STP: No more payment summaries

Reporting under Single Touch Payroll removes the requirement to issue payment summaries, payment summary annual reports and TFN declarations to the ATO.

Employees will have access to their to their information online via my.gov.au, and the Tax Office will also use the data to pre-load information for employees’ tax returns.

Single Touch Payroll started on 1 July 2018 for employers with 20 or more employees, and 1 July 2019 for those with 19 and under.

The Tax Office had advised that leniency will be available to small businesses attempting to comply within in the first year of implementation.

Businesses of all sizes are to be included. Concessionary arrangements for micro businesses and others are due to end with the expansion of STP to all employers from 1 July 2021.

What is Single Touch Payroll reporting?

Single Touch Payroll software solutions provide a direct reporting link from computer payroll systems to the Australian Taxation Office.

The purpose is real-time reporting, replacing the traditional process of reporting all payroll data at the end of the financial year. Payroll information is sent to the ATO at the time of the pay run, without having to separately lodge reports.

This means real-time access to accurate information is also available to employees through their individual account access to their payroll data.

A stated purpose of STP regime is to reduce employers’ reporting burden to other government agencies, such as Services Australia, and in due course to the States for the calculation of payroll taxes. See also Government Media Release: Cash flow support and red tape reduction to help small business.

Under the first STP phase the Tax Office receives payroll data including gross amount of wages, PAYG withholdings and superannuation information.

From 1 July 2021 closely held employees must be reported through STP. Small employees (employee count under 20) can report each pay or quarterly. Until 30 June 2021 small employees were not compelled to report closely held employee payments through STP.

Expanded payroll transaction reporting (the second STP Phase) commences 1 January 2022. See details outlined below.

The law has been amended to allow employers to voluntarily report child support deductions and garnishee amounts to the Tax Office instead of the Child Support Commissioner. The Child Support Commissioner will then be provided with access to the data by the Tax Office.

Voluntary reporting is also extended to employer superannuation contributions and fringe benefits amounts. See Treasury Laws Amendment (2020 Measures No. 2) Bill 2020.

Note: The government has announced that from 1 July 2026, employee super payments will be required to be paid at the same time as their salary and wages (rather than quarterly). See media release: Introducing payday super.

STP Phase 2 Reporting – January 2022

The expanded reporting requirements of Phase 2 implementation was deferred to 1 January 2022, with compliance generally required by 1 March 2022, however digital service providers can apply for bulk deferrals on behalf of their clients.

Lenient Phase 2 enforcement measures (no penalties for genuine mistakes) will be in place until 31 December 2022.

Deferrals (typically for a short periods of the implementation have been granted by the ATO on a selective basis to payroll solution providers who have applied, who in turn will notify their user base of their coverage under the issued deferral notice.

Additional detailed information to be reported under the Phase 2 requirements include:

- Income types (i.e. Salary and Wages, Closely Held Payees, Working Holiday Maker, etc.)

- Country codes when relevant (e.g. employees working overseas, Working Holiday Makers)

- Payment types including:

- Paid parental leave

- Defence leave

- Worker’s compensation

- Lump sums

- New allowance types

- Termination reason (i.e. voluntary or redundancy. Employee separation certificates will no longer be required)

- Withholding Payer Number (WPN) holders can report through STP

- TFN details are included, so separate TFN Declarations are no longer required

- Employment basis (full time, part time, casual)

- Ordinary time earnings, overtime, allowances, etc.

- Salary sacrifice

For more information about the Phase 2 reporting details, see ATO: Expanding Single Touch Payroll Phase 2 and payments guide.

