Budget Night 2014

Budget Night 2014

The Federal Budget 2014-15 was presented to Federal Parliament on Tuesday 13 May 2014 by Treasurer Joe Hockey.

See Budget Speech and Budget Papers 2014-15.

The following content pages have been updated to include the impact of budget proposals:

- Tax Rates (Resident) 2014-15, 2015-16, 2016-17 – introduction of 2% levy on high income earners

- Tax Rates (Non-Resident) 2014-15, 2015-16, 2016-17 – introduction of 2% levy on high income earners

- Dependent Spouse Offset – removal 1 July 2014

- Invalid and Carer Tax Offset – reduced income limit

- Mature Age Worker Tax Offset – removal 1 July 2014

- Medicare Levy – adjustment of family low income thresholds

- Fringe Benefits Tax – increase rate to 49% and adjustment of non-profit caps

- Superannuation Guarantee – revised timetable for increase to 12%

- R&D Tax Concessions – reduction of offset by 1.5%

- Excess non-concessional super contributions – proposal for withdrawal and tax-at-marginal rates scheme

- Company tax rates – reduction by 1.5% from 1 July 2015 and Exploration Development Incentive from 1 July 2014

- Age Pension – age increase, deeming thresholds, income & assets indexation, Health Card, Senior Supplement

- Family Tax Benefits – a number of changes to existing entitlements and the introduction of a new single parent allowance.

- Student HECS-HELP program – reduction of income repayment thresholds, a 2% repayment band, a changed method of indexation and removal of loan fees from 1 July 2015.

- Re-introduction of fuel tax indexation (to CPI) twice a year – commencing 1 August 2014. See PWC Tax Alert – 16 May 2014.

The Treasurer’s Budget Night Speech

Key tax announcements:

From 1 July 2014 Temporary Budget Repair Levy will increase the top marginal tax rate by 2% for people earning more than $180,000 a year.

Temporary Budget Repair Levy

The temporary budget repair levy applies to the:

- 2014-15 financial year;

- 2015-16 financial year; and

- 2016-17 financial year.

This levy will effectively increase the top marginal rate from 45% +2% = 47%

plus when applicable the Medicare levy of 2% (and potential surcharge up to 1.5%) could result in a top rate of 50.5%.

The levy will apply to both residents and non-residents.

The levy cannot be reduced by non-refundable tax offsets.

Consequential tax rates amendments

As a result of the Temporary Budget Repair Levy, there are a number of consequential amendments to tax rates which are set or calculated by reference to the top personal marginal tax rate. As well as taxing high incomes, the top marginal tax rate is typically applied as a penalty, or in circumstances of breach or non-compliance.

See amending legislation details in the explanatory memorandum.

Tax rates amendments will include:

- FBT – from 1 April 2015 to 31 March 2017 – the FBT rate will be 49%

- For Non-profits: Existing exemption and rebate caps are to be adjusted to maintain the cash value of those caps.

- For PBIs and health promotion charities the grossed-up exemption cap will increase to $31,177 per employee (currently $30,000).

- For public and not-for-profit hospitals and public ambulance services the grossed-up exemption cap will increase to $17,667 per employee (currently $17,000)

- For other tax-exempt entities, such as charitable institutions, that are currently rebatable at 48% the rebate rate

- increases to 49% for the 2015-16 and 2016-17 FBT years, and

- then reverts to 47% from 1 April 2017.

- (Also the cap would be increased from $30,000 to $31,177).

- Taxation of the unearned income of minors – tax rates will be increased by 2% in cases where that income is not otherwise subject to the levy because it is at or below the $180,000 threshold.

- Tax rate caps applicable to certain ETPs and superannuation lump sums – amendments are intended to ensure that the capped tax rates are preserved

- Section 99A trustee assessments (unallocated trust income) — the tax rate goes from 45% per cent to 47%

- Subsection 98(4) trustee assessments (foreign resident individual beneficiaries) — the tax rate goes from 45% per cent to 47%

- Non-complying superannuation funds — the tax rate goes from 45% per cent to 47%

- Non-arm’s length superannuation fund, ADF or PST income — the tax rate goes from 45% per cent to 47%

- Non-TFN contributions income of a superannuation fund or RSA — the tax rate goes from 47% per cent to 49% (less the ordinary rate of tax paid by the fund or provider)

- Share of the net income of a partnership attributable to a partner not having control and disposal of that income — the tax rate goes from 47% per cent to 49%

- Family Trust Distribution Tax – distributions outside the family group – the tax rate goes from 47% per cent to 49%

- Income Tax (Bearer Debentures) withholding tax – the tax rate goes from 45% per cent to 47%

- Income Tax (First Home Saver Accounts Misuse Tax) – the tax rate (effectively) goes from 47% per cent to 49%

- Income Tax (TFN Withholding Tax (ESS)) – non-quotation of ABN or TFN – the tax rate goes from 47% per cent to 49%

- Superannuation (Departing Australia Superannuation Payments Tax) – DASP payments

- from a taxed superannuation fund will be taxed at 38%

- from an untaxed superannuation fund will be taxed at 47%

- Excess non-concessional contributions tax – the tax rate (effectively) goes from 47% per cent to 49%. The potential doubling of tax which would otherwise apply to unwithdrawn excess concessional contributions which give rise to a breach of the non-concessional cap will be limited to 95%.

