Key Links

Major stimulus and support measures in response to the Coronavirus were released by the national government from 12 March 2020 and ongoing through 2020-21 and 2021-22.

This page is no longer being maintained and has been retained for historical reference only.

Due to the termination of most Covid-related support schemes, numerous links here are now redundant.

- [16 July 2022] The Federal Government has announced the reinstatement of the Pandemic Leave Disaster Payment to 30 September 2022, with eligibility for the payment backdated to 1 July 2022. See Media Release.

- [27 April 2022] Western Australia business support assistance expanded

- [1 March 2022] NSW Payroll Tax 50% liability reduction for 2021/22 payroll tax for grouped Australian wages of $10 million or less who experience a 30% decline in turnover

- [4 February 2022] Victoria $1.4 Billion Injection For Healthcare Omicron Response

- [30 January 2022] NSW Coronavirus Business Support Package Released

- [29 January 2022] SA Government Business Support Package

- [13 December 2021] SME Recovery Loan Scheme has been extended to 30 June 2022

- [18 October 2021] Individual lockdown support for Tasmanians

- [14 October 2021] NSW Summer Stock Guarantee (up to $20,000) and Small Business fees & charges rebate $2,000 measures through to 31 January 2022

- [1 October 2021] Guide to State and Territory based funding and cash flow programs – PWC

- [30 September 2021] Victorian business support extended and reopening

- [23 September 2021] COVID-19 relief for SMSF trustees extended to 2021-22

- [16 September 2021] Support for Victorian regional businesses

- [15 September 2021] ACT Business support extension

- [14 September 2021] Qld businesses on the NSW border emergency support package

- [14 September 2021] Expanded support for Tasmanian businesses

- [13 September 2021] Further support for SA small businesses

- [4 September 2021] Extended support for Victorian businesses

- [2 September 2021] Supporting tenants and landlords affected by ACT lockdown

- [31 August 2021] Increased support for ACT businesses impacted by COVID-19

- [25 August 2021] Expanded eligibility for the SME Recovery Loan Scheme

- [23 August 2021] Assistance grants for WA tourism businesses

- [23 August 2021] Support for businesses in regional Victoria

- [19 August 2021] Businesses lockdown support package Northern Territory

- [19 August 2021] Melbourne business support extended 2 weeks

- [17 August 2021] Extended support for ACT businesses impacted by COVID-19

- [15 August 2021] Article – Victoria’s Covid rent relief for commercial tenants

- [13 August 2021] $600 million package to help Queensland businesses

- [13 August 2021] Support for ACT businesses impacted by COVID-19

- [13 August 2021] $20 million package to help Tasmanian businesses

- [12 August 2021] More support for Melbourne businesses

- [11 August 2021] More coronavirus (COVID-19) support if you get Child Care Subsidy

- [10 August 2021] Support for Queensland tourism and hospitality

- [9 August 2021] Support for South Australian small businesses impacted by COVID-19

- [6 August 2021] Victorian support funding for small and medium businesses

- [28 July 2021] NSW – Business support package expansion

- [22 July 2021] NSW – Payroll tax reductions and deferrals

- [21 July 2021] Victoria further $282.5m small business assistance

- [20 July 2021] South Australia support measures, business support grant

- [20 July 2021] Services Australia (Centrelink) disaster payment lump sum

- [19 July 2021] NSW Support Measures Summary+ Business Grant Guidelines

- [15 July 2021] Victoria Covid-19 support package

- [14 July 2021] NSW Assistance update from the Prime Minister

- [14 July 2021] NSW Assistance for Renters and Landlords

- [13 July 2021] NSW COVID-19 Support Package – see summary below

- [23 June 2021] Government COVID-19 disaster payments quick guide

- [11 May 2021] Budget 2021 was announced on 11 May 2021

- [6 October 2020] Budget 2020 was announced on 6 October 2020.