STP Phase 2 Reporting Checklist

To locate an item start typing in the search box:

| Payment type | STP Phase 2 |

|---|---|

| Allowance – accommodation – domestic, amount does not exceed ATO reasonable amount | Not reported |

| Allowance – accommodation – domestic, amount exceeds ATO reasonable amount | Travel allowances (allowance type RD) |

| Allowance – accommodation – overseas, for business purposes | Other allowances (allowance type OD) with the description G1 (general) |

| Allowance – accommodation – overseas, for private purposes | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – car – flat rate | Other allowances (allowance type OD) with the description V1 (Private vehicle) |

| Allowance – cents per km - for a car in excess of the ATO rate for business related travel. | Cents per km allowance (allowance type CD) |

| Allowance – cents per km – for a car up to the ATO rate for business related travel | Cents per km allowance (allowance type CD) |

| Allowance – cents per km – for private travel such as travel between home and work. | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – cents per km – for vehicles other than a car such as a motorbike or van. | Other allowances (allowance type OD) with the description V1 (Private vehicle) |

| Allowance – confined spaces | Task allowances (allowance type KN) |

| Allowance – danger | Task allowances (allowance type KN) |

| Allowance – dirt | Task allowances (allowance type KN) |

| Allowance – district | Task allowances (allowance type KN) |

| Allowance – driving licence | Qualification and certification allowances (allowance type QN) |

| Allowance – equipment – where equipment is supplied by employee for business purposes | Tool allowances (Allowance type TD) |

| Allowance – first aid | Task allowances (allowance type KN) |

| Allowance – freezer | Task allowances (allowance type KN) |

| Allowance – height | Task allowances (allowance type KN) |

| Allowance – higher duties | Task allowances (allowance type KN) |

| Allowance – home office equipment | Other allowances (allowance type OD) with the description H1 (Home office) |

| Allowance – industry | Task allowances (allowance type KN) |

| Allowance – Internet | Other allowances (allowance type OD) with the description H1 (Home office) |

| Allowance – laundry – for cleaning of approved uniforms in excess of the ATO approved limit. | Laundry allowance (allowance type LD) |

| Allowance – Laundry – for cleaning of approved uniforms up to the ATO approved limit | Laundry allowance (allowance type LD) |

| Allowance – laundry – for the cost of laundering deductible conventional clothing | Other allowances (allowance type OD) with the description G1 (general) |

| Allowance – laundry – for the cost of laundering uniforms for private purposes | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – leading hand | Task allowances (allowance type KN) |

| Allowance – liquor licence | Qualification and certification allowances (allowance type QN) |

| Allowance – living away from home (FBT) | Not reported – but may form part of RFBA |

| Allowance – locality | Task allowances (allowance type KN) |

| Allowance – loss of licence | Qualification and certification allowances (allowance type QN) |

| Allowance – meals and incidentals – domestic, amount does not exceed ATO reasonable amount. | Not reported |

| Allowance – meals and incidentals – domestic, amount exceeds ATO reasonable amount | Travel allowances (allowance type RD) |

| Allowance – meals and incidentals – overseas, amount exceeds ATO reasonable amount | Travel allowances (allowance type RD) |

| Allowance – on call – ordinary hours | Task allowances (allowance type KN) |

| Allowance – on call – outside ordinary hours | Overtime |

| Allowance – overtime meals – amount does not exceed the ATO reasonable amount | Not reported |

| Allowance – overtime meals – amount exceeds the ATO reasonable amount | Overtime meal allowance |

| Allowance – recognition of skill level | Task allowances (allowance type KN) |

| Allowance – secondment | Task allowances (allowance type KN) |

| Allowance – site | Task allowances (allowance type KN) |

| Allowance – supervisor | Task allowances (allowance type KN) |

| Allowance – tools of trade | Tool allowances (allowance type TD) |

| Allowance – transport – for private purposes | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – transport – payments for the cost of transport for business related travel traceable to a historical award in force on 29 October 1986 | Award transport payments (allowance type AD) |

| Allowance – transport – payments for the cost of transport for business related travel not traceable to a historical award in force on 29 October 1986 | Other allowances (allowance type OD) with the description T1 (fares) |

| Allowance – travel – for private purposes | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – travel – part day | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – travel time – ordinary hours | Gross |

| Allowance – travel time – outside ordinary hours | Overtime |

| Allowance – wet weather | Task allowances (allowance type KN) |

| Allowance – working with children check | Qualification and certification allowances (allowance type QN) |

| Back pay – total is below Lump sum E threshold | The payment type that matches the payment. For example, back pay of ordinary pay = gross, back pay of higher duties allowance = task allowance (allowance type KN). |

