT.

See also: Rental Property Deductions.

Small business instant asset write-off and accelerated depreciation

Instant Asset Write-off From 1 July 2023

*** Temporary Full Expensing Expires 30 June 2023, replaced by an Instant Asset write-off of up to $20,000, limited to businesses with turnover under $10 million ***

From 1 July 2023 small businesses with an aggregated annual turnover of less than $10 million will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and

30 June 2024.

Small business pooling rules can be reapplied for assets in excess of $20,000 (i.e. allowing depreciation of 15% first year and 30% thereafter).

See progress of legislation: Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023 and Explanatory Memorandum

Temporary Full Expensing information references

- Law Companion Ruling LCR 2021/3 Temporary full expensing

- How to claim temporary full expensing – ATO

- Temporary full expensing of depreciating assets – PWC

- Temporary full expensing of depreciating assets – Tax Banter

The base amount of instant asset deduction when it commenced was $1,000, and in the absence of other temporary measures, this remains the default legislated allowance.

Over the years since then it has been increased to $6,500, $20,000, $25,000 and $30,000 and 100%.

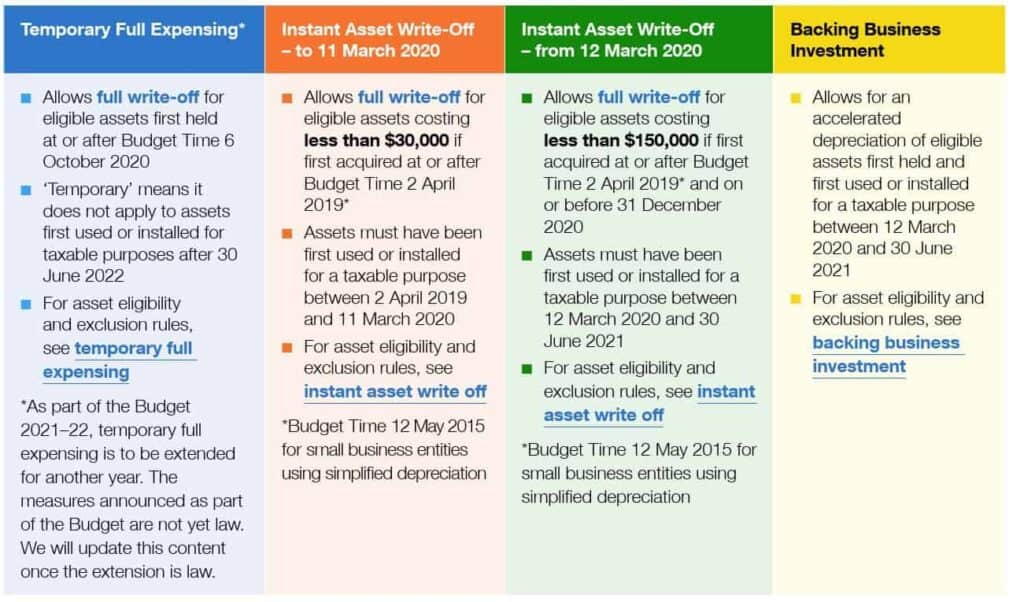

An instant asset deduction limit of $150,000 was implemented from 12 March 2020 with the Coronavirus measures, and subsequently (from 6 October 2020) extended to 100% (i.e. full expensing) until 30 June 2022 (since extended to 30 June 2023) for businesses with turnover up to $5 billion.

Temporary Full Expensing Expires 30 June 2023, replaced by an Instant Asset write-off of up to $20,000, limited to businesses with turnover under $10 million. Small business pooling rules can be reapplied for assets in excess of $20,000 (i.e. allowing depreciation of 15% first year and 30% thereafter).

