GST Matters – news

GST On Combination Foods – Ruling

The Commissioner has issued draft determination GSTD 2023/D1 which seeks to clarify the position when a food product is a combination of foods, at least one of which is taxable.

The ruling was issued in response to a tribunal decision in Chobani Pty Ltd and Commissioner of Taxation [2023] AATA 1664 which found a flavoured yoghurt product was taxable.

Details of the ruling are further outlined here.

GST Correction of errors

Draft Legislative Instrument LI 2023/D13 allows for the correction of errors made in earlier tax periods from on or after 2012 relating to GST, input tax credit within the period of review, and subject to certain compliance conditions.

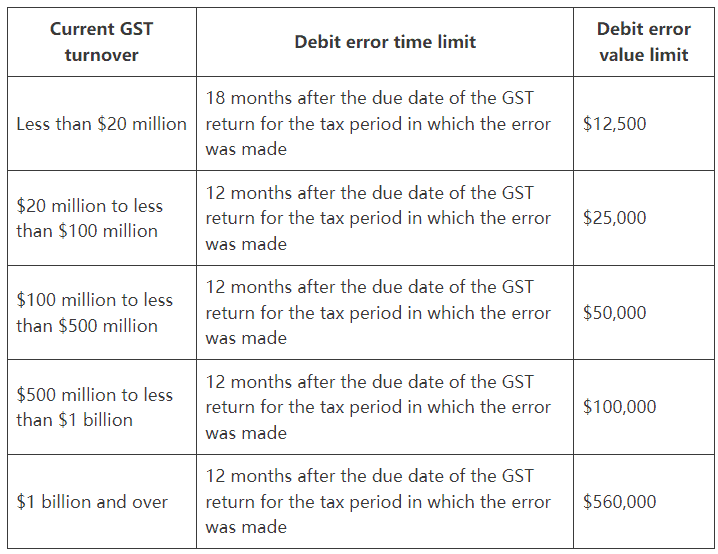

Debit error corrections are subject to time and value limits based on GST turnover:

See also: MT 2024/D1 Miscellaneous tax: time limits for claiming an input tax or fuel tax credit

GST free supply of cars & car parts for disabled

The GST-free supply of cars and car parts is extended to disabled people who:

- have lost the use of one or more limbs to such an extent that they are unable to use public transport, and

- intend to use the car for personal transportation to or from gainful employment for at least two years or 40,000 kilometres from the date of purchase or lease.

The proposed extension of GST free status does not affect existing certificated exemptions for disabled persons.

Importers GST deferral scheme

In the context of helping businesses during the COVID-19 period, the Tax Office is advising importers to consider swapping to monthly GST reporting and request a deferral of GST.

Current action (April 2020) is recommended before the end of April, otherwise the changes flowing from applications lodged in May or June would not take effect until 1 July 2020 (i.e. the next quarter).

Procedures for changing to monthly reporting and accessing the GST deferral scheme are explained here.

GST and Intangibles

The ATO has released guidance in the form of GSTR 2019/1 Goods and services tax: supply of anything other than goods or real property connected with the indirect tax zone (Australia).

GST and GSTR 2018/1

GST on tampons removed

The GST which applied to feminine hygiene products was removed with effect from 1 January 2019.

Amending the GST required the agreement of the states, which was obtained.

A GST determination was issued on 26 November 2018 taking effect 1 January 2019.

A list of GST–free health goods is here.

See further: Removing GST on feminine hygiene products

GST on new property sales to be remitted from settlement proceeds

The legislation has been passed by parliament to require purchasers to withhold and remit GST from settlement proceeds on the purchase of new residential premises and subdivisions.

See the Treasury Laws Amendment (2018 Measures No. 1) Bill 2018

The measures apply to contracts entered into from 1 July 2018, with pre-existing contracts excluded until 1 July 2020.