| Back pay – accrued less than 12 months before date of payment | The payment type that matches the payment. For example, back pay of ordinary pay = gross, back pay of higher duties allowance = task allowance (allowance type KN). |

| Back pay – accrued more than 12 months before date of payment | Lump sum E |

| Bonus – Christmas | Bonus and commission |

| Bonus – ex-gratia, in respect of ordinary hours of work | Bonus and commission |

| Bonus – paid to employee that has resigned to encourage withdrawal of resignation | Return to work payment (Lump sum W) |

| Bonus – paid to end industrial action | Return to work payment (Lump sum W) |

| Bonus – paid to ex-employee to return | Return to work payment (Lump sum W) |

| Bonus – performance | Bonus and commission |

| Bonus – referral | Bonus and commission |

| Bonus – relating entirely to time worked outside ordinary hours | Overtime |

| Bonus – retention | Bonus and commission |

| Bonus – sign-on | Bonus and commission |

| Breach of rest break payment | Gross |

| Call back payment | Overtime |

| Commission | Bonus and commission |

| Directors’ fees – working or non-working director | Directors’ fees |

| Flexi time – hours worked and taken | Gross |

| Identifiable overtime component of annualised salary | Overtime |

| Leave – annual – cashed out in service | Cash out of leave in service (paid leave type C) |

| Leave – annual – taken | Other paid leave (paid leave type O) |

| Leave – bereavement | Other paid leave (paid leave type O) |

| Leave – carer’s | Other paid leave (paid leave type O) |

| Leave – community service | Ancillary and defence leave (paid leave type A) |

| Leave – compassionate | Other paid leave (paid leave type O) |

| Leave – defence | Ancillary and defence leave (paid leave type A) |

| Leave – domestic violence | Other paid leave (paid leave type O) |

| Leave – family | Other paid leave (paid leave type O) |

| Leave – firefighting service | Ancillary and defence leave (paid leave type A) |

| Leave – gardening | Other paid leave (paid leave type O) |

| Leave – jury duty | Ancillary and defence leave (paid leave type A) |

| Leave – long service – cashed out in service | Cash out of leave in service (paid leave type C) |

| Leave – long service – taken | Other paid leave (paid leave type O) |

| Leave – parental – employer paid | Paid parental leave (paid leave type P) |

| Leave – parental – government paid (GPPL) | Paid parental leave (paid leave type P) |

| Leave – personal – cashed out in service | Cash out of leave in service (paid leave type C) |

| Leave – personal – taken | Other paid leave (paid leave type O) |

| Leave – RSPCA | Ancillary and defence leave (paid leave type A) |

| Leave – sick | Other paid leave (paid leave type O) |

| Leave – State Emergency Service (SES) | Ancillary and defence leave (paid leave type A) |

| Leave – study | Other paid leave (paid leave type O) |

| Leave – paid on termination – annual leave or leave loading accrued after 17 August 1993 paid on a normal termination | Unused leave on termination (paid leave type U) |

| Leave – paid on termination – long service leave accrued after 17 August 1993 paid on a normal termination | Unused leave on termination (paid leave type U) |

| Leave – paid on termination – annual leave or leave loading accrued after 17 August 1993, termination for genuine redundancy, invalidity or early retirement scheme reasons | Lump sum A, type code R |

| Leave – paid on termination – unused annual leave or leave loading paid on termination that accrued before 17 August 1993 | Lump sum A, type code T |

| Leave – paid on termination – long service leave that accrued between 16 August 1978 and 17 August 1993. | Lump sum A, type code T |

| Leave – paid on termination – long service leave that accrued before 16 August 1978 | Lump sum B |

| Loadings – annual leave loading (demonstrably referable to a loss of overtime) | Overtime |

| Loadings – annual leave loading (standard) | Leave type O |

| Loadings – casual loading | Gross |

| Ordinary hours | Gross |

| Overtime | Overtime |

| Penalties – public holiday | Gross |

| Penalties – shift | Gross |

| Public holiday - day not worked | Report as if the employee had worked (Gross and any other relevant payment types) |