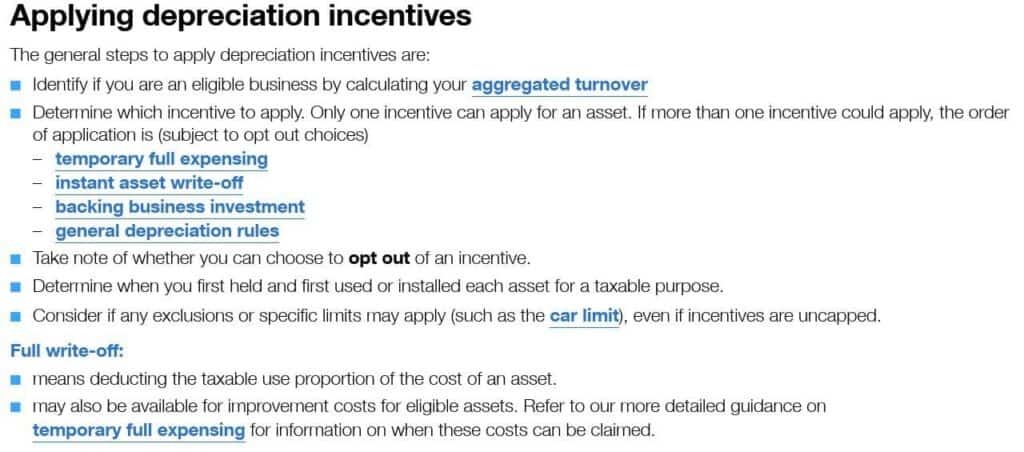

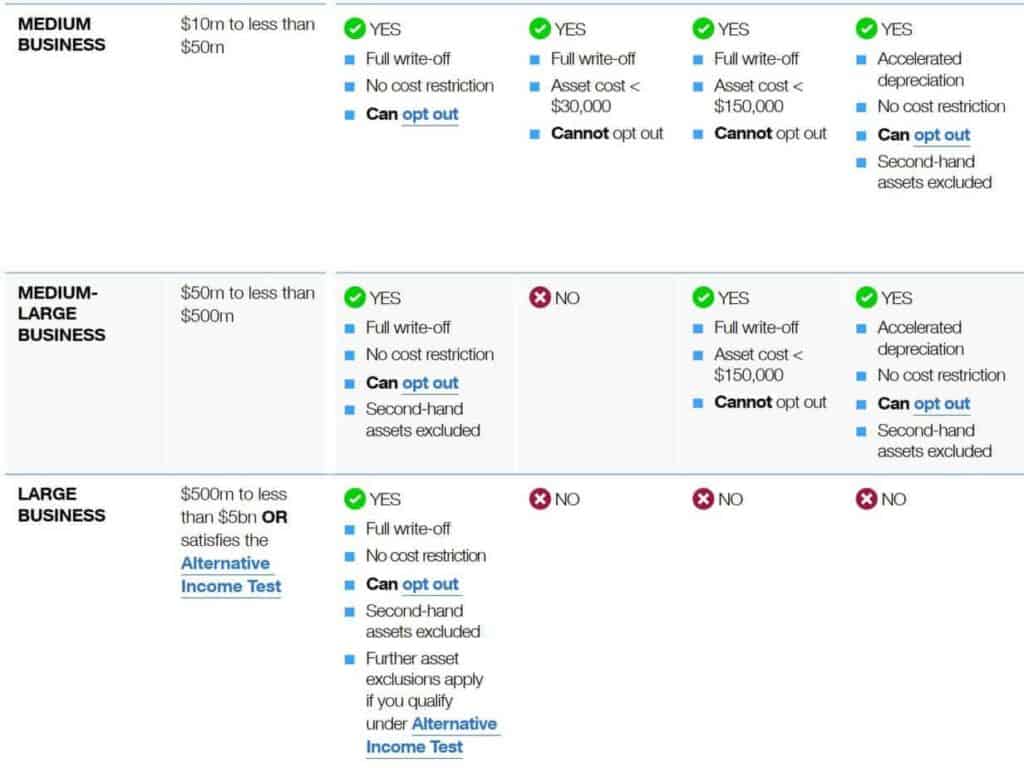

Summary of The Former Depreciation Incentives

(Source: ato.gov.au)

The main criterion for classification for these measures is a turnover test.

Each increase to the deduction limit has been specified for a temporary period, with $1,000 amount being the fallback amount if the higher valued concession is not renewed.

The instant asset deduction is applicable on an asset-by-asset basis, and the specific deduction amount applicable will depend on the date of purchase (and the usual installed ready for use requirements). Assets which cost more than the applicable limit would need to be depreciated.

Instant Asset Claims Chronology

[12 March 2020] Covid-19 Stimulus

Included in a package of Coronavirus stimulus measures were measures to apply from 12 March 2020:

- an expansion of the instant asset claim allowance from $30,000 to $150,000 for the period from 12 March 2020 until 30 June 2020 and to include businesses with business turnover of up to $500 million (previously $50 million). On 9 June 2020 the Treasurer announced that the concession will be available for a further 6 months until 31 December 2020.

