The checklist below is a tax deduction guide for property investors for expense claims against the income (or potential income) from the renting of property.

This guide provides an outline of what can be claimed on tax for an investment property which is earning income.

There are broadly two types of rental tax deduction:

- deductions available under specific tax provisions – such as Capital Allowances; and

- general deductions which require that there be a connection between the expense and the earning of rental income, adjusted to exclude any capital, private or non-deductible portions

Travel and depreciation expenses limitations, and a fee for foreign owners

Arising from 2017 budget measures announcements, the Treasury Laws Amendment (Housing Tax Integrity) Bill 2017 approved by parliament provides the following amendments:

Travel expenses not deductible

Travel expenditure incurred in earning income from residential premises is not deductible and cannot form part of the cost base of the property for CGT purposes.

This applies from 1 July 2017 for the 2017-18 and following tax years. See more here.

Rental Property Depreciation deductions limited to “new”

Depreciation deductions to be no longer available for ‘previously used’ depreciating assets used in earning income from residential premises used for residential accommodation. This applies for assets acquired from 9 May 2017.

An asset is ‘previously used’ for an entity if:

- the entity is not the first entity that used the asset or installed the asset ready for use (within the meaning of Division 40) other than as trading stock;

- the asset is used or installed ready for use during any income year in premises that are, at that time, a residence of the entity; or

- the asset is used or installed ready for use during any income year for a purpose that is not a taxable purpose, other than incidental or occasional use.

Exclusions

Exclusions are for corporate tax entities, superannuation plans (other than SMSFs), public unit trusts, managed investment trusts and unit trusts or partnerships of any of the above entities

Vacant Land Holding Costs Not Deductible

From July 2019, the holding costs associated with vacant land are not deductible.

Such costs may include interest, rates and taxes and maintenance costs.

See further commentary: Vacant Land Tax Deductions

CGT cost base

Undeducted depreciation is generally recognised for CGT purposes, which means on disposal a capital loss on depreciable assets may be recognised and used to offset against any capital gain.

Thus for the purchase of a ‘second hand property’, a depreciation schedule based on the valuation of depreciable assets which form part of the purchase price will no longer be of any benefit, because any allocation of value will be a subtraction from the value of the land and buildings component of the purchase price.

Any resulting capital gain or loss on subsequent disposal will be matched and cancelled by a corresponding loss or gain on the asset’s remaining value. There may however be some timing advantage if depreciable assets are sold or scrapped before the main property is sold. See an elaboration of this point here.

Foreign owners vacancy fee

An annual vacancy fee applies to foreign owners of residential real estate where residential property is not occupied or genuinely available on the rental market for at least 6 months in a 12 month period.

The fee applies from 7:30PM (AEST) on 9 May 2017. The fee is that which was payable at the time of the foreign investment application. See Foreign Acquisitions and Takeovers Fees Imposition Amendment (Vacancy Fees) Bill 2017

The Australian Tax Office is administering the charge. See further information at Annual vacancy fee for foreign owners

Rental expense deductions

Deductibility of expenses broadly depends on whether there is a required connection between the expense, and a profit-making purpose, in this case rental.

Situations where a rental property is used for part of the year for private purposes generally require that claimable expenses are apportioned to the period(s) for which the property was rented, or genuinely available for rent.

The circumstances of holiday houses are discussed in detail here.

Keep in mind “incurred”

Allowable expenses can be claimed in the tax year in which they are paid or incurred.

To comply with record-keeping requirements, you should keep a date-based record of expenses.

If an expense is incurred before it is paid, the earlier time is the relevant time for a tax deduction purposes. In practice this means that an expense can be claimed before the money has left your pocket.

Paid

Your time and date of payment for tax purposes can be determined from

- the transaction date of an electronic payment

- the transaction date of a credit card payment

- in other cases – as a practical matter – the date of the receipt.

Incurred

For tax purposes, some expenses can be claimed before actual payment is made, provided the expense has been legally “incurred”.

“Incurred” essentially means that the supplier has a legal right to be paid, usually crystallised by the issue and receipt of an invoice.

- An example – annual local government rates notice, which is due by a fixed date. Even if unpaid on the fixed date, the expense is tax deductible in the year received because the debt to the council is fixed, and they have the right to collect payment. The expense is clearly “incurred”.

- By contrast an insurance renewal will not usually become a fixed expense until the premium is paid, with the payment signifying an acceptance of the offer to renew. (see Tax Ruling TR 97/7)

Tip: In practice, rental expenses are often collated on a cash basis, which means expenses which have been legally incurred but not actually paid by the end of the financial year can be easily overlooked as a claim.

