Payments in consequence of termination of employment

Payments falling into the following categories each have a specific tax treatment.

The tax on employment loss of job payments varies according to the nature of the payment.

On this page:

Employment termination payments (concessional tax treatment)

Employment termination payments typically paid in a lump sum push income toward higher marginal tax rates. The tax rules reduce the tax by exemption or by tax offset on these kinds of payments when they are made within the ETP and/or Whole of Income caps.

Qualifying conditions for concessional tax treatment of an eligible termination payment (“ETP”)

The termination payments falling under this heading meet the following conditions:

✔️the payment is received in consequence of the termination of the person’s employment (see also death benefits). This requirement excludes regular salary and wage income

✔️the payment is received within 12 months of the termination (there are exceptions)

✔️the payment is not excluded (see the following list of exclusions)

Exclusions:

To be considered an ETP the payment must not be any of the following:

X a superannuation benefit

X a pension or an annuity

X unused annual leave

X unused long service leave

X the tax-free part of a genuine redundancy payment (the remaining part can be a ETP)

X the tax-free part of an early retirement scheme payment (the remaining part can be a ETP)

X a foreign termination payment to which Subdivision 83-D applies

X the CGT exempt amount arising from the small business retirement exemption

X an advance or a loan to the taxpayer on ‘arms length’ terms and conditions

X a deemed dividend

X a capital payment for the taxpayer’s personal injury in connection with a loss of earning capacity (payment must be reasonable)

X a capital payment for the taxpayer’s restraint of trade (payment must be reasonable)

X the commuted pension amount from a constitutionally protected fund or superannuation provider which is wholly applied to pay a superannuation contributions surcharge

X an amount included in your assessable income under Division 83A of this Act (which deals with employee share schemes).

Exceptions to the ETP 12 month rule

If a payment falls outside the 12 month requirements, tax at normal rates generally applies to the payments.

There are exceptions to this. A payment which fails the 12 month rule may still be treated as an ETP in the following circumstances:

- in the case of genuine redundancy or early retirement scheme payments

- the payments resulted from legal or insolvency processes commenced within the 12 month period (F2018L00431)

- the payments are from a redundancy trust within 2 years (F2019L00409)

- (upon request) if the Tax Office determines it is reasonable.

The tax on concessionally taxed eligible termination payments

The tax-free components of an ETP are described under other headings (see redundancies and invalidity).

The concession on the remaining parts is by way of a tax offset which operates to limit the tax to a maximum percentage.

The maximum tax percentage depends on your age, and specifically whether you have reached preservation age.

The concession also only applies to a limited amount, determined by the application of two separate caps. ETP amounts in excess of either cap are taxed at the top marginal tax rate.

The preservation age is 55 years for individuals born before 1 July 1960. For those born after that date, the preservation aged depends on date of birth.

| Date of Birth | Preservation Age (yrs) | Reaches preservation age .. |

| Before 1 July 1960 | 55 | before 1 July 2015 |

| 1 July 1960 to 30 June 1961 | 56 | 1 July 2016 to 30 June 2017 |

| 1 July 1961 to 30 June 1962 | 57 | 1 July 2018 to 30 June 2019 |

| 1 July 1962 to 30 June 1963 | 58 | 1 July 2020 to 30 June 2021 |

| 1 July 1963 to 30 June 1964 | 59 | 1 July 2022 to 30 June 2023 |

| 1 July 1964 and later | 60 | from and after 1 July 2024 |

The ETP cap is based on the amount of the ETP, and the ceiling value is indexed for inflation annually.

The available Whole of Income cap is the determined by subtracting the taxpayer’s other taxable income (excluding the ETP) from $180,000. (A negative result is taken as zero.)

The applicable cap is the one with the lowest value, usually the whole of income cap.

| Year | ETP Cap | Whole of Income Cap |

| 2024-25 | $245,000 | $180.000 |

| 2023-24 | $235,000 | $180,000 |

| 2022-23 | $230,000 | $180,000 |

| 2021-22 | $225,000 | $180,000 |

| 2020-21 | $215,000 | $180,000 |

| 2019-20 | $210,000 | $180,000 |

| 2018-19 | $205,000 | $180,000 |

| 2017-18 | $200,000 | $180,000 |

Whether both ETP and Whole of Income caps need to be applied, or just the ETP cap, depends on the type of payment.