Services Australia: COVID-19 Disaster Payments

Earlier measures/ announcements:

- Apprentice wage subsidy

- Arts industry grants and loan programs

- Business depreciation boost

- Business loans and insolvency

- Cash Flow Boost For Employers

- Child Care Sector Relief

- Coronavirus supplement $550

- Homebuilder program

- Jobkeeper, JobSeeker extended to 28 March 2021

- Jobkeeper update 22 May 2020

- JobKeeper information

- JobKeeper decline in turnover

- Job Seeker Measures

- JobSeeker supplement $550

- Land tax relief measures

- Legislation

- Overseas financial assistance

- NSW Support Package (July 2021)

- Vic Support Package (July 2021)

- Payroll tax relief measures

- Pensioners payment $750

- Pension drawdowns halved

- Pension deeming rate reduced

- Second stimulus payment of $750

- Superannuation early access

- Support measures – 12 March 2020

- Support measures – 22 March 2020

- Tasmania Pandemic Leave $1500

- Tax free? What’s free and what’s not

- Tax Return lodgment deferrals

- Victorians receive additional $1,500 support

Most initial cash flow measures were temporary, for 6 months or less. The (original 2020) Jobkeeper and JobSeeker support schemes were extended at a reduced rate for 6 months until 28 March 2021.

NSW COVID-19 Support Package

See media release: NSW COVID-19 Support Package and recent updates

[13 July 2021] Measures announced for Covid-19 affected businesses and individuals include:

- business grants program extended & cashflow support with Federal Goverment jointly assisting

- payroll tax waivers (25%) for payrolls up to $10 million, deferrals and interest free plans

- new grants program for micro businesses of $1500 per fortnight of restrictions

- capped relief ($1,500) for residential landlords

- land tax relief (up to 100%) equal to the value of rent reductions

- short-term eviction moratorium for rental arrears owed by residential tenants suffering loss of income

- recovery of security bonds, or lockouts or evictions of impacted retail and commercial tenants prior to mediation

- deferral of clubs’ gaming tax assessments until 21 December 2021 and hotels until 21 January 2021

- support packages for the performing arts and accommodation sectors

- funding for temporary accommodation for those at risk or homeless

- funding to support mental health

Disaster Payment for people affected by restrictions

[4 June 2021] Details of federal assistance measures claimable from Centrelink for those affected by state lockdowns has been published by Services Australia. Currently aimed at Victoria, for nominated hotspots only.

The assistance comprises one payment for each period of lockdown, where the lockdown is for more than 7 days. The payment is $325 for a loss of less than 20 hours of work, or $500 for more than 20 hours, and is reserved for those with less than $10,000 in liquid assest.

Claim procedures via Centrelink at my.Gov.au are open from 8 June 2021.

Further information – see Services Australia website.

Overseas financial assistance

On 2 September 2020 the government has announced the availability of a one-off interest-free loan to cover living expenses for Australian citizens currently stranded overseas.

For eligibility conditions and other information see COVID-19: Overseas financial assistance

Tasmanian workers $1500 Pandemic Leave Disaster Payment

From 22 August 2020 Tasmanian workers without alternative support are eligible for a $1,500 Pandemic Leave Disaster Payment if they cannot work because they need to self-isolate or quarantine.

Claims can be made by phone. See media release and Services Australia

Victorians receive additional $1,500 support

A $1,500 pandemic leave payment is being made available to workers in Victoria who need to self-isolate because of COVID-19.

The fortnight’s payment will be available to workers who do not have sick leave and have been directed to stay at home by a public health official.

Claims are being administered by Services Australia.