- an (alternative) accelerated depreciation for businesses with a turnover up to $500 million until 30 June 2021 to allow an additional 50% of the asset cost as a deduction in the year of purchase; or 57.5% as a small business using the simplified depreciation small business pool.

The instant asset provisions apply to new and second hand assets. The accelerated depreciation provisions apply only to new assets.

The instant asset claim cannot be used in conjunction with an accelerated depreciation claim.

The usual private use exclusions apply, as well as the car depreciation cost limit.

For further information see legislation and How it works.

[2 April 2019] Small businesses

The $20,000 limit for accelerated small business depreciation claims has been increased to $30,000 on an asset-by-asset basis and extended until 30 June 2020 under proposals announced in January 2019 and expanded upon in the Budget 2019 announcements. The Treasury Laws Amendment (Increasing and Extending the Instant Asset Write-Off) Bill 2019 has been approved by the parliament.

Budget 2019: Announced in the Budget – from 7:30 PM (AEDT) on 2 April 2019 (Budget night) until 30 June 2020:

- The small business (turnover up to $10 million) write-off limit is increased from $25,000 to $30,000, applied on a per asset basis. This applies until 11 March 2020.

- Medium sized businesses (turnover from $10 million to $50 million) will now also have access to the instant asset write off in respect of assets acquired from Budget night to 30 June 2020.

- (As before) the small business pooling (simplified depreciation) rules and suspension of the lockout rules continue until 30 June 2020.

[update Feb 2019] Instant Asset Deduction Extension

The availability of the instant asset immediate deduction is to be extended to 30 June 2020, with the ceiling lifted to $25,000 from 29 January 2019. See Treasury Laws Amendment (Increasing the Instant Asset Write-Off for Small Business Entities) Bill 2019

[update 8 May 2018] Budget 2018 Instant Asset Extension

The government has extended the small business $20,000 asset write-off provisions for a further 12 months until 30 June 2019. Small businesses will be able to immediately deduct purchases of eligible assets costing less than $20,000 first used or installed ready for use by 30 June 2019.

The deduction rules also apply to pool balances of less than $20,000 (as before).

The time extension also applies to the relaxation of 5-year lock-out rule, enabling re-entry of small businesses to the increased threshold arrangements, who would otherwise be barred through having previously opted out.

Relatively few assets are not eligible (such as horticultural plants and in-house software).

[update 3 May 2016] Budget 2016 Instant Asset Thresholds and Value

The Budget proposal provides that the small business entity turnover threshold will be increased from $2 million to $10 million from 1 July 2016, with access to the instant write off for equipment purchases of up to $20,000 along with other small business concessions (excluding CGT, for which the turnover threshold remains at $2 million).

The amending legislation is here: Treasury Laws Amendment (Enterprise Tax Plan) Bill 2016

[update 12 May 2015] Budget 2015 Fresh Instant Asset Provisions

The 2015 Budget has provided a fresh regime of accelerated depreciation (instant asset write-off) concessions for Small Businesses which take immediate effect:

- Instant asset write-off: Small businesses to get immediate deduction for the cost of assets acquired which are less than $20,000 (up from the current $1,000) to be available from 7.30 pm 12 May 2015 initially until 30 June 2017 but since extended).

- A small business year-end asset low value pool balance of less than $20,000 can also be fully deducted. See more here.

- from 1 July 2015 Small Business start-ups will be able to immediately deduct professional costs associated with starting a business rather than writing them off over five years as currently – see black hole expenses

Assets such as horticultural plants and in‐house software for which specific depreciation rules already apply are excluded.

The current 5-year bar on re-entry to simplified depreciation after opting out is suspended.

For Primary Producers (see more below):

- from

1 July 201612 May 2015 primary producers will be able to immediately deduct capital expenditure on fencing and water facilities (currently 30 years and 3 years respectively) and write off fodder storage assets over 3 years (currently 50 years). See Primary producers. A full write-off for fodder storage takes effect from 19 August 2018. See further under Primary Producers heading below.

Enabling legislation giving effect to these measures has now been passed by the Federal parliament, see also Small Business concessions.

[update 2 Sept 2014] The $6,500 Instant Asset Write-off Scheme Ending 31 December 2013

The $6,500 (and related $5,000 motor vehicle) Small Business asset write-off concessions are removed with effect from 1 January 2014 under the Mining Tax repeal legislation.

