The beneficiary tax offset or rebate is automatically given to taxpayers in their tax assessment.

The rebate applies to certain kinds of taxable government benefits and allowances.

Jobkeeper, Youth Allowance, Austudy, Farm household allowance and CDEP wages are examples of eligible payments, (but not the age pension – for which see SAPTO).

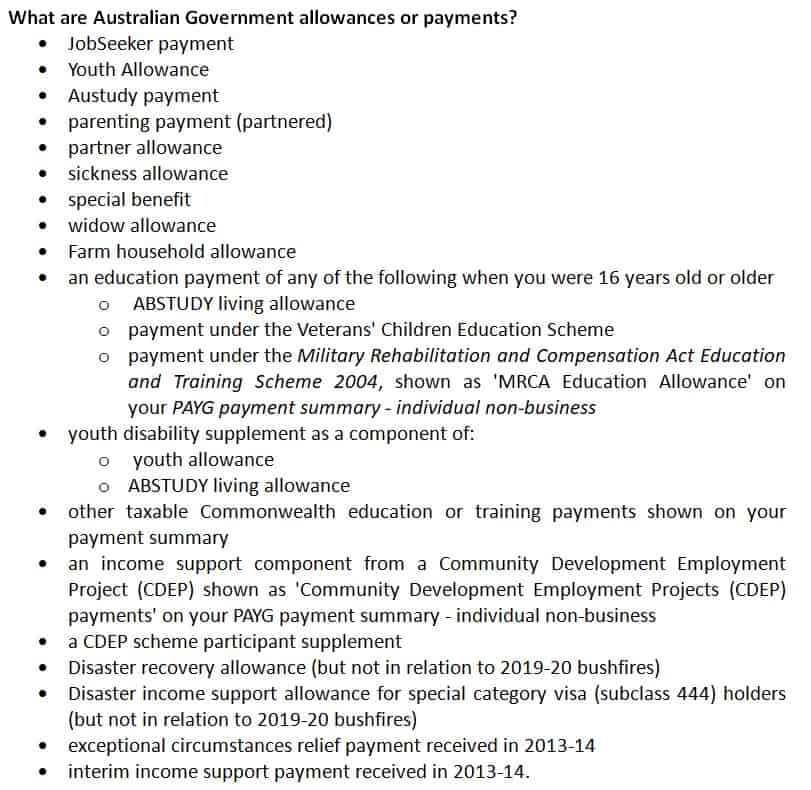

Section 160AAA specifies the types of payments which are eligible for the rebate. A full list of eligible payment types is set out below.

The rebate formula works to shield the government benefits from tax at lower levels of income. This ensures that if the government payments are the only source of income for an individual in a tax year, there is no tax to pay.

With effect from 1 July 2020 for 2020-21 and following tax years, the upper threshold of the lowest marginal tax rate (to which the beneficiary rebate formula is linked) was moved from $37,000 to $45,000. (See tax rates 2021).

Beneficiary Rebate Calculation Formula

Note: If you are also entitled to SAPTO, only one offset (the higher amount) is payable.

The current formula (since 2020-21) is

| Rebatable Benefits Income | Offset calculation |

| $0 to $45,000 | 15% of [Rebatable benefits – $6,000] |

| Over $45,000 | 15% of [Rebatable benefits – $6,000] + 15% of [Rebatable benefits – $45,000] |

If your taxable income is only made up of eligible rebatable payments (such as the government pension), the beneficiary tax offset calculation ensures that no tax is payable.

Note: If you are also entitled to SAPTO, only one claim (whichever is the greater) is allowed.

Beneficiary Rebate Calculator

Beneficiary tax offset is not refundable

If the tax offset is greater than the tax calculated, the balance is not refundable, nor can it be used to pay Medicare Levy.

How to claim Beneficiary Tax Offset

The beneficiary tax offset doesn’t have to be specifically claimed in your tax return, because it is automatically calculated from tax return data.

Therefore to trigger the calculation and receive the rebate, it is important that eligible income be entered at the correct label in your tax return, so that it is identified by the Tax Office and included in your tax assessment.