See report: abc.net.au

Jobkeeper & Jobseeker schemes extended to March 2021

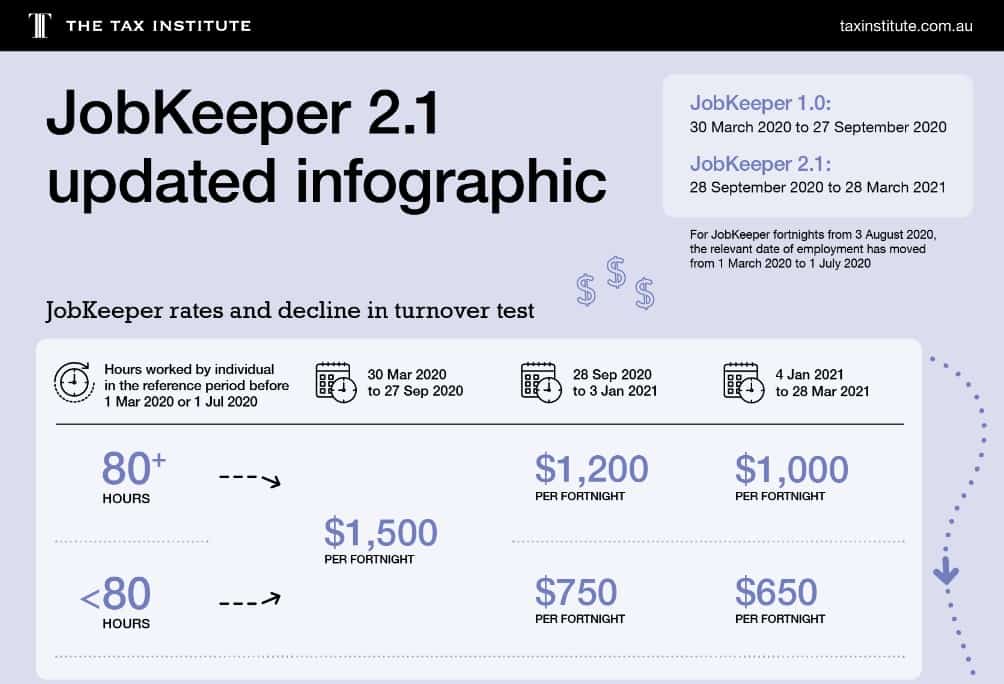

The 3 month review of the Jobkeeper payment scheme was released by Treasury on 21 July 2020.

Also on 21 July 2020 the government has released details of ongoing Jobkeeper and Jobseeker measures for periods beyond the initial 6 month program ending in September 2020.

On 7 August 2020 the Government announced that employee eligibility will be extended, with a worker qualifying if at their workplace since at least 1 July 2020, replacing the earlier 1 March 2020 deadline. The decline in turnover test has also been modified.

See in detail:

- CERP 2020/6 Coronavirus Economic Response Package (Payments and Benefits) Alternative Decline in Turnover Test Amendment Rules 2020

- Coronavirus Economic Response Package (Jobkeeper Payments) Amendment Bill 2020

- JobKeeper 2.1 [updated 7 Aug 2020]

- Extension of the JobKeeper Payment Fact Sheet [updated 7 Aug 2020]

- JobKeeper 2.0: key dates, reduced rates, payroll cycles and more [24 July 2020] and

- Changes to the COVID-19 social security measures: a brief assessment [30 Jul 2020]

JobKeeper (employers receive and pass on)

In summary, for the December 2020 quarter (from 28 September), the Jobkeeper payment for full time workers is to be reduced to $1,200 a fortnight from its current level of $1,500. For those working less than 20 hours per week the Jobkeeper payment will be reduced to $750 per fortnight.

For the March 2021 quarter (from 4 January 2021), the Jobkeeper payment for full time workers will be further reduced to $1,000 per fortnight, and $650 for those working less than 20 hours per week.

For further information and an explanation of the turnover test see: The Tax Institute

Jobseeker (paid by Centrelink)

For those on Jobseeker payments, the mutual obligation requirements will recommence from 4 August 2020, requiring a minimum of 4 four job searches a month; and..

The Coronavirus supplement of $550 per fortnight will be reduced from 25 September 2020 to $250 until 31 December 2020, and $150 per fortnight for the period 1 January 2021 to 31 March 2021. Subject to legislation – see media release.

The income free area threshold will increase to $300 per fortnight. Means testing and the Liquid Assets Waiting Period will also be re-introduced.

Normal JobSeeker rates will apply from 1 January 2021.

Homebuilder $25,000 grant

The Homebuilder program provides a $25,000 grant to home owners to build a new home or substantially renovate an existing home.

Key conditions of the program include:

- program available from 4 June 2020 to 31 December 2020

- must be Australian citizen, natural person, 18 years and over

- available to all eligible owner-occupier homeowners, not just first home buyers

- income test – maximum $125,000 for singles and $200,000 for couples (based on 2018-19 or later tax returns)

- dwelling price cap of $750,000 will apply for new home builds

- renovation price range must be minimum of $150,000 up to $750,000; renovating an existing home with a current value of no more than $1.5 million.

