Tax Rates 2015-2016 Year (Residents)

The 2016 financial year starts on 1 July 2015 and ends on 30 June 2016. The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year.

Personal Tax Rates 2015-16

| Taxable Income | Tax On This Income |

| 0 to $18,200 | Nil |

| $18,201 to $37,000 | 19c for each $1 over $18,200 |

| $37,001 to $80,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $80,001 to $180,000 | $17,547 plus 37c for each $1 over $80,000 |

| $180,001 and over | $54,547 plus 47c for each $1 over $180,000 |

The above rates reflect the withdrawal of previously legislated tax cuts associated with the carbon tax, now repealed.

The above tables do not include Medicare Levy or the effect of any Low Income Tax Offset (“LITO”).

There are low income and other full or partial Medicare exemptions available. A Medicare Levy Surcharge may also be applicable and is applied on a progressive basis if eligible private health insurance cover is not maintained.

Levy on higher income earners

The Federal Budget 2014-15 contained a proposal for a Temporary Budget Repair Levy of 2% applicable on taxable income in excess $180,000. This in effect increases the highest marginal tax rate from 45% to 47% (before Medicare) and takes effect for 3 years from 1 July 2014 until 30 June 2017.

What’s New in 2015-16

(not exhaustive)

- The Etax software program has been retired and is no longer available for download. For online tax return lodgement for individuals and sole traders, the MyTax 2016 web-based application has been expanded and updated. See more info here.

- The Family Tax Benefit Part B primary earner income limit is reduced to $100,000, and the Part A large family supplement will be limited to families with four or more children. These (and other social security measures) take effect from 1 July 2015.

- from 1 July 2015 the “preservation age” – the minimum age for normal access to superannuation starts to increase. For those born after 30 June 1960 and before 1 July 1961 the preservation age is 56 years. See Access to superannuation

A number of measures were announced in or leading up to the 2015 budget taking effect from 1 July 2015.

They include:

- small business company tax cut by 1.5% (see Company Tax Rates)

- small business owner 5% tax discount (see Small Business Tax Offset)

- small business deductibility of certain start-up costs (see black hole expenditure)

- adjustment of work-related car expense deductions to remove the 12% of cost and one-third actual expense methods, and to fix the per km rate at 66 cents (reviewed annually), regardless of vehicle size (see Work Related Car Expenses)

- Family Tax Benefit Part A overseas recipients limited to 6 weeks in a 12 month period (intended start 1 January 2016: see DSS Fact Sheet)

- softening of superannuation release conditions for the terminally ill – 2 years life expectancy (see Access To Superannuation)

- zone tax offset – FIFO and Drive-in-drive-out workers to be denied the offset by the requirement that the normal residence be within a zone (see Zone Tax Offset)

Other measures:

- The CGT consequences on the sale of a business subject to earnout conditions have been simplified, such that capital gains and losses in respect of a look-through earnout right are to be disregarded. Legislation takes effect from 24 April 2015. See more here.

- Employee Share Scheme benefits taxing rules have been revised with effect from 1 July 2015, with a reversal of some measures which were introduced in 2009, and a new regime of concessions aimed at eligible startup companies.

Tax free income

See the list of common income items which are not taxable.

Tax on long service leave

Long service and annual leave are generally taxed at marginal tax rates, however when paid in a lump sum, and with some planning ahead, there can be opportunities to save tax. See the explanation here.

See also

Superannuation concessional caps for 2015-16

Carbon tax repeal and 2015-16 tax cut reversal – in detail

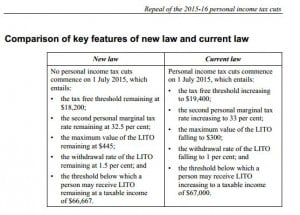

Legislation was passed by parliament in June 2015 to amend the 2015-16 tax scale (and Low Income Tax Offset) so that the overall tax rates are the same as the previous year.

Previously legislated tax rates for the 2015-16 year under the Clean Energy (Income Tax Rates Amendments) Act 2011 introduced carbon tax compensation to taxpayers by way of tax cuts, a second round of which were to have applied from 1 July 2015.

Those adjustments to the tax scale for 2015-16 were to:

- increase tax free threshold from $18,200 to $19,400

- increase of the 32.5 cent marginal rate to 33 cents

- reduction of the Low Income Tax Offset from $445 to $300.

Legislation to remove these tax cuts has now been passed by parliament.

2015-16 tax scale as it was before the amendment

| Taxable Income | Tax On This Income |

| 0 to $19,400 | Nil |

| $19,401 to $37,000 | 19c for each $1 over $19,400 |

| $37,001 to $80,000 | $3,344 plus 33c for each $1 over $37,000 |

| $80,001 to $180,000 | $17,534 plus 37c for each $1 over $80,000 |

| $180,001 and over | $54,534 plus 47c for each $1 over $180,000 |

The LNP government unsuccessfully sought to repeal the bundle of Clean Energy repeal bills in November 2013.

The Bills were defeated in March 2014, reintroduced in June 2014 and again defeated.

The Government however confirmed its intention to remove the tax cuts and with the subsequent support of the Labor Opposition finally got the law passed.

The effect of the repeal is to revert the 2015-16 tax scale and the Low Income Tax Offset to the same basic rates (excluding the Medicare and Temporary Budget Repair levies) which have been in place since the 2012-13 year.

This page was last modified 2020-04-14