Franking credits are a refundable tax offset. If no tax is payable, or if the franking credits are greater than the amount of tax calculated on your income, then the balance is payable to you as a refund.

When claimed in an individual tax return, franking credit claims are included at Item 11 of the personal income tax return, or as part of investment income declared under sections of the supplementary tax return. Tax return forms for the current and previous years are linked here.

With the introduction of higher tax thresholds since 1 July 2012, together with available offsets, especially for seniors, many taxpayers may no longer be required to lodge a tax return.

This can result in an oversight for taxpayers who might otherwise have claimed the refund of franking credits by including the details in their tax return.

To enable the claiming of franking credit refunds without having to prepare and lodge a tax return, the Tax office has a form “Application for refund of imputation credits”.

Franking credit refund forms & instructions

- Application form and instructions 2022-23

- Application form and instructions 2021-22

- Application form and instructions 2020-21

- Application form and instructions 2019-20

- Application form and instructions 2018-19

- Application form and instructions 2017-18

- Application form and instructions 2016-17

- Application form and instructions 2015-16

- Application form and instructions 2014-15

- Application form and instructions 2013-14

- Application form and instructions 2012-13

For Non-Profit Organisations

Eligible organisations receiving franked dividends in the financial year or entitled to franked distributions from a trust can get a refund of franking credits.

If a prior application has been made, the Tax Office will send a pre-filled form for 2020. Otherwise an application can be made using the information here.

See also Tax Office publication explaining investor tax records, tax implications etc:

- You and your shares 2023

- You and your shares 2022

- You and your shares 2021

- You and your shares 2020

- You and your shares 2019

- You and your shares 2018

- You and your shares 2017

- High Court clarifies question on trust streaming of franking credits

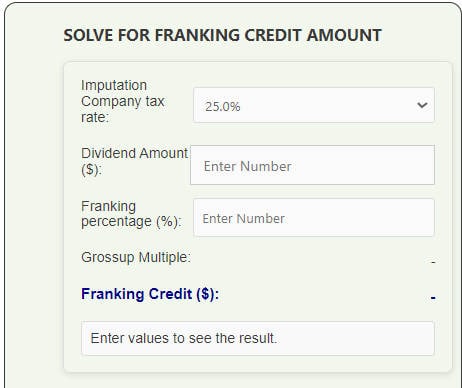

How To Calculate Franking Credits

Franking credits can be calculated from known variables, being the company tax rate (CTR), the franking credit percentage (FCP) and the dividend amount received (D).

Formula: Franking Credit = (D ÷ (1 – CTR)) – D) x FCP

Example: Let CTR = 30%; FCP = 70%; D= $10,000

Calculation: Franking Credit = (10,000 ÷ (1 – 0.3) – 10,000) x 0.7

Answer: Franking Credit = $3,000

Our calculator (linked below) performs this arithmetic.

Click here or the image below to see the franking credit calculators and further examples.

See also ATO articles:

This page was last modified 2023-06-22