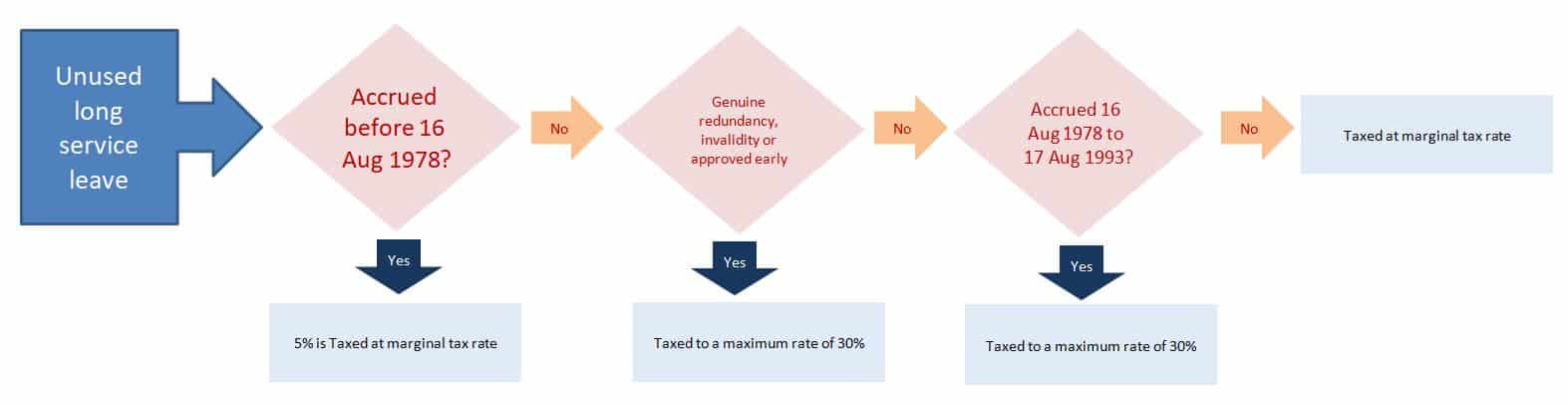

Long service leave accrued since 18 August 1993 is taxed at marginal tax rates, i.e. included in ordinary income subject to the normal tax scale.

Leave is specifically excluded from the concessionally taxed ETP rules, however certain payments attract tax concessions.

They include payments in respect of:

- accruals attributable to employment before 18 August 1993

- genuine redundancy or approved early retirement schemes

- invalidity

Amounts accrued before 18 August 1993 have tax limited by offset to a maximum 30% (plus medicare).

Of amounts accrued prior to 17 August 1978, only 5% is included as taxable income. For an overview of the tax treatment, please see the flow diagram at the foot of this page.

Payments on the death of an employee to beneficiaries or the trustee of the deceased’s estate are generally exempt from tax.

Allocation the long service leave payments into relevant taxing periods is based on the underlying period of employment which generated the leave accrual.

On taking leave ordinarily there is little opportunity to influence the tax applicable. The superannuation guarantee is also applied to leave taken in the ordinary course.

However if the leave is paid in a lump sum, either on termination or through a voluntary cashing out, then with some planning there may be opportunities to achieve tax savings.

What follows is not advice, but points of reference for discussion with your financial advisor.

Cashing out leave accruals

Cashing out is the process of being paid for leave in return for cancelling the accrual, rather than actually taking the leave. Depending on circumstances, the lump sum arising may provide planning or cash flow benefits.

Whether long service leave or annual leave can or should be cashed out depends on such factors as

- the terms of any award or industrial agreement

- the prevailing State law

- the terms of the employment contract

- the employer and employee’s desire or willingness to have the leave actually taken or not

- a consideration of cash flow issues

Effect of timing of receipt of a leave payment

If taken in a lump sum the timing of receipt of a leave payment (on termination or otherwise) may have a significant impact on the total taxable income for that financial year. If there is flexibility to choose the tax year in which relevant events occur, then lower overall tax payable can result.

In the case of a termination, to be considered is whether the leave is taken before the termination, or whether alternatively the accrued value is rolled up into a termination entitlements settlement. SGC superannuation is not mandatory under the SGC rules in respect of termination leave, and is potentially lost if the entitlement is not otherwise secured.

Salary sacrificed leave payments

With foresight, the payment of accrued leave may be able to be provisioned as a salary sacrifice.

If the sacrificed payment is contributed to a complying superannuation fund, there is potential for the leave amount to be shielded from the employee’s high marginal tax rate in favour of the concessionally taxed super fund environment. Contributed as a concessional contribution within the relevant caps the initial contributions tax rate on the lump sum could be as low as 15%.

Achieving an effective salary sacrifice in these circumstances requires careful attention to the terms of the salary sacrifice agreement and the surrounding employment laws.

See also

This page was last modified 2020-03-17