ETP cap only applies (“excluded payments”)

– death benefit ETP

– excess of genuine redundancy over tax free limit

– excess of early retirement scheme over tax free limit

– payments that would have been for a genuine redundancy had the employee not reached their retirement age, or Pension age

– tax free component of invalidity payments

– compensation payments for personal injury, unfair dismissal, harassment or discrimination

Apply the lowest of the 2 caps (‘non-excluded payments’)

– golden handshakes and gratuities

– non-genuine redundancy payments

– payments in lieu of notice

– payments for unused sick leave

– payments for unused rostered days off

The maximum tax rates for taxpayers who have reached preservation age

- amount up to the cap amount: maximum rate of 17%

- amount over the cap amount: top marginal rate of 47%

The maximum tax rates for taxpayers who are below preservation age

- amount up to the cap amount: maximum rate of 32%

- amount over the cap amount: top marginal rate of 47%

(These rates include medicare levy.)

Superannuation payments

Payments from a superannuation fund may occur in the context of a termination of employment, but are not treated as termination payments as such.

Employment termination payments which are “rolled over” into a super fund are not excluded from the tax applicable to employment termination payments.

The taxing of superannuation benefits is summarised here.

Pre-July 83 segment (tax free)

Any part of an employment termination payment which is referable to a period of service before 1 July 1983 is tax free.

The tax free amount can be determined by apportionment on a daily basis.

Formula:

A = No. of days employment before 1 July 1983

B = total days of employment to which the ETP relates

C = $Amount received.

The tax free amount = (A ÷ B) multiplied by C

Invalidity segment (tax free)

The invalidity component of an employee termination payment is determined by a calculation based in the future.

When an employee retires because of permanent disability, the part of the Employment Termination Payment (ETP) which relates to the period until normal retirement date, is the tax free invalidity component.

To be classified as an invalidity payment, the termination of employment must have taken place before the date the employee’s employment would have normally ended. For these purposes, this is referred to as the last retirement date.

If the date cannot be otherwise determined, then age 65 years is taken to be the last retirement date.

What is the disability causing the termination?

The nature of the disability giving rise to the termination of employment includes physical and mental incapacity; either total incapacity, or incapacity for that employment.

The disability must be verified by two medical practitioners as being likely that the employee will never be able to be employed in keeping with their education, training or experience.

Calculation of tax free invalidity component

To calculate the tax free invalidity component of an ETP, the period from actual termination to the last retirement date is compared to the total period (including the period to last retirement date). That ratio when applied to the ETP dollar amount is the tax free invalidity amount.

Employment days

For the calculation we need to know the total employment days – the total number days on which the ETP is based.

For continuously employed full time workers this is a readily obtained number calendar days.

For casual or part-time workers, the employment days total is the number of days in the period of employment (not the number of days worked).

For seasonal workers, the employment days total is the number of days in each seasonal period of seasonal work.

The formula:

A = the amount of the ETP in dollars

B = additional days from actual retirement to the last retirement date

C = total employment days PLUS the number of days in B

A x B ÷ C = $[Tax Free Invalidity Component]

ATO invalidity calculation worksheet

Employment termination payment with an invalidity segment worksheet (NAT 71949) can be downloaded from the Tax Office website here.

The worksheet lays out a calculation of taxable and tax free components of an ETP payment containing an amount for invalidity.

Death benefit employment termination payments

A death benefit termination payment is an employment termination payment received by a taxpayer after another person’s death in consequence of termination of the other person’s employment.

The concessional tax treatment of a death benefit employment termination payment depends on who it is paid to.

Payments to dependents of the deceased employee attract less tax than payments to non-dependents, via a tax free amount paid which is under the ETP cap.

Death benefit dependants

A ‘death benefits dependent’ is defined (Sec 302.195 ITAA 1997) as:

- spouse of either gender, including de facto spouse

- deceased person’s child under 18 years

- any person with whom the deceased had an interdependency relationship just before the time of death

- any other dependent just before the time of death

Tax rates on death benefits

| ETP amount | Dependants | Non-dependants |

| Up to the cap amount | 0% | 32% |

| Over the cap amount | 47% | 47% |

Rates include medicare.

Death benefit termination payments ETP cap

| Year | ETP Cap |

| 2024-25 | $245,000 |

| 2023-24 | $235,000 |

| 2022-23 | $230,000 |

| 2021-22 | $225,000 |

| 2020-21 | $215,000 |

| 2019-20 | $210,000 |

| 2018-19 | $205,000 |

| 2017-18 | $200,000 |

The death benefit cap calculations for an individual are not affected by or counted towards their own lifetime concessional caps calculations.

