2017-18 Federal Budget

The 2017 budget speech was delivered to parliament by the Treasurer at 7.30pm on Tuesday, 9 May 2017. budget.gov.au

Budget Highlights

- small business instant asset write-off (up to $20,000) will be extended by 1 year to 30 June 2018. Legislation has now been passed – see: Treasury Laws Amendment (Accelerated Depreciation For Small Business Entities) Bill 2017).

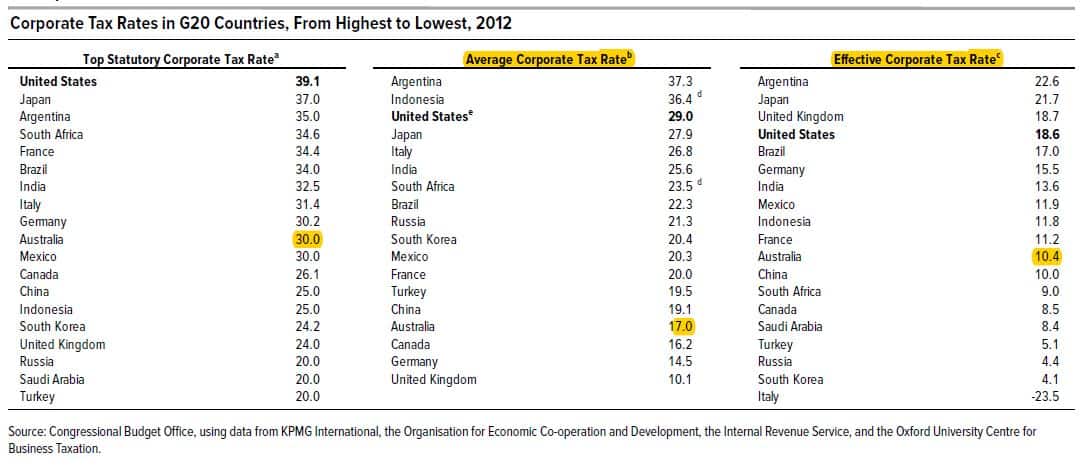

- Company Tax: The government has re-committed to its 10-year Enterprise Tax Plan to reduce the company tax rate to 25% for all companies. Following previous reductions (now passed by parliament), the corporate tax rate will be further reduced in stages from 1 July 2024 to reach 25% by the 2026-27 financial year for businesses with an aggregated turnover of less than $50 million.

- First home supersaver scheme. Salary sacrifice for first home-owner savers – super contributions made from 1 July 2017 may be withdrawn from 1 July 2018 for a first home deposit. Concessional contributions and earnings withdrawn will be taxed at marginal rates less a 30% offset. Up to $15,000 per year can be contributed, $30,000 in total within existing caps. Both members of a couple can combine savings for a single deposit to buy their first home together. How much can you save? Calculate it here.

- Downsizing home super contribution: Aged 65 and over can contribute up to $300,000 from sale of home as non-concessional superannuation contributions

- Residential rental property owners are to be hit with two deduction limitations:

- Deductions for travel expenses related to a residential rental property disallowed from 1 July 2017

- Depreciation of plant and equipment claims will be restricted to the owner who actually purchased the asset. This will apply prospectively to assets purchased after 7.30pm on 9 May 2017.

- Foreign resident CGT withholding will apply to Australian real property valued at $750,000 or more (down from $2 million), and the withholding rate increased (from 10%) to 12.5%

- Foreign and temporary tax residents will be denied access to the CGT main residence exemption from 7:30PM (AEST) on 9 May 2017, however existing properties held prior to this date will be grandfathered until 30 June 2019

- Foreign investor levy: An annual foreign investment levy of at least $5,000 on all future foreign investors who fail to either occupy or lease their property for at least six months each year. This measure will apply to foreign persons who make a foreign investment application for residential property from 7:30 pm (AEST) on 9 May 2017.

- The Government will introduce a 50 per cent cap on foreign ownership in new developments through a condition on New Dwelling Exemption Certificates. The cap will be included as a condition on New Dwelling Exemption Certificates where the application was made from 7:30PM (AEST) on 9 May 2017.

- Managed investment trusts will be able to invest in affordable housing

- Plant and equipment depreciation deductions to be limited for real estate investors from 1 July 2017

- Basic medicare levy to be increased by 0.5% to 2.5% from 1 July 2019, in order to ensure the National Disability Insurance

Scheme is fully funded. Tax rates which are linked to the top marginal rate (such as FBT) will increase accordingly). - Medicare levy low income thresholds again uplifted (CPI indexed) for 2016-17

- Taxable payments reporting system will be extended to courier and cleaning industries from 1 July 2018

- CGT discount for resident individuals investing in affordable housing up to 60% from 1 Jan 2018

- Use of LRBAs included in total superannuation balance and transfer balance cap from 1 July 2017

- GST treatment of digital currency (e.g. bitcoin) will be aligned with that of money from 1 July 2017