- Settlement Guide For Purchasers

- Settlement Guide For Vendors

- Detailed guidance – see Purchaser’s obligation to pay an amount for GST on taxable supplies of certain real property Law Companion Ruling LCR 2018/4

- Further info links – see summary here and here and summary of the transitional measures

- See also Stamp duty payable on the total consideration including GST, even if paid directly to the ATO

GST on low value imported physical goods

The Government has passed legislation to reduce the current tax-free threshold on online sales of imported physical goods from $1,000 to zero.

This measure starts on 1 July 2018.

The changes require non-resident suppliers with an Australian turnover of $75,000 or more to register and charge the GST.

- Dropshipping arrangements – see Law Companion Ruling LCR 2018/1 GST on low value imported goods

- see also:

- Law Companion Ruling LCR 2018/2 GST on supplies made through electronic distribution platforms

- Law Companion Ruling LCR 2018/3 When is a redeliverer responsible for GST on a supply of low value imported goods?

GST on imported digital products and services

A 2015 Budget measure now enacted extends the application of GST to digital products and services obtained by consumers online from overseas suppliers.

The changes apply from 1 July 2017.

Foreign suppliers to Australian consumers (not through an enterprise in Australia) are required to register for GST if their turnover exceeds $75,000.

Under these measures, GST applies to anything other than goods or real property supplied to non-GST-registered Australian residents.

Note that these measures do not require GST-registered Australian businesses to pay GST on their imported inputs.

Where supplies are made by merchants through an Electronic Distribution Platform, GST liability falls on the Operator of the Electronic Distribution Platforms rather than the merchant.

The intention is that the affected suppliers and supplies will be subject to the same GST turnover, registration and payment rules as Australian domestic suppliers.

See further:

Non-resident businesses registration obligations

The Tax and Superannuation Laws Amendment (2016 Measures No. 1) Bill 2016 passed by parliament in May 2016 relieves non-resident suppliers of the obligation to account for GST on certain supplies, with any GST obligations shifted to Australian-based business recipients that are already registered for GST.

Non-residents and their resident agents can agree that the resident agent will be the liable entity for GST, despite the other amendments.

The measures are designed to prevent nonresident businesses being unnecessarily drawn into the Australian GST system through B2B transactions and come into effect from 1 October 2016.

See further:

- GST registration system for non-resident businesses

- Law Companion Guide LCG 2016/1 – GST and carrying on an enterprise in the indirect tax zone (Australia)

Barter transactions simpler

A Practical Compliance Guideline (PCG 2016/18) released by the Tax Office potentially reduces GST compliance in relation to certain barter (countertrade) transactions.

Basically, direct barter transactions which are GST-neutral will not be the subject to ATO enforcement of the GST reporting requirements. Those requirements would otherwise require the production of tax invoices and the determination of GST value.

A proviso is that countertrade transactions are no more than “approximately 10% of the entity’s total number of supplies”.

Charities and GST-Free Supplies

Supplies by registered charities endorsed by the Tax Office are GST-free if provided for ‘nominal’ consideration.

In determining whether the consideration is nominal, the entity may (subject to qualification) use a market value or cost of supply method.

Where the market value method is used, the Tax Office provides market value benchmarks by which to determine whether a supply’s consideration may be considered ‘nominal’ (and hence GST-free) or not.

These reflect the application of Sec 38-250 of the GST rules

Under the market value method, the supply by an endorsed charity will be considered to be for nominal consideration if it is

- less than 75% of the GST-inclusive market value for supplies of accommodation

- less than 50% of the GST-inclusive market value for supplies other than accommodation.

Market value benchmarks categorised by expense type and geographical location are updated by the Tax Office on an annual basis.

Under the cost of supply method, the supply by an endorsed charity will be considered to be for nominal consideration if it is supplied at less than 75% of the cost to the charity.

GST and Property Transactions

The Tax Office has organised GST information as it applies to property transactions into categories.

See:

- GST and property

- GST and residential property

- GST and commercial property

- GST at settlement

- GST and the margin scheme

BAS Statements

See BAS statement info here: BAS Statements

This page was last modified 2023-10-11