Self-education expenses which are

- associated with a course

- to gain a formally recognised qualification

- from a place of education including a school, college or university

- that are related to your work as an employee

..may be a tax deduction if the following circumstances are true:

- the course maintained or improved a skill or specific knowledge required for your work at the time; and

- you can show that the course was likely to lead to increased income from those work activities; or

- other circumstances provided a sufficient direct connection between the course and those work activities

TR 2024/3 Income tax: deductibility of self-education expenses incurred by an individual

The Tax Office has released guidance for the claiming of self education expenses in the form of Tax Ruling TR 2024/3 which lists out 38 categorised examples of claimable and non-claimable expenses.

A summary of examples provided in the ruling is set out below:

| Example | Brief Description | Deduction? |

|---|---|---|

| Example 1 | Self-education expenses for maintaining/increasing knowledge required in current position | Deductible |

| Example 2 | Personal development course expenses not reimbursed by employer | Deductible |

| Example 3 | Driving course fee for skills directly related to employment | Deductible |

| Example 4 | Expenses for stress management course | Non-deductible |

| Example 5 | Overseas trip expenses for general knowledge improvement | Non-deductible |

| Example 6 | Apprenticeship expenses considered self-education | Deductible |

| Example 7 | Self-education leading to guaranteed promotion | Deductible |

| Example 8 | Self-education leading to higher income but in a different position | Non-deductible |

| Example 9 | Self-education at a point too soon | Non-deductible |

| Example 10 | Self-education to get new employment | Non-deductible |

| Example 11 | Self-education for new employment | Non-deductible |

| Example 12 | Course not opening new income-earning activity within current employment | Deductible |

| Example 13 | Self-education to get new income-earning activity | Non-deductible |

| Example 14 | Self-education to get new income-earning activity | Non-deductible |

| Example 15 | Self-education to get new income-earning activity / later incurred with connection to income-earning activities | Non-deductible / Deductible |

| Example 16 | Fees for education after being made redundant | Non-deductible |

| Example 17 | Self-education expenses for ABSTUDY recipient | Non-deductible |

| Example 18 | Incidental private purpose expenses | The main expenses can still be deductible |

| Example 19 | Course during holiday, private purpose not incidental | Apportioned Deduction |

| Example 20 | Course and holiday, dual purpose expenses | Apportioned Deduction |

| Example 21 | Cost of individual subjects directly related to employment | Deductible |

| Example 22 | Cost of personal development course | Partial deduction |

| Example 23 | Course fees for employment-related education, FEE-HELP received | Deductible |

| Example 24 | Course fees for employment-related education, FEE-HELP received, Commonwealth supported student in a CSP | Non-deductible |

| Example 25 | Cancelled enrolment fees for work-related course | Deductible |

| Example 26 | Interest on loan for deductible self-education expenses | Deductible |

| Example 27 | Interest on loan not related to self-education expenses to get new employment | Non-deductible |

| Example 28 | Cost of study supplies for deductible self-education expenses | Deductible |

| Example 29 | Digital subscription partially used for employment | Partly Deductible |

| Example 30 | Cost of airfares for work-related education | Deductible |

| Example 31 | Accommodation and meal expenses for educational activities | Deductible |

| Example 32 | Meals and incidental expenses, work-related conference, no overnight stay | Non-deductible |

| Example 33 | Accommodation and meal expenses for employment-related education, temporarily away from home expenses | Deductible |

| Example 34 | Accommodation and meal expenses for employment-related education, living away from home | Non-deductible |

| Example 35 | Accommodation expenses for employment-related study tour overseas | Deductible |

| Example 36 | Accommodation and meal expenses while living in the U.S. for a 12 months university course | Non-deductible |

| Example 37 | Expenses for 3 week course in London, extended to 6 months | Partly deductible |

| Example 38 | Public transport fares for travel from home to place of self-education related to employment | Deductible |

Note this summary is a general guide only. The Ruling should be consulted for an explanation of the principles on which the examples are based.

Deductible self-education expenses must be work-related at the time incurred.

In claiming the connection with work, the timing of expenses can be significant. In an AAT case, an employee was denied deductions for the costs of an MBA course which became payable after he was made redundant. See Thomas and Commissioner of Taxation (Taxation) [2015] AATA 687 (9 September 2015)

- Deductions which might otherwise be claimable against government assistance payments such as Austudy, ABSTUDY or Youth Allowance have not been allowed since 1 July 2011

- Expenses which enable new or unrelated employment are not allowable

- Payments to the various government student loans assistance schemes are not allowable

