The ATO’s database (once known as a register) of private binding rulings is available for free public search by reference number, topic, date or content. The rulings are edited for anonymity and privacy before publication.

Private rulings are a goldmine for real taxpayer issues which have been researched and commented upon by the Tax Office.

Where is the private rulings register?

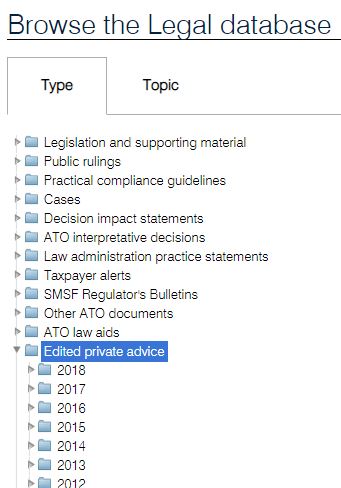

Edited versions of private advice have been moved to the Legal database under the category labelled “Edited private advice”. The Register of private binding rulings as it previously operated has been decommissioned.

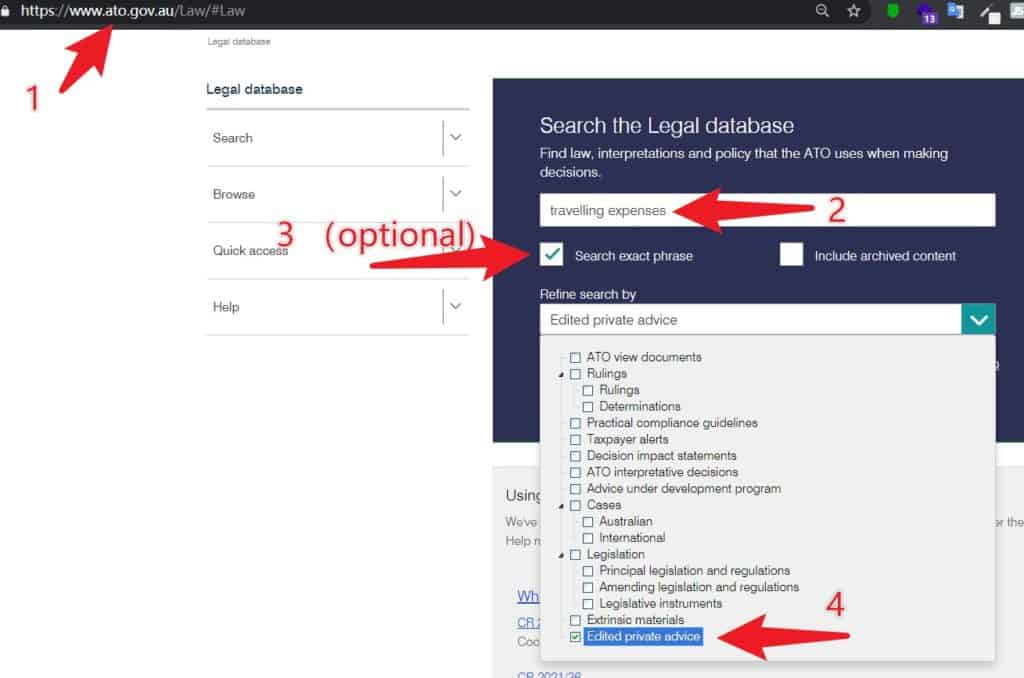

- Click here to browse the database

- Click here for a Quick Search (by ruling number)

- Click here for a search by keyword (advanced search)

The Legal database itself has over the past several years been upgraded in functionality, and has an improved search experience.

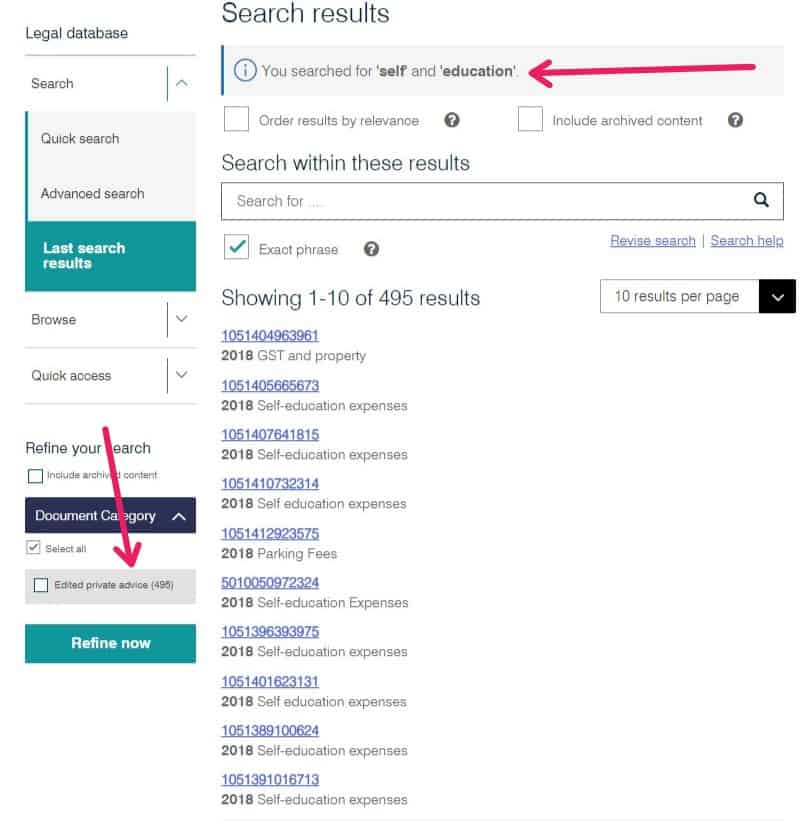

Keyword search using the legal database search box functions well for honing in on a subject matter (see example searches below).

Searching for content keywords, section numbers or PBR number all work equally well.

The Advanced search box enables limited logical search statements for even greater precision.

Older material has been tidied up to enhance relevancy of search results with rulings more than 15 years old deleted. Search results can be filtered by year-of-decision if required.

EXAMPLE SEARCH “self education”

Some limitations of a PBR

Search results from the Legal Database contains a statement of limitations.

The Tax Office’s fulsome disclaimer makes it very clear that PBRs published in the register are non-binding, offer no protection, and cannot be relied upon as a precedent or for establishing a Reasonably Arguable Position.

Important considerations include:

- PBRs are not law, just the Tax Office’s opinion, at a point in time, of the operation of the law in a specific fact situation

- PBRs are not updated in response to changes in the law, or to decided cases which may have a bearing

- When a PBR has been later amended, the published details of the original PBR are not amended

- PBRs are not intended to be relied upon by anyone other than the taxpayer requesting the ruling.

- PBRs can be withdrawn if the ATO changes its view of a matter (e.g. after the taxpayer has taken action in reliance)

- If correct PBR advice is provided on the basis of erroneous facts set out by the Commissioner, it cannot be challenged simply on that basis

- Descriptions of facts in a published PBR are often scant, and in any event will have been edited for reasons of privacy or confidentiality

Getting a private ruling from the Tax Office

Despite the limitations, there are good reasons for requesting a private ruling, with a view to reducing tax risk surrounding transactions which might attract ATO attention after the fact.

The Tax Office provides a general private ruling application form (Nat 74957) for use by agents and non-agents.

For private ruling application forms concerning specific subject matters see Applying for a private ruling.

For the Tax Office’s private ruling reference guide see here.

Finding rulings on a subject matter

Go to the Legal Database, then either search or browse under “Edited Private Advice”

See also

This page was last modified 2021-05-24