- the expenditure must be the subject of a contract with a registered or licensed builder (depending on the state or territory)

- the grant is tax free

- References and further information: Ministers’s media release – HomeBuilder Fact Sheet – HomeBuilder FAQ

Child Care Sector Relief Package

[update 8 June 2020] The Minister announced that the Early Childhood Education and Care Relief Package will end on 12 July 2020. The Child Care Subsidy will resume on 13 July 2020 along with some “transition measures”.

The Jobkeeper support scheme will cease from 20 July 2020 for employees of a CCS approved service and for sole traders operating a child care service.

See ATO bulletin regarding treatment of mixed businesses.

On 2 April 2020 the Prime Minister released details of a package of measures designed to support the child care and early childhood education sector in providing free child care for around 1 million families.

The new arrangements are to be reviewed after 1 month, and an extension considered after 3 months.

Key features of the package are:

- government to pay 50% of child care sector’s fee revenue up to the existing hourly rate cap (in lieu of existing funding)

- funding to apply from 6 April 2020 based on children in care as at 2 March 2020 (whether or not attending)

- Until payments are made, centres may waive gap fees for families who keep their children home, and families will be able to use the 20 extra absence days the Government has funded for Coronavirus-related reasons without giving up their place in a centre.

- funding conditional on child care centre remaining open and not charging for care

- higher funding may be available to meet circumstances involving emergency workers or vulnerable children

- families who have terminated enrolment since 17 February 2020 are advised to re-enrol

- re-enrolment does not require families to send their children to care or pay gap fees. The child’s place will be held until things start to normalise.

- means testing will cease for those accessing the child care subsidy during the 6 month Coronavirus emergency

See further:

JobKeeper eligibility and payment information

30 March 2020 the “JobKeeper” wage subsidy program was announced. The scheme starts on 30 March 2020 and ends on 27 September 2020.

See also:

- JobKeeper key dates & payroll cycles

- Article: Some JobKeeper Guidance from the Fair Work Commission (Russell Kennedy Lawyers)

[1 May 2020] Additional time: The Tax Office has issued internal guidance to staff exercising discretion to allow further time for a business to satisfy the eligibility criteria. See PS LA 2020/1 Commissioner’s discretion to allow further time

- JobKeeper for sole traders and other entities

- JobKeeper employer registration page

- JobKeeper information for large public and private groups

- JobKeeper Payment – information in other languages

- JobKeeper regulations (Jobkeeper payment rules)

- JobKeeper further regulations

- JobKeeper payments update & clarification

- Jobkeeper payment – decline in turnover test – Law Companion Ruling LCR 2020/1

- JobKeeper payment – guide to the modified decline in turnover test

- JobKeeper enrolment extension to 31 May 2020

- JobKeeper compliance -PCG 2020/4 Schemes – and further commentary

On 23 April 2020 regulations were released which provide alternative qualifying tests for businesses which cannot otherwise satisfy the decline in turnover test to access JobKeeper payments because there is no appropriate comparison period in 2019.

This may be relevant for more recently started businesses or businesses which have met an extraordinary circumstance affecting turnover in 2019.

See:

- Coronavirus Economic Response Package (Payments and Benefits) Alternative Decline in Turnover Test Rules 2020;

- Explanatory Statement

- ATO page: Alternative test

- ATO determination: CERP 2020/1 Alternative Decline in Turnover Test Rules 2020

The regulations set out alternative tests with respect to the following circumstances:

- Business commencements after the relevant comparison period

- Business acquisition or disposal that changed the entity’s turnover

- Business restructure that changed the entity’s turnover, being

– 50% or more in the 12 months immediately before the applicable turnover test period; or

– 25% or more in the 6 months immediately before the applicable turnover test period, or

– 12.5% or more in the 3 months immediately before the applicable turnover test period. - Business had substantial increase in turnover

- Business affected by drought or natural disaster

- Business has an irregular turnover

- Sole trader or small partnership with sickness, injury or leave

On 30 March 2020 the Prime Minister and Treasurer announced a “JobKeeper” wage subsidy program budgeted to cost $130 billion and to be in place for a period of 6 months (from 30 March 2020).

The jobkeeper scheme starts on 30 March 2020 and ends on 27 September 2020.