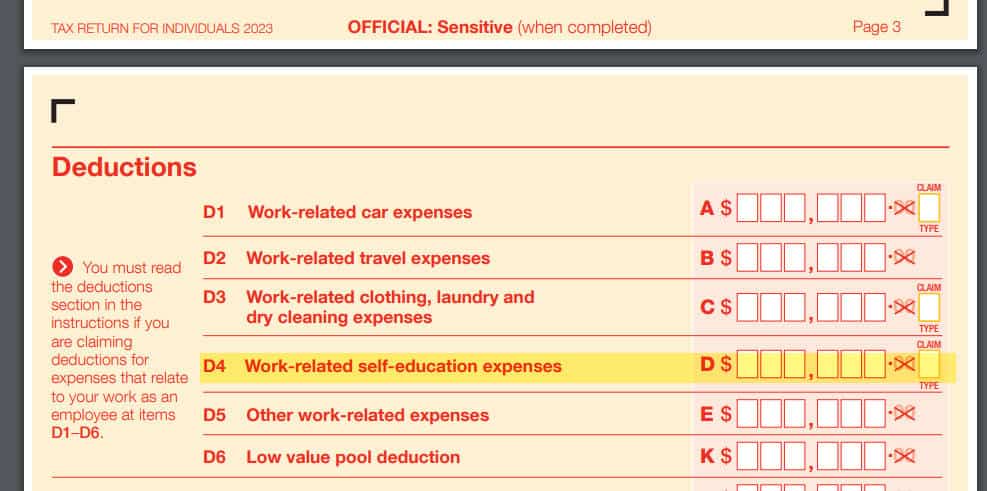

Self-education expenses are claimable at Item D4 of the individual income tax return.

Self education expenses are essentially a claim for a work-related expense under Section 8.1 (General Deductions), together with specifically allowable expense claims such as repairs and depreciation.

What’s included in a self-education claim

Expenses commonly qualifying for the self-education deduction include:

- tuition fees

- the cost of accommodation and meals during temporary overnight absences from home for the purpose of participating in self-education

- text books and professional or technical journals

- stationery

- student union fees

- computer expenses

- student services and amenities fees

- depreciation (decline in value) of a computer or other capital equipment (with apportionment for non-self-education use where applicable)

- travelling expenses for the trips between

- home and the place of education

- workplace and place of education

- interest on borrowings which are used to pay for deductible self-education expenses

- home study expenses – which includes the running expenses of a room set aside for self-education purposes. With appropriate substantiation, expenses associated with the study room may include:

- repairs & maintenance

- depreciation (decline in value) of furniture and equipment

- heating, cooling, lighting

- as an alternative to record keeping for the actual expenses:

- a fixed or hourly rate method may be claimed to cover certain home office expenses

- a “short-cut” fixed all-inclusive rate of 80 cents per hour (this method not available after 30 June 2022)

ATO Deduction Guidance: Draft Taxation Ruling TR 2023/D1 Income tax: deductibility of self-education expenses incurred by an individual

Self-education expenses deduction example calculation

(as applies from 1 July 2022)

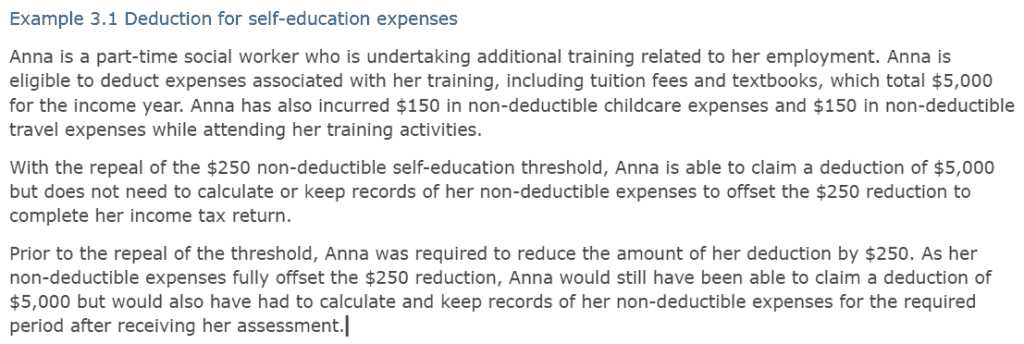

Note that the $250 expenses exclusion has been removed with effect from 1 July 2022.

The position until 30 June 2022 was that Section 82A operates to reduce the deductions under s8.1 by $250 (referred to as the sec. 82A reduction amount.)

Therefore any expenses which are eligible under Section 82A but not also deductible under 8.1 are used to absorb the $250, in order to maximise the remaining expense claims which are fully deductible under 8.1

Because of this, the calculations for self-education expenses claim require the listing and precise categorisation of expenses according to their type, Sec 82A and otherwise.

The May 2021 Budget first included an announcement that the $250 claim exclusion (the sec. 82A reduction amount) would be removed. (Budget paper No.2 page 26).

The bill was not approved before parliament was dissolved on calling of the May 2022 general election, but was revived in a fresh bill brought before parliament on 3 August 2022 and received assent on 12 December 2022.

The amendment has application for 2022-23 income tax year, and from 1 April 2023 for FBT purposes.

See Treasury Laws Amendment (2022 Measures No. 2) Bill 2022 (Schedule 3)

Further info: see Tax Office

Online self education expenses calculator

For the self-education expenses online calculator provided by the Tax Office – see Tax Office online self-education expenses calculator.

More information:

- ATO – Self-education expenses

- Depreciation

- TR 2024/3 Income tax: deductibility of self-education expenses incurred by an individual

This page was last modified 2024-02-21