Reviewing and comparing the expense schedules from the past two years can help you pick up anything missing from the current year’s expense line-up. See also the checklist below.

Prepayment of rental expenses

Pre-paying expenses can help to maximise tax deductions within a financial year, however there are limitations.

Generally a full deduction is available if the service period of the expense (e.g. insurance) is no more than 12 months or under $1,000 excluding GST.

Deductions not meeting these criteria will need to be spread over two or more years. For further information see Deductions for prepaid expenses guide 2022 (ATO)

Apportionment of expense claims

Expense claims are required to be adjusted (i.e. reduced) to the extent that any part relates to non-rental activities or income, and in proportion to the legal ownership interests of the co-owner investors, which will also reflect the allocation of income.

To be claimable, expenses must relate to a period that the property was rented, or genuinely made available for rent. Expenses which occur before-hand, and afterwards (with some limited exceptions(2)) are not allowable.

(2) Repairs which relate to an earlier period of rental, for a property which is no longer rented, and which are completed before the end of the same financial year are allowable.

Where a property is not rented for its commercial value, or if the property is not available for rental for a period, expenses claimed need to be appropriately apportioned, with losses not generally allowable. Examples:

- a property rented to a relative for less than full rental value

- a holiday house used privately for part of the year

See also: ATO Rental Property Blitz – Fortis Accounting Partners

Rental Property Expenses Schedule

Note: This is a checklist, not advice. Expense claims are subject to limitations based on their character, timing, extent of attribution to rental activities and substantiation. *Some expense claims may be required to be spread over more than one tax year.

- Advertising for tenants

- Property management fees

- Bank fees paid on an account used for rental transactions

- Body corporate or strata fees paid

- Borrowing costs*

- Mortgage discharge costs

- Loan establishment fees*

- Capital allowances, decline in value, depreciation 1 (see limitation from 9 May 2017)

- Cleaning

- Council rates

- Gardening maintenance

- Lawn mowing

- Tree pruning

- Pool cleaning

- Maintenance of grounds, buildings, contents

- Insurances including building, contents and landlords insurance

- Interest on loan(s) or credit cards used to purchase the property or to pay for anything directly associated with the property

- Land tax

- Legal fees – lease preparation

- Legal fees – debt collection, eviction etc

- N.B. Legal fees associated with the property purchase are generally not deductible, but would usually form part of the property’s cost base for CGT purposes.

- Pest control – prevention or eradication

- Repairs to property, equipment or fixtures (distinguish replacements or complete renewals which may need to be capitalised)

- Removal of asbestos 2

- Painting

- Replacing capital items – costs may need to be allocated over the effective life of the asset *

- Stationery, postage, telephone calls and internet access directly related to managing the property, e.g. collecting rent or organising maintenance

- Travelling to inspect, undertake maintenance and repairs or improvements to the property. In some circumstances this can include accommodation. Note: This deduction not available from 1 July 2017.

- Water rates and water consumption

1 Depreciation Limitation From 2017

Depreciation of plant and equipment claims will be restricted to the owner who actually purchased the asset. This applies prospectively to assets purchased after 7.30pm on 9 May 2017.

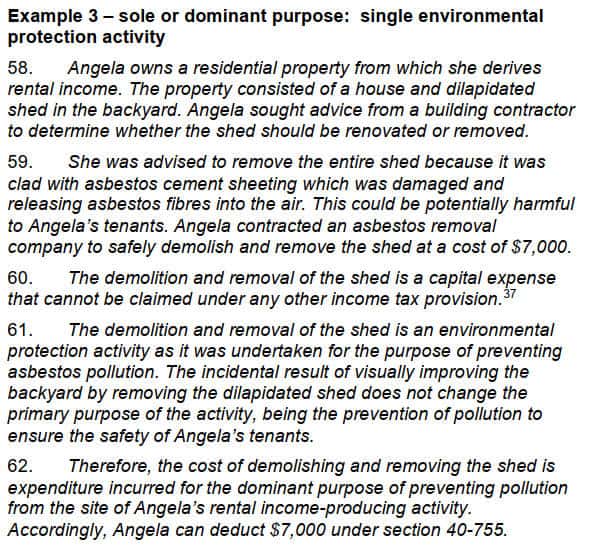

2 Asbestos Removal

Removal of asbestos: An ATO Interpretative Decision (ATO ID 2004/720) now replaced by Taxation Ruling TR 2020/2 confirms that a rental property owner is entitled to claim a deduction for the cost of demolishing and removing an asbestos shed.

The reasoning is that subparagraph 40-755(2)(a)(ii) of the ITAA 1997 allows deductions for the cost of environmental protection activities which prevent pollution of the ‘site of your earning activity’.

