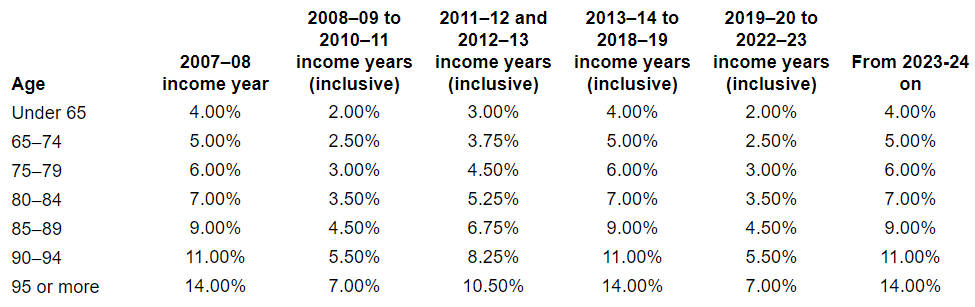

For an account based pension, also referred to as an allocated pension, a minimum amount is required to be paid each year, with no maximum except for transition to retirement pensions which are limited to 10% of the account balance.

Account based pension minimum payments

COVID-19 temporary relief measures

As part of the government’s Coronavirus response measures, the minimum withdrawal requirements were relaxed (halved) for the 2019-20, 2020-21 years, and since extended to the 2021-22 and 2022-23 financial years.

The ATO has confirmed that the 50% reduction of minimum withdrawal requirements ends 30 June 2023.

The return to normal rates applies for 2023-24 and 2024-25 ongoing.

Minimum Pension Drawdown Percentages Year By Year

The tax exemption available on pension fund asset earnings is crucially dependent on the minimum withdrawal requirements being observed.

A breach of the minimum payment rules can be overlooked only in limited circumstances; which may include an “honest mistake” resulting in a “small underpayment” and catch-up payments being made as soon as possible.

This enables tax exemptions on fund earnings and pensions to continue, despite the breach. See further: SMSFs: Minimum pension payment requirements – frequently asked questions

Super changes from 1 July 2017

A number of superannuation changes apply from 1 July 2017.

The changes include:

- a ‘transfer balance cap’ of (initially) $1.6 million indexed annually to the CPI limits the amount of super which can be transferred from an accumulation super account to the tax-free pension fund phase

- the indexed amount is proportional to the individual’s amount of available cap

- once established, pension fund growth from investment earnings in excess of the cap will not breach the cap rules

- pension fund shrinkage can’t be topped up once the cap is used

- if the cap is exceeded, tax is payable on the excess

- CGT relief is available if assets need to be moved back to accumulation fund by 30 June 2017 to comply with the new rules

- If, on 1 July 2017, you are over your $1.6 million cap by less than $100,000 and you remove this excess by 31 December 2017, excess tax will not apply

In some cases action will need to be taken before 30 June 2017 to avoid excess tax.

General Transfer Balance Cap

- from 1 July 2023 – (2023-24) $1.9 million (Defined Benefit Income Cap: $118,750)

- from 1 July 2021 – (2021-22 and 2022-23) $1.7 million (Defined Benefit Income Cap: $106,250)

- from 1 July 2020 (2020-21) – $1.6 million (Defined Benefit Income Cap: $100,000 for each of 2017-2021))

- from 1 July 2019 (2019-20) – $1.6 million

- from 1 July 2018 (2018-19) – $1.6 million

- from 1 July 2017 (2017-18) – $1.6 million

Investment growth (for example, interest earned) o

Transfer Balance Caps Indexation

| From.. | Cap |

| 1 July 2017 (commencement) | $1,600,000 |

| 1 July 2021 | $1,700,000 |

| 1 July 2023 | $1,900,000 |

Note that the full indexed cap increase may only be available on a proportional basis.

For example, if 70% per cent of the cap is used, the unused cap percentage will be 30%.