| Rostered day off (RDO) – hours cashed out in service | Leave type C |

| Rostered day off (RDO) – hours taken | Leave type O |

| Time off in lieu (TOIL) – hours taken | Other paid leave (leave type O) |

| Time off in lieu (TOIL) – hours cashed out in service | Overtime |

| Travel time – Excess, for travel outside ordinary hours | Overtime |

| Workers’ compensation – no work is performed | Leave type W |

| Workers’ compensation – paid after termination | Leave type W |

| Workers’ compensation – top-up, no work is performed | Leave type W |

| Workers’ compensation – top-up, work is performed | Gross |

| Workers’ compensation – work is performed | Gross |

Source: ato.gov.au | Download PDF

End Of Financial Year Finalisation

From 2021 there is a general deadline of 14 July for end-of-year finalisation.

Finalisation for closely held employees is 30 September, or the date of tax return lodgement date for small employers (less than 20 employees) with only closely held employees. See End-of-year finalisation through STP.

STP procedures require that employers make a finalisation declaration to the Tax Office on completion of annual payroll processing. By this process annual payment summaries become available for employees.

For non closely-held employees, this means that the information should be viewable on myGOV by the end of the year, and the employees’ tax returns are pre-filled with the income statement information.

One Touch Payroll and Superannuation

Under the STP arrangements, accrued super contributions are included in the data received by the Tax Office from the employer.

Super funds report payment of the contribution to the ATO, which is intended to “create visibility of non-payment or late payment of super entitlements and enable the ATO to take prompt action“.

Online Information For Employees

Employee’s point of access for information updated through One Touch Payroll is through my.gov.au (myGOV) where year-to-date information including super contributions can be reviewed.

There are a number of forms, typically required on commencement of employment, which can be completed electronically, pre-filled with ATO-held information.

The forms include:

- Tax file number declaration

- Superannuation choice

- Withholding declaration

- Medicare levy variation

Paper versions of the forms cam still be lodged as in the past, depending on employers’ procedures.

Further details and instructions are here: New Employees

Single Touch Payroll is compulsory

Single Touch Payroll reporting is mandatory for:

- Employers with 20 or more employees – from 1 July 2018

- Includes employers with 19 or fewer employees (i.e. ALL employers) – from 1 July 2019

Deferrals and Exemptions

The Tax Office has advised that “micro employers” (those with 1 to 4 employees) may report quarterly for the first two years via a registered tax or BAS agent rather than each time payroll is run.

Small employers (i.e. those due to start on 1 July 2019) were granted up to a 3 month exemption from penalties by starting their STP reporting any time from the 1 July start date to 30 September 2019, with no penalties for mistakes, missed or late reports for the first year, in addition to hardship considerations including where access to the internet is difficult or limited.

Closely held payees – small employers

Small employers are those with less than 20 employees.

Payments to “Closely held” payees were permitted to defer using STP until 1 July 2021. The original deadline of 1 July 2020 was first extended as part of the ATO’s response to COVID-19 conditions, and was extended again to 1 July 2021.

From 1 July 2021 this exemption ended, and small employers need to report closely held payee information.

From 1 July 2021 compliance with closely held employee reporting requirements for small employers can be done in 3 possible ways:

- actual payments each pay event

- Quarterly reporting actual payments each pay event.

- Quarterly reporting based on a reasonable estimate.

A closely held employee is one who is a “non-arm’s length employee, directly related to the entity from which they receive payments“, including family members of a family business, directors of a company and shareholders or beneficiaries.

For example, including:

- family members of a family business

- directors or shareholders of a company

- beneficiaries of a trust

See further:

- Taxation Administration – Single Touch Payroll – 2019-20 and 2020-21 Income Years Closely Held Payees Exemption 2021

- Small employers – closely held (related) payees

Concessional reporting for micro employees

Micro employers are those with 1 to 4 employees and were able to report quarterly for 2 years via a registered agent.

From 1 July 2021 this concession is only available in exceptional circumstances.

See further: Concessional reporting for micro employers

Deferrals

The ATO recognise grounds for deferral of STP reporting in circumstances of

- transition – only in exceptional circumstances

- inadequate internet services – a recurring penalty-free late lodgement may be available, based on submitted evidence

- operational and recurring ‘special circumstances’ may be grounds for an ongoing penalty-free late lodgment.

