The purpose of the foreign tax credit offset is to relieve double taxation, where tax has been paid in a foreign country on income which is also subject to tax in Australia.

Offsets are a reduction of tax payable. The foreign tax offset is non-refundable offset- i.e. the amount of the credit is limited to the amount of Australian tax payable (including medicare levy and surcharge), and any difference is not refunded, nor can it be carried forward to future years.

The entitlement to a foreign income tax offset is provided for and governed by Division 770 of the Income Tax Assessment Act 1997.

Claims up to 1 July 2008

The current arrangements for claiming foreign income tax credits have been in place since 1 July 2008. For claims in periods up to 30 June 2008, the Tax Office has guidance here.

Basic Requirements

In general, the minimum requirements for a tax offset are

- The amount on which foreign tax has been paid is included in assessable income (or as non-assessable non-exempt income)

- foreign tax has been paid on the income (not necessarily in the same tax year)

The amount included in assessable income is the gross amount, inclusive of the tax paid or withheld.

Which Foreign Taxes?

The offset applies in respect of direct taxes on income, profits or gains (including capital gains), including taxes similar to the Australian withholding tax and any other taxes identified in an International Tax Agreement.

Taxes which are not eligible for a Foreign Tax Credit Offset include inheritance taxes, annual wealth taxes, net worth taxes, taxes based on production, credit absorption taxes or unitary taxes. The meaning and scope of these terms is outlined here (2023).

Basis of claim for Foreign Tax Credit Offset

Written evidence of an entitlement is required to be kept.

Per ATO published information, written records must show the following information:

- the amount of foreign income or gains in the foreign currency

- the foreign tax year in which the income or gains were derived

- the nature and amount of foreign tax levied on the foreign income or gains

- the date on which the foreign tax was paid

- whether the tax paid represents an advance, instalment, or final foreign tax payment for the relevant foreign income or gains

Calculation of Foreign Income Tax Offset

Up to $1,000

If claiming an offset of $1,000 or less, you only need to record the actual amount of foreign income tax paid that counts towards the offset (up to $1,000), and enter that amount in the tax return.

More than $1,000

If the value of foreign tax paid is more than $A1,000, there is the option of just claiming $1,000, or..

..claiming a foreign income tax offset of more than $1,000, a calculation is required, because the foreign tax credit is subject to a cap.

The cap is the amount of Australian tax attributable to the double-taxed foreign income, calculated according to a formula which compares

- the tax on total taxable income;

with

- tax on non-foreign income (excluding deductions attributable to the foreign income apart from interest not associated with an overseas permanent establishment)

The difference between these two tax calculations is the maximum allowable offset.

Both tax calculations for comparison purposes include medicare and ignore offsets.

Any shortfall between the calculated offset and actual foreign tax paid cannot be carried forward or otherwise recovered.

Example calculations are given here for the years:

2017 – 2018 – 2019 – 2020 – 2021 – 2022 – 2023

Caution: This is a summary of simple circumstances. For more complete information see the ATO guides below.

Foreign tax paid for an earlier tax year

A tax offset cannot be claimed until after the foreign tax has been actually paid.

In circumstances where foreign tax is paid after the relevant income has been included in a tax return already lodged, the procedure for claiming a foreign tax credit is to lodge an amended tax return.

The amended tax return is for the tax year in which the foreign income was declared.

The time period for this kind of amendment is longer than the normal period, and is for 4 years commencing from the date of payment of the foreign income tax.

Tax return claim

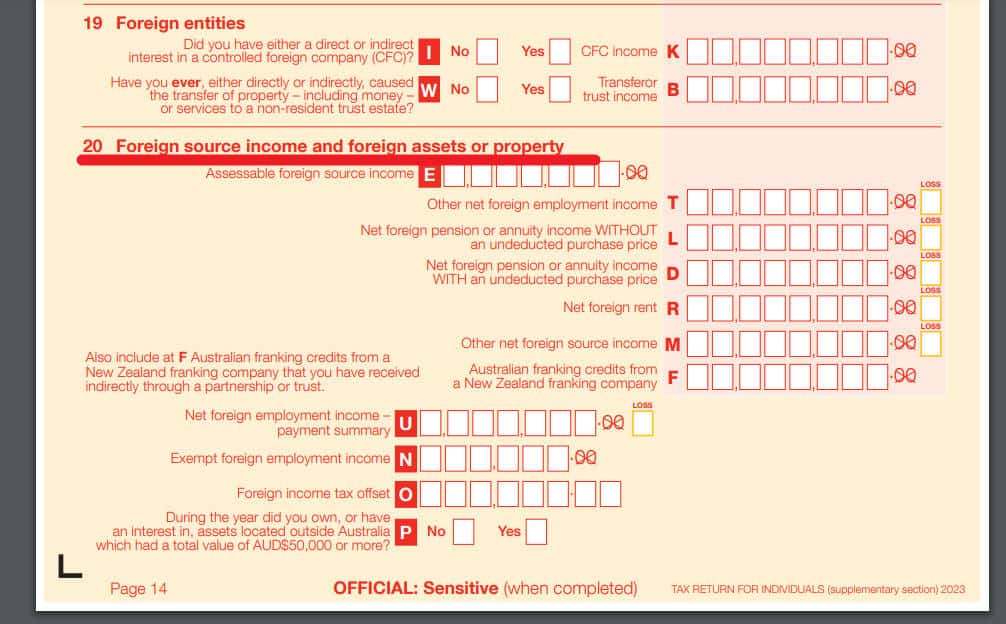

Item 20 of the supplementary section of the income tax return form on page 14 (2023) must be completed to include the foreign income and the amount of offset claimed entered at label O.

- Taxation Determination TD 2020/7 Net capital gains do not have a source, and are disregarded under subparagraph 770-75(4)(a)(i) for purposes of the FITO limit calculation

- Guide to foreign income tax offset rules 2023

- Guide to foreign income tax offset rules 2022

- Guide to foreign income tax offset rules 2021

- Guide to foreign income tax offset rules 2020

- Guide to foreign income tax offset rules 2019

- Guide to foreign income tax offset rules 2018

- Guide to foreign income tax offset rules 2017

This page was last modified 2023-05-25