Small Business write-off concessions revert back to the $1,000 limits for low pool assets and normal rules for vehicles.

The accelerated depreciation concessions were in place for the period 1 July 2012 to 31 December 2013.

The removal legislation was approved by parliament on 2 September 2014. See: Mining Tax repeal legislation

[Period 2012-13] $6,500 instant asset threshold

For the period 1 July 2012 to 31 December 2013, there was a $6,500 instant asset threshold, with special rules for motor vehicles. Under the instant asset write-off provisions, the immediate deductions increase to $6,500 or $5,000 for motor vehicles costing more than $6,500.

Asset costs in excess of these amounts may be claimed 15% in the first year and 30% in subsequent years. (Note the termination of this concession from 1 January 2014).

From 1 July 2012 pool all assets for deduction at the rate of 30% per annum on a diminishing value basis (15% for first year assets), with simplified adjustments for business use percentage, and adjustments on disposal.

Up to 1 July 2012, separately pool assets with an effective life of 25 years or more for deduction at the rate of 5% per annum on a diminishing value basis (2.5% for first year assets)

See also: ATO Simplified depreciation for Small Business

The Tax Commissioner’s Effective Life Tables

The Effective Life Tables provide a ‘safe harbour’ estimate of effective life as the default alternative to self assessment.

The tables provide an estimated life for assets as determined by the Tax Office.

Effective life schedules have been updated for application from 1 July 2022 per determination Income Tax (Effective Life of Depreciating Assets) Amendment Determination (No 1) 2022.

Commissioner’s Effective Life Rulings

| Tax Year | Ruling |

| 2022-23 | TR 2022/1, html version |

| 2021-22 | TR 2021/3, html version |

| 2020-21 | TR 2020/3 |

| 2019-20 | TR 2019/5 |

| 2018-19 | TR 2018/4 |

| 2017-18 | TR 2017/2 |

| 2016-17 | TR 2016/1 |

| 2015-16 | TR 2015/2 |

| 2014-15 | TR 2014/4 |

| 2013-14 | TR 2013/4 |

| 2012-13 | TR 2012/2 |

| 2011-12 | TR 2011/2 |

Self Assessment of Effective Life

Apart from exceptions, in general you don’t have to use the Commissioner’s estimate when determining the effective life of an asset for depreciation purposes. The alternative is to choose to self assess.

For information about the self-assessment process, see: Self Assessment of Depreciation rates.

Commissioner’s estimated depreciation rates for the following common items:

Composite Assets

The Tax Office has issued a ruling TR 2024/1 containing guidance on how and when to treat depreciable components as separate assets, or as a single asset.

The ruling sets forth relevant factors as the basis for determining whether a separate asset is defined:

‘Identifiable‘: the depreciating asset performs a separately identifiable function

‘Use‘: a depreciating asset will tend to be an item that performs a discrete function

‘Degree of integration‘: the depreciating asset will tend to have a high degree of physical integration

‘Effect of attachment‘: the item, when attached to another asset having its own independent function, varies the performance of that asset.

‘System‘: a depreciating asset will tend to be the multiple components that are purchased as a system to function together as a whole

There are 14 practical examples discussed in the ruling. They include:

- Industrial storage racking

- Desktop computer package

- Mainframe computer

- Local area network

- Aircraft engine and frame in service on rotation

- Car global positioning system

- Jointly-held fibre optic cable communications system

- A new electricity distribution line

- Replacing electricity pole

- Upgrade of transformer

- Rail transport infrastructure

- New railway branch line

- Solar power system

- Photographic lighting equipment

Depreciation on residential rental properties

Effective from 9 May 2017, Div 40 has been amended to deny depreciation tax deductions for ‘previously used’ depreciating assets used in earning income from residential premises used for residential accommodation.

Assets acquired before 9 May 2017 will not be affected. Future deduction claims will be restricted to assets acquired by the taxpayer.

“Previously used” essentially refers to assets that are not first owned and used by the taxpayer. There are exclusions from these measures for certain corporate, trading and other entities.

See more details here: Rental property tax deductions

Immediate deductions – non-business taxpayers

There are immediate deductions for depreciating assets costing $300 or less, for non-business taxpayers, which includes investors, landlords and employees. (See Section 40-80(2)). For an expanded explanation and examples, see Capital allowances – $300 immediate deduction tests.

