SMSF trustees are required to appoint a registered auditor to report annually on the operations of the fund and its compliance.

The report is included with the Fund’s annual tax and information return.

An earlier proposal to change the audit reporting cycle to 3 yearly was abandoned by the government.

Audit time limits

An approved auditor must be appointed at least 45 days before the due date for annual return lodgement.

The auditor must provide the audit report to the SMSF trustees within 28 days “after the trustee of the fund has provided all documents relevant to the preparation of the report to the auditor.”

SMSF Auditor registration

From 1 July 2013 auditors may not undertake SMSF audits unless registered with ASIC as an “approved SMSF auditor”.

To obtain registration, auditors must meet minimum education, experience and competency requirements, and ongoing statutory obligations.

SMSF auditors are required to quote their ASIC-issued SMSF auditor number (SAN) in the annual return of the fund.

Registers of approved and disqualified auditors are maintained by ASIC and can be accessed online.

ATO’s Approved Auditor Checklist

The Tax Office has published a checklist of requirements which need to be satisfied in respect of the both the auditor’s qualifications and the quality of the SMSF audit.

The checklist which is also downloadable, can be accessed here.

See also Compliance audit

Auditors’ Independence, Reciprocal Audit Arrangements

The Tax Office frowns on “reciprocal” arrangements under which auditors agree to audit each other’s SMSF or those of their clients.

Problematic arrangements are those which create potential threats to independence as described under the Accounting Professional and Ethical Standard (APES) 110 Code of Ethics for Professional Accountants.

They include threats arising from self interest, familiarity and potential intimidation.

See further: Issues of Concern

On the issue of SMSF auditors independence more generally, a recent Q&A compilation published by CPA Australia as a downloadable PDF is a valuable guide to practical questions. The direct link is here.

The CPA Australia Tools and Resources page for Self-managed superannuation fund auditors is here.

How To Complete The SMSF Audit report

A downloadable template with instructions of the self-managed superannuation fund independent auditor’s report (NAT 11466) is available here together with associated information for registered super fund auditors.

Reports may also be lodged electronically.

Part A & B SMSF Audit Report Qualifications

Detailed instructions for completing the SMSF independent auditor’s report including Parts A & B and potential qualifications are published by the Tax Office online here.

Audit Contravention Report

The SMSF Auditor’s role is to identify, quantify and report contraventions of the rules governing SMSFs, which enables the Tax Office to assess ongoing eligibility for the preferential tax treatment that SMSFs enjoy.

Contraventions are required to be reported within 28 days of audit completion.

The Tax Office specifies the criteria on which contraventions must be reported, by requiring the application of a series of tests:

Test 1: Fund Definition – meeting the definition of an SMSF under section 17A of the SISA. These are fundamental requirements such as the number of members (currently 6) and the fund’s structure.

Test 2: New fund test – if the SMSF is less than 15 months old and has a single contravention exceeding $2,000, then all contraventions must be reported, regardless of financial threshold.

Tests 3, 4 and 5: Trustee behaviour tests – whether previously identified contraventions have been rectified.

Tests 6 and 7: Financial threshold tests – additional information where value of all contraventions is more the 5% of the value of the fund’s total assets; or the value of all contraventions of a section or regulation listed in tables 1A and 1B is more than $30,000.

In addition to observing auditing and assurance standards, auditors are encouraged to exercise professional judgement in providing such “other information that you think will help us perform our function as the regulator of SMSFs” (see ATO – contravention report instructions).

Disclosure and whistleblower implications

The Tax Office’s website information points out that provision of additional information to the Commissioner as regulator of SMSFs, carries with it consent to disclosure of identity.

To maintain anonymity, information can be passed on by using a tip-off form, or by phoning the information to 1800 060 062.

Covid-19 pandemic conditions and potential contraventions

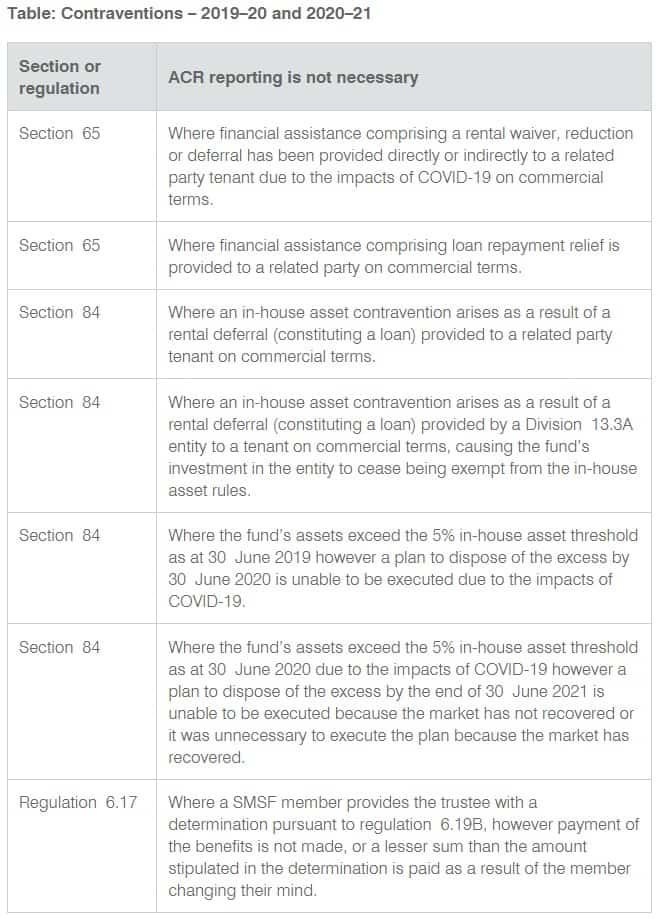

Additional guidance has been issued by the Tax Office for the 2020, 2021 and 2022 financial years which addresses the impact of Covid pandemic conditions on the reporting criteria.

The ATO’s compliance approach is modified accordingly – which is spelled out in detail here.

As a result, the following contraventions in 2019-20, 2020-21 and 2021-22 do not need to be reported. (The Tax Office nevertheless recommends that relevant matters be included in a management letter to the trustees).

Withdrawal of e-SAT tool

From 1 March 2022 the Tax Office has closed the electronic superannuation audit tool (eSAT).

Replacement resources are being made available to auditors through the Online Services For Business portal (OSB).

To access OSB myGovID registration is required, linke d to the RElaionship Authoristioan Manager (RAM).

See further: eSAT closes 1 March – switch to OSB now!.

Further information and key links

- Self-managed superannuation fund auditors – Resources published by CPA Australia

- Auditor compliance reviews

- The SMSF auditor and verifying market values in an SMSF

- ASIC – approved auditor registration and information

- ATO – SMSF Auditors

- SMSF annual return lodgement dates

- Downloadable SMSF fund annual return forms:

- return forms (NAT 71226) – 2008 to current year

- instructions (NAT 71606) – 2008 to current year

This page was last modified 2022-07-08