A “new” tax is born 20 September 1985

Capital gains tax in Australia started on 20 September 1985.

Generally assets acquired previously are not subject to CGT, however subsequent events involving a pre-CGT asset can in some instances bring the gain (or some part of it) into the post-1985 tax net.

Costs of Ownership included from 20 August 1991

For assets acquired after 20 August 1991, the costs of ownership as a ‘third element’ of cost can be included in the calculation of cost base. See subsec 110-25(4) of ITAA 1997

Third element costs include the costs of maintaining, repairing or insuring the asset, interest on money borrowed to acquire or refinance the asset or for capital improvements, and when applicable may also include rates and land tax. Non-ownership costs such as travel and accommodation are excluded, as are collectibles and personal use assets.

Third element costs of ownership are not indexable, and sufficient record-keeping is essential in being able to support claims in a CGT disposal calculation which may be required many years after the date of the cost transaction.

Cost base indexation ended 20 September 1999

For assets acquired before 21 September 1999 and held for at least 12 months, excluding the days of purchase and sale, the cost base calculation can optionally be indexed by reference to the applicable quarterly CPI up to the quarter ending on 30 September 1999.

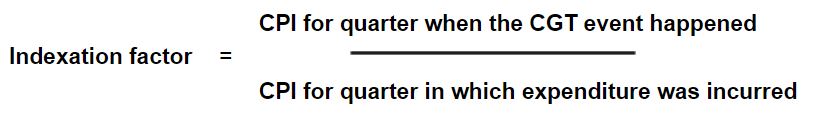

Under indexation, each cost element – except third element costs – is increased by the CPI indexation factor in the calculation of the net capital gain.

Companies’ CGT cost base calculations are automatically indexed because they do not have access to the discount.

Formula: The asset costs (excluding third element) are increased by indexation factor, which is the ratio of the disposal quarter CPI divided by the acquisition quarter’s CPI. The indexation factor is calculated to three decimal places, by rounding up if the 4th decimal place is 5 or more.

CPI Indexation Factors to September 1999

(base adjusted September 2012):

| Quarter Ending | ||||

| Year | 31 Mar | 30 June | 30 Sept | 31 Dec |

| 1999 | 67.8 | 68.1 | 68.7 | n/a |

| 1998 | 67.0 | 67.4 | 67.5 | 67.8 |

| 1997 | 67.1 | 66.9 | 66.6 | 66.8 |

| 1996 | 66.2 | 66.7 | 66.9 | 67.0 |

| 1995 | 63.8 | 64.7 | 65.5 | 66.0 |

| 1994 | 61.5 | 61.9 | 62.3 | 62.8 |

| 1993 | 60.6 | 60.8 | 61.1 | 61.2 |

| 1992 | 59.9 | 59.7 | 59.8 | 60.1 |

| 1991 | 58.9 | 59.0 | 59.3 | 59.9 |

| 1990 | 56.2 | 57.1 | 57.5 | 59.0 |

| 1989 | 51.7 | 53.0 | 54.2 | 55.2 |

| 1988 | 48.4 | 49.3 | 50.2 | 51.2 |

| 1987 | 45.3 | 46.0 | 46.8 | 47.6 |

| 1986 | 41.4 | 42.1 | 43.2 | 44.4 |

| 1985 | 37.9 | 38.8 | 39.7 | 40.5 |

For more about indexation, including some exceptions and qualifications, see Indexation Method

Discount Capital Gains – from 21 September 1999

On the cessation of cost-base indexation, a discount was introduced.

Except for companies, for disposals after 20 September 1999 of assets held for at least 12 months, excluding the days of purchase and sale, a non-indexed discount of 50% can optionally be claimed (super funds 331/3%). (Companies’ CGT cost base calculations are automatically indexed because they are excluded from the discount.)

Net Capital Gain Calculation Formula

Note that any CGT losses must be deducted from the capital gain before a discount is applied. See the Net Capital Gain Formula in sec 102.5 ITAA 1997

Removal of capital gains tax discount for non-residents – from 8 May 2012

The 50% capital gains tax discount for foreign and temporary resident individuals on taxable Australian real property or mining assets capital gains accrued after 7.30 pm (AEST) on 8 May 2012 is no longer available. See more here.

Non-residents denied main residence exemption – from 9 May 2017

Foreign and temporary tax residents will be denied access to the CGT main residence exemption from 7:30PM (AEST) on 9 May 2017, however existing properties held prior to this date will be grandfathered until 30 June 2019. See further here.

Further information

This page was last modified 2018-12-19