On the indexation increase of the cap by $200,000 on 1 July 2023 (from $1.7 million to $1.9 million), the personal cap availability thus increases by 30% of $200,000 which is $60,000. The effective personal cap in that case becomes $1.76 million.

If the cap has been fully used prior to indexation, there is no further cap increase available.

See further:

- Article (April 2023): Increase in the Superannuation Transfer Balance Cap

- Super contributions caps – new rules from 1 July 2017

- Pensions from 1 July 2017 — some tips and traps for SMSFs

- Bring forward rules

- Super contributions caps

Failure to pay minimum pension – consequences and FAQs

In the ATO’s view underpaying the minimum pension means that the pension may be taken to have stopped at the start of the income year, and any payments made in the year would then be treated as lump sum payments.

The Tax Office has discretion to allow the pension to continue to be exempt in the case of “small” underpayments which are quickly rectified. A small underpayment is taken to mean not exceeding one‐twelfth of the minimum pension obligation for the year.

The ATO answers FAQs surrounding the minimum payment requirements and compliance.

- what are the consequences of failure to meet minimum payment requirements?

- what happens if you fail in year one, then subsequently meet requirements?

- can an exception be made, when requirements haven’t been met?

- does any exception apply to TRIS funds, allocated pensions commenced prior to 19 September 2007, or an SMSF with multiple pensions?

- what does the Commissioner consider to be a ‘small’ underpayment?

- how long is “as soon as practicable”?

- can a trustee apply an exception?

- what happens if the minimum payment is not made in multiple years?

- when is a written exception request required?

- can underpayments be ‘accrued’ in the accounting records?

- when does the exception for underpayments apply?

Answers from the Tax Office are here.

Determining ‘Age’

Age is either at:

- 1 July in the financial year in which the payment is made; or

- the commencement day if that is the year in which the pension or annuity commences.

The ‘account balance’

‘Account balance’ means:

- the pension account balance on 1 July in the financial year in which the payment is made; or

- if the pension commenced during the financial year – the balance on the commencement day

Where the pension commences after 1 July, the minimum payment amount for the first year is apportioned by the number of days in the payment period to the end of the year. If the pension commences on or after 1 June in a financial year, no minimum payment is required that financial year.

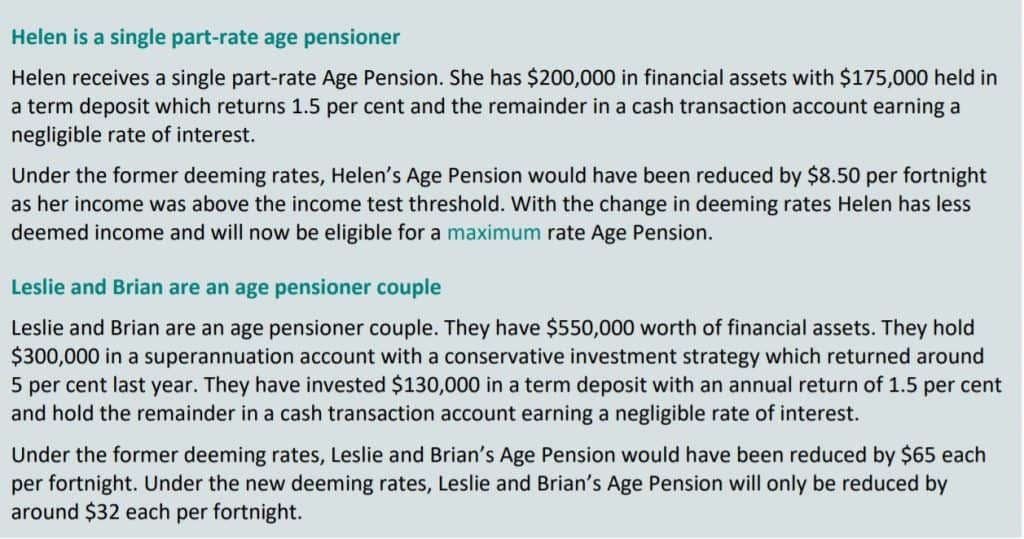

Age Pension eligibility – deeming rates

COVID-19 temporary relief measures

COVID-19 temporary relief measures

As part of the government’s Coronavirus response measures, the pension deeming rates are to be reduced to a minimum rate of 0.25% and maximum 2.25% from 1 May 2020. See Treasury pension deeming rates and fact sheet 6