Detailed information: Deferrals

Exemptions

The ATO published information regarding exemptions mostly refers to deferrals for the 2018-19 year, with reporting to commence in 2020 or 2021 financial years, depending on the type of entity.

The entity and deferral types available are here.

Exemption requests can be:

- made by Tax or BAS agent online on behalf of the business ; or

- by phone to 13 28 66

- via the Business Portal

Single Touch Rollout Payroll Timetable

Source: ATO’s Single Touch Payroll update and other ATO published information

| Date | Activity |

| July 2017 | STP reporting limited functionality for a select number of employers |

| September 2017 | ATO writing to employers with more than 15 employees |

| October 2017 | Service providers starting to release payroll software solutions |

| 1 April 2018 | Employers required to do a head-count to determine STP reporting obligation |

| 1 July 2018 | Single Touch Payroll mandatory reporting for employers with 20 or more employees |

| 1 July 2019 | Single Touch Payroll mandatory reporting for employers with less than 20 employees (closely held employees excluded for 2 years) |

| 1 July 2021 | Closely held employees mandatory reporting (3 options) |

| 1 Jan 2022 | Phase 2 expansion of info reporting, closely held employees included |

How To Implement Single Touch Payroll

Implementation of STP reporting requires compliant upgraded payroll products.

The process and procedure for implementing STP by a business will therefore rely primarily on its payroll software, and any support available from the chosen software provider.

There is a product register for complying software solutions here. The list can be filter by price, number of employees and other factors.

STP Penalties

The legislation provides the Commissioner of Taxation with authority to specify a grace period for entities to make corrections to withholding statements.

A general 14-day grace period is provided to make corrections. See Correcting a Pay Event Report and Legislative Instrument STP 2019/5 Single Touch Payroll – Grace periods for correcting statements

The Tax Office has stated that the first 12 months Single Touch Payroll reporting will be a transition period, during which failing to report on time penalties will not be applied, unless the Commissioner of Taxation has first given the employer written notice advising that a failure to report on time in the future may attract a penalty.

The Tax Office has advised that leniency will be available to small businesses attempting to comply within in the first year of implementation which starts on 1 July 2019. See further under Deferrals and Exemptions.

What happens if employee numbers drop below 20?

Once you’re in the STP reporting arrangements, you have to stay in, regardless of employee numbers.

Low Cost, Free and All Approved Payroll Software Solutions

Compliant software solutions can be identified from the ATO’s product register or simply a Google search.

See also further Single Touch Payroll info:

