The Tax Office has for many years conducted an ongoing program (referred to as data matching protocols) collecting transactional data which it uses to match to the returns of taxpayers in its effort to ensure that all income required to be reported by taxpayers is done so.

This is in addition to the collection of data from income sources such as wages and salaries, interest and dividends, and from certain contractors (taxable payments reporting).

The Tax Office also matches the performance of small businesses against benchmark averages.

Generally a specific type of income for a specific financial year, or number of years, is identified in the protocol which is implemented by regulation and announced by the Tax Office from time to time.

A current list of the data sources and the legal bases for their collection are set out here.

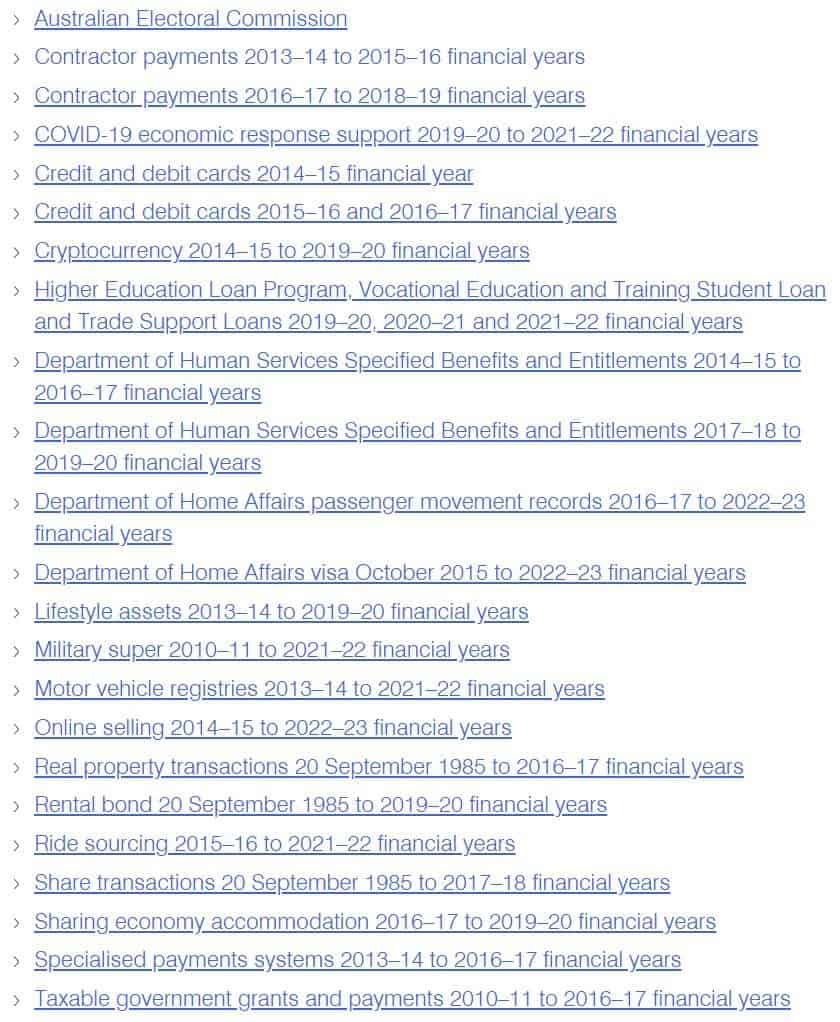

Example of data matching projects listed on ato.gov.au (date retrieved May 13, 2021)

This page was last modified 2021-05-13