A Digital Games Tax Offset takes effect from 1 July 2022.

The purpose of the DGTO is to encourage the growth of the digital games industry in Australia.

The framework of the offset includes:

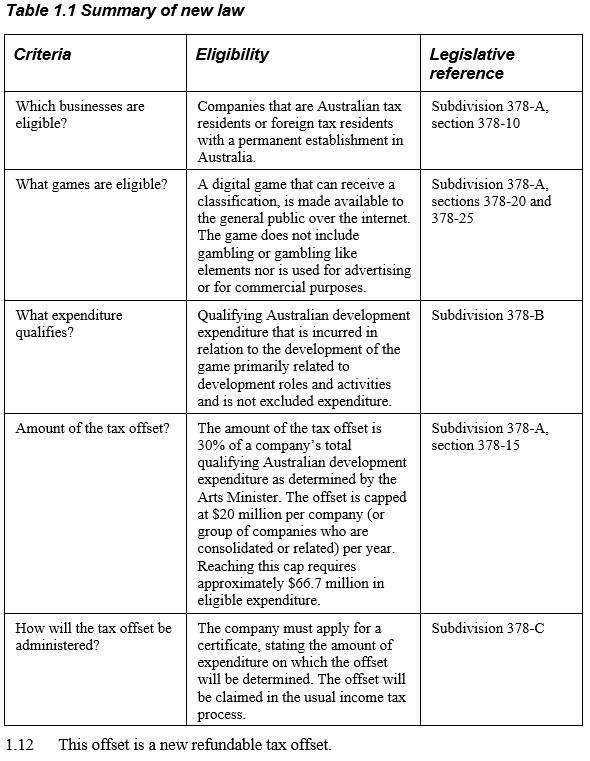

- the offset will be 30% of minimum $500,000 of qualifying Australian games expenditure

- The meaning of ‘eligible games’ is reviewed here (digital currencies, e.g. bitcoin are excluded)

- games with gambling elements or that cannot obtain a classification rating will not be eligible

- the offset will be refundable

- the offset will be available to Australian resident companies or foreign resident companies with a permanent establishment in Australia

- commencement date is 1 July 2022

The offset is capped at $20 million per year.

The rationale is the understanding that skills in the digital games area are readily transferable to other sectors such as defence, health, education, agriculture and urban planning.

At the time of writing, the offset claim information has not yet been included in the current year’s (2023) company tax return form.

Summary of the new law

Digital Games Tax Offset Regulations

Regulations have been introduced which provide rules for the administration of the DGTO.

Key elements of the rules:

- The Arts Minister is responsible for issuing the certificates needed to claim the DGTO.

- There is a special board called the Digital Games Tax Offset Advisory Board to help with the process.

- Companies may need to provide additional information and obtain expert verification in support of their claims

- The rules provide for the issue of non-binding provisional certificates as guidance for whether a game will qualify for final DGTO certification.

See: Income Tax Assessment (Digital Games Tax Offset) Rules 2023

Application For Digital Games Certificate

Application links and information are on the page: https://www.arts.gov.au/what-we-do/screen/digital-games

For further information about DGTO see:

- Digital Games Tax Offset – ATO

- Digital Games Tax Offset and digital currency taxation: Digital game on!

- Law: Treasury Laws Amendment (2022 Measures No 4) Bill 2022

Digital Games Tax Offset Key Features

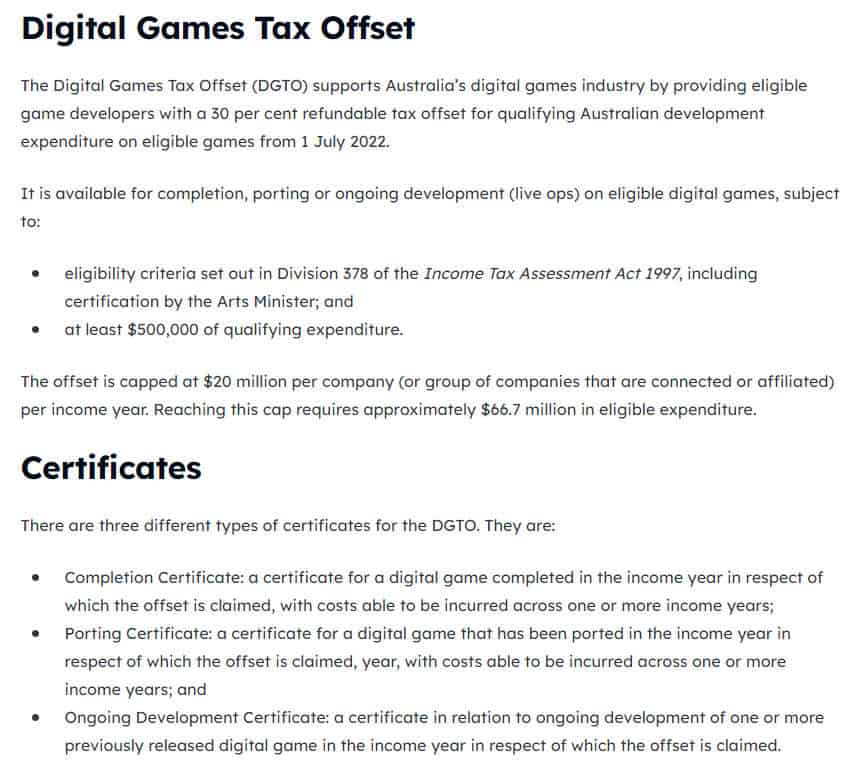

- The Digital Games Tax Offset (DGTO) is a refundable tax offset offered by the Australian Taxation Office.

- The offset is available to

- Australian resident companies

- Foreign tax resident companies with a permanent establishment in Australia

- Eligible Australian companies engaged in digital games development can claim 30% of their total qualifying Australian development expenditure (QADE) through this offset.

- The QADE must be certified by the Minister for the Arts and should be for a minimum of $500,000 qualifying expenditure, incurred on or after July 1, 2022.

- The offset is subject to a cap of $20 million per company per income year.

- The cap applies to both individual companies and groups of companies connected or affiliated with each other.

To claim the DGTO, companies need to:

- Obtain a certificate from the Minister for the Arts confirming eligibility and total QADE.

- Include the offset in their company tax return for the relevant income year.

- Qualify as either an Australian resident company with an ABN or a foreign resident company with an ABN and a permanent establishment in Australia.

- After obtaining the certificate, the DGTO can be claimed in the 2022-23 company tax return under the calculation statement at label E – Refundable tax offsets.

This page was last modified 2023-08-30