Other asbestos removal costs, such as the removal of asbestos roofing, may be claimable on the same basis.

However note that these environmental protection provisions are ‘provisions of last resort’ – meaning that if a deduction is available under any other section of the Tax Act (e.g. for capital works, or repairs), an environmental protection deduction cannot be claimed.

Rental Property Capital Gains tax

CGT was introduced from 20 September 1985 and has an impact on the acquisition and disposal of rental properties and associated assets.

For Information on CGT, see

Further information:

- ATO – Rental Properties Guide 2023

- ATO – Rental Properties Guide 2022

- ATO – Rental Properties Guide 2021

- ATO – Rental Properties Guide 2020

- ATO – Rental Properties Guide 2019

- ATO – Rental Properties Guide 2018

- ATO – Rental Properties Guide 2017

- ATO – Rental Properties Guide 2016

- Bantacs – Owning a rental property booklet

- Negative Gearing

- Reducing PAYG instalments

- ATO guidance – Holiday Homes

- Rental Properties and Travelling Expenses

- Rental Property Tax Return Checklist – Knox Taxation and Business Advisory

Rental properties and GST

This article is primarily from the point of view of an individual investor in residential property, which is not a rental business, and is input taxed for GST purposes.

Although there is much in common, the leasing of commercial properties, rental businesses and activities conducted by non-individual entities have issues other than those referred to here.

For more information see: Leasing and renting commercial premises (ATO)

Rental Property Business

Whether a taxpayer is carrying on business is determined by facts and circumstances.

Procedures exist for clarifying a tax position in this regard – see details here.

Depreciation legislation for Australian Property investors – from May 2017

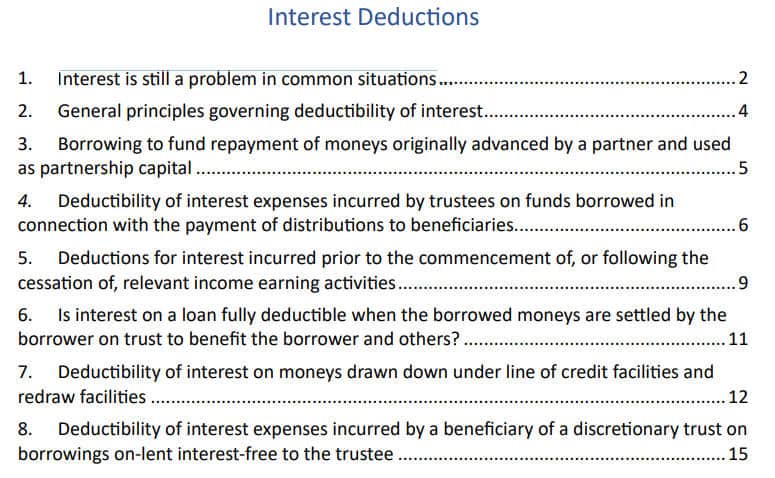

Rental Properties Interest Expenses

There are a number of misunderstandings about how an interest deduction associated with a rental property should be calculated and claimed.

In general, interest on loans used to buy a rental property, or associated assets and renovations can be claimed, including interest pre-paid up to 12 months in advance.

Repayments of loan principal are not deductible, nor are interest costs associated with loans for any other purpose.

Where there is a dual purpose, interest must be apportioned. For further details and examples, see the fact sheet below.

The ATO has published a fact sheet clarifying when interest is deductible and where applicable, to what extent.

Click to read (PDF)

Claiming interest is still a problem in some situations

Some circumstances can be complex, especially when it comes to allocating deductions in relation to partnerships and trusts, and misunderstandings still prevail in common situations.

The Tax Rambling blog has recently (June 2023) published a paper highlighting the issues.

Click to read (PDF)

ATO’s Tax Time Focus On Rental Income & Deductions

The ATO routinely receives data for matching purposes to enable tracing of erroneous tax returns.

Their advice has been published referring to aspects of their compliance focus.

They include:

- Include all income, including from short term arrangements and miscellaneous income such as insurance recoveries

- expenses, including capital expenses to be correctly allocated to financial years based on timing or the capital allowance provisions

- loan interest calculations to be correctly adjusted in accordance with the tax purpose of the loan and eliminating any private elements

- CGT to be considered on the sale of a property, along with clearance certificates (or 12.5% withholding) on properties over $750,000

- Keep good records of transactions for 5 years from date of tax return lodgement or asset disposal.

See further:

- Taxpayer alert – ATO to crack down on landlords, short-term rentals and WFH deductions – Holding Redlich

- Tax time focus on rental property income and

deductions 2022 – ATO

This page was last modified 2023-06-28