The log book method can be used to substantiate work related car expense claims.

Using the Log Book method, a percentage of actual car expenses is claimed.

The percentage claimable is determined by the log book record showing the proportion of business kilometres travelled.

Log book claims are only allowed by a taxpayer who owns or leases the car for which expenses are being claimed.

On this page:

Log book requirements

Log book format

Car expenses claim

Substantiation of expenses

Electric Vehicles

Estimating fuel costs

Why use the log book method?

Disposal

Log Book Requirements

A log book record of car trips doesn’t need to be kept for the whole year. The minimum requirement is a continuous 12-week period which commences in or before the tax year.

For two or more cars, the log books must cover the same 12 week period. If a car is swapped, a new log book is not required, but a ‘nomination’ must be made noting the following information for both cars:

- start and ending odometer readings for the period

- make, model and registration particulars

- engine capacities

Unless circumstances change, the next log book is required in 5 years time.

Changed circumstances include:

- a request from the Tax Office

- a second car is introduced

- you wish to vary the percentage claim

In practice, the Log Book is treated pretty much as the final word in substantiating car expense claims, extending as it does for a 5-year period. But if there is a material change in circumstances, the onus remains on the taxpayer to ensure that business percentage claims in the non-log book years remain ‘reasonable’.

Log Book Format

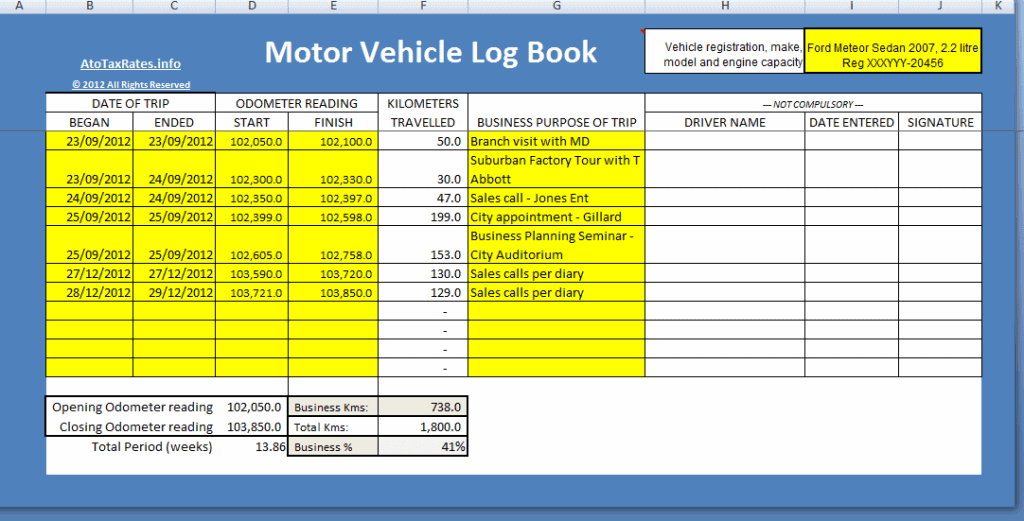

There is no prescribed Log Book format, only prescribed information. Printed log books in the correct format can be bought from newsagents, or you can devise your own with the required information.

A Log Book may also be kept in electronic form. For the paperless option, there is a simple spreadsheet version of a motor vehicle log book here.

Information Required:

You must record the make, model, engine capacity and registration number of the car, and the Log Book must record for a 12 week period:

- starting and ending log book dates

- starting and ending odometer readings

- total kilometres travelled

- total business kilometres travelled

- the business percentage

For each journey, record the following:

- beginning and end date

- beginning and ending odometer readings

- total kilometres for the journey (consecutive business journeys may be aggregated)

- reason(s) for the journey (important: clearly identify the work/business related purposes)

- total business kilometres

Log book entries no longer need to be signed, or identify the person making the entry.

There’s a vehicle log book spreadsheet here.

Car Expenses Claim

The deduction claimed as a result of the Log Book method is calculated as a percentage of total operating expenses.

The percentage is simply the ratio of log-book business kilometres to total kilometres.

Claimable expenses include depreciation up to a limit. The purchase costs of a car cannot be claimed in full, but form the basis of a depreciation allowance calculation which is included with the other operating expenses.

Car parking fees and tolls are not considered to be ‘car expenses’ and can be claimed separately (i.e. without the need to be adjusted by the log book business percentage).

Claimable expenses must relate to the period of ownership or leasing, and the period of related business activity. Claimable expenditure includes operating or recurring expenses, such as:

- Fuel and oil

- Maintenance & repairs

- Insurance and licensing

- Financing costs (e.g. interest)

- Leasing fees, except for Luxury Cars for which the leasing costs are replaced by a depreciation claim using the capped depreciation limit plus finance costs

- cost of electricity used to recharge an electric vehicle

Substantiation of expenses

Expenses must be fully substantiated. This means having documentary (i.e. written) evidence available to support the claims.

This doesn’t necessarily mean a receipt as such, although that is likely to be the most convenient record to serve this purpose.

However the Tax Office has indicated than other than a written document from the supplier, other records or combinations of records may suffice. And that can include bank statements and electronically produced records.