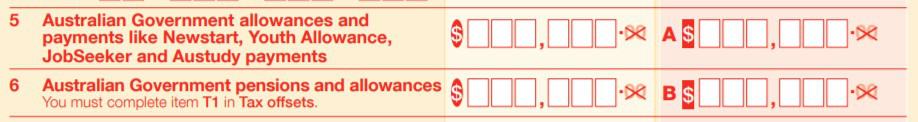

Relevant income should be entered at Income Item numbers 5 or 6 of the individual income tax return form – which are the amounts referred to in the calculation formula (set out above) as the “rebatable benefits”.

This information should be available from your annual summary payments statement, or in the case of mytax data will be prefilled at the correct label.

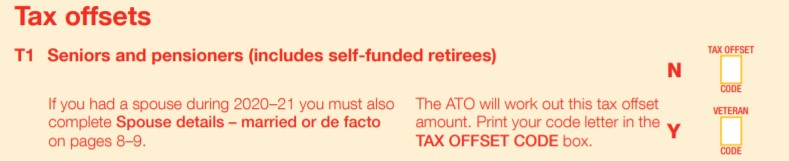

Notice also that if Item 6 is completed, Item T1 must also, as well as spouse details if applicable:

If you have already lodged your tax return and didn’t get your beneficiary tax offset tax entitlement, you can request that your tax assessment be amended.

For information about getting an amendment, start here: Tax Return Amendments.

Beneficiary rebate calculation formulae for past years up to 2019-20

Formulae

Years 2010-11 to 2019-20

| Rebatable Benefits Income | Offset calculation |

| $0 to $37,000 | 15% of [Rebatable benefits – $6,000] |

| Over $37,000 | 15% of [Rebatable benefits – $6,000] + 15% of [Rebatable benefits – $37,000] |

Year 2009-10

| Rebatable Benefits Income | Offset calculation |

| $0 to $35,000 | 15% of [Rebatable benefits – $6,000] |

| Over $35,000 | 15% of [Rebatable benefits – $6,000] + 15% of [Rebatable benefits – $35,000] |

Year 2008-09

| Rebatable Benefits Income | Offset calculation |

| $0 to $34,000 | 15% of [Rebatable benefits – $6,000] |

| Over $34,000 | 15% of [Rebatable benefits – $6,000] + 15% of [Rebatable benefits – $34,000] |

Year 2007-08

| Rebatable Benefits Income | Offset calculation |

| $0 to $30,000 | 15% of [Rebatable benefits – $6,000] |

| Over $30,000 | 15% of [Rebatable benefits – $6,000] + 15% of [Rebatable benefits – $30,000] |

Year 2006-07

| Rebatable Benefits Income | Offset calculation |

| $0 to $25,000 | 15% of [Rebatable benefits – $6,000] |

| Over $25,000 | 15% of [Rebatable benefits – $6,000] + 15% of [Rebatable benefits – $25,000] |

Year 2005-06

| Rebatable Benefits Income | Offset calculation |

| $0 to $21,600 | 15% of [Rebatable benefits – $6,000] |

| Over $21,600 | 15% of [Rebatable benefits – $6,000] + 13% of [Rebatable benefits – $21,600] |

Year 2004-05

| Rebatable Benefits Income | Offset calculation |

| $0 to $21,600 | 17% of [Rebatable benefits – $6,000] |

| Over $21,600 | 17% of [Rebatable benefits – $6,000] + 13% of [Rebatable benefits – $21,600] |

Interaction with SAPTO – no double-up

Section 160AAA includes a provision which prevents both SAPTO and the beneficiary rebate being claimed together.

If a taxpayer qualifies for both, the higher value rebate must be claimed. Only one rebate can be claimed if the values are the same. (Sec 160AAA(4))

Income which qualifies for the beneficiary offset

The following are Government allowances or payments. See further: section 160AAA or ato.gov.au

For a list of items on which you don’t pay tax, see: Income on which you don’t pay tax

See:

Income Tax Assessment Act 1936 – Sect 160AAA

Income Tax Regulations 1936 – Reg 13

This page was last modified 2022-07-06