Website costs can be broadly classified as either capital expenses, or ongoing running costs.

Running costs (maintenance) will normally be deductible as a business outgoing.

Capital expenses may be deductible under a number of possible tax provisions, based on the character and purpose of the expense.

The current position regarding deductibility is comprehensively discussed in a Tax Office ruling which was issued following a detailed review. See TR 2016/3 Taxation Ruling Income tax: deductibility of expenditure on a commercial website

The Tax Ruling covers expenditures on a commercial website which fall into the following categories:

- Typically recurring expenses, maintenance (Sec 8.1)

- Capital Allowances (Division 40)

- Small Business concessions (Division 328)

- Expenses subject to capital gains tax (CGT rules)

- Black Hole expenditure (rarely, sec 40-880)

- In-house software

For practical purposes, most expenditure is fully deductible.

The distinction between capital and non-capital expenses matters, because of the potentially different timing of deductions and applicability of CGT rules.

Currently, the delayed or allocated timing of capital expense deductions which might otherwise apply is superimposed by the accelerated depreciation rules for businesses with up to $5 billion in turnover. These rules allow temporary full expensing until 30 June 2023.

Exclusions

There are peripheral exclusions from deductibility which are noted in the Ruling.

They refer to Research & Development expenditure (Div 355) and expenditure related to the earning of exempt or Non Assessable Non Exempt (NANE) income.

Specific website content which may have a value independent from the value of the website is treated separately.

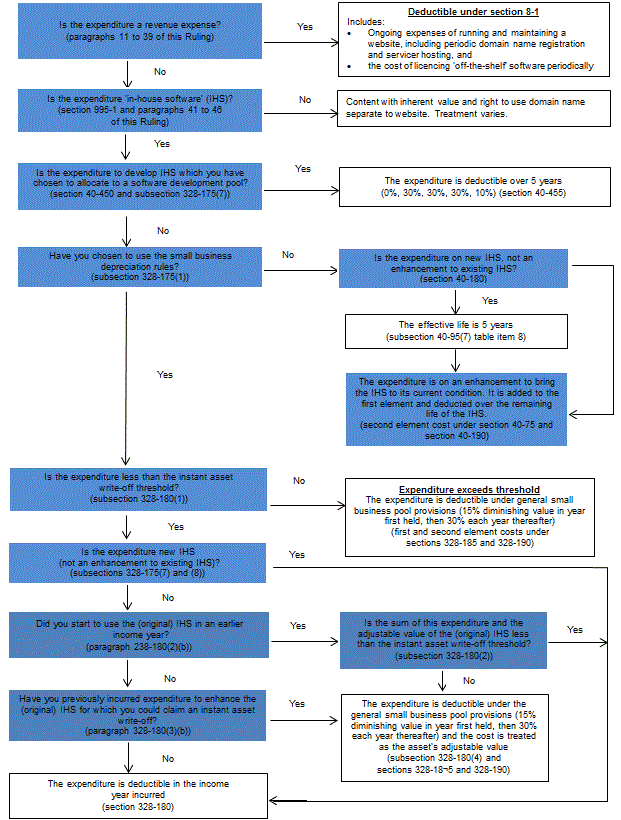

Website deductions decision flowchart

The Tax Ruling provides a decision flowchart as Appendix 2 (see page 41 or the web version of the ruling here.)

Website Cost Tax Deduction Examples

TR 2016/3 sets out 26 examples of commercial website-related expenditure which is worth reading in full for an understanding of the reasoning applied to different types of expenditure.

The cost of acquiring the rights to register and use a website domain name is treated as property (capital expense) under the Capital Gains rules. However the domain name registration fee is fully deductible as a recurring expense.

This is an edited summary and should not be relied upon as a substitute for professional advice.

A website is not a depreciating asset under Divisions 40 and

(TR 2016/3 para. 40)

328, except to the extent it can be classified as ‘in-house software’.

Example 1 – software which is not part of the website, not in-house software.

The costs of software products sold via a commercial website are not depreciable. A website’s software is an intangible asset which does not include software which is sold on the website for installation on a user’s device.

Example 2 – content which is considered part of the website, in-house software

Content articles on an e-commerce website (e.g. containing tips and methods) have no independent value and so form a part of the website. Site visitor data and analytics is also considered to be part of the website software.