The ATO allows all taxpayers to claim immediate deductions for capital items costing $100 or less, or to use statistical sampling to determine a proportion of total expenditure to be treated as immediately deductible items. For details, see ATO Practice Statement PS LA 2003/8

Low-cost assets – Low Value Pool

Low-cost assets costing less than $1,000 * and assets which have been depreciated under the diminishing value method to less than the Low Value can be optionally bulked into a “Low Value Pool“, with a single arbitrary depreciation write-off schedule. ( see Section 40-425).

If the choice is not made, depreciation is determined under the generally applicable effective life basis.

Assets in the Low Value Pool have only one method of depreciation, diminishing value, over an assumed effective life of 4 years.

The taxable use percentage must be estimated, and can’t be varied.

| Low Value Pool Depreciation rates (Diminishing Value Method Only) | |

| Low Cost – First Year – year of acquisition (LCA) | 18.75% |

| – subsequent years | 37.5% |

| Depreciated to less than Low Value and added to the pool (LVA) | 37.5% |

See also: concessions for Small Businesses

Depreciation of Software – In House Software

The general depreciation rules under Div 40 include “in-house” software as a depreciable asset.

Note: Common payments for software which are in the nature of annual licence fees (such as for tax and accounting software) are generally considered to be business outgoings which are fully deductible when incurred, and are therefore not required to be treated as capital expenditure, and depreciation provisions are not appliable. See also: Claiming a deduction for digital product expenses

In house software is given a statutory effective life as the basis of depreciation claims:

- from 1 July 2015 the statutory effective life of in-house software is 5 years

- (from 13 May 2008) – the effective life is 4 years – a rate of 25% p.a. prime cost; or

- (before 13 May 2008) – the effective life is 2.5 years – a rate of 40% p.a. prime cost

“In-house” software by definition includes computer software acquired, developed or commissioned mainly for the taxpayer to use.

Excluded is software which is trading stock or which is deductible elsewhere under the tax rules, or which is in the nature of an annual renewal or subscription which would be fully deductible as a business outgoing.

Subject to eligibility, non-revenue costs of in-house software may alternatively be allocated to a Software Development Pool.

See further

Self-assessment of effective life of patents etc. not proceeding.

On May 6, 2021, the then LNP government notified its intention to amend the law to allow the self-assessment of effective life of patents, registered designs, copyrights and in-house software for tax purposes from 1 July 2023.

That would have meant deductions being brought forward if the self-assessed effective life is shorter than the statutory life, consistent with the treatment of tangible assets. See announcement and Budget Papers No.2 pages 14-15

However, this proposal was dropped in the Labor budget of 25 October 2022.

In house software – Software Development Pool

Expenditure on the development of in house software can be allocated to a “Software Development Pool” which provides for a write-off over 4 years – extended to 5 years from 1 July 2015 (see table below).

Excluded: “In-house software” expenditure on acquiring software or a right to use computer software cannot be allocated to the Software Development Pool. (Sec 40-450)

Once a pooling choice is made, all similar expenditure must then be allocated to the pool. (See Section 40-450).

Pool depreciation deductions are calculated under the prime cost method, as follows: (Section 40-455):

| In-House Software Development Pool Depreciation (Prime Cost Method Only) | ||

| to 30 June 2015 | From 1 July 2015 | |

| First Year | Nil | Nil |

| Second Year | 40% | 30% |

| Third Year | 40% | 30% |

| Fourth Year | 20% | 30% |

| Fifth Year | 10% |

Primary Producers and Primary Production

Primary Producers receive specific deductions.

Budget 2015: On and from 12 May 2015 primary producers special deductions were amended.

The amendments have been added to the notes below.

Water facilities Sec 40-515 Sec 40-540

Depreciation:33.33% per year for 3 yrs until 12 May 2015;

100% from 7.30pm (AEST) 12 May 2015

Fencing Sec 40-551

Depreciation:Effective life to 12 May 2015;

100% from 7.30pm (AEST) 12 May 2015

(except if the expenditure relates to a stockyard, pen or portable fence)

Fodder storage assets Sec 40-548

Depreciation: Effective life to 12 May 2015;

33.33% in each of 3 income years from 7.30pm (AEST) 12 May 2015 to 18 Aug 2018

From 19 August 2018 immediate deduction 100%.