Employment termination payment 12 month rule

One of the qualifying conditions for the concessional tax treatment is that the termination payment be paid within 12 months of termination. Exceptions to the 12 month rule are summarised here.

In the absence of concessional treatment the payment is taxed as income at usual marginal rates.

Genuine redundancy payments

Within limits, tax on loss-of-job payments is concessional.

A genuine redundancy payment has a tax free component which is calculated using amounts which are indexed annually, and are set out in the table below.

The amount of redundancy payment in excess of the calculated tax free amount is concessionally taxed as an employment termination payment subject to the ETP cap, provided it meets the requirements as such.

Redundancy Tax Free Component

There are automatic tax free amounts calculated according to a formula which specifies

- a base amount; to which is added

- an additional amount multiplied by years of completed service.

These formula amounts are indexed each year, as shown in the table below.

Example

An employee with 8 completed years of service is retrenched and receives a lump sum redundancy payment of $65,000 in January 2015.

“Years of service” – The Tax Office has ruled that if earlier years of service with a previous employer are carried over and acknowledged on commencement with a new employer that later makes a redundancy payment to an employee, those years of service can be included in working out the tax-free amount of the genuine redundancy payment. See more on this here: PBR 1051239750456

The tax-free redundancy component (e.g. using 2014-15 values) is:

Formula: $Base_Amount + [8 times the Additional_Amount]

Numbers: $9,514 + [8 x $4,758] = $47,578.

The employer should separately identify tax-free components in the employee’s payment summary, which then do not need to be shown in the employee’s income tax return.

The redundancy tax free base amount and additional amounts

| Income Year | Base Amount | Additional Amount |

| 2024-25 | $12,524 | $6,264 |

| 2023-24 | $11,985 | $5,994 |

| 2022-23 | $11,591 | $5,797 |

| 2021-22 | $11,341 | $5,672 |

| 2020-21 | $10,989 | $5,496 |

| 2019-20 | $10,638 | $5,320 |

| 2018-19 | $10,399 | $5,200 |

| 2017-18 | $10,155 | $5,078 |

| 2016-17 | $9,936 | $4,969 |

| 2015-16 | $9,780 | $4,891 |

| 2014-15 | $9,514 | $4,758 |

| 2013-14 | $9,246 | $4,624 |

| 2012-13 | $8,806 | $4,404 |

| 2011-12 | $8,435 | $4,218 |

| 2010-11 | $8,126 | $4,064 |

| 2009-10 | $7,732 | $3,867 |

| 2008-09 | $7,350 | $3,676 |

| 2007-08 | $7,020 | $3,511 |

Tax free amounts are adjusted annually each year in line with movements in the Average Weekly Ordinary Time Earnings (AWOTE).

Pre 1 July 1983 service component (tax free)

The amount of a genuine redundancy or early retirement scheme payment which is not tax free, must be apportioned between pre-1 July 1983 service and post-30 June 1983 service.

In most cases, this is done with a simple ratio of calendar days compared to the total period (or sum of separate periods) of service.

The pre-July 1983 segment is tax free.

Post 30 June 1983 service and everything else (taxable)

The taxable components of a genuine redundancy or early retirement scheme payment are those parts which are not tax free.

These amounts are concessionally taxed as an employment termination payment provided they meet the requirements as such, subject to the ETP cap only.

The tax is limited by way of tax offset to the following:

The maximum tax rates for taxpayers who have reached preservation age

- amount up to the cap amount: maximum rate of 17%

- amount over the cap amount: top marginal rate of 47%

The maximum tax rates for taxpayers who are below preservation age

- amount up to the cap amount: maximum rate of 32%

- amount over the cap amount: top marginal rate of 47%

(These rates include medicare levy.)

ETP Caps

Life benefit termination payments ETP cap

| Year | ETP Cap |

| 2023-24 | $235,000 |

| 2022-23 | $230,000 |

| 2021-22 | $225,000 |

| 2020-21 | $215,000 |

| 2019-20 | $210,000 |

| 2018-19 | $205,000 |

| 2017-18 | $200,000 |

The ETP cap amount is indexed annually in line with Average Weekly Ordinary Time Earnings ‘AWOTE‘ in increments of $5,000 (rounded down).

What is a Genuine Redundancy?

A genuine redundancy payment is one ‘received by an employee who is dismissed from employment because the employee’s position is genuinely redundant’.

There are four qualifying conditions:

- the payment must be received in consequence termination of employment

- the termination must involve the employee being dismissed

- the dismissal must be caused by the redundancy of the employee’s position

- the redundancy payment must be made genuinely because of a redundancy.

