The tax rules specify interest rates for situations where you pay the Tax Office interest on late or delayed tax payments.

For some situations in which the tax offices owes you, for example an over-payment, an early payment or delayed refund, interest is paid or credited to the taxpayer as reimbursement.

Daily interest rate credits for early or over-paid tax are based on the quarterly average Reserve Bank 90 day bill acceptance rates, in accordance with Section 8AAD of the Tax Administration Act.

However, when you are required to pay the Tax Office, a margin is added (see further below).

The Reserve Bank 90 day bill rates are published in a spreadsheet “Interest Rates and Yields – Money Market – Monthly – F1.1“.

Interest when you owe the Tax Office

ATO General Interest Charge (GIC) Interest Rates, SIC and Penalties

Financial penalties administered by the Tax Office have a number of possible components:

- an administrative penalty, based on the degree of culpability; and

- Interest, comprising either or both of:

- shortfall interest charge (SIC) which is applied on a daily basis to understatements of tax on the period from original assessment due date to the amended assessment due date

- general interest charge (GIC) which is applied to overdue tax debts (including SIC and penalties) on a daily basis, from due date to date of payment

Administrative penalties are applied to a wide range of transgressions, not necessarily just involving a shortfall of tax, but include for example, the late or non-lodgement of returns or other documents.

They can be calculated as a percentage of the tax involved, or as a multiple of “penalty units” which have a fixed dollar value.

There is a hierarchy of penalties based on culpability and the level of cooperation.

The penalty regime applies to most taxes, including income tax, FBT, GST and PAYG.

The Tax Office also has the power to prosecute offences in a court, in practice generally reserved for more serious cases. Information about the ATO Disputes policy and mechanisms can be viewed here: ATO disputes policy. (pdf)

The Tax Office keeps track of the movements in the key interest rates on a quarterly basis. See:

Current Debit Interest Rates Calculations:

The General Interest Charge (GIC) rates are set by reference to the 90-day Bank Bill rate plus 7%, and updated on a quarterly basis in a table of GIC rates maintained by the Tax Office here.

The Shortfall Interest Charge (SIC) rates are set by reference to the 90-day Bank Bill rate plus 3%, and updated on a quarterly basis in a table of SIC rates maintained by the Tax Office here.

Deductibility of GIC and SIC Interest

The general interest charge is tax deductible** in the year that it accrues, while the shortfall interest charge is deductible in the year that the taxpayer is given notice of the liability.

** The Government has announced that from 1 July 2025 both GIC and SIC interest charges will no longer be tax deductible (subject to legislation being passed). (see MYEFO 2023).

This change characterises the interest charges more as a penalty than a calculated reimbursement to the Commonwealth for the cost of delayed tax payments.

See further commentary: General interest charge and shortfall interest charge – a new ATO “penalty?”

See also: PS LA 2006/8 – remission of SIC and GIC for shortfall periods.

Note also that recoupments of GIC or SIC are assessable income.

Interest when the Tax Office owes you

For individuals, companies, taxable trusts and super funds, the tax rules provide for interest to be be paid in specific circumstances of an over-payment, an early payment or delayed refund.

See more information here: PS LA 2011/23 Credit interest

Interest received is taxable income

Interest paid to you by the Tax Office (or debit interest remitted) must be included in taxable income.

- 2023 credit for interest paid to you by the Tax Office.

- 2022 interest guide (individuals and trusts).

- 2021 interest guide (individuals and trusts).

- 2020 interest guide (individuals and trusts).

- 2019 interest guide (individuals and trusts).

- 2018 interest guide (individuals and trusts).

Interest rates for interest paid to you

The interest paid is calculated using a Reserve Bank published average quarterly 90 Bills acceptance rate.

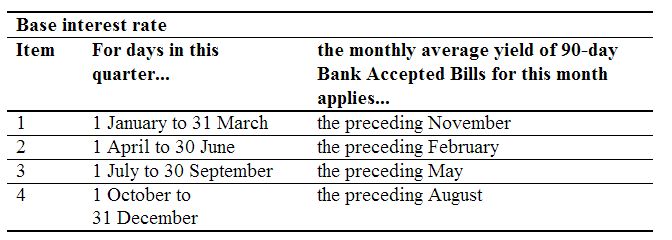

The quarterly interest rates are based on the Reserve Bank’s published months of November, February, May and August, in respect of the March, June, September and December quarters respectively (Section 8AAD).

The Reserve bank’s monthly rates are published in a regularly updated spreadsheet here.

To find out the credit rates applicable to periods since the tax year end, the relevant rate can be referenced from the Reserve Bank spreadsheet, or looked up from the updated GIC debit interest tables, with the credit rate determined by subtracting the 7% debit surcharge.

See also: Applying for a private ruling can bring protection from tax penalties

Division 7A Benchmark Interest Rate

When the Div 7 interest rate is used in a conforming loan agreement the adverse tax consequences of a private company loan being deemed a dividend can be avoided.

Interest charged at a minimum of the specified rate forms part of the documented safe harbour loan arrangement for these purposes.

The benchmark interest rate is updated anually and is based on the variable housing loans interest rate published by the Reserve Bank.

We keep track of the annual interest rates here:

ATO Div 7A Benchmark Interest Rate

FBT Benchmark Interest Rate

The FBT benchmark interest rate is used to calculate the taxable value of loans and certain car benefits for fringe benefits tax purposes.

Interest rate is determined from the standard variable rate for owner occupier housing loans of the major banks published by the Reserve Bank of Australia in the period immediately before the FBT year.

The interest rate is updated annually, and we keep track of the rates here:

FBT Benchmark Interest Rate

Further Information:

Interest and penalties

This page was last modified 2023-12-14