Horticultural plants Sec 40-520

Depreciation: Immediate deduction if effective life less than 3 yrs, otherwise see table formula:

Plants with effective life of 3 or more years:

| Effective life (years) | Annual write-off | Write-off limit |

| 3 to less than 5 | 40% | 2 yrs 183 days |

| 5 to less than 6⅔ | 27% | 3 yrs 257 days |

| 6⅔ to less than 10 | 20% | 5 years |

| 10 to less than 13 | 17% | 5 yrs 323 days |

| 13 to less than 30 | 13% | 7 yrs 253 days |

| 30 or more years | 7% | 14 yrs 105 days |

Grapevines

Depreciation: Effective life; or

Commissioner’s rate: dried grapes – 15 years; table grapes – 15 years, wine grapes – 20 years; or

Horticultural plant (see above table) rate of 13% over maximum 7 years 253 days.

Landcare Sec 40-630

Depreciation: Immediate deduction

Electricity and telephone Sec 40-645, Sec 40-650

Depreciation: 10% each year over 10 years

Capital costs of acquiring trees Sec 70-120

A deduction (100%) allowed for the cost of trees sold, which were acquired as part of a land acquisition or as a right to fell. Carbon sink forest deductions amounts are specifically excluded.

Carbon Sink Forests

This is a deduction for the direct costs of establishing trees in a carbon sink forest for the dedicated purpose of carbon sequestration – the process by which trees absorb carbon dioxide from the atmosphere.

From 1 July 2012 the deduction is based on a write off over 14 years and 105 days (7% per year) starting from the date of the establishment costs.

See further:

- Claiming a deduction for carbon sink forest expenses

- Subdivision 40J

- Guidelines to deduct cost of trees for carbon sequestration

Minerals exploration etc:

Immediate deductions (whether capital expenditure or not) are available for exploration, prospecting, rehabilitation, petroleum rent resource tax and environmental protection.

(See section 40-730 and tax ruling TR 2017/1 Income tax: deductions for mining and petroleum exploration expenditure.

See also section 40-80 and tax determination TD 2019/1 (for a discussion of what constitutes use and first use of a mining etc. asset)

Environmental Protection

Section 40-755 provides a deduction for expenditure which has the sole or dominant purpose of carrying on ‘environmental protection activities’.

Environmental protection activities are those related to a taxpayer’s income-earning activities and include preventing, fighting or remedying pollution and dealing with waste.

See further at ato.gov.au and Taxation Ruling TR 2020/2

Blackhole Expenditure – business-related costs:

Black hole expenses are capital business-related expenses, which but for Sec 40-880 would be non-deductible. This can include startup and wind-up expenses, and applies from 1 July 2005.

Sec 40-880 provides that these expenses be deducted over five years – at the rate of 20% each year.

From 1 July 2015 small or medium (from 1 July 2020) business start-ups can immediately deduct professional costs associated with starting a business. (Sec 40-880 (2A)). These expenses would otherwise have been treated as black hole expenses and written off over 5 years.

Enabling legislation was passed by parliament on 13 August 2015. Small businesses are those with aggregated turnover below the qualifying threshold.

Tax ruling TR 2011/6 sets out the Tax Office’s view of the operation of the black hole provisions and contains 40 examples.

Taxation Determination TD 2022/D2 provides that capital expenses incurred in establishing and an Employee Share Scheme qualify as blackhole expenditure, deductible in equal proportions over 5 years.

Other Capital expenditure that is deductible over time

Other business related capital expenditure:

Deductions are provided for certain expenses which would not otherwise be depreciable or claimable. This includes project expenditure for

- mining capital expenditure (Section 40-860)

- transport capital expenditure (Section 40-865)

These costs are pooled and written off over the life of the project according to formulae in Sections 40-830 and 40-832.

Depreciation Methods

Section 40-30 has a general definition of a “depreciating asset” (and lists some exclusions, such as land).

Calculating a tax depreciation claim for an eligible depreciating asset requires:

1. Determine effective life:

- by a self-assessment of effective life of the asset; or

- choose the Tax Office estimate of effective life – see the Effective Life tables, updated annually, which are linked at the top of this page

2. choose a calculation method:

The choice is between Diminishing Value and Prime Cost methods of calculating the depreciation for the year (or part year if applicable).

Each of the methods is the arithmetic combination of

- Base Value or Cost

- days held

- effective life (or remaining effective life)

Diminishing Value Method

The diminishing value method tends to bias the depreciation amount in the earlier years.