Key points of the program include:

- the JobKeeper payment is paid to eligible employers to support all employees on the books as at 1 March 2020

- the payment is a flat amount of $1,500 per fortnight to be paid to all employees of eligible businesses, including full time, part-time and long-term casuals (at least 1 year) and including employees who may have been stood down or retrenched since 1 March 2020. Terminated workers will need to go back on the books in order to get the payment.

- payments under the scheme will start to flow from the Tax Office from 1 May 2020, and be backdated for entitlements from 30 March 2020

- eligible employers will register with the Tax Office on the self-assessed condition of having suffered a minimum 30% reduction of turnover relative to a comparable period a year ago of at least 1 month (or a 50% reduction in the case of businesses with turnover over $1 billion) See ATO page: Basic Test

- Charities will have a concessional 15% reduction test

- all businesses and not for profits including charities are included in the program

- self-employed individuals may also be eligible

- the program will be administered by the ATO through a registration page on their website

- the scheme will be available to support New Zealanders on temporary 444 visas, other temporary visa holders not included at this stage

- the payment does not include superannuation; it will be up to employers to determine whether super is paid any additional wage component

- there can be no “double-dipping” with JobSeeker, recipients can either get one or the other.

- Employees with more than one employer may only be recorded for a JobKeeper payment through one employer

- the measures will require legislation for which parliament will be recalled on a date to be determined after consultation with the Opposition

Coronavirus Measures Announced 22 March 2020

- Jump to 12 March 2020

- Jump to 30 March 2020

- Child Care – 2 April 2020

- States’ payroll tax measures

- Jump to resources summary

- Back to page top

Job Seeker measures

The measures are temporary. Key measures from the package include:

- Coronavirus Supplement of $550 per fortnight to be temporarily (for 6 months from 27 April 2020) paid to government income support recipients including Jobseekers (previously called Newstart), Youth Allowance, Parenting Payment, Farm Household Allowance and Special Benefit.

- An amendment to the enabling legislation (passed by parliament on 23 March 2020) extends the Coronavirus Supplement to full-time students on Youth Allowance, Austudy and Abstudy.

- The Coronavirus Supplement income test is set at $1,075, which means that most of those already receiving reduced payments based on other income, will nevertheless still get the full Supplement.

- For Jobseekers income support recipients, the assets test and waiting periods are waived.

- from 13 July 2020 the issue of a second stimulus payment of $750 to be paid to social security and veteran income support recipients and eligible concession card holders, except for those eligible to receive the Coronavirus supplement. The first payment will be made from 31 March 2020 to people who have been receiving one of the eligible payments any time between 12 March 2020 and 13 April 2020.

- The income test on partner’s income of JobSeeker recipients is to be temporarily relaxed, allowing the JobSeeker and Coronavirus Supplement to continue where partner income is up to $3,068 per fortnight. The income test on individuals remains unchanged. See more details at DSS link here.

Early access to superannuation

Application can be made for early access to up to $10,000 of superannuation in 2019-20 (apply before 1 July 2020) and a further $10,000 in 2020-21 (apply before 24 September 2020).

The withdrawn amounts will be tax free and not affect entitlement to Centrelink or Veterans’ Affairs payments. This is available for those who are eligible for the coronavirus supplement as well as sole traders who have seen their hours of work, or income, fall 20% or more as a result of the coronavirus.

Applications for superannuation release can be made online (via myGov) with a simple declaration to the Tax Office. Applications opened on 20 April 2020. See further: Access to superannuation.

Pension deeming rates

Pension deeming rates to be further reduced (in addition to 12 March 2020 announcement) to a minimum rate of 0.25% and maximum 2.25% from 1 May 2020. See further: pension deeming rates.

‘Cash flow boost’ for employers

Cash Flow Boost Eligibility Guide

[1 May 2020] Additional time to comply for JobKeeper and Cash Flow Boost measures

The Tax Office has issued internal guidance to staff exercising discretion to allow further time for an eligible business participant to satisfy the eligibility criteria for the cash flow boost or the JobKeeper payments, including:

– registering for an ABN

– providing notice of inclusion of business income or making a taxable supply in a relevant period

See Practice Statement Law Administration

PS LA 2020/1 Commissioner’s discretion to allow further time for an entity to register for an ABN or provide notice to the Commissioner of assessable income or supplies

SMEs and Not For Profit employers with eligible turnover under $50 million are to get tax free payments automatically delivered by the Tax Office based on BAS information of wage and salary tax withheld to be delivered starting from 28 April 2020.