A genuine redundancy results from the action of an employer, when the employer no longer requires particular work to be carried out.

- a job is no longer required to be done

- the decision to retrench is not based on normal staff turnover

- the basis of termination is not specific to an individual employee, i.e. it relates to a category or class of employees

It is also a requirement that the actual payment made should not exceed what could reasonably be expected if the parties had been dealing at arm’s length.

Payments which generally qualify include payments in lieu of notice, time based calculation of severance or redundancy payments and lump sum gratuities.

Tax ruling TR 2009/2 outlines in further details the requirements to be met for treatment as a genuine redundancy payment.

Early Retirement Payment

Subject to the qualifying conditions as an early retirement payment being met, early retirement payments are taxed in the same manner as genuine redundancy payments.

The tax free component is determined from annually indexed amounts used in a formula which combines a fixed amount plus an amount for years of service.

The formula:

The tax-free amount is worked out by the formula: Base amount + (additional amount × years of service)

| Income Year | Base Amount | Additional Amount |

| 2023-24 | $11,985 | $5,994 |

| 2022-23 | $11,591 | $5,797 |

| 2021-22 | $11,341 | $5,672 |

| 2020-21 | $10,989 | $5,496 |

| 2019-20 | $10,638 | $5,320 |

| 2018-19 | $10,399 | $5,200 |

The taxable components of an early retirement scheme payment are those parts which are not tax free.

These amounts are concessionally taxed as an employment termination payment provided they meet the requirements as such, subject to the ETP cap only.

The tax is limited by way of tax offset to the following:

The maximum tax rates for taxpayers who have reached preservation age

amount up to the cap amount: maximum rate of 17%

amount over the cap amount: top marginal rate of 47%

The maximum tax rates for taxpayers who are below preservation age

amount up to the cap amount: maximum rate of 32%

amount over the cap amount: top marginal rate of 47%

(These rates include medicare levy.)

ETP Caps

| Year | ETP Cap |

| 2023-24 | $235,000 |

| 2022-23 | $230,000 |

| 2021-22 | $225,000 |

| 2020-21 | $215,000 |

| 2019-20 | $210,000 |

| 2018-19 | $205,000 |

| 2017-18 | $200,000 |

To be eligible for concessional tax treatment, an early retirement scheme must be approved by the Tax Office, usually before implementation, or by exercise of discretion after the fact.

What is an early retirement payment?

An acceptable early retirement scheme requires the following features:

- must be offered to all employees in an approved class

- must be due to a rationalisation or re-organisation of the employer’s operations

- payments under the scheme must be in addition to the ETP which would be paid on a voluntary retirement

- retirement must be “early”. From 1 July 2019 this means earlier than the age pension age, or if it would have been sooner, the normal retirement age. Before 1 July 2019 the retirement age was taken to be age 65 or earlier.

- payments must be “arms length” values

- there must be no arrangement for re-employment

Extension of age limit from 1 July 2019

*In the 2018-19 MYEFO, the Government announced that from 1 July 2019 it would extend the concessional tax treatment of genuine redundancy and early retirement scheme payments to those under Age Pension qualifying age.

This is in the context of the age pension age being progressively increased from 65 to 67 years, such that some taxpayers would otherwise be disqualified from the early retirement/redundancy tax concession as being over the age of 65, yet still not eligible for the age pension.

The Treasury Laws Amendment (2019 Measures No. 2) 2019 giving effect to this measure was passed by parliament in October 2019 and takes effect for qualifying terminations from 1 July 2019.

The amendment increases the maximum age at which employees can access concessional tax treatment for genuine redundancy and early retirement scheme payments from 65 years to age-pension age.

Further information

- Approved early retirement schemes

- An example of an approved early retirement scheme

- Tax Ruling 94/12 – “Approved early retirement scheme and bona fide redundancy payments”

- Taxation Ruling TR 2009/2 Income tax: genuine redundancy payments

- ETP payg withholding rates (Schedule 11 Table A)

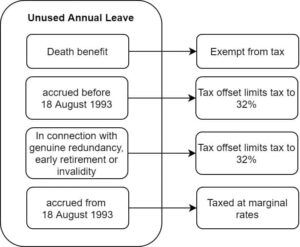

Unused annual leave

Annual leave is

- leave ordinarily known as annual leave, including recreational leave and annual holidays; and

- any other leave made available in similar circumstances

A payment for unused annual leave which has accrued since 18 August 1993 is included in assessable income.