- STP reporting issues and errors – ATO website

- (ATO) Single Touch Payroll

- STP Legislation link: Budget Savings (Omnibus) Bill 2016

Employees – Using myGov To Check Your Pay and Super Details

- Step 1 Login to my.gov.au

- Step 2 Select ATO services

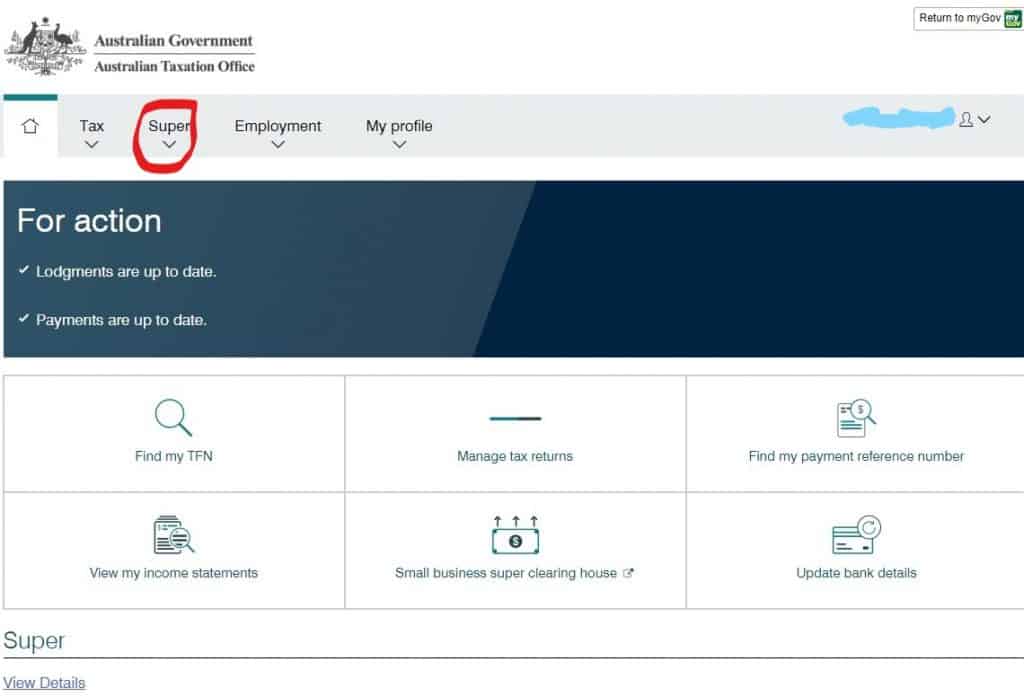

- Step 3 Select the “Super” label at the top of the screen (or top left on mobile)

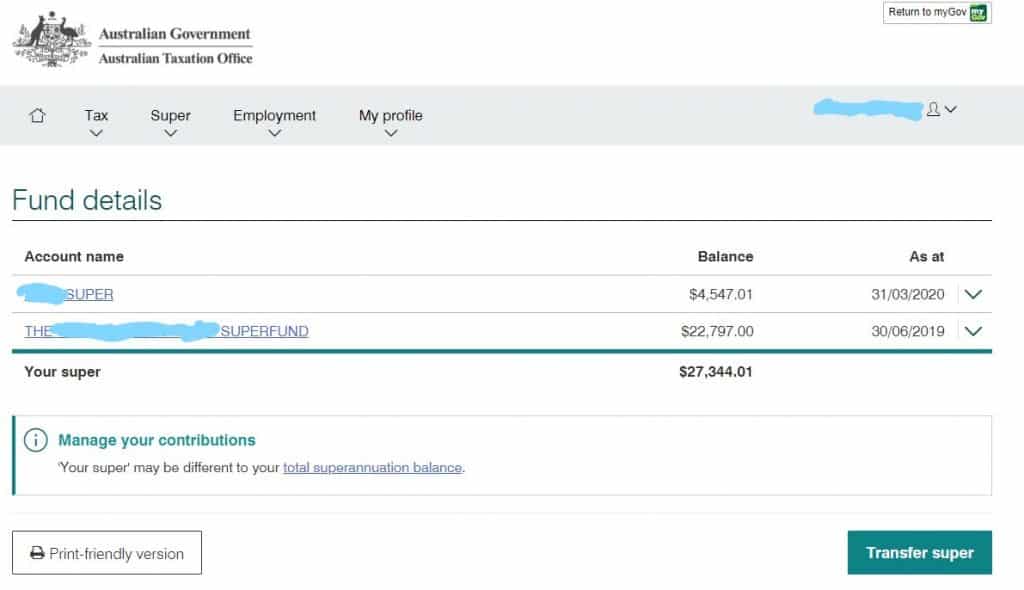

Then select “Fund details” from the expended menu. This will display the ATO’s record of your super funds, the balances and the last date updated.