A measure first announced on 12 March 2020 offered 50% of tax withholdings for a minimum $2,000 up to a maximum of $25,000.

This second announcement (22 March 2020) increases that previous offer to 100% of the tax withheld for a minimum of benefit of $10,000 up to a maximum of $50,000 (from 28 April 2020).

From 28 July 2020 an additional cash payment matching the total of the previous payments will be issued, bringing the total credits to a minimum of $20,000, and a maximum of $100,000, however this is subject to the PAYG withholdings being at least equal to or exceeding the minimum. (For example if PAYG withholdings do not reach $10,000 over the benefit periods, then the benefit is limited to the minimum, being $10,000.)

When and How?? See ATO information page.

Small Business Loans and Insolvency measures

- [20 July 2020] Loan scheme scope expanded and extended until 30 June 2021. From 1 October 2020 support is for loan size up to $1 million for a maximum term of 5 years. See Treasurer’s media release.

- Loans for SMEs (turnover under $50 million) bank loan guarantee scheme to enable small businesses to get access to unsecured interest free working capital loan funding of up to $250,000 for up to 3 years with no repayments for 6 months

- Relaxation of insolvency laws, including an increase in the creditor petition threshold from $2,000 to $20,000 and an increase in the allowed response period from 21 days to 6 months

See in detail: COVID-19 – how does the cash flow boost for employers work?

More information:

- Bloomberg

- abc.net.au

- Govt media release

- Treasury

- All resources summary

- Economic response to coronavirus—social security measures part 1 (Parliament’s “Flagpost” blog)

- Economic response to coronavirus—social security measures part 2 (Parliament’s “Flagpost” Blog)

- Dept of Social Services Coronavirus (COVID-19) information and support

First Announced Coronavirus Stimulus Measures 12 March 2020

- Announcement 22 March 2020

- Announcement 30 March 2020

- Child Care – 2 April 2020

- Resources summary

- States’ payroll tax relief

- Back to page top

On 12 March 2020 the Prime Minister and Treasurer announced a series of assistance measures in response to the currently deteriorating economic conditions. (See also extensions to the depreciation concessions announced in the 2020-21 Budget)

The measures include:

- Instant Asset Deduction boost: from 12 March 2020 until 30 June 2020 an increase in the instant asset write off threshold from $30,000 to $150,000 and to include businesses with aggregated annual turnover of up to $500 million (previously $50 million). On 9 June 2020 the Treasurer announced that the concession will be available for a further 6 months until 31 December 2020. See further how it works here.

- Accelerated depreciation: from 12 March 2020 until 30 June 2021 accelerated depreciation for businesses with a turnover up to $500 million to allow an additional 50% of the asset cost as a deduction in the year of purchase. Existing depreciation rules will apply to the balance of the asset’s cost. This measure is an alternative to the instant asset concessions, not in addition, and so would apply to assets costing more than $150,000. On 9 June 2020 the Treasurer announced that the concession will be available for a further 6 months until 31 December 2020. How it works.

- Cash Boost for employers: From $2,000 up to $25,000 tax free for eligible small and medium-sized businesses with a turnover of less than $50 million that employ staff between 1 January 2020 and 30 June 2020. Businesses will receive payments of 50% of their Business Activity Statements or Instalment Activity Statement from 28 April with refunds to then be paid within 14 days. NOTE: this offer later was increased to 100% in the announcements of 22 March 2020. see Cash Boost for Employers

- A wage subsidy for eligible employers of 50% per cent of an apprentice’s or trainee’s wage for up to 9 months from 1 January 2020 to 30 September 2020. The subsidy will be transferable to a new employer that employs that apprentice. The apprentice or trainee must have been in-training with a small business as at 1 March 2020. Businesses will be reimbursed up to $7,000 per quarter, up to a maximum of $21,000, per eligible apprentice or trainee. Final claims for payment must be lodged by 31 December 2020. Registrations are being handled through the Australian Apprenticeship Support Network.