The formula:

– assets from before 10 May 2006 : Base Value x (Days held / 365) x (150% / Effective life in years) (Section 40-70)

– assets from on or after 10 May 2006: Base Value x (Days held / 365) x (200% / Effective life in years) (Section 40-72)

The Base Value is initially the cost, but this can be modified by later improvements and the forgiveness of commercial debts.

Prime Cost Method

The Prime Cost method allocates the costs evenly over the years of ownership.

The formula:

Cost x (Days held / 365) x (100% / Effective life in years)

The Cost and calculation may be later modified by a recalculation of effective life, later improvements, forgiveness of commercial debts, application of rollover relief, GST and currency adjustments. (Section 40-75 Prime cost method)

Note also that where applicable, luxury cars have an upper depreciation limit.

Determining Effective Life

Except when there is a tax provision specifying otherwise, you generally have the choice of two methods of determining effective life:

- self assess: i.e. make your own estimate, based on relevant features of the asset and the way it is intended to be used (see Section 40-105); or

- adopt the Commissioner’s estimate

Exceptions

The choice of self-assessment or Commissioner’s estimate is not available where an asset has been acquired from an associate or when the end-user hasn’t changed, as in a sale and lease-back situation.

In such cases, generally the same depreciation method must be continued, or if the previous method cannot be ascertained, then the Commissioner’s estimate of effective life schedule is required to be used. (See Section 40-95)

For a calculator which converts effective life to a depreciation percentage rate – see: Converting Effective Life to the percentage depreciation rate – spreadsheet calculator

Intangible assets effective life

Proposed amendment to Section 40-95

Most intangible assets have an effective life which is specified in the UCA depreciation rules, reproduced below.

In the budget of May 6, 2021 the Coalition government announced an intention to amend the law to allow the self-assessment of effective life of patents, registered designs, copyrights and in-house software for tax purposes.

The subsequent Labor budget of October 2022 abandoned this proposal in favor of keeping things as they are. Thus the useful lives of intangible assets will continue to be determined by legislated rates rather than self-assessed by taxpayers.

Statutory effective life of intangible assets

| Asset | Effective life (years) |

| Standard patent | 20 |

| Innovation patent | 8 |

| Petty patent | 6 |

| Registered design | 15 |

| Copyright (except copyright in a film) | The shorter of 25 years or period to end |

| A licence (except one relating to a copyright or in-house software) | Term of license |

| A licence relating to a copyright (except copyright in a film) | The shorter of 25 years or period to end |

| In-house software | 2 or 4 (see In-house software) |

| Spectrum licence | Term of license |

| Datacasting transmitter licence | 15 |

| Telecommunications site access right | Term of the right |

Statutory Caps on Effective Life

Certain transport assets which have an effective life fixed by law.

Caps on Effective Life

Certain assets have a cap on effective life. When shorter than the Commissioner’s determined effective life, and when the Commissioner’s Effective Life determination for effective life is selected, the capped effective life must be used when available. For rates and assets affected – see Capped Effective Life.

Guide To Depreciating Assets

Each financial year the ATO issues an updated depreciation guide which details claimable deductions available for depreciating assets and other capital expenditure.

The latest available publication at the time of writing is the Guide To Depreciating Assets 2023, which refers to the 2022-23 financial year. Links to earlier years’ publications are below.

Other Years’ Guides To Depreciating Assets

Guide To Depreciating Assets 2022

Guide To Depreciating Assets 2021

Guide To Depreciating Assets 2020

Guide To Depreciating Assets 2019

Guide To Depreciating Assets 2018

Guide To Depreciating Assets 2017

Guide To Depreciating Assets 2016

Guide To Depreciating Assets 2015

Guide To Depreciating Assets 2012

Guide To Depreciating Assets 2011

Guide To Depreciating Assets 2010

Guide To Depreciating Assets 2009

Guide To Depreciating Assets 2008

Guide To Depreciating Assets 2007

Guide To Depreciating Assets 2006

Guide To Depreciating Assets 2005

Guide To Depreciating Assets 2004

Further Depreciation Information Links

- ATO’s depreciation calculator tool

- Depreciation rates

- BMT Online Depreciation Rate Finder

- Other capital expenses

See also linked pages:

- ATO depreciation rates

- Depreciation of computers and laptops

- Depreciation of motor vehicles

- Depreciation of mobile phone

- Capped Effective Life Depreciation

- Car Depreciation Cost Limits

- Self Assessment of Depreciation Rates

- Effective Life Conversion Calculator

This page was last modified 2023-10-07