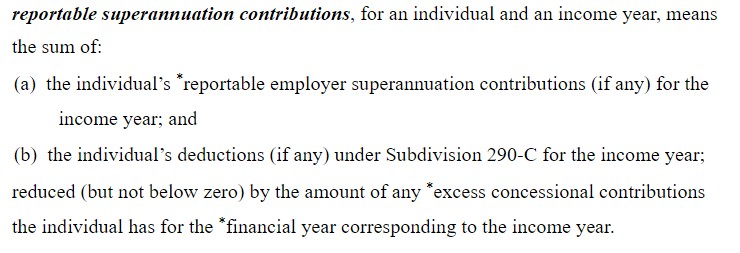

Reportable employer superannuation contributions are additional to the compulsory contributions your employer must make.

An example of a reportable employer superannuation contribution is a contribution made under a salary sacrifice arrangement.

Personal deductible contributions for which a deduction has been claimed are also included in the definition.

The total of reportable super contributions is included in the income tests for some tax offsets, deductions, concessions, the Medicare levy surcharge, and certain government benefits and obligations.

Reportable Employer Contributions

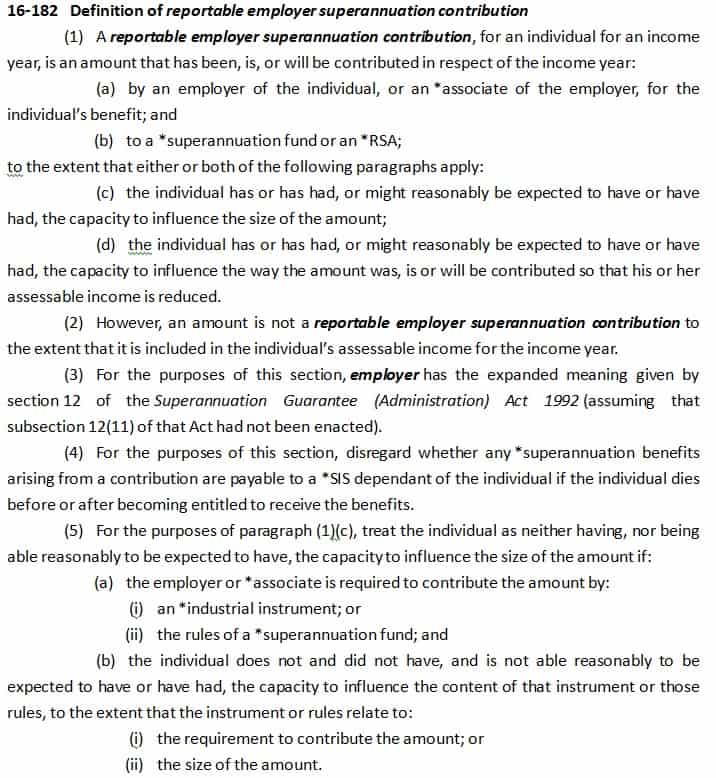

Reportable employer super contributions are contributions which:

- you influenced the amount or rate of super your employer contributes

- are additional to the compulsory contributions made in accordance with

- super guarantee law, or

- a collectively negotiated industrial agreement, or

- the trust deed or governing rules of a super fund, or

- a federal, state or territory law.

Reportable employer super contributions include contributions made under a salary sacrifice agreement or additional amounts directed by you to your super fund (e.g. an annual bonus) or an increased super contribution as a part of your salary package (for example, under individual employment contracts).

Reportable Contributions in Payment Summaries

Employee payments summaries include a label for employers to include all reportable employer superannuation contributions made for an employee.

Compulsory employer super contributions, such as superannuation guarantee, are not recorded on the payment summary.

If reportable employer superannuation contributions have been made, the employee must be provided a payment summary even if no salary or wages have been paid.

Further information

- For Employers – Identify reportable employer super contributions

- Employee and self-employed guide to reportable super contributions

Legal definitions:

Reportable Employer Super Contribution(s) Income Tax Assessment Act 1997 Sect 995.1

This page was last this page was last modified 2021-06-18