The R&D Incentive Scheme

The R&D Tax Incentive scheme provides a refundable tax offset on eligible expenditure for eligible entities.

The scheme provides a tax offset for eligible R&D activities targeted at R&D that benefits Australia.

R&D Rates & Eligibility From 1 July 2021

Since 1 July 2021 a tiered rate structure applies a higher tax credit percentage to larger entities spending a higher proportion of their total expenses on R&D (referred to as “intensity”).

The applicable rates are set out in the legislation: Sec 355.100 Entitlement to tax offset.

Here is a summary:

| Entity Aggregated turnover | Expenditure intensity | R&D tax credit percentage |

|---|---|---|

| Less than $20 million | N/A | Corporate tax rate + 18.5% |

| Less than $20 million and controlled by an exempt entity | N/A | Corporate tax rate |

| More than $20 million | Up to 2% of total expenses | Corporate tax rate + 8.5% |

| More than $20 million | More than 2% of total expenses | Corporate tax rate + 16.5% |

The rules under Sec 355.100 apply to eligible R&D expenditure of between $20,000 to $150 million. For R&D expenditure exceeding $150 million in your income year, the tax offset is simply your company tax rate, which provides no additional tax benefit.

Claims involving expenditure of less than $20,000 can still be made, but must be established by the engagement of a Research Service Provider.

For entities with an aggregated turnover of less than $20 million per annum the tax credit is the corporate tax rate + 18.5% for eligible entities and corporate tax rate for those controlled by income tax-exempt entities.

For all other eligible entities, the R&D tax credit percentage is the corporate tax rate + 8.5% for R&D expenditure up to 2% of total expenditure and corporate tax rate + 16.5% for R&D expenditure above 2% of total expenditure.

R&D Registration Deadline

The necessary registration of eligible R&D activities to enable an R&D Tax Incentive claim must be within 10 months from the end of your income year.

For June 30 balancing companies the registration deadline is April 30.

For December 31 balancing companies the registration deadline is 31 October.

Registration deadlines falling on public holidays are extended to the next business day.

Registration is via the business.gov.au portal.

Basic R&D Eligibility

To be eligible for the R&D tax incentive you must be an R&D entity, engaging in eligible activities and in most cases have notional R&D deductions of at least $20,000.

Registration is required annually. See here.

‘Eligible activities’ must meet a definition of core R&D activities. Other activities may be eligible as supporting R&D activities.

The Tax Office has a full outline of eligible expenditures which can be reviewed here.

Detailed explanations and registration information: business.gov.au

The Tax Office has issued a number of alerts targeting potentially incorrect R&D tax claims:

- Building or construction activities. TA 2017/2 refers to certain building or construction expenditure which is expressly excluded from being taken into account in calculating an R&D tax offset, or which does not otherwise relate to eligible R&D activities

- Ordinary business activities. TA 2017/3 refers to expenditure which relates to ordinary business activities, which are not eligible R&D activities.

- Software development. TA 2017/5 refers to R&D Tax Incentive claims for certain software development costs which are not eligible R&D activities. An addendum to TA 2017/5 seeks to further clarify when routine testing steps in software development projects should not be claimed,

- Ineligible agricultural activities. TA 2017/4 refers to R&D Tax Incentive claims for certain agricultural activities which are not eligible R&D activities. This includes activities carried on by family trusts, such entities not being eligible to claim.

The “At Risk” Rule

The at risk rule requires that for expenditure to be eligible for the R&D tax offset it must be notionally deductible under Division 355 of the Income Tax Assessment Act.

Taxation Ruling TR 2021/5 considers the tests for determining whether expenditure meets the at risk requirements, including for example where R&D activities are connected with commercial contracts for the supply of goods or services.

The ‘at risk’ rule compares the money spent on R&D with any payment or benefits (“consideration”) you might get, worked out at the time you incurred the expenditure

If the consideration is

- a direct or indirect result of expenditure being incurred (the nexus to expenditure test); and

- regardless of the results of the activities on which you incur the expenditure (the regardless of results test)

– then that consideration is excluded from R&D eligibility.

(See Taxation Ruling TR 2021/5 paragraph 4.)

Taxation Ruling TR 2021/5 contains 11 example scenarios which illustrate how the at risk rule would apply.