Examples of the new deeming rates from 1 May 2020 (source: fact sheet 6):

Entire Balance Taken Into Account From 2015

From 1 January 2015 the entire balance in the superannuation fund that is paying an Account Based Pension will be subject to the deeming rates.

The new rules apply to people that become eligible for the Age Pension from 1 January 2015.

Whilst there are grandfathering provision to protect pre-existing accounts, a change of product can easily trigger the new rules. See further: Centrelink deeming fact sheet

Further information:

- Bank accounts which meet the requirement of section 295-385 to be a segregated current pension asset – see Tax Determination TD 2014/7

More on account based pensions

(This information is mainly for complying SMSF funds)

Pensions, or regular income streams, are a form of retirement benefit, and are treated differently for tax purposes from lump sums.

Most funds have the capacity to provide benefits as a pension, or lump sum, or a combination. The individual fund’s rules determine whether, when and how pensions can be drawn. Subject to rules, pensions may also be able to be “commuted” i.e. converted to a lump sum.

The tax rules for complying super funds set age limits and other requirements around starting and stopping the payment of pensions. The tax payable (if any) on a pension income stream depends on when the pension is paid, and the source of the funds.

There are two types of SMSF account-based pension arrangements:

- transition to retirement – a pension which can begin while still working. See age requirements and other details here.

- account based pension – from age 65, or from after preservation age if retired.

Preservation age

An account based pension can begin before the age of 65 if the individual has reached preservation age and is retired.

The preservation age for an individual depends on their date of birth.

Preservation age based on date of birth

| Date of birth | Preservation age |

| Before 1 July 1960 | 55 |

| 1 July 1960 to 30 June 1961 | 56 |

| 1 July 1961 to 30 June 1962 | 57 |

| 1 July 1962 to 30 June 1963 | 58 |

| 1 July 1963 to 30 June 1964 | 59 |

| After 30 June 1964 | 60 |

Tax payable by the individual on account based pension income

The tax payable (if any) on a pension income stream depends on the age of the individual and the character of pension income – which is either tax free or taxable.

The taxable and tax-free components of the pension income are calculated in the same proportion as those components exist in the super fund.

Taxable funds are those typically sourced from concessional contributions and earnings (i.e. tax deductible, or paid before tax as with salary sacrifice and employer contributions).

Tax-free super funds are non-concessional contributions for which no tax deduction was claimed and entered the super fund tax free. Typically these are personal contributions paid for by the individual out of after their after-tax income.

| Individual’s income tax on pensions | Tax rate | Pension rebate |

| From preservation age to 59 – tax free component | 0% | n/a |

| From preservation age to 59 – taxable component | Marginal rate | 15% |

| Age 60 and over | 0% | n/a |

Tax payable by the super fund supporting an account based pension

The super fund tax rate on income and capital gains is NIL for a complying pension fund in pension phase.

Up to 30 June 2017, this exemption was also available in respect to transition to retirement pensions (for which the individual must not yet be retired) – but was removed from 1 July 2017 along with other superannuation reforms.

In associated changes, from 1 July 2017 a limitation was placed on the value of assets (market value) to be used for account based pensions – the transfer balance cap. The initial cap is $1.6 million, to be indexed annually. See more on the new contributions caps here.

See also

- Funds: starting and stopping a pension

- Access to super

- Transition to retirement

- How long will your pension last? – Moneysmart Calculator

This page was last modified 2023-06-28