The farm management deposits scheme allows farmers to smooth their income over a number of financial years. This avoids the potential tax spike which might otherwise be caused by a higher-income year.

FMD – how it works

The principle of the scheme is to allow a tax deduction against current year profits for cash placed into an approved deposit, which becomes taxable only when withdrawn.

[News March 2021] The Farm Management Scheme is under review.

Implementation of changes recommended in the Agricultural Competitiveness White Paper on 4 July 2015 became law in May 2016.

Changes applying to income years commencing on or after 1 July 2016 include an increase of the deposit limit from $400,000 to $800,000, and allowing FMD bank accounts to be used as a farm business loan offset.

FMD features and general requirements:

- Authorised deposit-taking institution

The farm management deposit account has to be maintained as an FMD account by an authorised deposit-taking institution. That includes banks, building societies and and credit unions who normally take care of the paperwork with the necessary FMD agreement.

- FMD accounts are only available to individuals carrying on a primary production business*

- Accounts cannot be held jointly

- Primary production activities must not cease for more than 120 days in an income year

- The effect of death or bankruptcy during the income year is to terminate an FMD.

- FMD deposits must be between $1,000 and $400,000 ($800,000 from 1 July 2016)

- Minimum withdrawals are $1,000 or the deposit balance

- Deductions are claimable in the year the deposit is made

- To enable a tax deduction, the FMD must be held for at least 12 months (primary producers affected by natural disasters are excluded)

- From 1 July 2012 FMD deposits may be with more than one provider, and can transferred intact without triggering tax consequences even if within 12 months

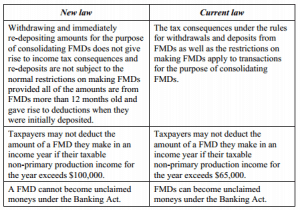

- Deposits which are consolidated trigger tax consequences (but not from 1 July 2014* if held for at least 12 months)

- Non-primary production income must be $65,000 or less ($100,000 from 1 July 2014*)

- Interest earned by the FMD account is taxable

* From 1 July 2014 – amendments

- Non-primary production income allowance lifted to $100,000 per annum

- Consolidation of deposits does not trigger tax consequences if they have been held for at least 12 months

Further information:

- Carrying on a primary production business – Tax Ruling TR97/11

- Farm management deposits scheme information for primary producers

- Drought help (ATO)

- Practical Compliance Guideline PCG 2019/2 Fuel tax credits – practical compliance methods for farmers in disaster affected areas

This page was last modified on 2021-05-18