The examples should be read in full for proper context. Here is a summary of examples 1 to 8:

| Example Number | Scenario | “At Risk” Outcome |

|---|---|---|

| 1 | R&D entity spends money on R&D under a contract which provides $1.20 for every $1 spent | Expenditure is more than fully recoverable, so it’s not “at risk.” Nexus and results tests both failed. |

| 2 | R&D entity spends money on R&D under a contract for a fixed consideration. | Consideration is reasonably expected to be received as a result of incurring the expenditure, and irrespective of the results. |

| 3 | R&D entity receives a subsidy under a state government scheme, which is payable regardless of research results | The ‘at risk’ rule reduces the notional deduction by the amount of the subsidy. |

| 4 | R&D entity conducts research which produces new knowledge which is commercially valuable. A later, an offer to sell an interest is accepted. | The ‘at risk’ rule does not apply, because the consideration was not reasonable expected at the time of expenditure. |

| 5 | R&D entity spends on R&D to improve a device which was otherwise salable without the need for additional expenditure. | The ‘at risk’ rule does not apply, because the nexus to expenditure test is not satisfied |

| 6 | R&D entity spends on R&D to improve an existing tangible product for a 2 tiered consideration, the higher of which is contingent upon success of the development. | The ‘at risk’ rule is not met for the first tier consideration, because it was reasonably expected (nexus and result tests). The conditional second level consideration is at risk because it could not have been reasonably expected. |

| 7 | R&D entity spends on R&D pursuant to a fixed price contract to provide a device. | The ‘at risk’ requirement is not met because the consideration had the requisite nexus to the R&D expenditure incurred and was payable regardless of the R&D results. |

| 8 | R&D entity contracted to produce a new device receives an advance payment of consideration, repayable in the event of non-delivery. | The ‘at risk’ rule is met because R&D entity could not have reasonably expected to retain the consideration regardless of the outcome of the R&D |

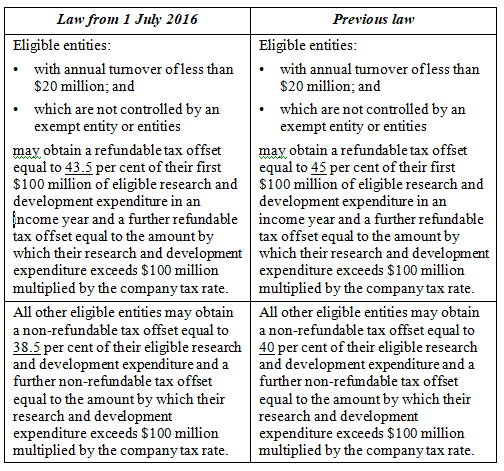

Rates Applicable 1 July 2016

The incentive came into effect on 1 July 2011 to replace the former R&D tax concession.

For financial years up to 30 June 2016 the refundable offset rate was 45% and the the non-refundable offset rate was 40%.

Expenditure below $100m offset reductions (2016)

The government reduced the offset rates by 1.5% from 45% to 43.5% and from 40% to 38.5% for the refundable and non-refundable tax offset rates respectively, first flagged in the 2014 Budget.

These rates apply from 1 July 2016. For details of the amending legislation see Budget Savings (Omnibus) Bill 2016.

(Current offset rates are here.)

Quarterly credits abandoned

A government-announced proposal to allow companies with aggregated turnover of less than $20 million to obtain the cash flow benefit of the their R&D offset offset on a quarterly basis, rather than waiting for a tax assessment was intended to commence 1 January 2014. However along with a number of other measures it was confirmed by the Federal Treasurer Joe Hockey in December 2013 that this measure would not proceed.

Further information see MYEFO Dec 2013.

At Risk Rule for R&D activities subsidised by JobKeeper payments

[22 Dec 2021] Taxation Determination TD 2021/9 outlines the view that an R&D entity triggers the at-risk rule and therefore cannot notionally deduct all or part of its wage expenditure in respect of a JobKeeper payment received.

See further:

- TD 2021/9

- Article: Tax implications for R&D activities subsidised by JobKeeper payments (Johnson Winter & Slattery)

Pre July 2011 – and the transition from the R&D tax concession to the R&D tax incentive

Prior to 1 July 2011, the R&D tax concession allowed companies to claim a tax deduction of up to 125% (and in some cases up to 175%) of eligible R&D expenditure.

R&D expenditure incurred in respect of R&D activities performed prior to 1 July 2011, continue to be claimed under the R&D tax concession. See ATO detailed notes.

Further information

- Research and Development Tax Incentive – ATO

- Developments in R&D: the year in review – PWC 1 April 2016

- TD 2020/D1 Income tax: notional deductions for research and development activities subsidised by JobKeeper payments

This page was last modified 2023-10-17