Tax at the equivalent of the top marginal rate plus medicare is required to be withheld from a payment to a supplier unless an invoice is provided which quotes an Australian Business Number (ABN).

Since 1 July 2017 this rate has been 47%.

From 1 July 2014 to 30 June 2017 the rate was 49% (inclusive of the 2% Temporary Budget Repair Levy) and prior to that it was 46.5%.

Alternatively, a correctly completed form “Statement by a supplier (reason for not quoting an ABN to an enterprise)” may be given by the payee to the payer.

The Statement by a supplier certifies one or more of a number of valid circumstances under which the requirement to withhold tax does not apply (see details below).

ABN withholdings annual reports

Taxable Payments annual reports are due by 28 August of each tear and should not include amounts reported in a PAYG withholding where no ABN quoted – annual report.

Otherwise – where amounts are withheld for non-quotation of an ABN, payment summaries and an annual report are required to be lodged by 31 October each year.

Payment summary requirements and a downloadable form PDF (Nat 3283) can be found here.

ABN Withholding Exceptions

If tax is not withheld because an exception applies, sufficient evidence of that must be held. This means keeping records which:

- identify the supply and the supplier

- justify the reason for not withholding

Statement By Supplier

Form Nat 3346 Statement by a supplier details in checklist format a number of valid circumstances (i.e. valid exceptions) and reasons for the non-quotation of an ABN, which therefore justify not withholding tax from the payment.

The reasons (selections on Form Nat 3346) include:

- The payer is not making the payment in the course of carrying on an enterprise in Australia

- The supplier is an individual aged under 18 years and the payment does not exceed $120 a week

- The payment does not exceed $75, excluding GST

- The supply that the payment relates to is wholly input taxed

- The supplier is an individual and has given the payer a written statement to the effect that the supply is either

- made in the course or furtherance of an activity done as a private recreational pursuit or hobby, or

- wholly of a private or domestic nature (from the supplier’s perspective)

- The supply is made by an individual or partnership without a reasonable expectation of profit or gain

- The supplier is not entitled to an ABN as they are not carrying on an enterprise in Australia

- The whole of the payment is exempt income for the supplier

The Form “Statement by a supplier (reason for not quoting an ABN to an enterprise)“ can be downloaded here.

Indigenous Artists

Payments made to indigenous artists for artistic works where the artist works or lives in zone A (ordinary or special) and does not quote an ABN are not required to have PAYG withheld.

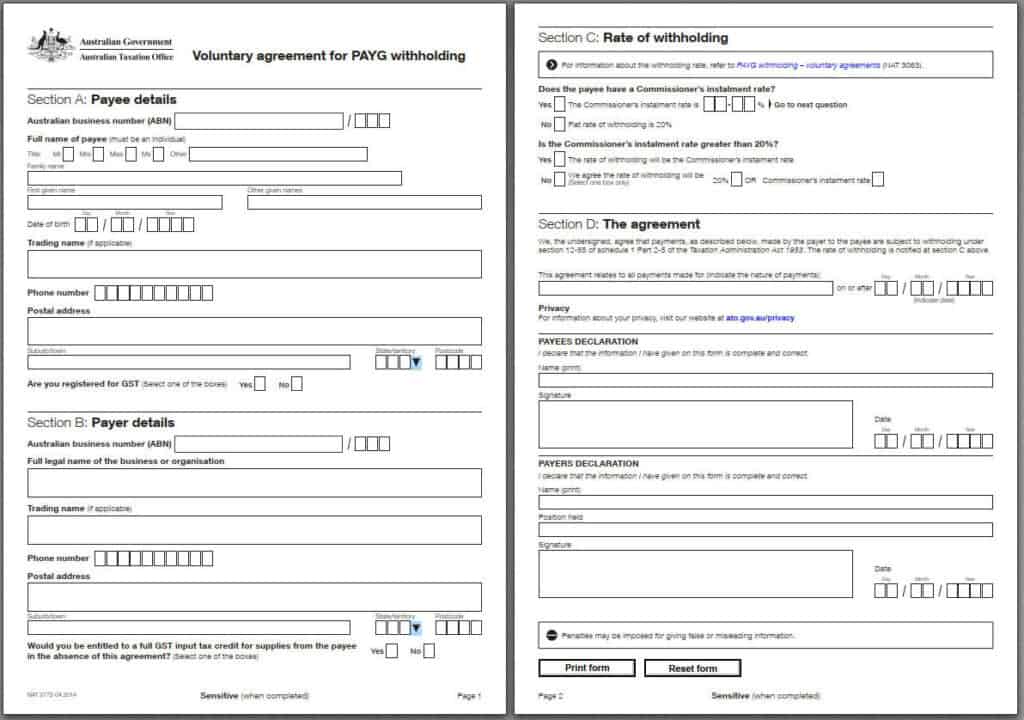

Individual Contractors – Voluntary Agreement

A Voluntary Agreement can only apply to individual contractors with an ABN who are not employees, for which the tax withholding rate will be either of

- a flat 20%; or

- at a rate which is notified by the Tax Office

The withholding rate is notified to the contractor by the ATO after the lodgment of their most recent income tax return. Generally if a rate is not known at the time of payment, the rate of 20% must be used. GST (if any) is excluded from the withholding calculations.

For a Voluntary Agreement to be effective, the relevant Tax Office form must be fully and correctly completed. See downloadable PDF link here.

Further information withholding in business transactions

This page was last modified on 2018-12-05