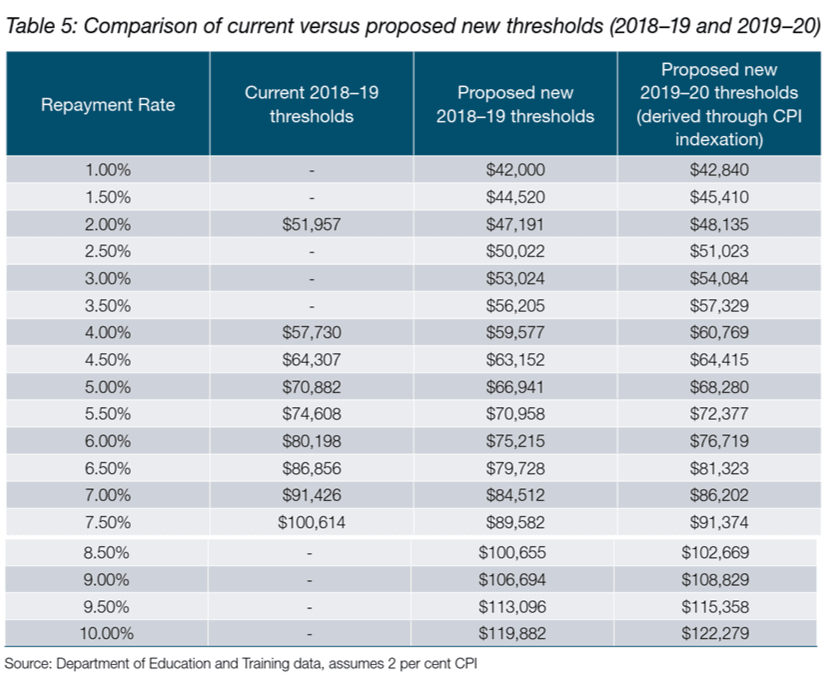

- New repayment thresholds and rates for HECS-HELP program from 1 July 2018 (previously announced)

- Purchasers of new residential properties to remit GST directly to ATO. The measures are to apply to contracts entered into from 1 July 2018, with pre-existing contracts excluded until 1 July 2020. For updates and progress see GST matters.

- The pensioner concession card is to be restored to those impacted by the pension assets test change introduced earlier this year (2017), there will be a tightened residency test and a one-off Energy Assistance Payment

- The government has re-committed to the its 10-year Enterprise Tax Plan to reduce the company tax rate to 25% for all companies.

In addition to reductions which have already passed through parliament, the corporate tax rate will be further reduced in stages from 1 July 2024 to reach 25% by the 2026-27 financial year for businesses with an aggregated turnover of less than $50 million.

Further information:

- The contents of the 2017-18 Budget (budget papers) can be viewed online here.

- Budget Review 2017–18 – Budget Briefs prepared by the Parliamentary Library

- Budget measures – by alphabetical list – Department of Human Services

- Federal Budget Winners and Losers (abc.net.au)

- Holding Redlich’s expert guide to the 2017 Federal Budget

Budget Reports

- Federal Budget Review (Grant Thornton)

- PwC`s 2017-18 Federal Budget Analysis (PWC)

- Federal Budget Plan your trip. Road work ahead (Pitcher Partners)

- A Review of the Budget’s Major Business Implications (KPMG)

- Federal Budget Tax Bulletin (Thomson Reuters)

Treasurer’s Budget Speech

Opposition Leader’s Budget In Reply Speech

Pre-budget 2017 news and speculation

- (May 9, 2017) Federal budget 2017: What we know so far

- (May 8, 2017) Small Business Wish List & CPAA claims extension of instant asset write-off is likely

- (May 7, 2017) Scott Morrison warns of spending cuts to pay for budget health and education fixes

- (May 6, 2017) Scott Morrison: new budget test for ‘nowhere man‘

- HECS-HELP repayment schedules are to be revised:

[News May 1, 2017] The Minister Simon Birmingham has announced a new lower income repayment threshold of $42,000 will be introduced with a repayment rate of 1%, and additional higher threshold bands increasing to a top 10% repayment rate.

For further details – see media release here and the Higher Education Reform Package document (pdf). See also HECS-HELP repayments further information.

- (May 1, 2017) HECS repayment income threshold to be reduced to $42,000

- (May 1, 2017) Here’s what to expect in the 2017 budget

- (April 27, 2017) Scott Morrison flags budget reporting changes

- (April 19, 2017) How can we simplify the tax system?

- Reserve Bank snapshots

- (April 13, 2017) Turnbull slaps down super-for-housing push

- (April 10, 2017) Housing affordability and negative gearing – Treasurer’s address to the Australian Housing and Urban Research Institute, Melbourne

- (April 7, 2017) Just how uncompetitive is Australia’s tax system?

- (March 30, 2017) Scott Morrison on his company tax plan – ABC 7.30 Report

- (Feb 17, 2017) 2017-18 pre-Budget submissions

This page was last modified 2017-11-07