- Superannuation (Excess Untaxed Roll-over Amounts Tax) – the tax rate goes from 47% per cent to 49%

- Taxation (Trustee Beneficiary Non-disclosure Tax) (No. 1) – the tax rate goes from 47% per cent to 49%

- Taxation (Trustee Beneficiary Non-disclosure Tax) (No. 2) – the tax rate increases to 49%

- Interest on non-resident trust distributions – (interest charge on foreign trust income accumulations) – the tax rate goes from 45% per cent to 47%

- Untainting tax (companies) – increase by 0.5% from 1 July 2014 to reflect increase in Medicare levy and 2% for the Budget Repair Levy in the years to which it applies

- Trust Recoupment Tax (trust stripping arrangements) – the tax rate goes from 45% per cent to 47%

- Withholding (PAYG) rates – Non-quotation of TFN or ABN – and all other PAYG schedules to be adjusted to take the additional 2% levy into account

Details of the Bills and and their progress through parliament can be reviewed on the Federal Parliament website

- From September 2017, increases in pensions will be linked twice a year to inflation.

- Asset and associated income test thresholds will be indexed between now and 2017, but then remain at fixed levels for three years.

- Current family assistance rates will be kept at the same level for two years. Thresholds for the Private Health Insurance Rebate and most Medicare fees will also be paused.

- The Family Tax Benefit Part B income threshold will be reduced to $100,000. For a typical family receiving the base rate of Family Tax Benefit Part A, payments will start to reduce when family income exceeds $94,316 per year.

- From next year, unemployed people under 25 will get Youth Allowance, not Newstart. People under 30 will wait up to six months before getting unemployment benefits, and then will have to participate in Work for the Dole, to be eligible for income support.

- For Australians over 50, a payment of up to $10,000 to a business that employs an Australian over the age of 50 who has been on unemployment benefits or the Disability Support Pension for six months.

- Our changes to higher education will allow universities to set their own tuition fees from 2016. For students already studying, existing arrangements will remain until the end of 2020.

- Establishment of a $20 billion Medical Research Future Fund to be “within six years, the biggest medical research endowment fund in the world”. The Medical Research Future Fund will receive all the savings from the introduction of a $7 Medicare co‑contribution from 1 July 2015, changes to the Pharmaceutical Benefits Scheme and other changes in the Health Budget, until the Fund reaches $20 billion. (See detailed explanation here.)

- the Government is re‑introducing fuel indexation where every dollar raised by the increases will be linked by law to the road‑building budget.

Budget summaries:

- CCH Budget Night Report 2014

- ICAA – Thomson Reuters Federal Budget Tax Bulletin

- PWC – Budget 2014-15 – Is It Crunch Time?

- Department of Human Services – an alphabetical listing of all 2014-15 budget measures relevant to the Department

- Not For Profits – Thomson Geer Lawyers – Charities Alert May 2014

Parliamentary Library

- Parliamentary Library’s Budget Review 2014–15 – background research papers for each policy area

Pre-budget media and commentary

- “Budget 2014: what we know” – ABC

- “Labor’s mess..”

- Motorists to pay more with Coalition poised to reintroduce indexation of fuel excise – ABC

- Debt tax firms as Coalition asks for Australia’s trust – ABC

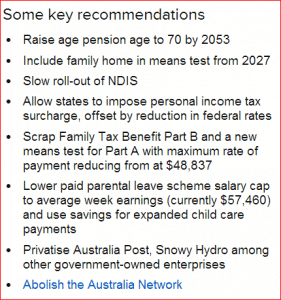

- Commission of Audit recommends – ABC

- Prime Minister Tony Abbott confirmed at a press conference that the Paid Parental Leave cap will be reduced from $150,000 to $100,000 in the upcoming Budget.

- Deficit levy: Government MPs openly question proposal to raise taxes for higher-income earners – ABC

- Temporary deficit levy plans leaks in to pre-budget talk – ABC

- Hockey says Australians need to ‘work as long as they can’ – ABC

- Hockey spells out the detail behind the ‘budget crisis’ – AFR

- Federal budget: Joe Hockey warns of wide-ranging cuts, says all must do ‘heavy lifting’. – ABC

- The Federal Budget will be published in data form for the first time this year. – Dept of Finance

.

This page was last modified on 1 Sept 2017

Budget Night 2014

Budget Night 2014