Example 3 – content which is not part of the website

The copyright in digital images uploaded to a photographer’s website is not in-house software, the images are not website assets and are separately depreciable.

The initial upload of images is a capital expense; subsequent updates are a deductible website maintenance cost.

Example 4 – software which is not part of the website, not in-house software

A company-developed estimating software tool for electrical contractors, is used by the company in its business, and also licensed for use by other contractors. The software is not considered part of the company’s website.

Example 5 – leased website – the lease payments are an operating cost

A company leases as website as point of contact for consumers, in support of its appliance repair business. The lease payments are deductible as an operating cost.

Example 6 – existing business establishes a basic website, in-house software

A retail business commissions the establishment of a website containing promotional content and contact details but no e-commerce facility.

The website is considered to be in-house software and is a depreciable asset.

Example 7 – acquisition of investment website – carrying on a

business

- An employed solicitor purchases a pet care website as a going concern. The business meets the criteria of TR 97/11 for ‘carrying on a business’ and is treated as a small business entity.

- the cost of the website is considered an in-house asset and is depreciable as such. The small business capital allowance rules can be applied.

- the capital cost of acquiring the right to use the domain name forms part of the cost base of the domain name.

- annual domain registration and hosting fees are deductible operating expenses.

- web developer costs incurred to maintain the currency of website software and to install provided content updates are treated as deductible operating or maintenance costs.

Example 8 – business sets up microsite, in-house software

The costs of developing a ‘microsite’ for the purpose of promoting one specific product of an online bakery (with a separately successful main website) is considered to be a capital expense, and is in-house software.

Example 9 – online business – maintenance of website, deductible section 8-1

An online business earns income from a combination of sales commissions on promoted products and advertising fees.

“The success of (the).. website business” is dependent on regularly publishing interesting content and maintaining product links.

The costs of maintaining the website (including the upload of fresh content) are considered maintenance expenses deductible under section 8-1.

Example 10 – minor modification to website functionality, deductible revenue expense

An e-commerce website is modified by the addition of another payment option. The developer’s fee ($500 in the example) is a revenue expense.

Example 11 – business adds online sales function, in-house software

An existing business website is expanded to include e-commerce functionality, with a shopping cart, payment facility, stock management and a customer database.

The cost of the upgrade is considered to be a capital expense and is in-house software. The ongoing maintenance costs, including technical support, are of a revenue nature.

Example 12 – e-business promotional activity – temporary change to website appearance, operational costs, not in-house software

An e-business sells vouchers online, earning income from fees and commissions on voucher sales.

As part of a special promotion, the appearance of the website is changed for a period of two weeks. The costs of doing so, and of restoring the website afterwards, are considered to be deductible operational costs (not in-house software).

Example 13 – non-sales website modification, not in-house software

A mining company with an investor information website enhances the site’s user monitoring software to better understand the visitor profile and use of its website.

Expenditure on the modification is considered to be of a revenue nature, deductible as an expense (not in-house software).

Example 14 – addition to functionality of a website, in-house software

A pizza shop’s website has an online menu. A developer is engaged to design and add an online ordering system.

The cost of the developed software is considered significant ($5,000 in the example), being more than annual cost of maintaining the website.

“On balance” the expenditure is considered to be of a capital nature and is in-house software claimable under the capital allowances provisions.

Example 15 – online business – maintenance is on revenue account, upgrade is capital

An online insurance comparison website earns income from insurance product referrals.

The costs of updating the software comparison tool and insurance products are considered to be maintenance costs on revenue account.

A redesign (upgrade) of the website to enhance functionality involving “significant planning and expenditure” (the amount not specified in the example) is considered to be capital expenditure.

Example 16 – online business – back-end upgrades, in-house software

An online travel bookings site “upgrades its website architecture to increase its business efficiency”. The user interface and functionality does not change.

It is considered that the scale and effect of the upgrade “goes beyond the the ordinary operation of the business” and is therefore considered in-house software with deductibility worked out under Div 40 as capital expenditure.

Example 17 – managed website – expenditure on in-house

software, in-house software

A business providing employee assistance services to large businesses and government engages an IT contractor to both maintain and upgrade its website.

