What is capped effective life?

The Commissioner’s schedules for determining effective life contain a number of asset types and industry categories where the effective lives have been “capped”.

Capped effective lives are shorter than the effective life determined by the Commissioner’s normal determination process, and must be used when the Commissioner’s effective life method is selected.

Taxpayers claiming depreciation have a choice of determining effective life from a process of self-assessment, or by using a Tax Office prescribed schedule referred to as the Commissioner’s Effective Life schedules.

This however does not remove the option to self-assess effective life as an alternative.

How to check or find capped effective life assets

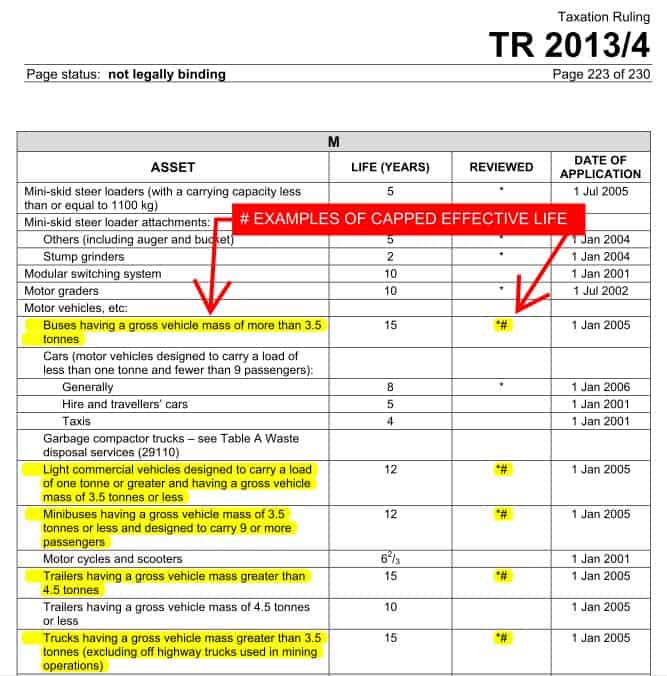

Assets which have a cap applied to their effective life are indicated in the Commissioner’s schedules with the “#” symbol – see examples below:

For the most recently released Commissioner’s Effective Life schedules -see Ato Depreciation rates

There are two types of capped effective life assets:

General – assets which have a capped effective life regardless of the industry usage

| Item | Asset | Effective Life (yrs) | Start Time * |

| 1 | Aeroplane used predominantly for agricultural spraying or agricultural dusting | 8 | 1 July 2002 |

| 2 | Aeroplane to which Item 1 does not apply | 10 | 1 July 2002 |

| 3 | Helicopter used predominantly for mustering, agricultural spraying or agricultural dusting | 8 | 1 July 2002 |

| 4 | Helicopter to which Item 3 does not apply | 10 | 1 July 2002 |

| 5 | Bus with a gross vehicle mass of more than 3.5 tonnes | 7.5 | 1 January 2005 |

| 6 | Light commercial vehicle with a carrying capacity of one tonne or greater and a gross vehicle mass of 3.5 tonnes or less (including utilities, vans, and light trucks) | 7.5 | 1 January 2005 |

| 7 | Minibuses with a gross vehicle mass of 3.5 tonnes or less and seats for 9 or more passengers | 7.5 | 1 January 2005 |

| 8 | Trailers with a gross vehicle mass greater than 4.5 tonnes | 10 | 1 January 2005 |

| 9 | Truck with a gross vehicle mass greater than 3.5 tonnes (other than a truck that is used in mining operations and that is not of a kind that can be registered to be driven on a public road in the place in which the truck is operated) | 7.5 | 1 January 2005 |

Assets which have a capped effective life ONLY where used in the specified industry

| Item | Asset | Industry | Effective Life (yrs) | Start Time * |

| 1 | Gas Transmission Asset | Gas supply | 20 | 1 July 2002 |

| 2 | Gas Distribution Asset | Gas Supply | 20 | 1 July 2002 |

| 3 | Oil Production Asset (Other Than An Electricity Generation Asset Or An Offshore Platform) | Oil And Gas Extraction | 15 | 1 July 2002 |

| 4 | Gas Production Asset (Other Than An Electricity Generation Asset Or An Offshore Platform) | Oil And Gas Extraction | 15 | 1 July 2002 |

| 5 | Offshore Platform | Oil And Gas Extraction | 20 | 1 July 2002 |

| 6 | Asset (Other Than An Electricity Generation Asset) Used To Manufacture Condensate, Crude Oil, Domestic Gas, Liquid Natural Gas Or Liquid Petroleum Gas But Not If The Manufacture Occurs In An Oil Refinery | Petroleum Refining | 15 | 1 July 2002 |

| 7 | Harvester | Primary Production Sector | 6 2/3 | 1 July 2007 |

| 8 | Tractor | Primary Production Sector | 6 2/3 | 1 July 2007 |

* The start time of an asset is when it is first used, or installed ready for use. A capped effective life cannot apply if a contract to acquire an asset or if it was acquired, or its construction commenced, before 21 September 1999

This page was last modified on 2017-10-21