- a one-off tax free $750 payment to pensioners, social security, veteran and other income support recipients and eligible concession card holders. Around half of those that will benefit are pensioners. The payment will be tax free and will not count as income for Social Security, Farm Household Allowance and Veteran payments. Payments will be made from 31 March 2020 on a progressive basis, with over 90% expected to be completed by mid-April.

Those to receive the payment will recipients of the following benefits:

Age Pension

Disability Support Pension

Carer Payment

Carer Allowance

Parenting Payment

Wife Pension

Widow B Pension

ABSTUDY (Living Allowance)

Austudy

Bereavement Allowance

Newstart Allowance

Youth Allowance

Partner Allowance

Sickness Allowance

Special Benefit

Widow Allowance

Farm Household Allowance

Family Tax Benefit A

Family Tax Benefit B

Double Orphan Pension

Veterans Service Pension

Veteran’s Income Support Supplement

Veterans’ Compensation payments

War Widow(er) Pension

and the following card-holders:

Pensioner Concession Card

Commonwealth Seniors Card

DVA Gold Card.

- a 0.5 % reduction in both the upper and lower social security deeming rates

- $1 billion allocated for other assistance to “severely-affected regions” including the waiver of fees, supply chain and export market assistance to businesses, and to domestic tourism.

- deferral of tax payments for up to 4 months (similar to bushfire relief) on a case-by-case basis

More information:

What’s Tax Free?

A number of Coronavirus relief measures are tax free.

- See Income on which you don’t pay tax

- Victorian business grants

- Early access to superannuation – tax free

- Business Cash Flow Boost For Employers – tax free

- Payment to pensioners $750 – tax free

- Second stimulus payment of $750 – tax free

- JobKeeper and other wage payments including leave taken – normal (existing) taxing rules apply, including the tax free/tax concession rules for redundancy and early retirement. See COVID-19 Tax on employment payments.

- JobKeeper and payroll tax – Western Australia exempt

Coronavirus Economic Response Key Legislation

- The Coronavirus Economic Response Package Omnibus Bill 2020 (and accompanying bills)[approved 23 March 2020]

- Coronavirus Economic Response Package Omnibus (Measures No. 2) Bill 2020 (and accompanying bill)[approved 8 April 2020]

- Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 (Jobkeeper payment rules)

- Treasury Laws Amendment (Release of Superannuation on Compassionate Grounds) Regulations 2020 (early access to super rules)

- Coronavirus Economic Response Package (Payments and Benefits) Alternative Decline in Turnover Test Rules 2020; and Explanatory Statement

Coronavirus Economic Response Resources and References

- JobKeeper eligibility & payment info

- Economic response to coronavirus—social security measures part 1 (Parliament’s “Flagpost” blog)

- Economic response to coronavirus—social security measures part 2 (Parliament’s “Flagpost” Blog)

- Dept of Social Services Coronavirus (COVID-19) information and support

- Govt media release (12 March 2020)

- Moore Stephens (12 March)

- abc.net.au (12 March)

- abc.net.au (22 March measures)

- Bloomberg (22 March measures)

- Govt media release (22 March 2020)

- Am I eligible for the jobkeeper payment? Guardian (30 March 2020)

- COVID-19 – how does the cash flow boost for employers work?

- COVID-19 – how the ATO has offered to help (23 March 2020)

- Prime Minister Media Release – Child Care (2 April 2020)

- Treasury (economic measures)

- States’ payroll tax relief measures

- Legislation & rules:

- The Coronavirus Economic Response Package Omnibus Bill 2020 (and accompanying bills)

- Boosting Cash Flow for Employers (Coronavirus Economic Response Package) Act 2020

- Coronavirus Economic Response Package Omnibus (Measures No. 2) Bill 2020 (and accompanying bill)

- Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 (Jobkeeper payment rules)

- Coronavirus Economic Response Package (Payments and Benefits) Amendment Rules (No. 2) 2020 (JobKeeper further payment rules)

- Coronavirus Economic Response Package (Payments and Benefits) Alternative Decline in Turnover Test Rules 2020; and Explanatory Statement

- ATO determination: CERP 2020/1 Alternative Decline in Turnover Test Rules 2020

This page was last modified 2024-04-18