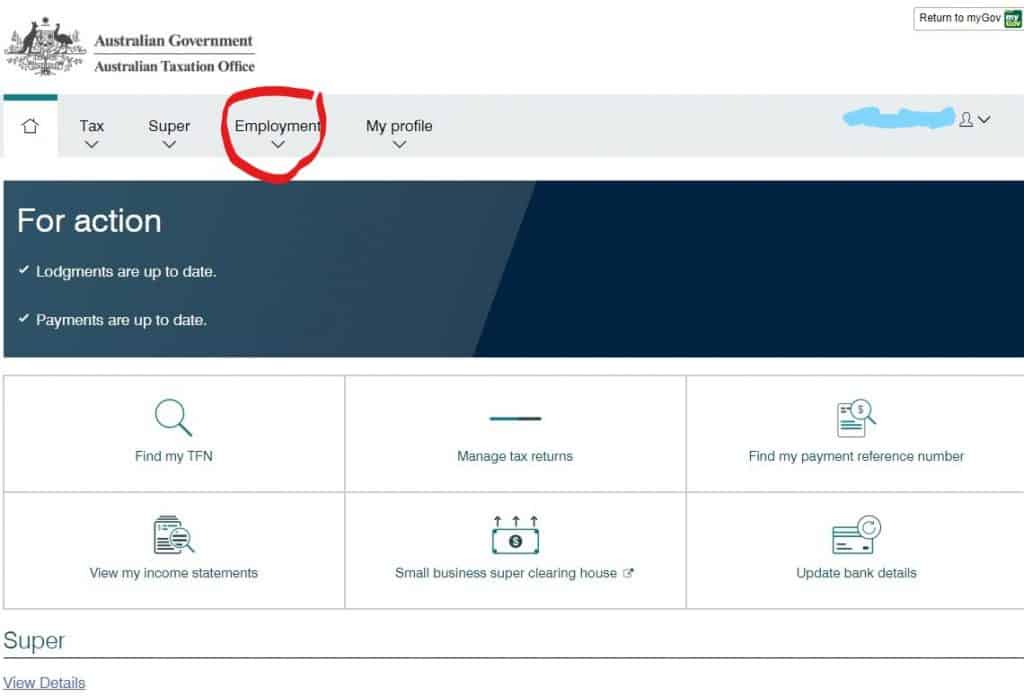

Step 4 Select the “Employment” drop down from the top of the screen.

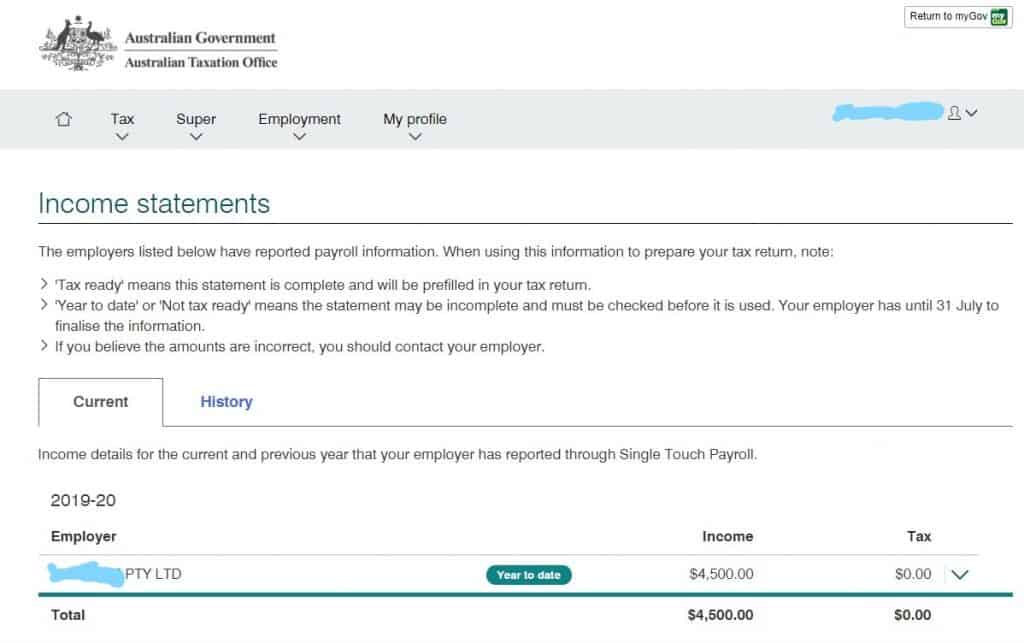

Then select “Income statements” from the Employment drop-down menu. This will show your employers and employment income year to date.

If any details of your records don’t look right, contact your super fund or employer to find out why.

STP Software Solutions ATO Register

The Tax Office maintains a register of compliant payroll software products helpfully categorised by business type.

Your can inspect the register here.

This page was last modified 2023-12-13