Whatever the document or combination of documents, the following information that must be identifiable:

- name of the supplier

- amount of the expense

- nature of the goods or services

- date the expense was incurred

- date of the document

If the nature of goods or services is not shown, you are allowed to write this on the document before your tax return is lodged.

The Tax Office Practice Statement PS LA 2005/7 has more on this.

The Tax Office will accept fuel and oil costs estimated if receipts or other sufficient records haven’t been kept (see below)

Minor expenses of $10 or less each up to a total of $200 per year can also be claimed in circumstances where a receipt is not obtainable – e.g. toll fees.

Log book expenses substantiation records

| Fuel | Receipts* or reasonable estimate |

| Oil | Receipts* or estimate e.g. based on usual oil change intervals |

| Insurance, rego, repairs, maintenance | Receipts* |

| Depreciation | Receipts* for vehicle purchase and depreciation calculation method |

| Finance costs (loan or lease) | Contract |

| Home electricity (electric vehicles) | Cost or estimate per PCG 2023/D1 |

* i.e. receipts or other records which meet the information requirements as described above

Estimating Fuel Costs

Fuel and oil expenses can be claimed on the basis of a ‘reasonable estimate’. The Tax Office has provided specific guidance on this in Tax Determination TD97/19.

The key points in summary are:

- Records of odometer readings are required to support the kilometres travelled, including start and end of the period of ownership or lease

- Records should also show the car’s engine capacity, make, model and registration number

- Average fuel costs can be based on Australian Bureau of Statistics data for capital cities or from another independent source in other places e.g. see AAA fuel prices

- Average fuel consumption may be based on based on the Green Vehicle Guide Fuel Calculator

It is open to a taxpayer to prove higher costs or consumption than the above sources indicate, if the evidence can be produced. For example, verifiable data based on local conditions or special circumstances.

Estimating fuel costs, based on the actual price and consumption can be done like this:

- Fill the vehicle’s fuel tank and record (a) the odometer reading

- Next time you fill the tank, record (b) the odometer reading, (c) litres consumed and (d) the total cost.

- Calculate kms travelled (k) = (b) – (a)

- Calculate cost per litre CPL = (d) ÷ (c)

- Calculate litres per km LPK = (c) ÷ (k)

- Calculate the cost per kilometre = CPL ÷ LPK

To handle the arithmetic, there’s a spreadsheet here. Just copy it to your drive. (Menu>file>make a copy)

Home Electricity (Battery Recharging) Costs 4.2 cents Per Kilometre

To enable the calculation of home electricity cost for deduction purposes, the Tax Office has provided a calculation method in Practical Compliance Guideline PCG 2024/2 at the rate of 4.2 cents per kilometre.

Practical Compliance Guideline PCG 2024/2 -Electric vehicle home charging rate

If you’re charging your electric car at home and need to figure out the electricity costs for tax reasons, PCG 2024/2 provides guidelines to follow.

This applies to zero-emission electric vehicles, but it doesn’t cover plug-in hybrids or electric bikes and scooters.

You’ve basically got two choices: use the method suggested in the guideline or work out the actual electricity costs yourself.

Starting from 1 April 2022, the cost for charging at home is pegged at 4.20 cents per kilometer, or from tax year starting on 1 July 2022. This is based on collected vehicle and electricity cost data.

If the deductible percentage of charging costs can’t be determined, you can choose between using the fixed home charging rate or the costs from commercial charging stations.

If the home charging cannot be accurately determined, and you opt for the fixed rate, costs from commercial charging stations must be excluded from the calculation.

But you have the flexibility to choose annually between methods.

It’s important to keep records. This means recording odometer readings and, if applicable, maintaining a valid logbook.

EV electicity cost calculation scenarios:

The Guidelines provide some illustrative examples with scenarios, which include:

- Example 1: Plug-in hybrid vehicle not eligible for EV home charging rate

- Example 2: Home charging percentage accurately determined by vehicle report

- Example 3: Home charging percentage not accurately determined and commercial charging station cost disregarded

- Example 4: Reimbursement of home charging cost for novated lease car benefit

- Example 5: Reimbursement of home charging cost as an exempt car expense payment benefit

- Example 6: Statutory formula method for electric vehicle above luxury car tax threshold

- Example 7: Electric vehicle eligible for FBT exemption and reportable fringe benefit amount

- Example 8: Operating cost method for electric vehicle

- Example 9: Logbook method for electric vehicle

Why use the logbook method?

The choice of claim method can be made each year, and ideally records are kept so that a comparison reveals the best choice.

In practice the “hassle factor” often determines the choice of method. The need to keep a log book for 12 weeks every 5 years along with substantiation of all expenses is not everyone’s preference.

If only odometer records and business kms have been recorded or estimated, then the log book method cannot be used, and cents per km method is the alternative.

On the other hand if business travel is high (greater than 5,000 kms for the year), or if expenses are particularly high, then a claim using the the cents per km method may well fall short of a log book claim, depending on the business percentage and the other vehicle cost factors.

Disposal

When a car that has been the subject of a tax claim is sold, lost or destroyed, a ‘balancing charge’ adjustment might need to be calculated for your tax return for the year of disposal.

This page was last modified 2024-02-02