A tax offset applies to limit the tax to 32% (including medicare) on leave which accrued before 18 August 1993; or if the payment was made in connection with a payment that includes, or consists of, any of :

- a genuine redundancy payment

- an early retirement scheme payment

- the invalidity segment of an employment termination payment or superannuation benefit

Where payments are made for periods which cover before and since 18 August 1993, the payment is apportioned by the number of days to determine the tax treatment.

Payments on the death of an employee to beneficiaries or the trustee of the deceased’s estate are generally exempt from tax.

Leave is specifically excluded from the concessionally taxed ETP rules.

Depending on circumstances, it may be possible to influence the tax applicable to unused annual leave by paying attention to employment agreements, timing and the opportunities for salary sacrifice. See the notes and references in respect to this here.

Further information

- Schedule 7 – Tax table for unused leave payments on termination of employment

- Withholding from unused leave payments on termination of employment

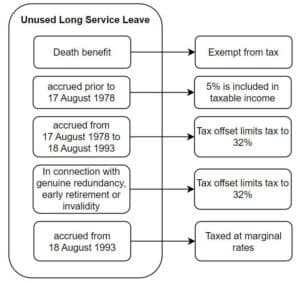

Long service leave

Long service leave accrued since 18 August 1993 is taxed at marginal tax rates, i.e. included in ordinary income subject to the normal tax scale.

Leave is specifically excluded from the concessionally taxed ETP rules, however certain payments attract tax concessions.

They include payments in respect of:

- accruals attributable to employment before 18 August 1993

- genuine redundancy or approved early retirement schemes

- invalidity

Long Service Leave Tax Treatment

Amounts accrued from 18 August 1993 are taxed at marginal tax rates, except the following.

Tax is limited by tax offset to 32% (including medicare) if the payment was made in connection with a payment that includes, or consists of, any of :

- a genuine redundancy payment

- an early retirement scheme payment

- the invalidity segment of an employment termination payment or superannuation benefit

Other time periods:

- Amounts accrued from 17 August 1978 to 18 August 1993 have tax limited by offset to a maximum 32% (including medicare)

- Of amounts accrued prior to 17 August 1978, only 5% is included as taxable income (not subject to tax offset).

- Payments on the death of an employee to beneficiaries or the trustee of the deceased’s estate are generally exempt from tax.

Allocation of the long service leave payments into relevant taxing periods is based on the underlying period of employment which generated the leave accrual.

On taking leave ordinarily there is little opportunity to influence the tax applicable. The superannuation guarantee is also applied to leave taken in the ordinary course.

However if the leave is paid in a lump sum, either on termination or through a voluntary cashing out, then with some planning there may be opportunities to achieve tax savings.

What follows is not advice, but points of reference for discussion with your financial advisor.

Cashing out leave accruals

Cashing out is the process of being paid for leave in return for cancelling the accrual, rather than actually taking the leave. Depending on circumstances, the lump sum arising may provide planning or cash flow benefits.

Whether long service leave or annual leave can or should be cashed out depends on such factors as

- the terms of any award or industrial agreement

- the prevailing State law

- the terms of the employment contract

- the employer and employee’s desire or willingness to have the leave actually taken or not

- a consideration of cash flow issues

Effect of timing of receipt of a leave payment

If taken in a lump sum the timing of receipt of a leave payment (on termination or otherwise) may have a significant impact on the total taxable income for that financial year.

If there is flexibility to choose the tax year in which relevant events occur, then consideration can be given to choosing a date which produces a better tax result.

In the case of a termination, to be considered is whether the leave is taken before the termination, or whether alternatively the accrued value is rolled up into a termination entitlements settlement. SGC superannuation is not mandatory under the SGC rules in respect of termination leave, and is potentially lost if the entitlement is not otherwise secured.

Salary sacrificed leave payments

With foresight, the payment of accrued leave may be able to be provisioned as a salary sacrifice.

If the sacrificed payment is contributed to a complying superannuation fund, contributed as a concessional contribution within the relevant caps the initial contributions tax rate on the lump sum would be 15%.

Achieving an effective salary sacrifice in these circumstances would require careful attention to the terms of the salary sacrifice agreement and the surrounding employment laws. This is not advice; simply a suggestion to review these issues with your professional advisor.

PAYG withholding rates

The PAYG withholding schedules for deducting tax from termination payments broadly reflects the ultimate tax position.

The Tax Office provides online material and methodologies for calculating tax withholdings.

Links are provided here:

- Unused leave

- Unused long service leave

- Schedule 11 – Tax table for employment termination payments (includes death benefits)

This page was last modified 2023-04-05