The website publishes information about the business’ services and provides an interactive portal for clients’ employees.

On behalf of the business, the IT contractor carries out a significant upgrade of the portal software, the cost of which exceeds the ordinary annual support budget. The upgrade both improves usability of the portal and extends its life.

The upgrade expenditure is considered a capital improvement to the business’s structure, and so deductibility is determined under Div 40 as in-house software.

Example 18 – existing website modified for mobile devices

A restaurant website containing product information and contact details seeks to upgrade the website for compatibility with mobile devices, and has two choices:

Option 1 is to modify the existing website software to offer a mobile-friendly layout to smart phone visitors. This upgrade is considered an ordinary business expense, and not capital, because it is to maintain existing functionality.

Option 2 is to redirect smart phone visitors to a separate website which is built in a mobile-friendly format. This is considered capital expenditure because it results in a new and separate commercial website.

Example 19 – online business – ongoing compatibility updates, not in-house software

A large online home products business has a team working exclusively to maintain its e-commerce website.

Activities include ongoing software upgrades, testing and bug resolution and maintaining functionality in a changing environment.

The associated labour costs are considered to be operational in nature and therefore deductible.

Example 20 – online business – incremental changes comprising a substantial upgrade

A business selling luxury products through an e-commerce website has a professional team, sometimes using the input of consultants to perform:

- site monitoring

- identifying customers’ usage patterns

- identifying areas for functional improvements

- responding to feedback

- rolling out regular releases

The business undertook a substantial platform upgrade which it opted to roll out as an early release with basic functionality, rather than a later release with full functionality.

Full functionality was achieved over period of time through items included in the normal pattern of regular releases.

The character of expenditure on the substantial upgrade items is determined as a whole, (i.e. including labour included in subsequent regular releases) and is considered to be capital in nature.

Labour costs linked to the substantial upgrade are identified through documentation and analysis of causal relationships.

Labour costs included regular releases which are not clearly linked to the substantial upgrade should be “apportioned on a reasonable basis”.

Example 21 – business with social media presence, deductible marketing costs

A fabric retailer with a commercial website incurs labour costs setting and running a social media profile, including posting regular content.

The social media profile is considered to be a capital asset separate from the main website, and is not in-house software.

However the establishment costs are trivial, and indistinguishable from the ongoing maintenance activities which are deductible marketing expenses.

Example 22 – off-the-shelf software – part of a website, in-house software

An off-the-shelf software program is used by a business owner to design a commercial website for a printing business.

The program is fully integrated with the website and is therefore part of the capital cost of the website asset, and in-house software for the purpose of capital allowance deductions.

Example 23 – definition of ‘in-house software’ – do-it-yourself

website-building application

An online commercial website provides a “DIY” online-only site-builder software tool packaged with web hosting services.

Built sites are not easily transferred to another host.

For the provider, the site-builder software is integral to the business of providing a comprehensive website service, is part of the commercial website, and is therefore in-house software.

For the customer, the site-builder fees are capital in nature, with the resulting website being in-house software. Hosting and maintenance costs are deductible.

Example 24 – software – not part of a website, not in-house software

A software provider offers browser-based free versions of a number of software applications running on its servers. Subscription-based functionality upgrades are also available.

The software is not part of the provider’s website, is indistinguishable from subscription versions and is not provided to enable further interaction with users.

Therefore it is not in-house software.

Example 25 – business from hobby

An employed salary earner engages a web developer to establish a home-handyman website and upload some content.

After some months the site owner decides that website traffic is sufficient to generate income, and enters into relationships for links and advertising and spends significant time on content.

This commercialisation decision meets the criteria in paragraph 13 of TR 97/11 for ‘carrying on a business’ and hosting and maintenance fees are tax deductible from that point forward.

Initial website expenditure is considered an in-house software asset, but decline in value deductions are also not available until the point of carrying on a business. The initial period has the characteristics of a hobby.

Example 26 – domain name

A company buys a domain name at auction for $25,000 which is used in a business.

The purchase price is not immediately deductible but forms part of the cost base for CGT purposes, along with incidental costs such as brokerage fees.

Ongoing periodic registration fees are deductible over the period to which they relate.

See also

This page was last modified 2022-07-18