If you are an owner or part owner of a rental property, claims for expenses for travelling to the property to carry out maintenance or to inspect the property or for other reasons associated with the rental activity, such as collecting the rent, were deductible up until 30 June 2017.

Travelling expenses no longer deductible

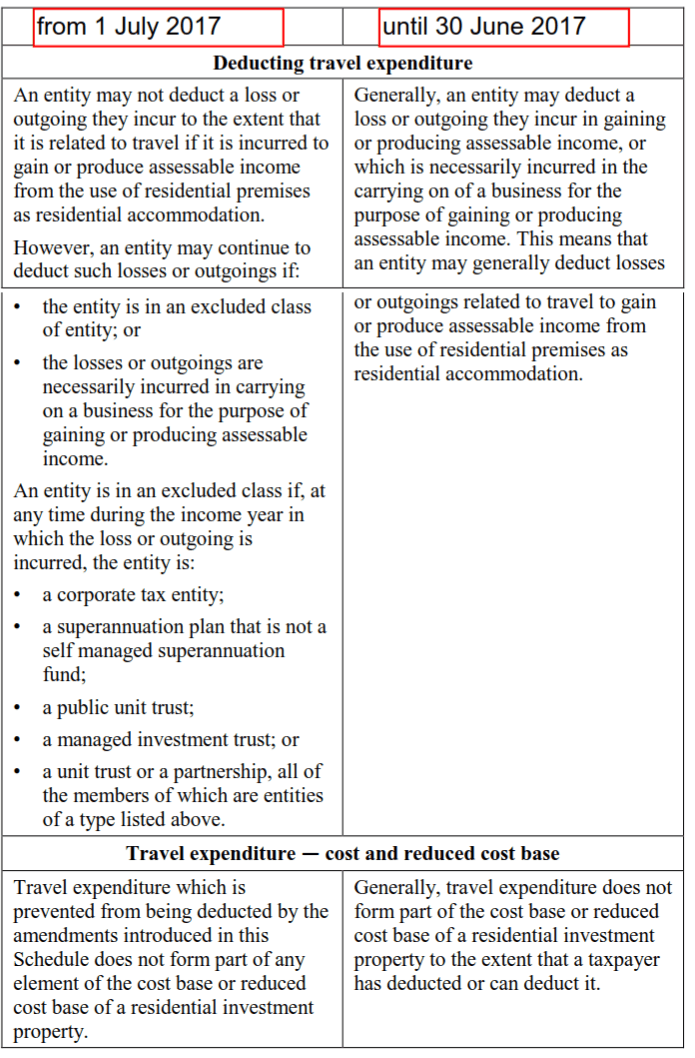

As foreshadowed in the 2017 budget, the Treasury Laws Amendment (Housing Tax Integrity) Bill 2017 (now law) provides that from 1 July 2017 travel expenditure incurred in earning income from residential premises is not deductible.

Rental property travel expenses also cannot form part of the cost base of the property for CGT purposes.

Detailed guidance on the operation of the new rules can be found in Law Companion Ruling LCR 2018/7, including important definitions for “residential premises” and “carrying on a business” and how to treat expenses which have multiple purposes.

Deductions for travel:

The following reflects the position until 30 June 2017:

The property must be rented, or genuinely available for rental. This generally means that expenses of pre-purchase property inspections, or travelling during a pre-rental renovation period are not claimable as rental deductions.

Any expenses claimed must be mainly associated with the rental activity and not incidental to it.

Journeys which have a mainly private purpose are not claimable. Subject to that important exclusion, and according to the circumstances, a travelling claim can therefore include a claim for motor vehicle expenses, or if the property is far away, air fares, accommodation and meals can be substantiated and claimed as travelling expenses.

For evidence of deductible costs, choose one of the alternative car expense substantiation methods applicable to car expenses, or otherwise written evidence in the form of receipts and a travel diary would be necessary.

One simple and relatively claim substantiation method is by use of a diary record of trips and their purpose, with a tax claim calculated as a per kilometre rate using the Tax Office set rates.

At the other end of the scale, larger claims for travelling expenses in connection with a rental property which is in an interstate location for example, or even overseas, are more likely to attract the attention of Tax Office auditors, who will want to see written evidence not only of the actual costs, but evidence which excludes the possibility that the expenses are private, or only incidentally associated with the rental activity.

Further information:

This page was last modified 2018-10-10